Investment & Trading Platforms in Switzerland

The new local app comparison guide for investing

clarity ✔︎ comparisons ✔︎ tests ✔︎ rates ✔︎

trends ✔︎ comparisons ✔︎

decrypts ✔︎ innovations ✔︎

spiel

Top 5 Neobanks for Investing in Switzerland in December 2025

“A critical eye to compare and choose” heyneo.ch

Yuh: the investment and trading platform. Its diversified investment options and fractional trading function can help democratize access to financial markets, despite the lack of advanced trading features. Use the promo code C9QK67 to receive 500 SWQ (with an initial deposit of CHF 500.-).

The best online bank for investing? Alpian, the 100% digital Swiss private neo-bank, stands out with a unique approach. Analysis of advantages, mandates, limits, and fees: we decipher everything to save you time. 💰 Use the promo code HEYALP when opening your account to receive 75 CHF for deposits of 500 CHF and 125 CHF for any mandate of at least 10,000 CHF. Let's get started!

Neon, the Swiss platform that simplifies stock and ETF investment and trading, makes financial markets accessible to everyone. Even without advanced trading features, it offers an intuitive solution for buying and selling securities. Use the promo code VSWH3C when opening your account.

Our review of Selma: the investment platform for automating wealth management with low fees. From registration to the investment itself, is this the online investment platform for you? To determine this, we analyze Selma's offering point by point. Open your account with promo code NEOSEL to earn 34 CHF.

Radicant, the Swiss neo-bank that simplifies sustainable investment. Build a portfolio aligned with your values thanks to its thematic and diversified investment options. To receive up to 200 CHF, use the promo code B99703 when opening your account. Happy reading!

Switzerland’s investment ecosystem is evolving

Beyond the numbers, investment is becoming more democratic in Switzerland. New platforms are appearing in the form of online banks and smartphoneapplications. What are they worth? Can they replace the traditional approach? What is the feedback?

How can I compare investment/trader apps?

Before exploring the intricacies of each platform, heyneo.ch takes a look at the fundamentals. We test all the essential points for investing, buying and selling securities with peace of mind, such as :

- bank security guarantees

- clarifications on investment products

- interactions with customer service

After verifying and satisfying these criteria, we test the functionalities of each application over time. Whether it is the trading functionalities of stocks, bonds, ETFs, cryptocurrencies, trackers, thematic investment funds: we explore a substantial part of each type of product. available for investment.

Assessing the differences between investment/trading platforms

To compare pragmatically, you need to choose the evaluation criteria that are most practical for you as a user. At heyneo.ch, we use apps to measure the details that make a difference in everyday life, such as :

- easy-to-understand financial products

- affordability

- clear performance indicators

- ease of use

- UX user experience and ergonomics

- investment education

- diversity of investment themes

- integrating environmental impact

Putting neo-banks in context

Your voice counts to reflect the opinions of users and investors

The ranking of trading and investment apps/platforms of neobanks reflects the specificities of the Swiss market. Your experiences and opinions shape our evaluations and help heyneo.ch answer the questions of other investors and users of neo-banks in Switzerland.

- Radicant Closes its Doors: BLKB Launches Liquidation, What should Clients Do?

- Radicant for Sale: BLKB Exits, What’s Next for Clients?

- BaaS – What Will Become of Yapeal from 2025?

- Swiss Account for Non-Residents: Solutions for Opening a Bank Account in 2025

- Credit Cards in Switzerland: Comparison and Overview (2025)

free cards & accounts | Iban CH | Apple Pay | TWINT | bank for cross-border commuters | Google Pay | virtual bank cards…

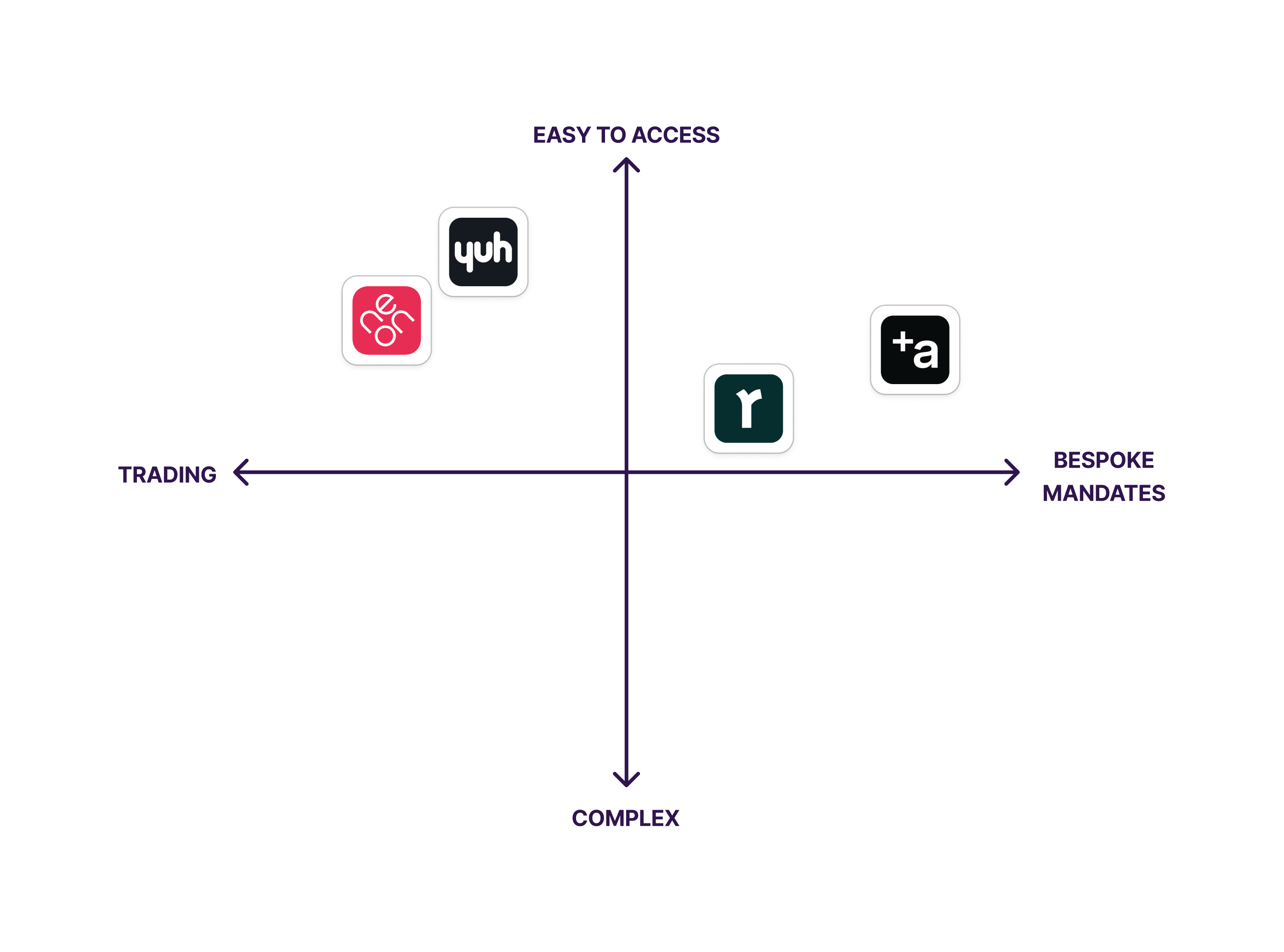

It’s the matrix…