Are you a Swiss cross-border commuter looking for the best bank to manage your finances?

This article compiles the experience of real cross-border workers who share their tips to guide you in setting up the most effective system in 2025:

✔︎ the most practical solution for everyday use.

✔︎ the most economically advantageous option.

✔︎ the shortest possible time to open an account.

Receiving your Swiss salary and living in France: which bank is truly suitable for cross-border workers in 2025?

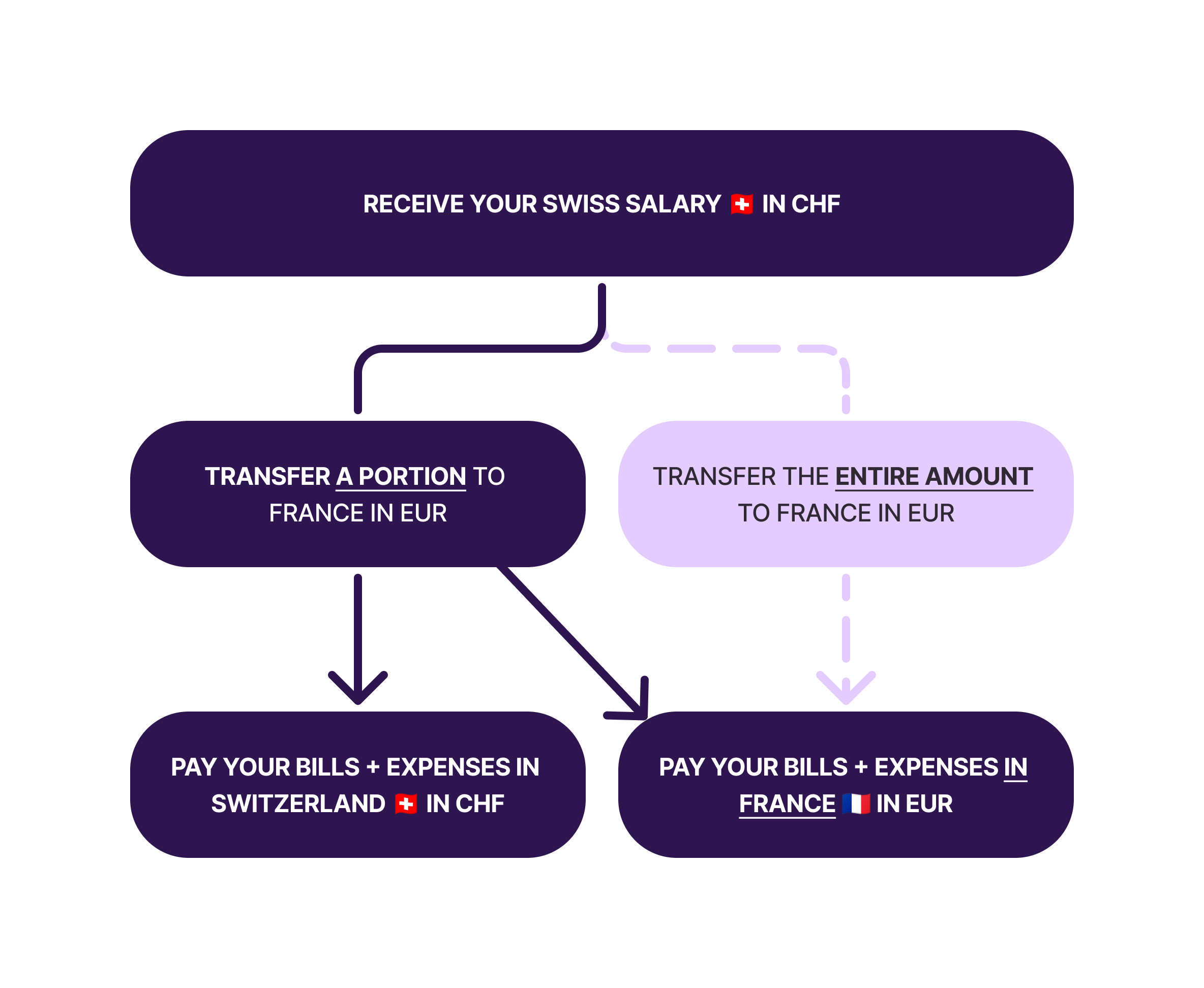

Basically, if you are a cross-border commuter, you need :

It is essential to have :

✔︎ A personal bank account with a CH IBAN (required by employer).

✔ A currency exchange service for your CHF to EUR.

✔ A bank account in France in EUR.

✔ Payment methods to live your life.

What are the concrete options?

Swiss and French bank “border packs”: the wall of reality

Opening a non-resident account in a traditional Swiss bank with a CH IBAN as a cross-border worker: it’s technically possible at UBS, CA Next Bank, PostFinance, or even Banque Migros.

In practice, this is more complex and, above all, more expensive if you live in France. The same applies to the “packs frontaliers” offered by French banks such as Crédit Mutuel or CIC.

These offers are often :

- A consumption tunnel generating additional costs.

- A formula insufficiently adapted to the specific constraints of cross-border commuters:

Unexpected expenses in two countries – Foreign cards refused for certain types of payment – Cross-border repayments between friends or colleagues – Days when you don’t have the right card with you – Cash withdrawals on both sides of the border – Unfavorable exchange rates in online stores depending on the country – etc.

“One fee can hide another”. The :

- opening fee

- additional monthly fees (non-residents)

- minimum income requirements

- international transfer charges

- cash withdrawal costs

- exchange rates

- exchange commission

- bank card rates

This article on non-resident accounts explains all the features you need to know.

“With a salary of around CHF 5,000, that’s hundreds of euros or more than a thousand euros a year to use.”

Cross-border forum, for heyneo.ch

Unless you want to pay, these solutions are not advantageous. Because cross-border commuters are not interesting enough for conventional banks:

“The cross-border worker receives a salary, doesn’t use banking services on the spot, is very sensitive to the exchange rate and repatriates all his money directly to France.”

Article économique du média suisse Le Temps

Online foreign exchange services with IBAN CH

Cheaper than the previous solution, but not the cheapest (nor, above all, the most practical):

- They do not automatically give access to a personal CH IBAN.

- Their exchange rate is not automatically the best on the market.

- 24 or even 48 hours waiting to receive funds.

- You can’t use them like normal banks on a day-to-day basis.

- There is a fee per transaction below a minimum amount.

This solution is not flexible and efficient enough. It clearly requires sacrificing user comfort throughout the year (for not much in return).

Neo-banks with currency exchange: the best solution for cross-border workers in 2025

There are two neobanks that accept cross-border workers / Swiss non-residents:

Yapeal

✘ no transfers possible

✘ no credit card

With Yapeal for CHF 4.90/month:

✘ 0.75-1.65% foreign transfer fee

Another important aspect, Yapeal has a Fintech banking license, which is easier to obtain than the standard banking license. See the review in the full Yapeal review.

YUH

YUH – free ✔︎

– Bank account with personal CH IBAN

– Mastercard Debit card

– Accessible to non-residents

– TWINT + Swiss bill payments

– Multi-currency account

– Banking license from Swissquote Bank SA (FINMA approved)

See the review on Yuh in the full review.

Promo Code

Free account ✔︎

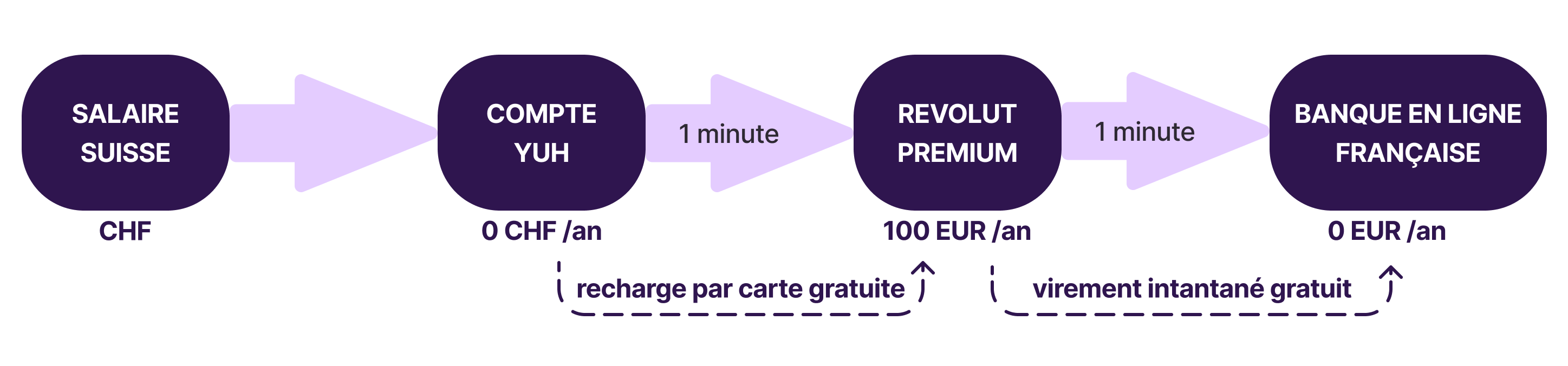

YUH + Revolut Premium

The winning combination for hundreds of cross-border commutersYUH + Revolut Premium which offers maximum savings, unbeatable exchange rates and a plethora of features.

Revolut Premium – 100 EUR /year ✔︎

– Best exchange rate on the market

– Free reloading by card

– Virtual, temporary cards

– Multi-currency account

With a :

French online bank to choose from – free ✔︎

– BoursoBank, Fortuneo, HelloBank, etc.

– Carte bleue

Here’s how it works:

● The salary is paid into your free YUH account (with IBAN CH).

● Top up your Revolut Premium account with the YUH bank card

(0 transfer fees, instant).

● Convert your CHF into EUR (unbeatable interbank rate).

● Transfer the EUR to your French online bank.

Comparison table between Yuh alone and Yuh + Revolut

| Difference in costs and exchange rates | YUH | YUH + REVOLUT Premium |

|---|---|---|

| account rate | 0.- | 100 EUR /year |

| card | 0.- | 0.- |

| CHF 1000.00 | 1 022,65 € | 1 030,42 € |

| CHF 2,500.00 | 2 556,66 € | 2 438,00 € |

| CHF 4500.00 | 4 602,03 € | 4 603,47 € |

| CHF 6,500.00 | 6 647,38 € | 6 643,74 € |

| 4 CHF withdrawals/month | 0.- | – |

When does the €100/year Revolut Premium offer pay for itself?

With YUH alone, you need to change CHF 10,000 to reach the equivalent of EUR 100, paying a commission of 0.95% (EUR/CHF 0.95). This threshold may vary slightly according to fluctuations in YUH and Revolut rates.

Starting from about CHF 833.- per month to exchange into euros, Revolut Premium pays for itself.

You can literally do everything free of charge in both countries

Here are the common situations:

- Do your shopping in Switzerland after work and avoid the traffic jams on the way home.

- Fill up with fuel, buy tobacco on the Swiss side of the border.

- Buy your lunch at foodtrucks, etc.

- Pay the doctor, your usual medication and your healthcare expenses in Switzerland.

- Pay with TWINT free of charge anywhere in Switzerland (there are few places where TWINT is not accepted).

- Pay by card, free of charge, in Switzerland and France.

- Pay without fees and without exchange commission in any online store.

Don’t hesitate to leave us a comment below this article to share your experience.

Promo Code

Free account ✔︎