WISE Switzerland – Review, Test, and Comprehensive Review (December 2025) + Free Card

| Offering | 7.7 |

|---|---|

| Security | 8.5 |

| Opening an account | 9 |

| Bank card | 8.5 |

| Features | 6.5 |

| Interest rates | 0 |

| Transfer speed | 9.5 |

| TWINT | 0 |

| Fees | 8.7 |

| Abroad | 9.5 |

| Cash deposit | 0 |

| Customer service | 8.5 |

Review of WISE Switzerland: The Best Choice for Currency Exchange? Our Test in Concrete Situations: Strengths… Weaknesses… Banking Services… Fees… Features… Pros and Cons… This Complete Review Saves You Valuable Time for Comparison. Use the Promo Link When Opening Your Account to Support Our Simplification and Comparison Work. Happy reading!

Description

Summary of the Wise banque offer

Over 16 million users. Wise (formerly TransferWise) is an international neo-bank that offers low-cost international money transfer services and multi-currency accounts and cards.

Account and card 💳

0 CHF/month

Security: is Wise Safe?

– Wise does not have a banking license in Switzerland. Therefore, deposits are not guaranteed by the 100,000 CHF deposit protection.

– WISE Europe SA, operating in the Swiss market, is a payment company regulated by the National Bank of Belgium.

– Unlike banks, Wise cannot lend. Client funds are safeguarded in a pool of low-risk liquidity (regulatory obligation).

– 40% of assets are kept in cash in several banks with strong liquidity.

– 60% are placed in secure liquid assets such as money market funds with BlackRock and State Street.

– Wise offers two-factor authentication (2FA) to secure account access.

– The generation of ephemeral virtual cards reduces the risk of hacking.

Promo Code

Free account ✔︎

Open a Wise account

Wise is available in French, German, English, Italian, Spanish.

Conditions for opening an account:

– No age or income requirements (YUH 14 years, Neon 15 years, ZAK 15 years).

– Reside in Switzerland, Europe, or elsewhere in the world. (Find the most suitable bank for cross-border workers and non-residents).

– Have a smartphone.

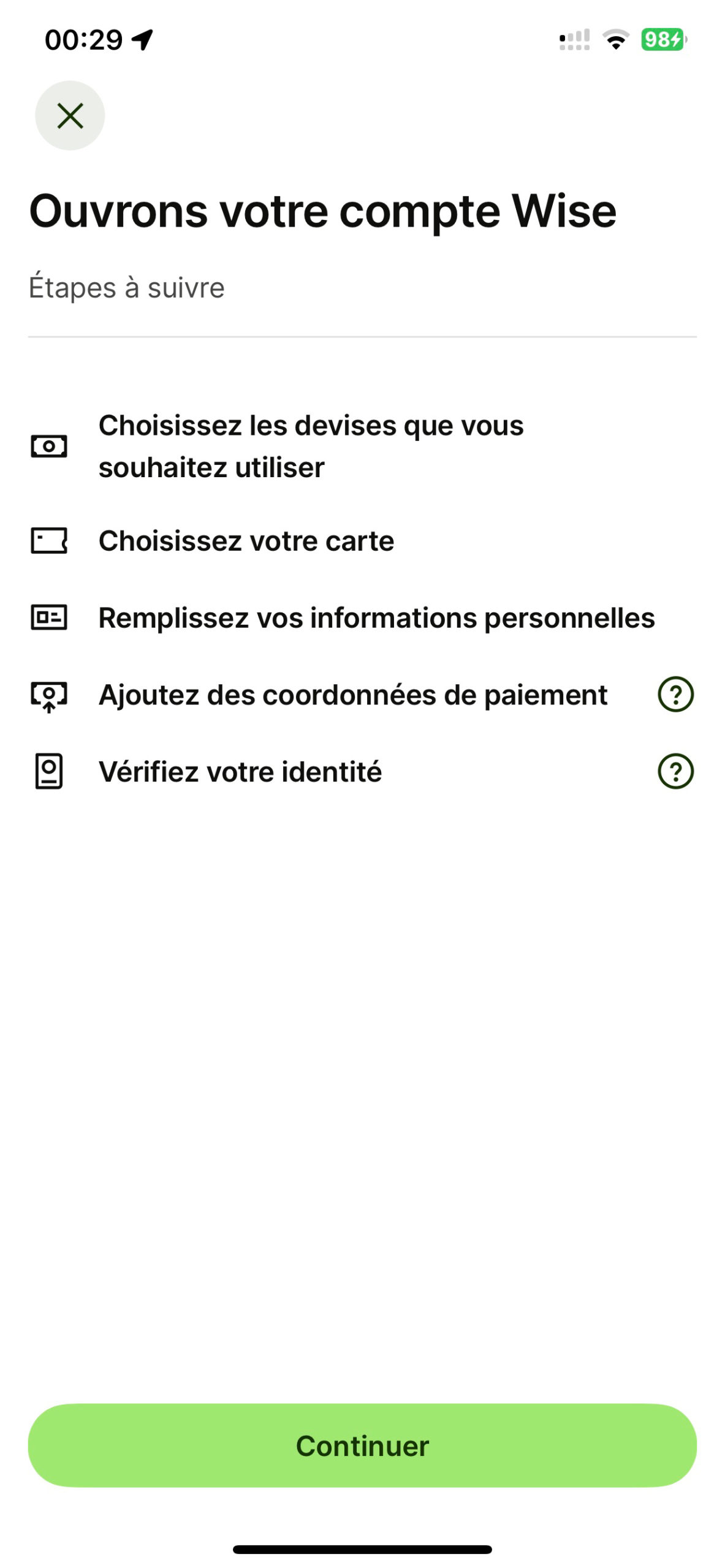

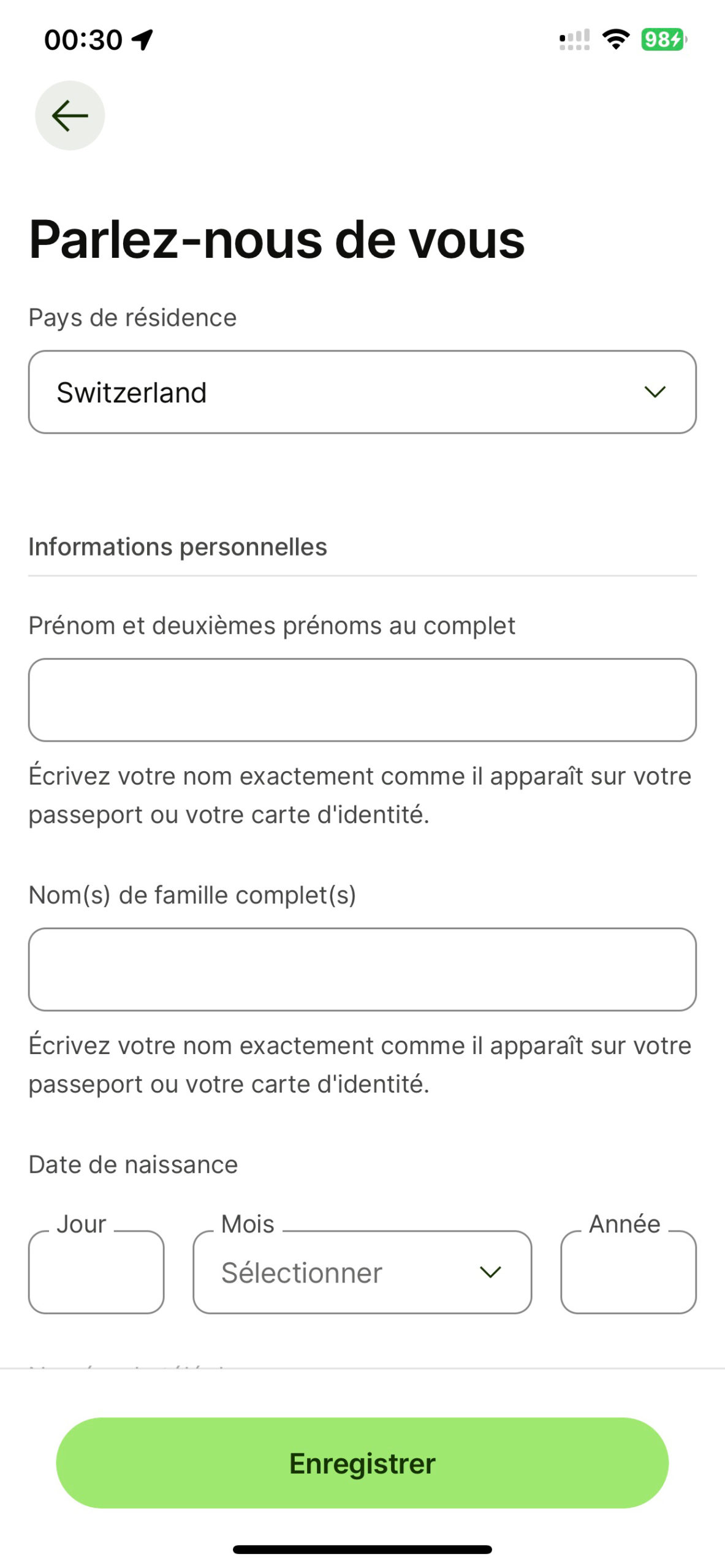

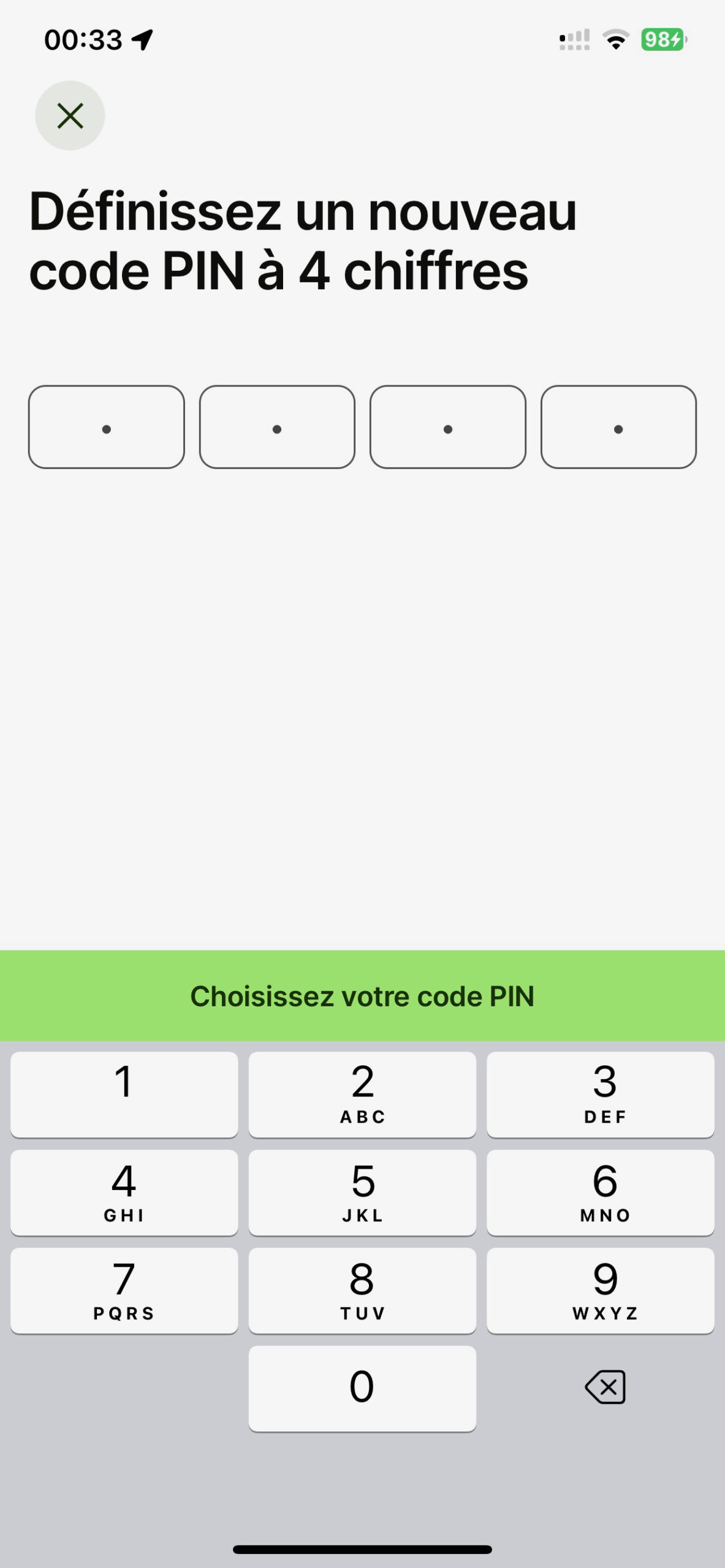

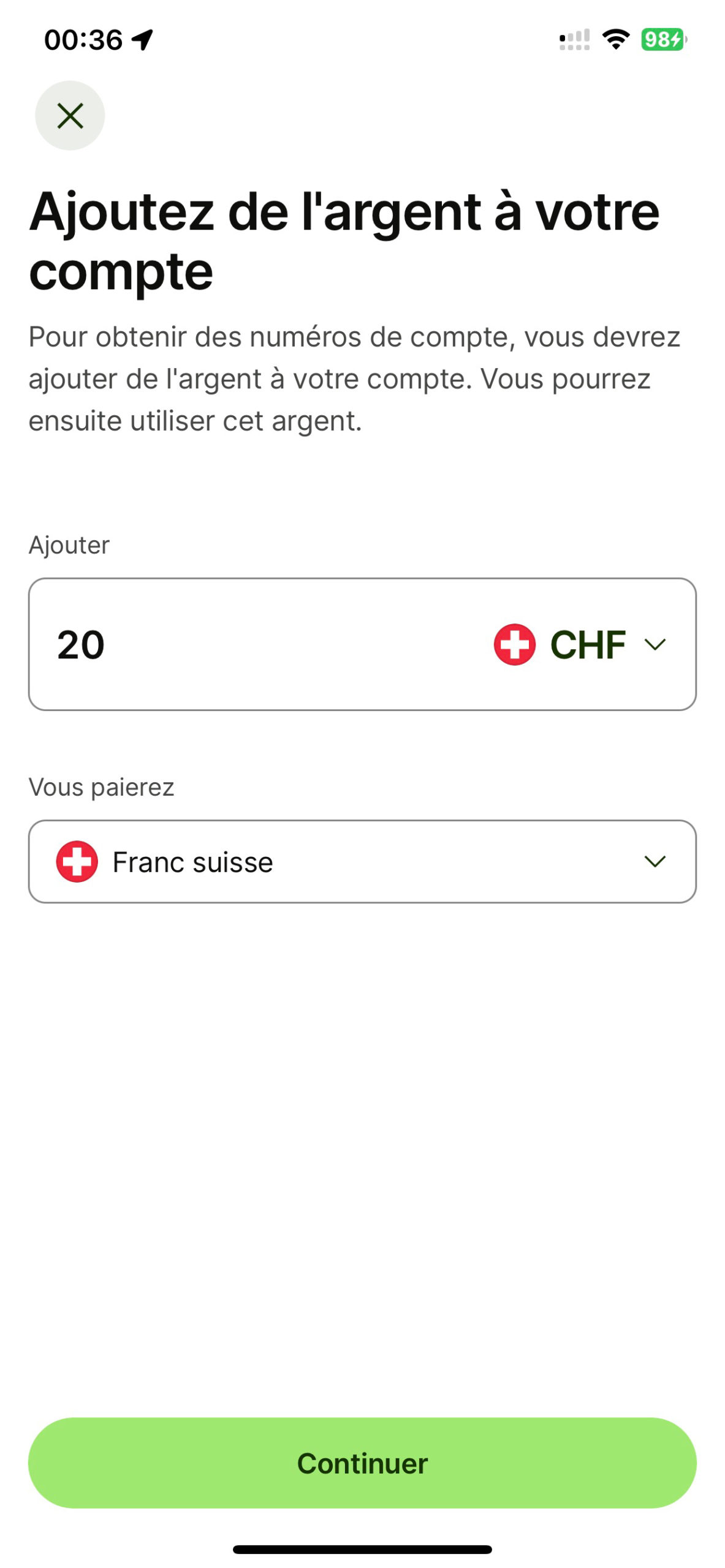

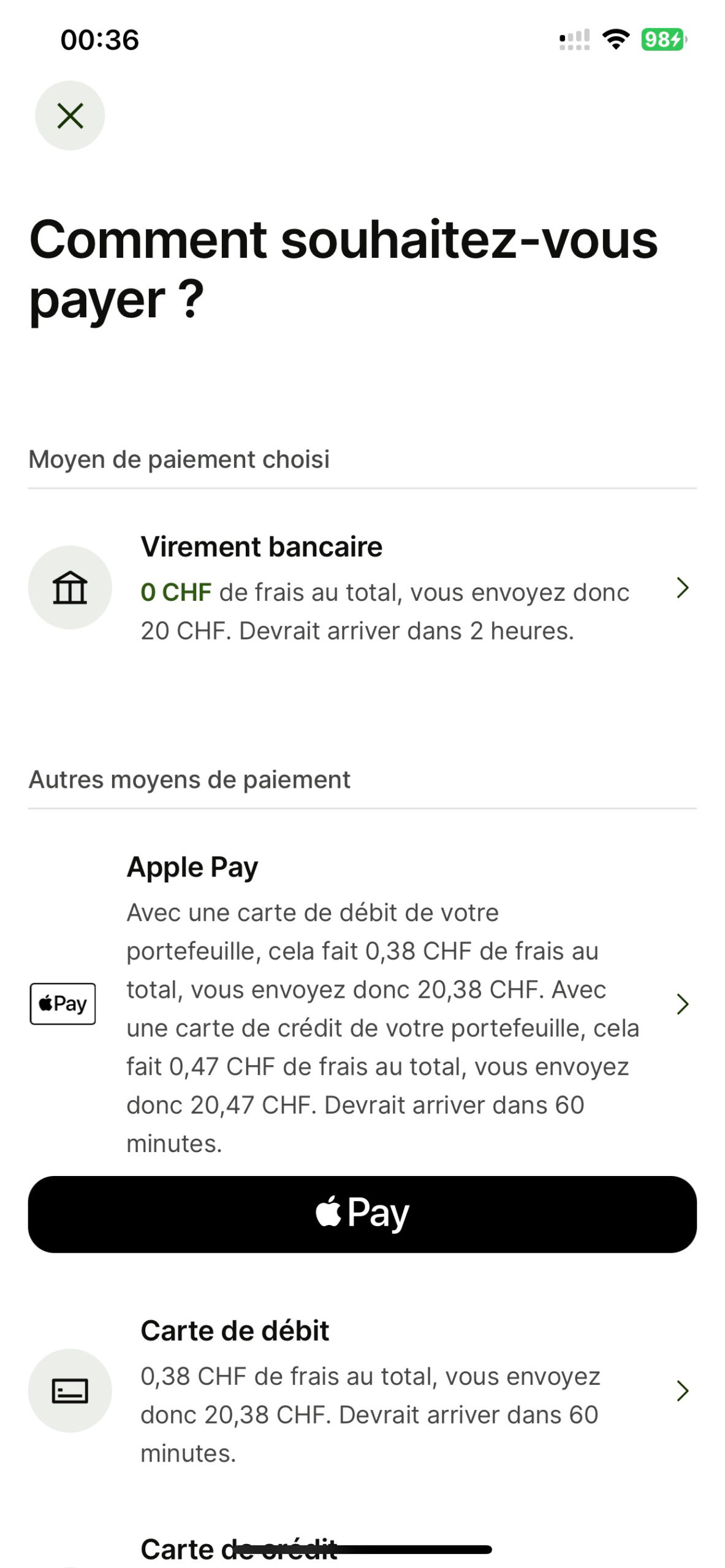

Step-by-Step Guide to Opening a Wise Account

The Wise bank card

💳 The Wise Mastercard Debit card in brief:

- Code-free contactless payment up to CHF 80/purchase. Beyond that, the code is required.

- Works with Apple Pay / Google Pay / Samsung Pay / Garmin Pay / Fitbit Pay

- The PIN code can be changed directly from the application.

You can temporarily freeze 🥶 or unfreeze 🥵 your card from the app.

To activate contactless, you need to finalize a first payment with the card code.

Can I rent a car?

Promo Code

Free account ✔︎

Wise application: features

Complete and mature UX

In addition to the basic functions :

- Track account movements

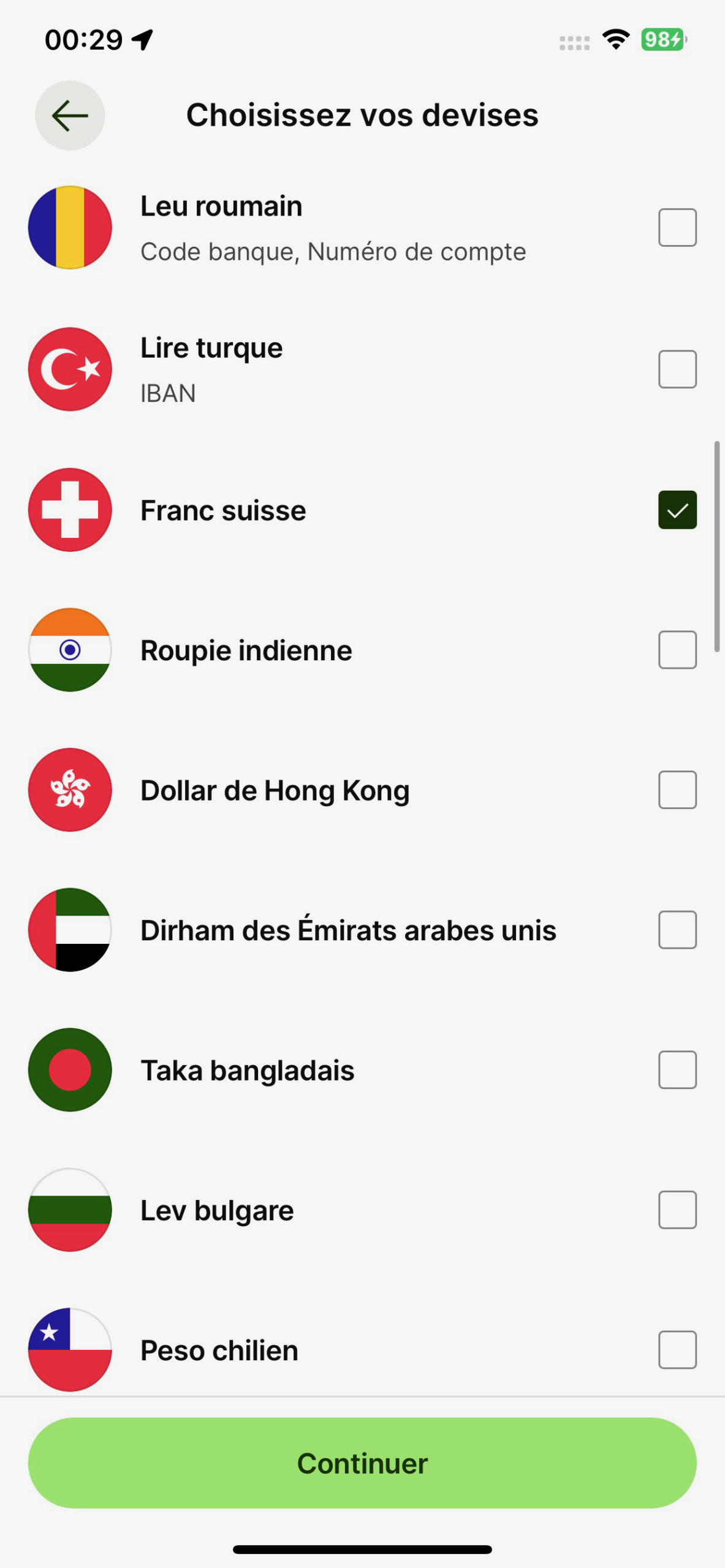

- Add other currencies

- Standing orders

- Instant payment between WISE users

- Dark mode

- Change contact details

- Freeze your card temporarily

- Change bank card PIN code

- Virtual card generation (up to 3 simultaneously)

“Payment Request” is a handy feature for simplifying claims and keeping track :

Essential features missing for the Swiss market:

✘ eBill 🇨🇭

✘ QR-bills not compatible

✘ TWINT

✘ Swiss LSV direct debit 🇨🇭

✘ Joint pots (as offered by ZAK for example)

These shortcomings, along with the BE (Belgium) IBAN, make WISE a supplementary solution for life in Switzerland, as a second or third account.

Wise account interest rates

Wise allows you to earn interest on assets only if you reside in the USA.

Transfer speed with Wise – send money

● Instant transfers between Wise users.

● International transfers are almost instantaneous (max. 24 h). WISE operates with its own local payment network worldwide. This solution is not only faster but also less expensive and more transparent than IBAN and SEPA transfers. Everything is directly announced in the app at the time of the transaction.

● A foreign transfer (outside SEPA) takes 1 working day. A transfer outside SEPA / SWIFT can take up to 4 days.

Promo Code

Free account ✔︎

Wise Twint – pay with TWINT anywhere in Switzerland

Wise does not support TWINT payments. This is unfortunate because TWINT remains by far the #1 payment app in Switzerland, which allows you to:

– Pay in stores.

– Transfer money between friends.

– Split a bill within a group (restaurant, outings, etc.).

– Pay for parking meters.

– Pay online and at train stations.

Wise Banque fees: card, foreign exchange, transfers, cash withdrawals, etc.

● Free multi-currency account

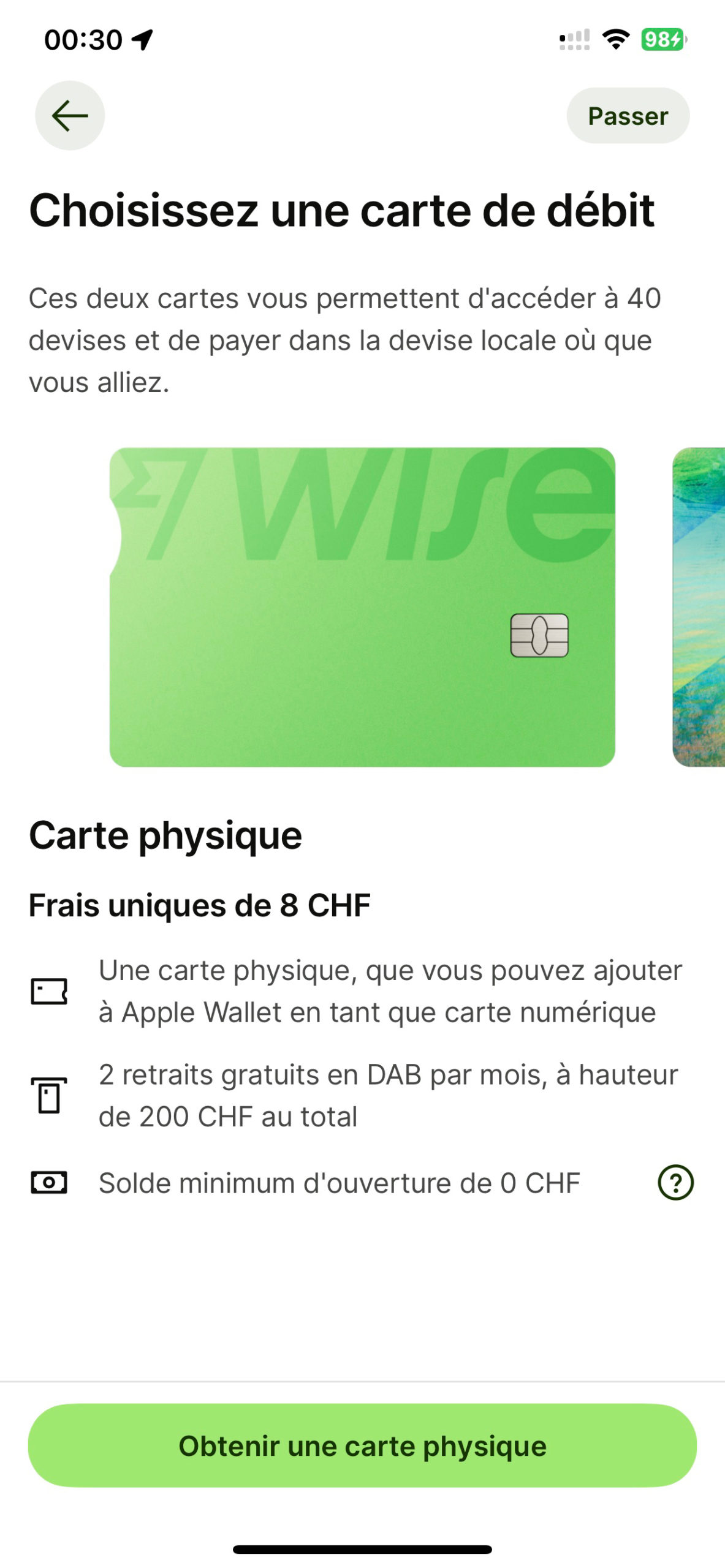

● Mastercard Debit card 8 CHF (one-time fee)

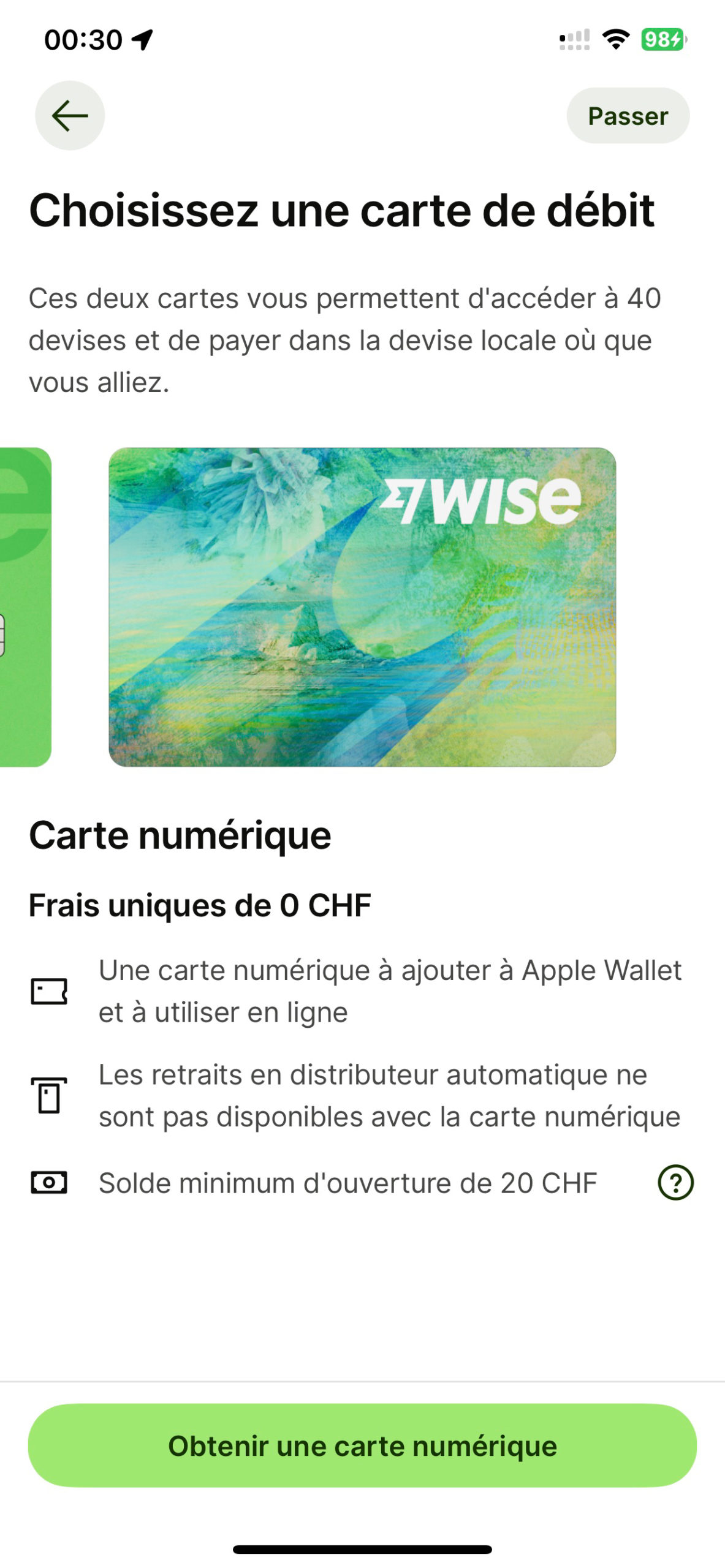

● Free virtual card

● Replacement card 4 CHF

● 💳 Card payments without transaction fees.

● Foreign exchange surcharge based on actual Reuters rate 3x /day (from 0.43%)

Money transfers in Switzerland 🇨🇭 ➔ 🇨🇭

● Transfers within Switzerland cost CHF 0.50.

International transfers 🇨🇭 ➔ 🌍

SEPA transfers are free of charge (conversion charges only).

Card charges are higher. Prefer transfers via :

- Wise account

- Bank transfer

- Low-cost transfer

The application allows you to simulate fees in real time for each transfer method.

Cash withdrawals in Switzerland 🇨🇭

● Free 2x/month (+1.75% of the amount beyond 200 CHF /month)

● Then 1.75% + 0.50 CHF / withdrawal (beyond the 2 free withdrawals or 200 CHF/month)

The app provides access to the updated free withdrawal threshold.

Cash withdrawal limits

The limits are flexible and can be modified from within the application.

Wise on the road and abroad

Wise is one of the most advantageous applications abroad, whatever the day of the week. Only Revolut can compete with its real rate of up to CHF 1,250, which drops to 1% at weekends.

Automatic multi-currency: when abroad, Wise pays in the correct currency at the time of purchase, at no extra charge. If the currency is not available, the amount is debited in the best-funded currency to the account at the advantageous WISE rate.

📍Paying in local currency is recommended even without funds in the currency account to benefit from WISE rates.

Promo Code

Free account ✔︎

Cash deposit on Wise account

It is not possible to deposit cash on your Wise account.

Wise customer service

● Accessibility: by phone 🤳 in English only. A callback request must be made from the app or website. By e-mail for other languages including French, German, Spanish and Italian. Response time is less than one working day.

A chat service is available but on a random basis.

Good reasons to open an account with Wise banque

WISE has a complementary role to a Swiss neo-bank that benefits from deposit protection.

It offers very attractive services for expenses and sending money abroad, but it does not provide sufficient services to support life and work in Switzerland. Its BE IBAN is not suitable for use as a salary account and regular payment of bills, particularly via Swiss LSV automatic debits.

Coupled with a Swiss neo-bank, WISE is one of the best solutions for exchanging funds. It offers a more advantageous rate than Neon, Yuh, Zak and CSX. You can compare all Swiss neo-banks using heyneo’s detailed comparison.

✔︎ You can open an account and receive your card for free using this Wise promotional link.

Wise vs. Revolut – Quick Comparison ⚡️

Wise is designed for currency payments. You choose the currency, know exactly the applied rate, and see the total cost before each transaction. The card allows you to pay or withdraw in almost all countries without changing accounts.

Revolut adds more features. You can create shared vaults, add virtual cards, or activate cashback. But each plan has its thresholds, withdrawal rules, and weekend restrictions. You need to follow the conditions if you don’t want to exceed the limits.

Both offer a true multi-currency account. But neither allows you to manage a budget in CHF nor connect to Swiss banking tools.

To be preferred if…

- You want to send or convert currencies with a transparent rate without having to manage a plan: Wise

- You’re looking for a comprehensive app with more features for payments and currencies: Revolut (read Revolut review and test)

To avoid if…

- You live in Switzerland or receive a salary in CHF

- You want a simple application without thresholds or limits to monitor

- You use TWINT or Swiss banking tools daily

Wise vs. N26 – Quick Comparison ⚡️

N26 allows you to manage a euro budget without friction. The personal IBAN facilitates transfers from a European employer or client. The app is clear and stable for daily use in the SEPA zone. But as soon as you need to manage other currencies, the limitations become apparent. It’s not possible to maintain multiple balances, convert at real rates, or visualize fees outside of euros.

Wise fills this blind spot. You can open a balance in different currencies, pay with the card without automatic conversion, and send money to over 70 countries. But it’s not a full-fledged bank. There’s no personal IBAN in EUR, SEPA direct debits are restricted, and you can’t easily centralize your income there.

For someone living or working in the eurozone, N26 remains a functional base. For recurring payments in foreign currencies or international transfers, Wise stands out as a more effective complement.

To be preferred if…

- You are paid in EUR or carry out the majority of your transactions in the SEPA zone: N26 (read N26 review and test)

- You often pay in other currencies or make international transfers: Wise

To avoid if…

- You’re looking for a complete solution to centralize local payments and currencies

- You need a Swiss IBAN or access to Swiss banking services

- You use TWINT, eBill, or direct debits in CHF

Lightning comparison between Wise, Neon and Revolut ⚡️

To compare all the details, you can see the reviews on the complete review of Neon and the complete review of Revolut Switzerland.

Wise vs. Neon vs. Revolut

Promo Code

Free account ✔︎

Additional information

Specification: WISE Switzerland – Review, Test, and Comprehensive Review (December 2025) + Free Card

| Online banking | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ||||||||||||||||

| Bank card | ||||||||||||||||

| ||||||||||||||||

| For who? | ||||||||||||||||

| ||||||||||||||||

| Mobile payments | ||||||||||||||||

| ||||||||||||||||

Reviews (0)

User Reviews

Show only reviews in English (0)

There are no reviews yet.