Selma – My full review and opinion in December 2025

| Investment security | 10 |

|---|---|

| Fees | 9.1 |

| Investment income | 8.8 |

| Crypto-currencies | 4.3 |

| Trading features | 7.2 |

| Training | 8.6 |

| Customer support | 9.8 |

| Opening an account | 9.4 |

Our review of Selma: the investment platform for automating wealth management with low fees. From registration to the investment itself, is this the online investment platform for you? To determine this, we analyze Selma’s offering point by point. Open your account with promo code NEOSEL to earn 34 CHF.

Description

[Update – 2025-11-11: New transaction filtering tool.]

[Update – 2025-11-04: Introduction of new portfolio types and the “Swiss Bias”.]

[Update – 2025-11-01: Review of the Selma 3a offering.]

Why consider Selma for investing in

2025

When you start looking into investment solutions in Switzerland without doing everything yourself, you quickly come across four names:

- Yuh Investment, which allows you to manually buy stocks or ETFs.

- Neon Investment, which offers automated passive management via True Wealth.

- Inyova, focused on selectable societal causes.

- Alpian Investment, for a mix of automation and human support.

And then there’s Selma, a Swiss robo-advisor that allows you to manage a diversified portfolio automatically, based on a questionnaire.

What does it mean to entrust your money to a fully automated solution?

Do you understand what is invested, under what conditions, and at what cost?

Can you maintain a minimum of control, or is everything fixed?

I’ve tested Selma in detail, from account opening to portfolio monitoring.

So here’s what Selma allows and what Selma doesn’t allow you to do…

Selma’s Investment Plan is 100% Automated

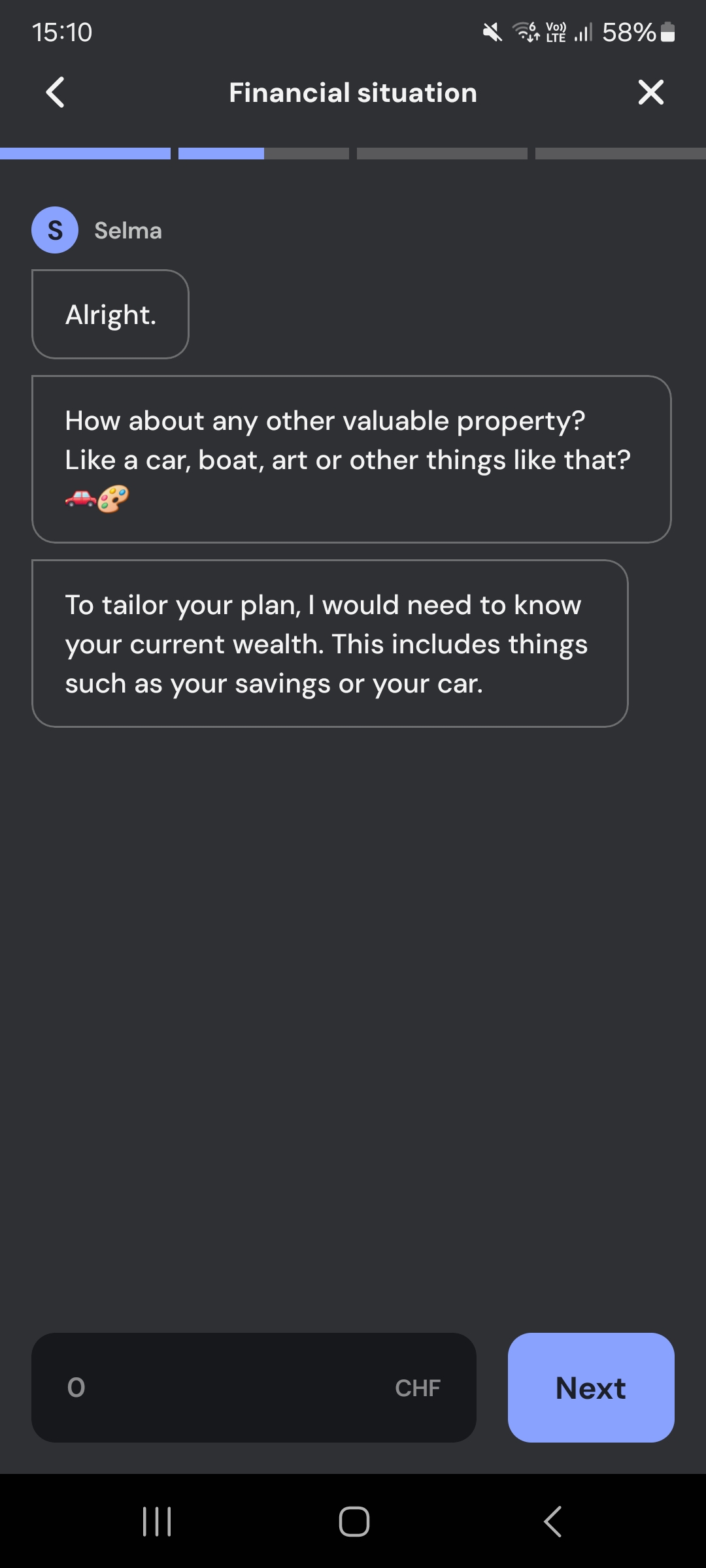

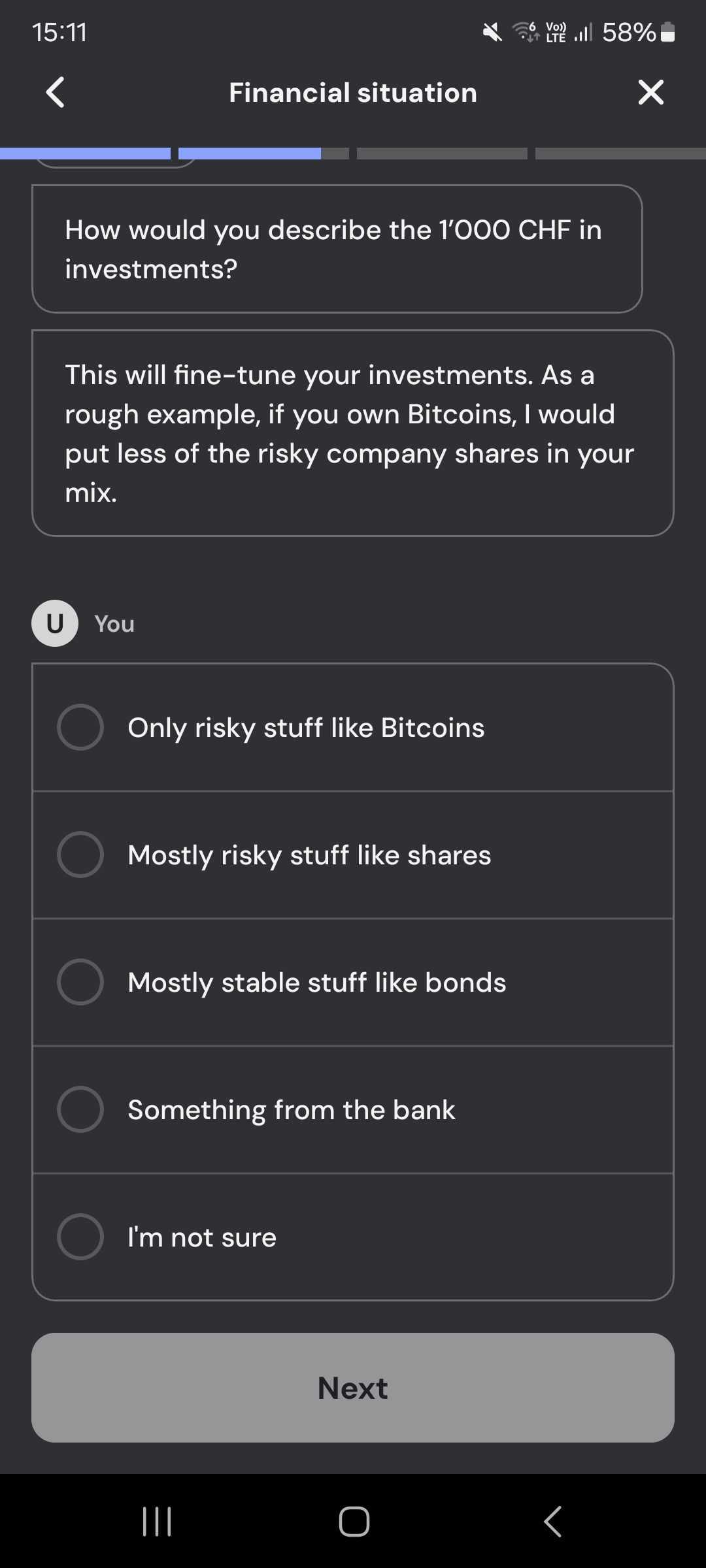

The entry into Selma starts with a questionnaire (accessible and without technical jargon).

It describes:

- Your life situation

- Your income

- Your investment goals

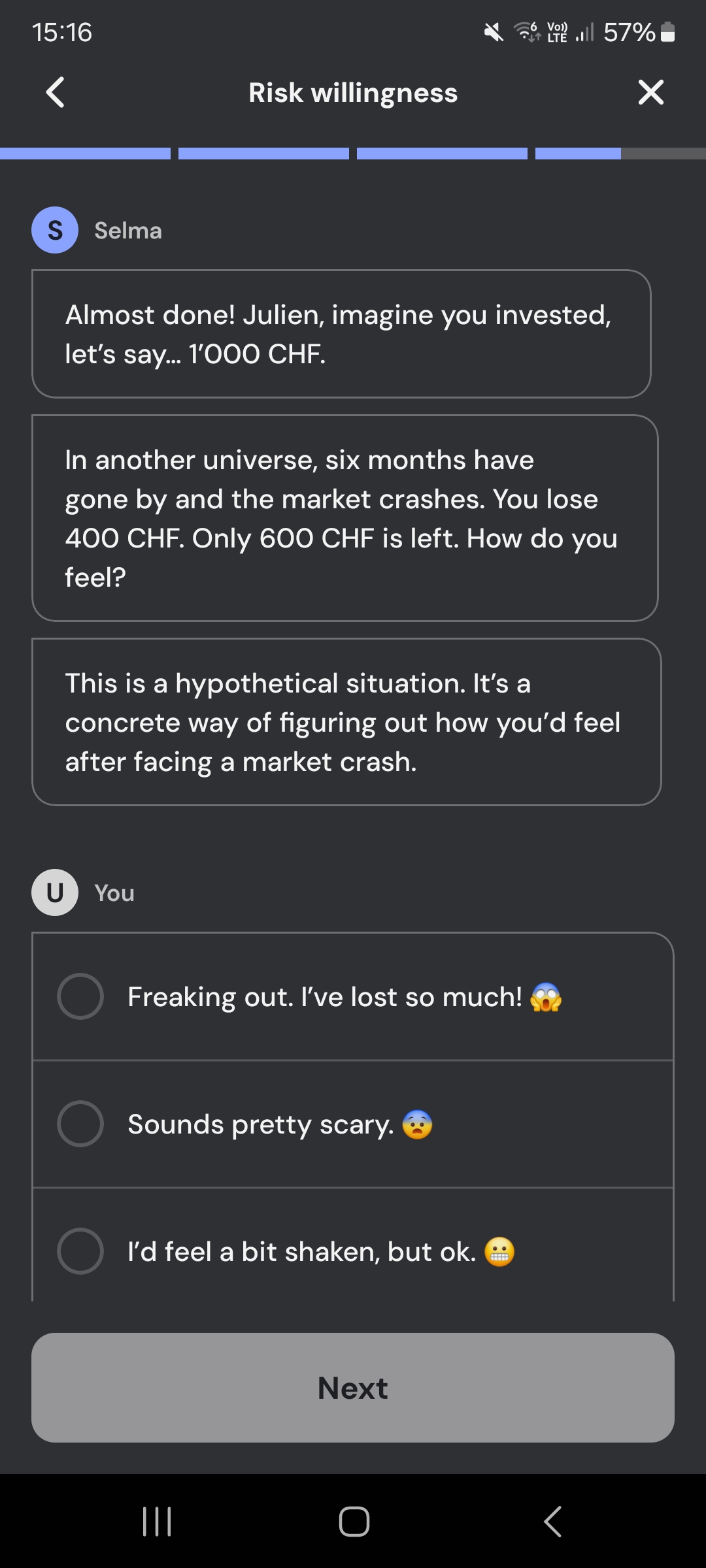

- Your risk tolerance

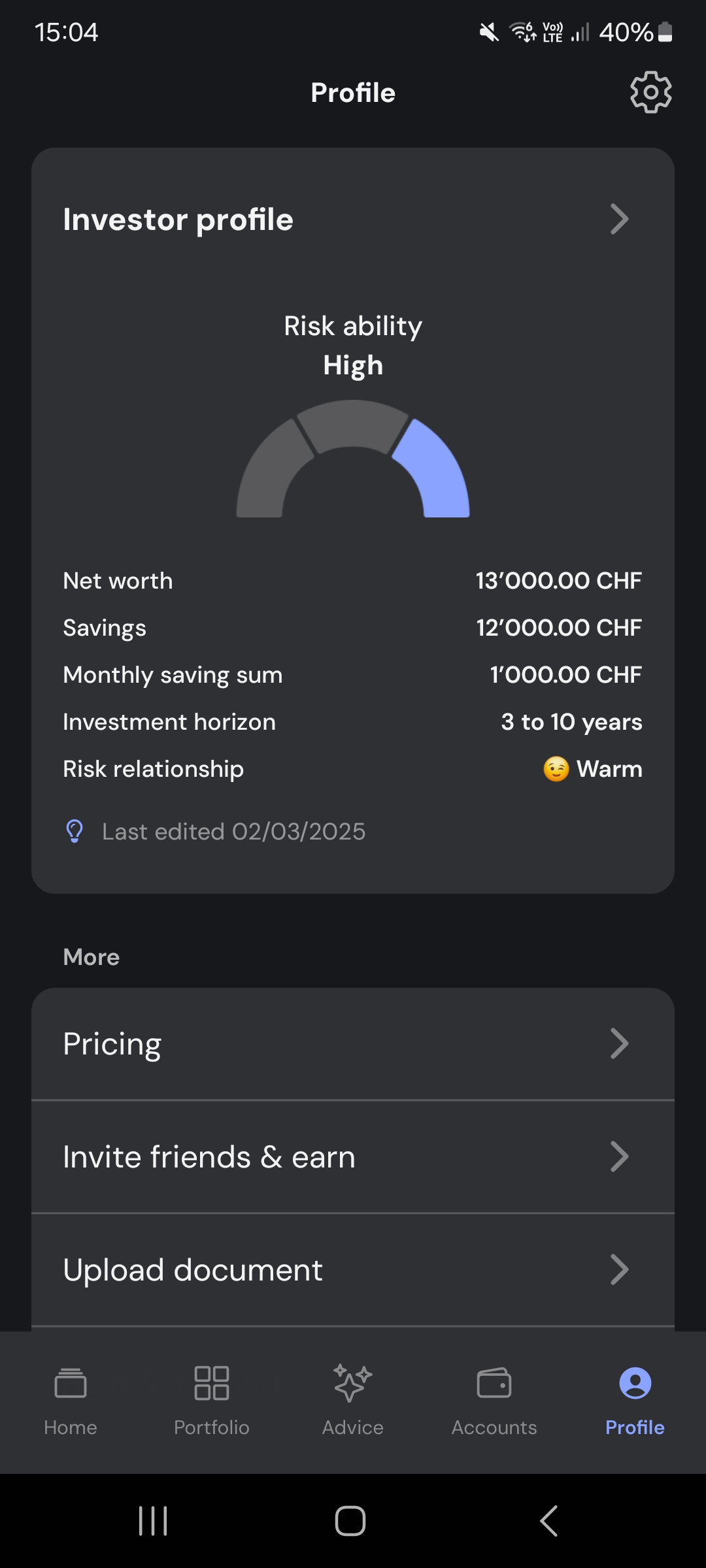

It’s on this basis that Selma generates a personalized investment plan.

The questionnaire takes into account what I already own.

For example, if I have real estate or a 3rd pillar, Selma avoids overexposing me to these themes.

This allows me to maintain a balanced portfolio, without invisible duplications.

But this “personalized” plan should be understood in a broad sense:

There is no manual selection possible, neither for securities nor for allocation.

Everything is managed by the algorithm. The proposed allocation is based on a combination of diversified ETFs, all filtered according to ESG criteria.

The approach is radically passive. No attempt to outperform the market. No tactical adjustments. Once the plan is validated, you can no longer intervene. The portfolio’s evolution follows its course according to the internal rules defined by Selma.

In comparison with alternatives in Switzerland:

- Yuh and Neon Invest allow you to choose your own securities.

- Inyova allows thematic selection (education, equality, climate, etc.).

- Alpian offers a fixed investment plan, but with an advisor available at any time.

Selma, on the contrary, removes all room for maneuver once the plan is validated.

From a certain point of view, it’s a strength, but this framework doesn’t suit everyone.

What I actually got at the end of the questionnaire

Once the questionnaire is completed, Selma generates a portfolio entirely composed of ESG ETFs.

No fund names are displayed, only the main asset classes: stocks, bonds, cash.

We receive a synthetic view of the allocation, but without details on the issuers or the applied ESG criteria. There are no options to refine or filter anything.

You need to deposit at least 2,000 CHF to activate the investment (or 500 CHF for pillar 3a).

This amount puts Selma on par with Inyova or Alpian Essentials, but well above Yuh (25 CHF minimum) and Neon Invest, which starts from 1 CHF.

Opening a Selma account in 24 hours (blocked without initial deposit)

The account opening was done from the mobile app.

The process is well-structured: upload your ID, specify your tax status, income, and sign electronically.

Everything went smoothly, but the wait for the validation service was a bit long. My advice: call at the end of the day after 6:00 PM when most people have already passed.

As long as the 2,000 CHF are not deposited, the portfolio remains inactive.

This threshold is equivalent to Inyova or Alpian Essentials, but much higher than Yuh, which allows initial fractional investments from 25 CHF.

Selma offers a 3rd pillar (3a) alternative from 500 CHF, but in a different tax framework.

It is not possible to open an account for “exploratory” purposes or to start with small amounts. You need to commit financially from the start, without detailed visibility on the products used.

The application is smooth, but we remain simple spectators

The interface is clean and well-constructed.

You can easily access the portfolio allocation, value evolution, and the latest important information.

The charts are readable, navigation is smooth, without unnecessary clutter.

A feature called “Insight” allows you to ask questions to an integrated AI.

It answers the most common queries (e.g., what is rebalancing? how does Selma manage inflation?), but doesn’t replace a real strategy or personalized exchange.

What’s striking is the total lack of control:

- No possibility to buy or sell

- No modification of the allocation

- No visualization of the exact funds used

The data is updated once a week.

It works the same way as with Managed by Alpian Essentials, but unlike Alpian, you cannot contact an advisor to ask specific questions.

Unlike Yuh or Neon, you don’t follow the market in real-time, and you can’t adjust anything.

The experience is consistent with the delegation promise, but it leaves no room for initiative.

A passive management by ETF, without bets or adjustments

Selma does not seek to beat the market or make tactical choices.

The portfolio is built solely from ETFs — funds that replicate the performance of a stock market index, such as the global market or government bonds.

These ETFs are filtered to exclude certain controversial sectors (oil, tobacco, weapons…), but no manual decisions are made:

→ There is no company selection,

→ no strategy change based on current events,

→ no possibility to target a specific theme like tech or climate.

The structure remains the same:

- a portion in stocks (more or less important depending on the risk profile)

- a portion in bonds

- some cash

The only possible adjustment is made automatically, at regular intervals.

Selma monitors an indicator called CAPE (for Cyclically Adjusted Price-to-Earnings), which is used to detect if the stock market is too expensive compared to its 10-year history.

When this threshold is crossed, a part of my portfolio is automatically transferred to a safety pocket, such as gold.

It doesn’t replace real active management, but it avoids staying too exposed to an overheating market.

And since everything is done behind the scenes, I don’t have to trigger anything myself.

My portfolio is built around three blocks:

- Growth, with global stock ETFs

- Stability, via bonds

- Protection, with a portion of gold

Selma adjusts the allocation based on my risk profile.

If I’m more cautious, the share in bonds and gold increases.

Very limited personalization (framing)

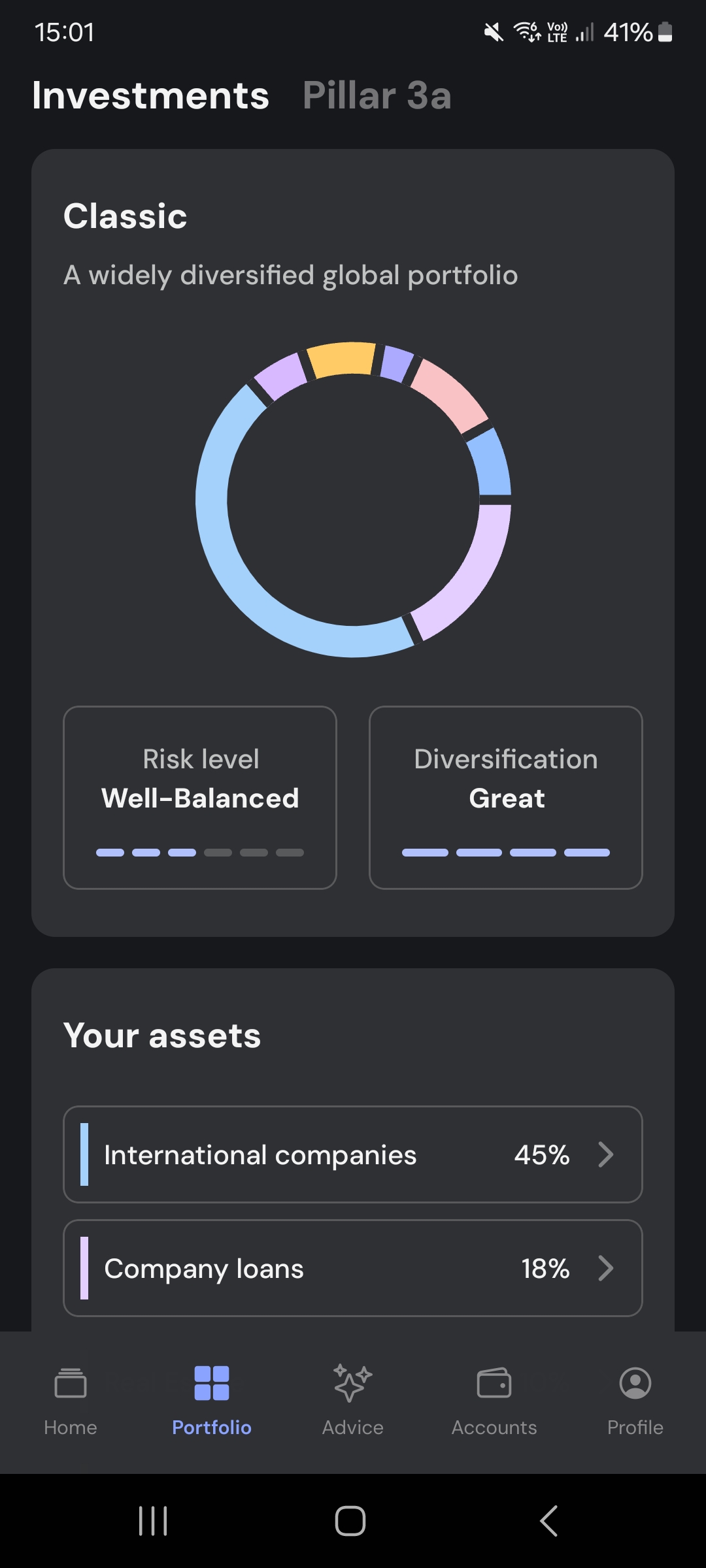

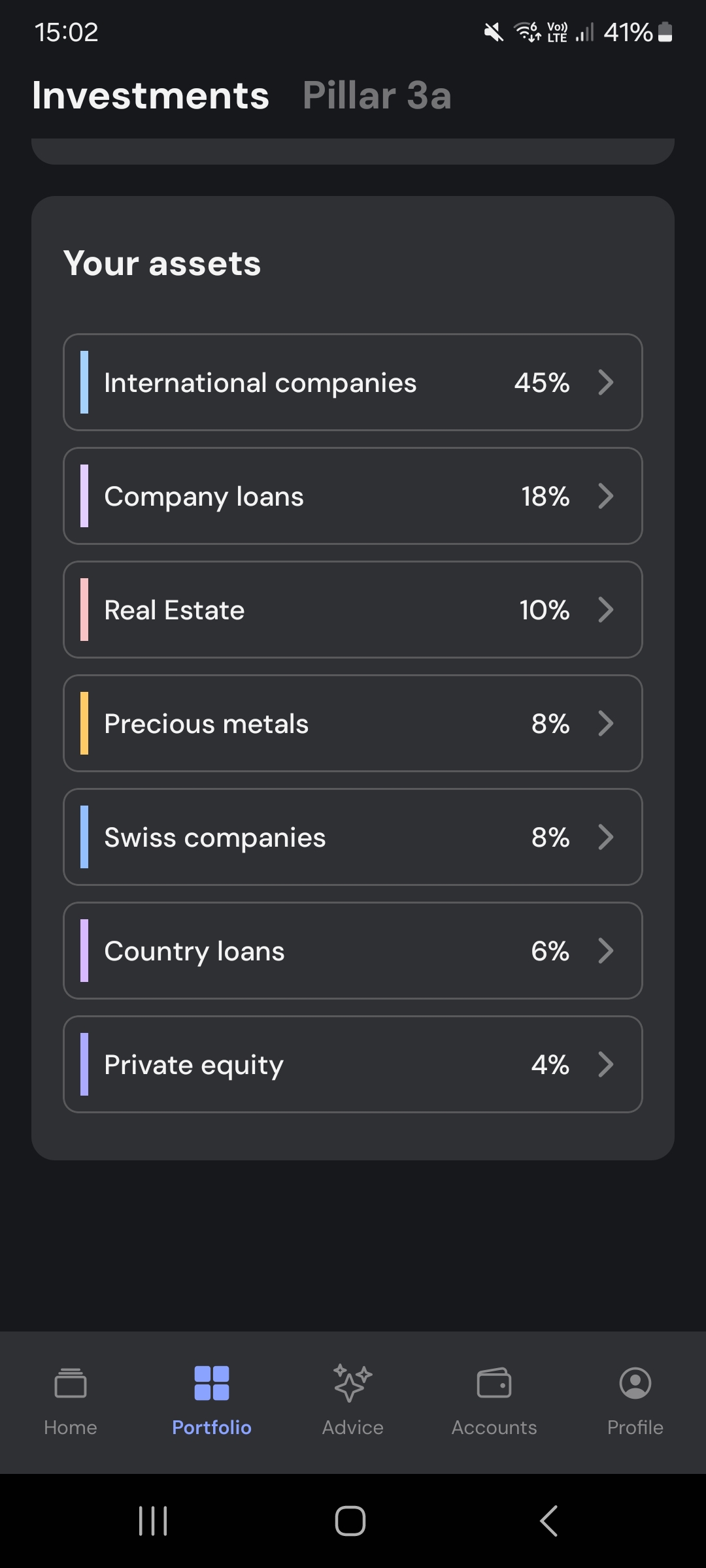

Once the questionnaire is completed, Selma displays a proposed allocation.

It’s presented in the form of a pie chart, with a distribution between stocks, bonds, and cash, in my case, 45% in international companies, 18% in government bonds, 10% in real estate:

Just below, a performance simulation shows three possible scenarios: optimistic, moderate, pessimistic.

We quickly understand that the riskier the profile, the higher the share of stocks.

But everything remains very general. No fund names are displayed, no details on the countries, sectors, or companies involved.

Nothing can be modified once the plan is validated, but I can update my profile if my situation changes.

This is part of the simplification: we have to validate this plan without knowing exactly where the money is going. And once it’s done, we can’t change anything:

- impossible to change the weightings

- impossible to exclude a sector

- impossible to target a theme or geographic area

If I change jobs, if my goals evolve, or if I become more comfortable with risk, Selma proposes a new allocation.

This is the only way to change my portfolio.

In comparison:

- Inyova allows you to select causes to support (climate, equality, innovation…)

- Yuh and Swissquote offer total freedom to choose investments

- Alpian Essentials offers a pre-set strategy, with an available advisor, but without portfolio personalization

- The Alpian discretionary mandate (from 30,000 CHF) allows you to request precise adjustments (exclusions, weightings, etc.)

There are also several predefined portfolios that I can choose from the outset.

Three different approaches are offered, each with its own objectives. Depending on my situation, I can activate a ‘retirement’ mode that automatically adjusts the strategy to reduce risk.

Classic Portfolio

This is the default option. It seeks a global balance between return and risk, without any particular bias. If you prefer not to overthink it, this option gets the job done.

Sustainability Portfolio

Here, Selma filters out companies linked to fossil fuels, armaments, or tobacco. The selection follows quite strict ESG criteria. While I cannot choose the exclusions myself, the approach aims to be more responsible.

Income Portfolio

This portfolio aims to generate consistent income. It is primarily designed for retirees or those who desire supplementary income without excessive exposure.

Each portfolio can be configured with or without a Swiss bias.

When choosing your portfolio, you can activate an option that gives more weight to Swiss investments. With this local bias, your portfolio is less exposed internationally but more aligned with the country’s economy, which can be fiscally advantageous or simply reassuring.

Conversely, if I do not activate it, my strategy remains entirely global, without preference for Swiss assets.

Once switched to “Pension Mode,” Selma automatically adjusts the portfolio: the risk level decreases, the equity portion declines, and priority is given to more stable investments, often Swiss.

I can activate this mode from the app, without needing to contact anyone. It works with any type of portfolio.

Selma is suitable for those who want to invest without getting involved

Selma works well when you want to invest without complicating your life, without having to follow markets or choose your investments.

You just need to fill out the questionnaire, validate the proposed plan, and then you have nothing else to do.

Selma is suitable if:

- you want to avoid complex decisions

- you’re looking to invest long-term, in a structured way

- We appreciate the idea of a portfolio filtered according to ESG criteria

- We accept not controlling everything, as long as the management is smooth and without surprises

There is nothing to manage on a daily basis and the application takes care of the monitoring.

What remains satisfying is being able to visualize the evolution of your portfolio over time.

Even if we don’t control anything, we see the performances, the distributions, the small automatic adjustments — and it gives a sense of continuity. We still maintain good visibility on what’s changing, which allows us to follow the broad lines without feeling left behind.

Apart from judging others, my thing is to talk about complicated things at dinners without putting in too much effort.

Neo – Unsolicited advice (as usual).

Selma is not for those who want to understand or intervene

From the moment you start wanting to closely monitor your investments or keep control over your choices, Selma shows its limitations.

We don’t see which ETFs are used, we can’t filter sectors or adjust the allocation.

Even if you’re somewhat interested in portfolio management, you hit a wall.

Everything is decided once and for all. And then, there’s nothing more to do… nor to really understand.

This is where frustration can appear:

For those who want to invest in line with their convictions, explore certain sectors, or simply adjust their strategy according to the context, Selma offers no flexibility.

In this case, it’s better to turn to other options:

Yuh or Neon Invest allow total freedom to invest by yourself;

Inyova allows you to choose concrete causes to support;

Alpian allows delegation with real room for adjustment.

As for Swissquote, it opens the door to more technical, more advanced management.

Selma remains consistent… as long as you don’t ask for more than what it offers.

🌱 Selma’s ESG Approach

Selma displays “sustainable” management by systematically integrating ESG criteria.

All portfolios are built with filtered ETFs: no weapons, no tobacco, no fossil fuels.

The selected funds rely on scores provided by external agencies — but we can’t choose which ones.

This ESG filter applies automatically, without the possibility of adaptation.

We can’t decide to strengthen certain exclusions, nor to highlight causes that are close to our hearts.

It’s impossible, for example, to build your portfolio around climate or health, or to exclude a sector that doesn’t align with your values.

Even the visualization is limited: no indicator allows you to track the real impact of your investments.

In short: Selma guarantees a minimal ESG base, but doesn’t go further.

We have no control over the sustainable dimension of our portfolio, beyond the initial filter.

In comparison:

- Inyova allows you to build a tailored portfolio, around your convictions, with a clear impact score

- Alpian offers an ESG option, without the possibility of refinement

- With Yuh, Neon Invest or Swissquote, nothing is filtered — everything relies on your own choices

With Selma, we know that our portfolio excludes certain sectors, but we don’t know exactly which ones. And if we’re looking to give precise meaning to our investments, this might not be enough.

Visible and stable fees, unlike the spreads of Yuh or Neon

Selma displays its fees transparently.

We pay an annual management fee, to which are added costs related to ETFs and currency exchange operations.

The structure is simple:

- Management fees: 0.68% up to 50,000 CHF invested, then decreasing to 0.42% from 500,000 CHF

- ETF fees: about 0.22% per year (internal fund fees)

- Exchange fees: about 0.25% for each conversion (CHF → USD or EUR)

In practice, this means that with a portfolio of 10,000 CHF, you pay:

- ~68 CHF/year for management

- ~22 CHF/year for ETFs

- A few CHF in exchange fees, depending on rebalancing

Quick comparison of fees (10,000 CHF invested)

| Solution | Management fees | ETF Fees | Other Fees | Estimated Annual Total |

| Selma | 0.68 % | ~0.22% | ~0.25% exchange fee | ~110-120 CHF |

| Yuh | 0% displayed* | Included in the product | Spreads on each order (buy/sell) | Variable and not very transparent |

| Neon Invest | 0% displayed* | Same as Yuh | Spreads on ETFs | Variable and not very transparent |

| Inyova | 0.9-1.3% (all-inclusive) | — | No additional fees | ~90-130 CHF |

| Alpian Essentials | 0.75 % | Included | No additional fees | ~75 CHF |

*Unlike Selma, Yuh and Neon do not charge direct management fees,

but costs are integrated into the buy and sell prices, in the form of spreads.

These fees are less visible, sometimes more difficult to evaluate, and vary depending on the product or timing.

It’s more flexible… but not necessarily cheaper in the long run.

What are spreads again?

It’s the difference between the purchase price and the selling price of a financial product.

When buying an ETF on Yuh or Neon, you pay a price slightly above its real value.

This margin (invisible on the invoice) is taken by the platform.

The more orders you place, the more this hidden fee accumulates.

And since it depends on the product, timing, and liquidity, it is impossible to accurately anticipate.

Selma charges its fees in a direct, visible, and stable manner.

Yuh or Neon seem cheaper, but their real cost depends on the frequency of investment and the products used.

So in summary:

Selma is more predictable, but more expensive on paper.

Yuh/Neon are more flexible, but less clear and potentially more costly over time.

No human contact, no personalized assistance

Selma does not offer any personalized support.

Once the investment plan is validated, you’re on your own with the application.

All management is automated, and there is no interface to discuss your situation or ask questions about your strategy.

The app includes a feature called “Selma Insight”, a form of AI that allows users to ask general questions (e.g., “What is rebalancing?” or “Why did my portfolio change this week?”).

The answers are clear but generic. They do not take into account the user’s personal situation.

You can contact technical support in case of problems, but it’s not financial guidance. There are no possible appointments as with Alpian Essentials, no exchange with a dedicated advisor.

In comparison:

- Inyova offers a welcome call with an advisor, and possible contact in case of doubt

- Alpian (from the Essentials offer) provides a human advisor, available to explain and guide

- Yuh, Neon or Swissquote function like Selma: no advice, but total freedom of action.

With Selma, as everything is framed from the start, you don’t need help. At least, that’s the idea.

But if you’re looking for an outside perspective, an exchange, or validation of your decisions, this is not the right solution.

Selma vs Yuh, Neon, Inyova, Alpian: Key Differences

When looking to invest simply in Switzerland, Selma is not alone in the market.

Other platforms offer passive or semi-automated approaches, with very different levels of freedom, advice, or impact:

Comparison Table – Selma vs. Swiss Alternatives (in

December 2025)

| Criteria | Selma | Yuh | Inyova | Alpian Essentials | Neon |

| Minimum Amount | 2,000 CHF | 25 CHF | 2,000 CHF | 2,000 CHF | 1 CHF |

| Management | 100% automated | Free | Semi-automated | Automated + support | 100% automated |

| Choice of Investments | No | Yes | ESG Themes | No | No (predefined profile) |

| ESG | Standard screening | None | Customized ESG | Standard ESG option | Standard screening (True Wealth) |

| Approx. fees (10k CHF) | ~110–120 CHF/year | Variable (spreads) | ~90–130 CHF/year | ~75 CHF/year | ~50–80 CHF/year |

| Human support | No | No | Yes (limited) | Yes (dedicated advisor) | No |

What I observe:

- Selma focuses entirely on simplicity and total delegation, but imposes a very rigid framework.

- Yuh allows complete freedom, but without guidance or ESG filter.

- Inyova is more engaging and customizable, but more expensive.

- Alpian Essentials offers a balance: automation + human presence, at a moderate price.

Selma is interesting if you want to manage nothing yourself, without necessarily building a committed or tailored portfolio. But as soon as you expect more control, conviction or exchange, better-suited alternatives exist.

Guarantees, regulation and security of Selma

Selma is a Swiss company, registered as an asset manager and supervised by FINMA through the OSIF supervisory body.

It acts as an intermediary, but does not hold funds or securities.

Specifically:

The portfolio is managed at VZ Vermögenszentrum

With a deposit account at Saxo Bank

- Saxo Bank (Switzerland) is a custodian bank regulated by FINMA.

- VZ VermögensZentrum is a recognized asset manager.

- ETFs are held in a personal securities account, opened in the client’s name.

This means that the assets remain the property of the client, even if Selma were to cease operations.

You can recover your entire portfolio, or transfer it to another provider.

Personal data is stored in Switzerland. Access to the application is secure, and operations go through double validation (2FA).

So to summarize: Selma is not a bank, but an interface. It does not manage money flows or securities custody. Everything relies on identified and regulated Swiss partners.

Conclusion – A clear but rigid solution. It all depends on what you expect.

Selma keeps its main promise: invest effortlessly, without making choices, without managing arbitrage.

The experience is smooth, stable, well-framed. You delegate completely, and you can monitor your portfolio without get lost in details.

But for it to work, you must accept not managing anything yourself.

No ETF choices, no ESG customization, no human contact.

The framework is set from the start, and you have to stick to it.

Selma is relevant if:

- you want to start investing without learning the technique

- you’re looking for a Swiss, simple, structured, ESG-filtered solution

- you accept paying a bit more to avoid any active management

Selma is not suitable if:

- you want to understand precisely where your money goes

- you’re looking to adapt your strategy to your convictions or current events

- you expect a minimum of human interaction or room for maneuver

“Selma allows you to delegate everything, but that’s exactly what can become frustrating as soon as you seek to readjust, understand or get more involved.”

But this comfort comes with very clear trade-offs: no flexibility, no customization, no exchange. So it all depends on the level of involvement you wish to maintain in your portfolio.

Also read

- Review and Test of Yuh Investment Trading

- Review and test of Neon Investment Trading

- Review and Test of Alpian Investment Trading

What do you think of Selma for your investments?

- Has the Selma app facilitated your investments?

- What feature would you like to customize or improve?

- Does Selma satisfy you in terms of advice?

Share your feedback with all Neo’s friends 😈

Additional information

Specification: Selma – My full review and opinion in December 2025

| Security | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ||||||||||||||

| Investment | ||||||||||||||

| ||||||||||||||

| For who? | ||||||||||||||

| ||||||||||||||

| Accessibility | ||||||||||||||

| ||||||||||||||

Reviews (1)

1 review for Selma – My full review and opinion in December 2025

Show only reviews in English (1)

Paul –

I have been using Selma for few weeks now. I really appreciate the customer service. They answered my questions quickly, even on investment questions.