Radicant – Investment: Full Analysis and Review (December 2025)

| Investment security | 9.2 |

|---|---|

| Fees | 8.7 |

| Investment income | 7.5 |

| Crypto-currencies | 0 |

| Trading features | 6.4 |

| Training | 8.6 |

| Customer support | 8.5 |

| Opening an account | 8.2 |

Radicant, the Swiss neo-bank that simplifies sustainable investment. Build a portfolio aligned with your values thanks to its thematic and diversified investment options. To receive up to 200 CHF, use the promo code B99703 when opening your account. Happy reading!

Description

[Update – November 11, 2025: Radicant Closes its Doors: BLKB Launches Liquidation, What should Clients Do?

A few weeks after its announced sale, Basellandschaftliche Kantonalbank (BLKB) confirms that no buyer has been found. Radicant officially enters liquidation. Accounts remain secure for now, but the Swiss sustainable neo-bank will cease its operations in the coming years. ]

Radicant, investment and trading bank

Radicant is an innovative Swiss neo-bank, focused solely on sustainable investing and aligned with the United Nations Sustainable Development Goals (SDGs). This unique approach combines financial technology and environmental commitment, social and governance (ESG).

Radicant offers quality sustainable discretionary management solutions, but this offering may not satisfy investors looking for a wider range of traditional financial instruments or sophisticated trading tools.

In this review, we examine Radicant’s investment offer in detail:

- How can you measure the impact of your investments?

- How do Radicant’s investment products and fees compare to those of Alpian, Neon Invest and Yuh?

- Are Radicant’s innovations relevant to your objectives?

- What are Radicant’s limitations for investors seeking broad diversification?

- Entry threshold and management fees: how does Radicant compare with traditional banks?

What are the security guarantees of Radicant’s investment platform?

Radicant, as a Swiss bank, offers a level of security in line with the high standards of the Swiss banking sector:

- Regulated by FINMA, Radicant guarantees deposits up to 100,000 CHF.

Radicant offers the option of investing in funds or certificates. It’s important to look at the differences between these two products, particularly in terms of security.

- Certificates offer short-term, low-cost diversification, but are subject to issuer insolvency risks and offer no special protection.

- Investment funds are long-term instruments offering greater investor protection. In the event of bankruptcy of the company managing a fund, the capital invested is separated from the estate, to the benefit of investors.

The choice between certificates and funds therefore mainly depends on the investor’s investment horizon and risk profile.

Radicant app investment features

Radicant offers one of the most comprehensive interfaces of any new bank in Switzerland.

Portfolio performance monitoring

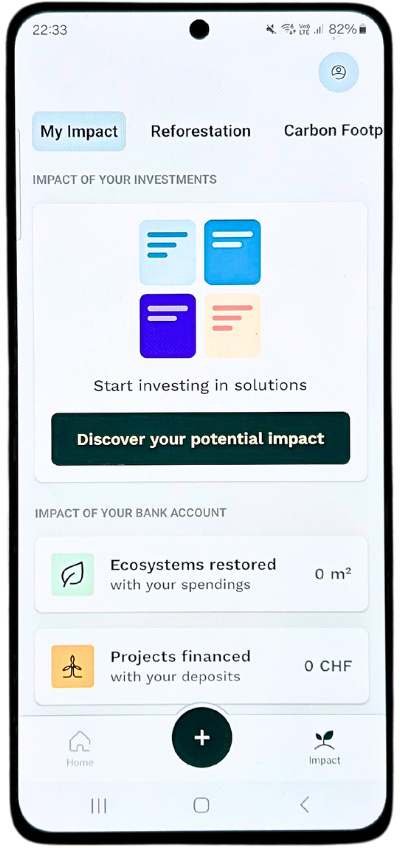

My Impact: Radicant’s most satisfying feature

- How can investors be informed of the impact of their decisions on sustainable development objectives?

- How can we encourage them to keep going?

My Impact helps you become aware of the impact of your investments and your bank account. This remains an assessment, but presenting impact indicators makes investments more concrete. It’s a satisfying and encouraging feature! #onelove

Carbon footprint monitoring by Radicant

- In concrete terms, you can view the CO2 impact of each transaction and track the evolution of your overall carbon footprint.

- This tool aims to make users aware of the environmental impact of their consumption choices and encourage them to adopt more sustainable habits.

- Although the calculation of CO2 emissions is based on estimates, this feature offers an interesting first step towards better understanding and reducing your environmental impact.

The features it lacks :

✘ Advanced analysis tools for experienced investors.

✘ Real-time trading features.

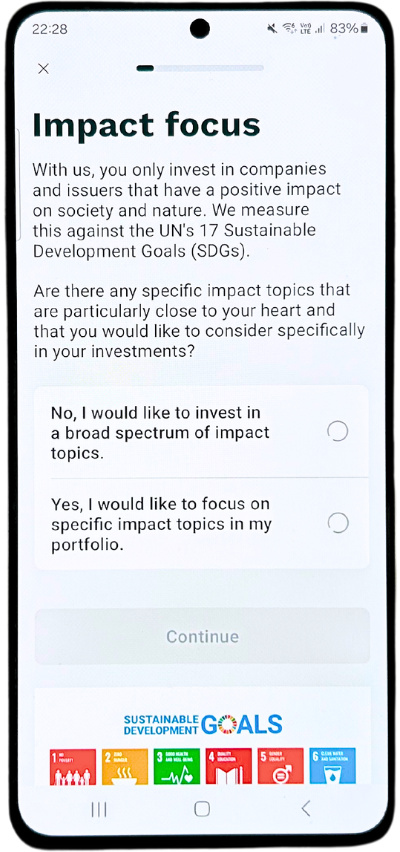

Definition of investment strategy

The onboarding process allows you to define your risk profile and personalize your investments according to your objectives. A detailed presentation is available in the “Investment solutions and products” section.

Radicant management mandate

Radicant offers an active, discretionary management mandate. Once the mandate has been defined, you have no further say in the management of your investments. You can modify the mandate at a later date if your needs or risk sensitivity change.

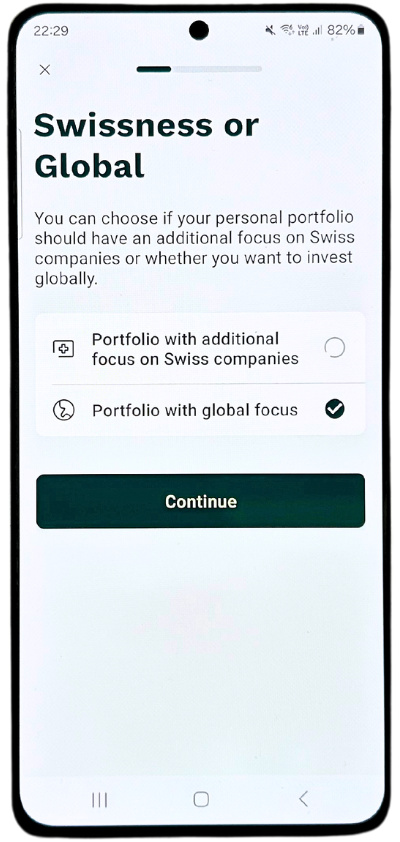

There are 3 steps before selecting the products that make up the mandate from a choice of funds and certificates:

1/3 Direct investments (sectors, Swiss or global stocks)

You need to define your intentions in terms of the desired impact:

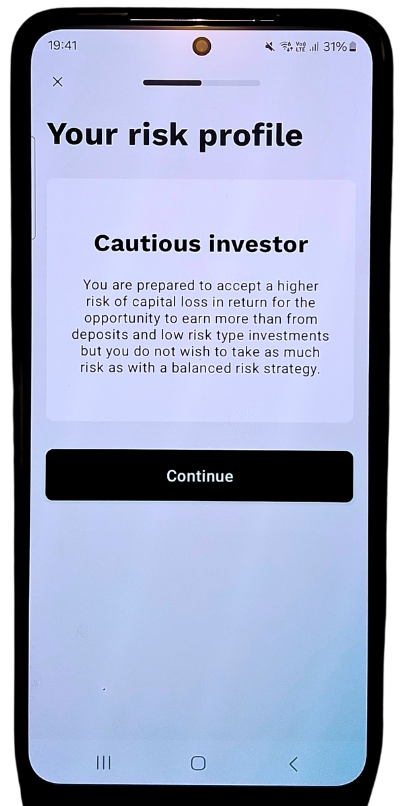

2/3 Establishing the right risk profile

→ Risk is the volatility (variations) of portfolio performance. As a general rule, the more equities a portfolio contains, the more sensitive it is to market fluctuations and therefore considered risky, as the capital invested is subject to greater volatility.

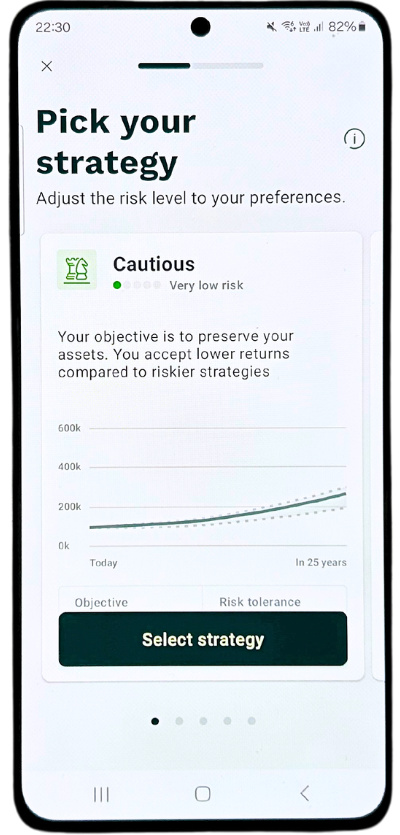

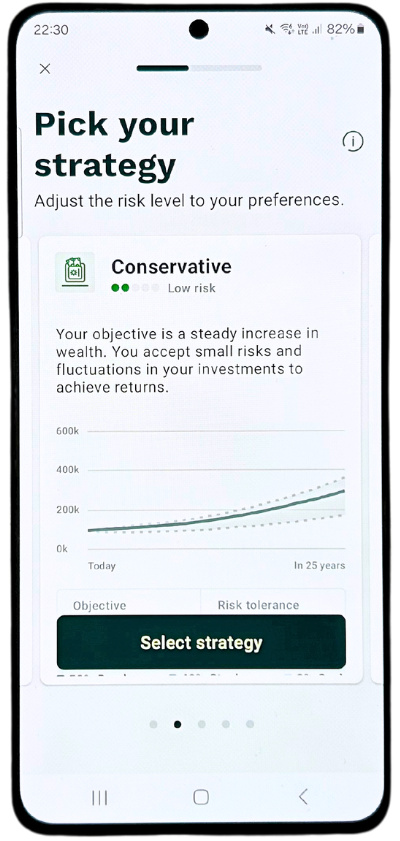

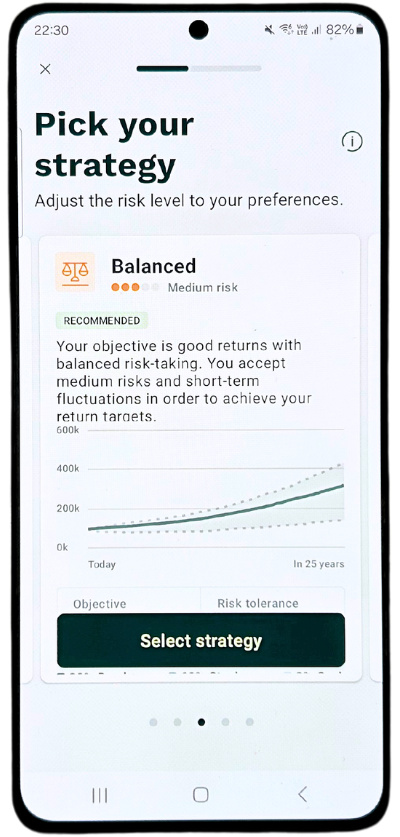

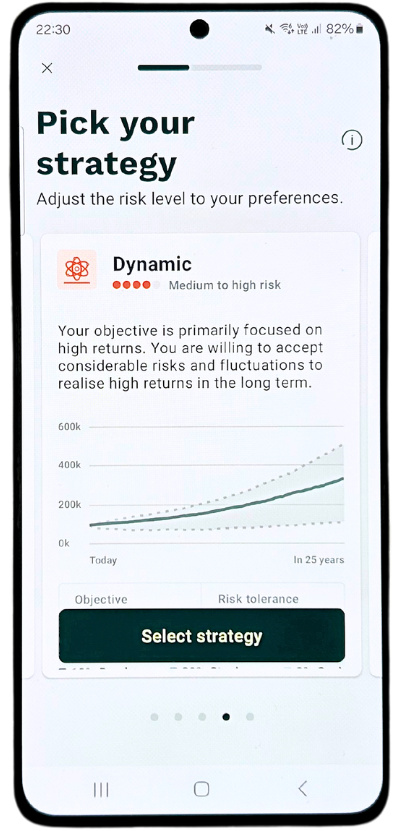

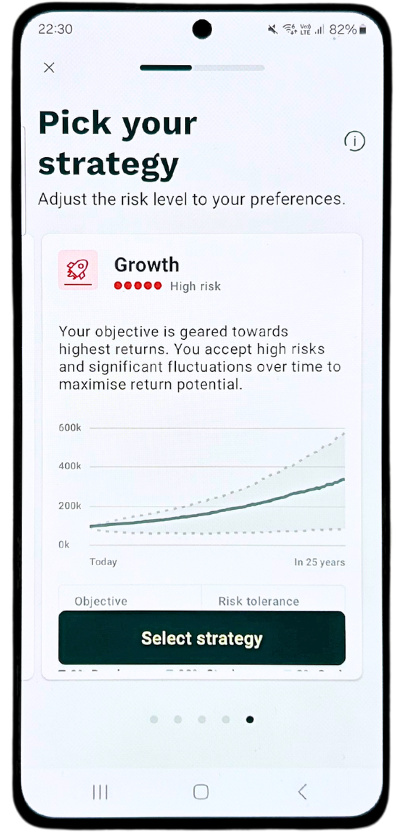

3/3 Choosing your personalized investment strategy

Among 5 profiles, from least risky to most risky :

- Cautious: 20% stocks

- Conservative: 40% stocks

- Balanced: 60% stocks

- Dynamic: 80% stocks

- Growth: 98% stocks

Advantages:

– Customized management adapted to the investor’s risk profile.

– Alignment with sustainability objectives.

– Simplified portfolio creation process.

Disadvantages:

– As mentioned in the “costs” section, the minimum investment is CHF 1,000.

– Lack of direct control over investments.

Radicant investment products

Investment funds

Radicant offers 3 funds issued by LGT Fund Mgmt. Company Ltd. and actively managed by Radicant’s investment teams.

They aim to generate long-term returns while making a positive contribution to the SDGs.

Equity funds

Swiss Sustainable Equities : invests in Swiss companies.

Global Sustainable Equities: invests in companies around the world that contribute to the SDGs.

Bond funds

Global Sustainable Bonds: invests in sustainable bonds from international issuers

Advantages:

– Focus on sustainable investments

– Geographic and asset class diversification

– Rigorous selection of companies based on a proprietary impact rating system

Disadvantages:

– Limited range of funds compared with more traditional offerings

– Lack of options for investors seeking non-sustainable strategies

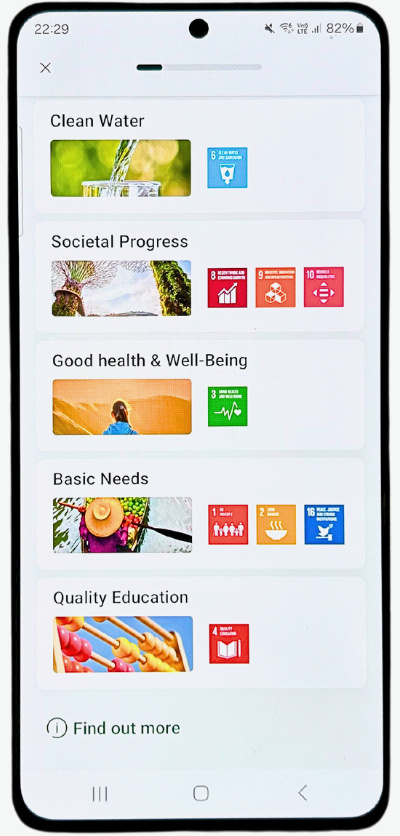

Thematic certificates (baskets of shares)

Radicant offers 8 thematic certificates linked to the SDGs, such as quality education, gender equality, climate stability, clean water and sanitation (between 1 and 3 SDGs are covered depending on the product).

These certificates are issued by Zürcher Kantonalbank and actively managed by Radicant.

Advantages:

– Targeted thematic investment to focus on specific SDGs

– Clear alignment with sustainable development goals

Disadvantages:

– Limited choice of themes compared with other thematic offerings on the market

– Certificates do not offer the same asset protection as funds

Crypto-currencies and commodities

✘ Radicant excludes crypto-currencies and commodities from its investments as they do not fully meet its sustainability criteria.

The bank focuses solely on companies and international organizations that actively contribute to achieving the SDGs.

Promo Code

Free account ✔︎

Radicant investment costs

Radicant’s pricing structure is relatively transparent, but complex, with several fee levels:

The base

- Reference currency: CHF

- Foreign currencies: Investments may be affected by fluctuations in foreign currencies (e.g. EUR, USD, GBP, JPY).

- Minimum investment: CHF 1,000

Annual management fees

- 0.45% for CHF 1,000 – 24,999 (instead of 0.90% – promotion)

- 0.40% for CHF 25,000 – 99,999 (instead of 0.80%)

- 0.325% for CHF 100,000 – 249,999 (instead of 0.65%)

- 0.25% from CHF 250,000 (instead of 0.50%)

→ These fees include management, trading, custody, stamp duty and VAT.

Additional product-related costs

- 0.40-0.47% p.a. depending on strategy and products selected

- Sustainable funds: 0.40% p.a. of the amount invested (including 0.25% administration fee for LGT Fund Management Company Ltd.)

- Thematic certificates (radiThemes): 0.75% p.a. of the amount invested (including 0.25% administration fee for Zürcher Kantonalbank)

Advantages:

– Transparent fee structure, with no hidden charges.

– Attractive discounts on management fees during promotional periods.

Disadvantages:

– Complex pricing structure may be difficult to understand for novice investors

– Potentially high fees for small portfolios, despite promotion

Investing in trends by investment theme

Among its investment products, Radicant offers thematic certificates (baskets of shares), all linked to sustainable development objectives.

This limited choice does not offer a real opportunity to invest in a sufficiently diversified range of themes.

Thematic investment is therefore an incomplete possibility at Radicant.

Promo Code

Free account ✔︎

Training and support

Radicant attaches great importance to raising awareness and educating investors about sustainable investment. It offers cutting-edge content:

- A blog with educational content on sustainable investment and the SDGs

- Very detailed information on the investment products it offers and their impact on the SDGs

- A proprietary impact rating system enabling investors to understand the impact of their investments

Radicant’s customer service is satisfactory and truly professional. It is accessible by phone (for a fee), email or chatbot, but does not yet offer livechat (planned for the future).

Open your Radicant account

The step-by-step registration process is illustrated in Radicant’s comprehensive guide. You need a phone and the promo code to receive your reward upon opening. It’s all explained 🙂

Switzerland’s best neo-investment bank?

Radicant represents an innovative and committed option in the Swiss neo-banking market. Its innovative investment approach focused on sustainability and the SDGs is ideal for investors concerned about the impact of their investments.

Radicant’s strengths:

- Unique focus on sustainable investment

- Product range clearly aligned with sustainability objectives

- Customized approach based on risk profile and SDO preferences

- Proprietary impact rating system providing transparency on the impact of investments

- Transparent fee structure, with a current promotion offering significant discounts

Radicant’s weak points:

- Minimum investment of CHF 1,000

- Limited product range compared with traditional investment platforms

- Lack of options for non-sustainability-oriented investors

- Potentially complex pricing structure

Compare Radicant with other investment platforms of neo-banks in Switzerland:

What do you think of Radicant for your investments?

- Has the app. Radicant changed your investment considerations?

- What feature would you like to customize or improve?

- Is Radicant right for you when it comes to measuring the impact of your day-to-day spending?

- Have you become more energy-efficient by installing Radicant?

Share your feedback with all Neo’s friends 😈

Promo Code

Free account ✔︎

Additional information

Specification: Radicant – Investment: Full Analysis and Review (December 2025)

| Security | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ||||||||||||||

| Investment | ||||||||||||||

| ||||||||||||||

| For who? | ||||||||||||||

| ||||||||||||||

| Accessibility | ||||||||||||||

| ||||||||||||||

Reviews (0)

User Reviews

Show only reviews in English (0)

There are no reviews yet.