[Update – November 10, 2025: Introduction of new fees for Managed by Alpian Essentials mandates.]

1 Day Before Starting with Alpian Essentials

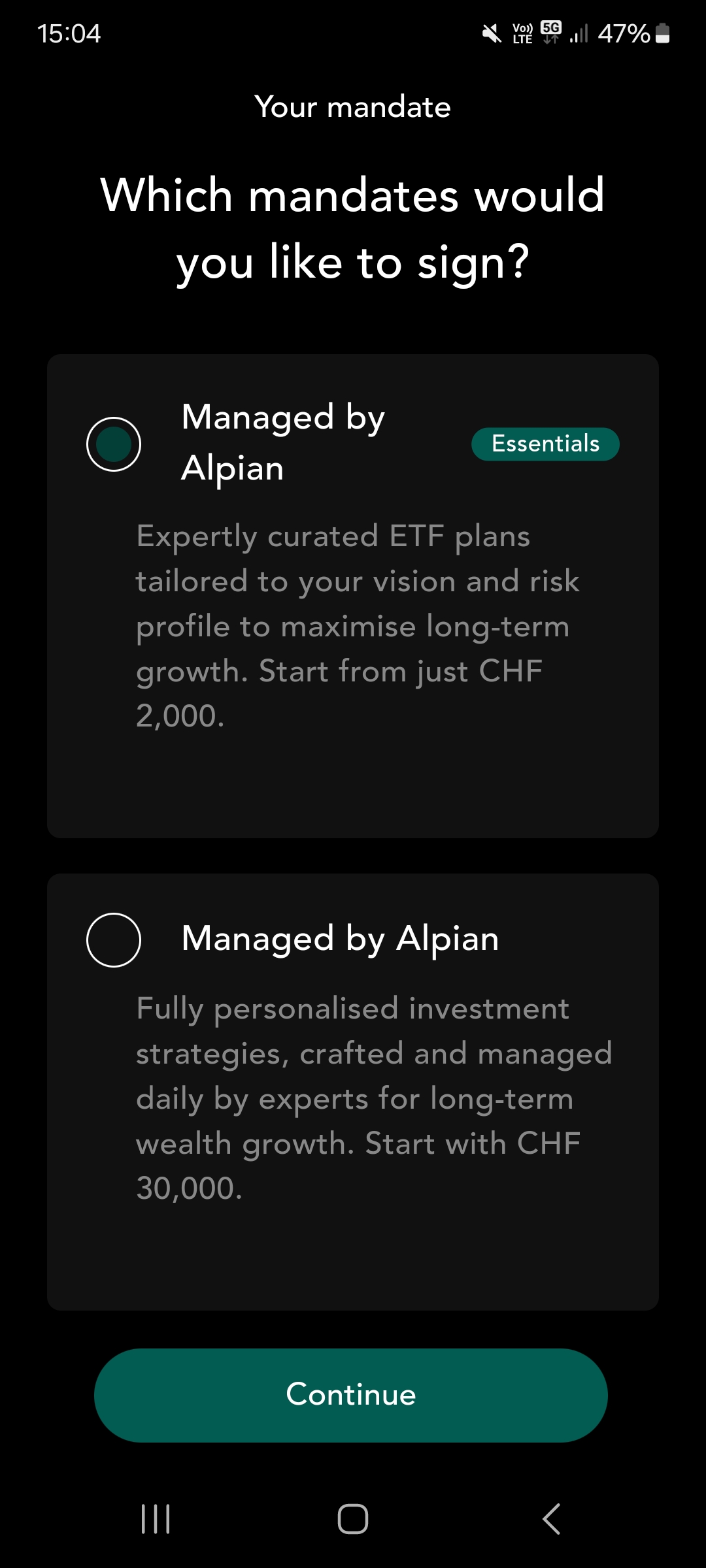

Before investing with Alpian under the ‘Managed by Alpian Essentials’ mandate, I wanted to be sure I was choosing the right solution. A minimum investment of CHF 2,000 is still a significant amount of money. I was looking for a solution that would allow me to delegate the management of my investments to avoid classic beginner mistakes and not have to constantly monitor stock prices. All this for a reasonable price. So here’s my review of Managed by Alpian Essentials.

Where do I come from?

First, I “searched for the most accessible options to invest in the stock market. I” found that the choice is often between two types of platforms. Those that require self-management of investments, like Yuh, Neon and Swissquote. They allow total control, but require involvement and some knowledge to avoid mistakes. On the “other hand, platforms like Alpian Essentials or Selma guide and automate” investing.

Managed by Alpian Essentials and the Competition?

“One of the first things that mattered to me” was accessibility, how much I needed to invest initially.

With an entry threshold of 2,000 CHF, Managed by Alpian Essentials requires the same as Selma, but much more than Yuh or Swissquote which allow buying individual securities (or fractions of securities), but for a different service.

I then compared the fees. Alpian charges fixed fees between 0.50% and 0.75%, depending on the chosen plan (more information on the plans offered by Alpian is available in the “fees” chapter of our Alpian review), covering management, access to advisors, performance reports, and year-end tax reports. This is significantly cheaper than Swiss private banks (around 2%), but not necessarily the most economical option among digital solutions:

- Yuh charges no management fees, but 0.5% on each transaction.

- Selma is at 0.72%, practically the same as Alpian.

- Neon Invest applies 0.5% on Swiss ETFs and 1% on international ones, but has no custody fees.

In summary, Alpian is not the cheapest option, but this is quite normal given that the nature of the service is ultimately different. What intrigued me (and later convinced me) was notably the support from human advisors, a service rarely included in competing offers.

What are the risks of investing with Alpian Essentials?

What types of investments are accessible?

Are there any limits that could be problematic?

My Expectations Before Trying Alpian Essentials

For me, Alpian ticked all the right boxes for a first investment: it is a regulated Swiss bank with access to advisors. I knew I would have to make concessions on flexibility and the lack of active management. But what I really wanted to know was whether these limitations would actually detract from my experience or whether, on the contrary, I would enjoy this simplicity.

There was only one way to find out: open my account and test it.

After registration: my first impressions of Alpian Essentials

I had already installed the app on my mobile and opened my Alpian account by following the steps in the Alpian guide. I had also made an initial payment of CHF 2,000.

From the first screens of the subscription process for Managed by Alpian Essentials, everything is clear and well-structured, without information overload. This is what I expect if I’m venturing into investing for the first time.

Risk Profile: The Analysis is More Refined Than Expected

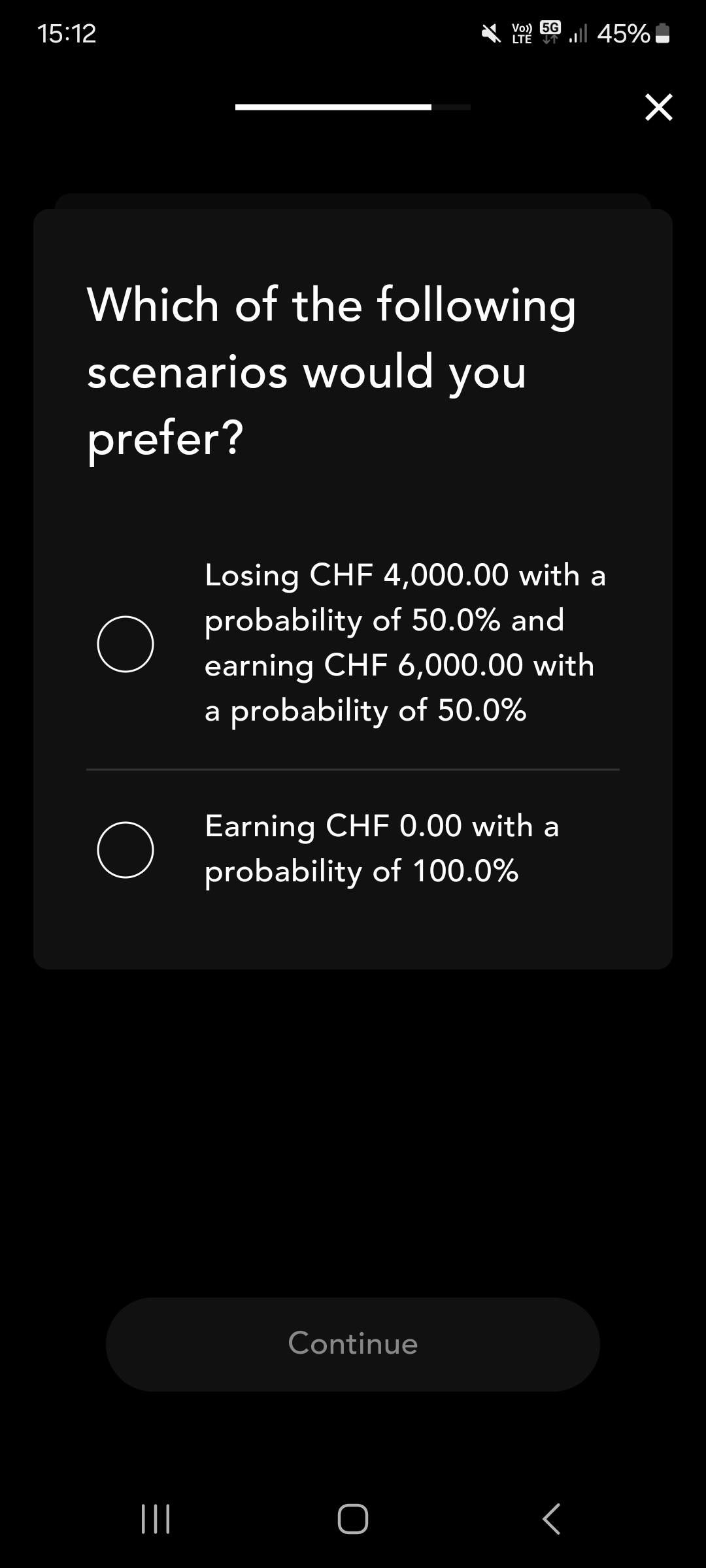

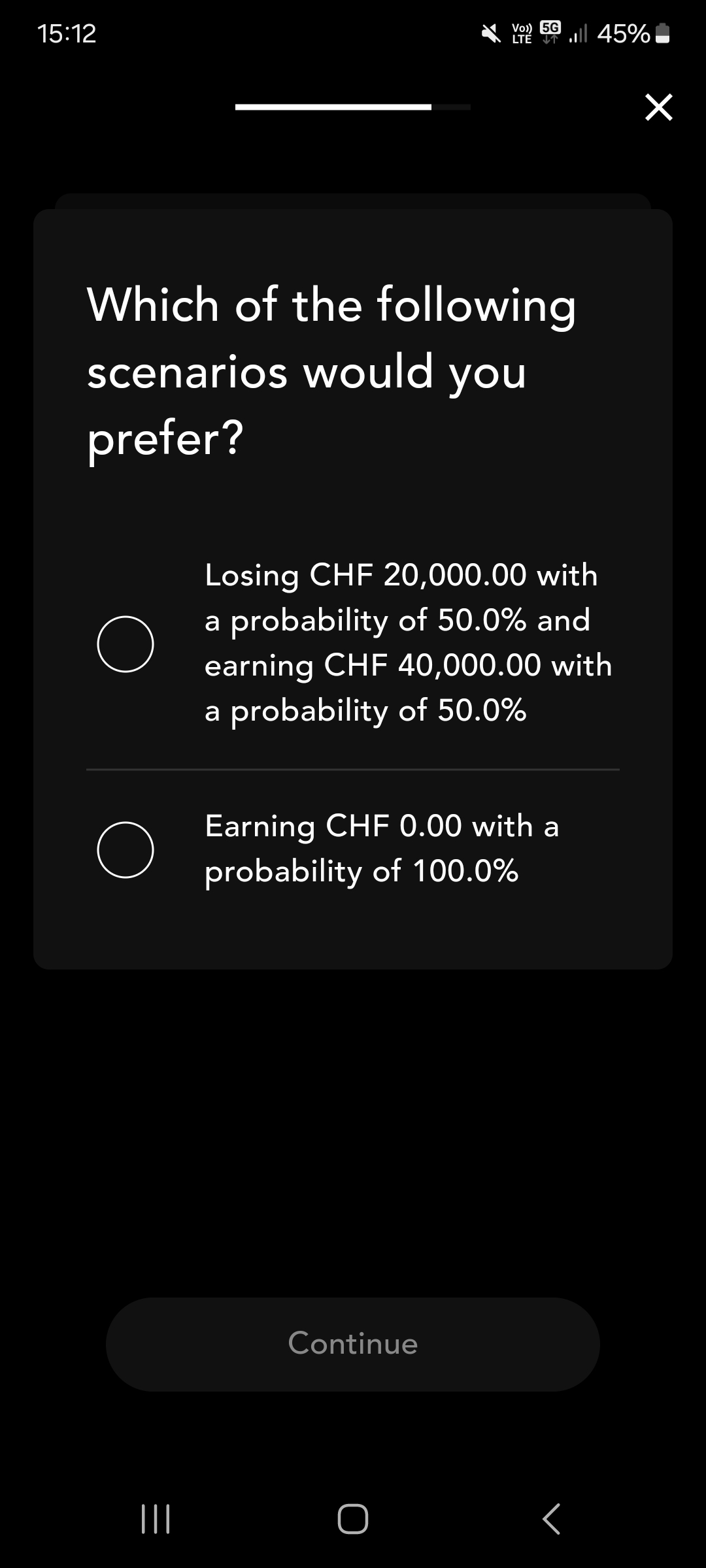

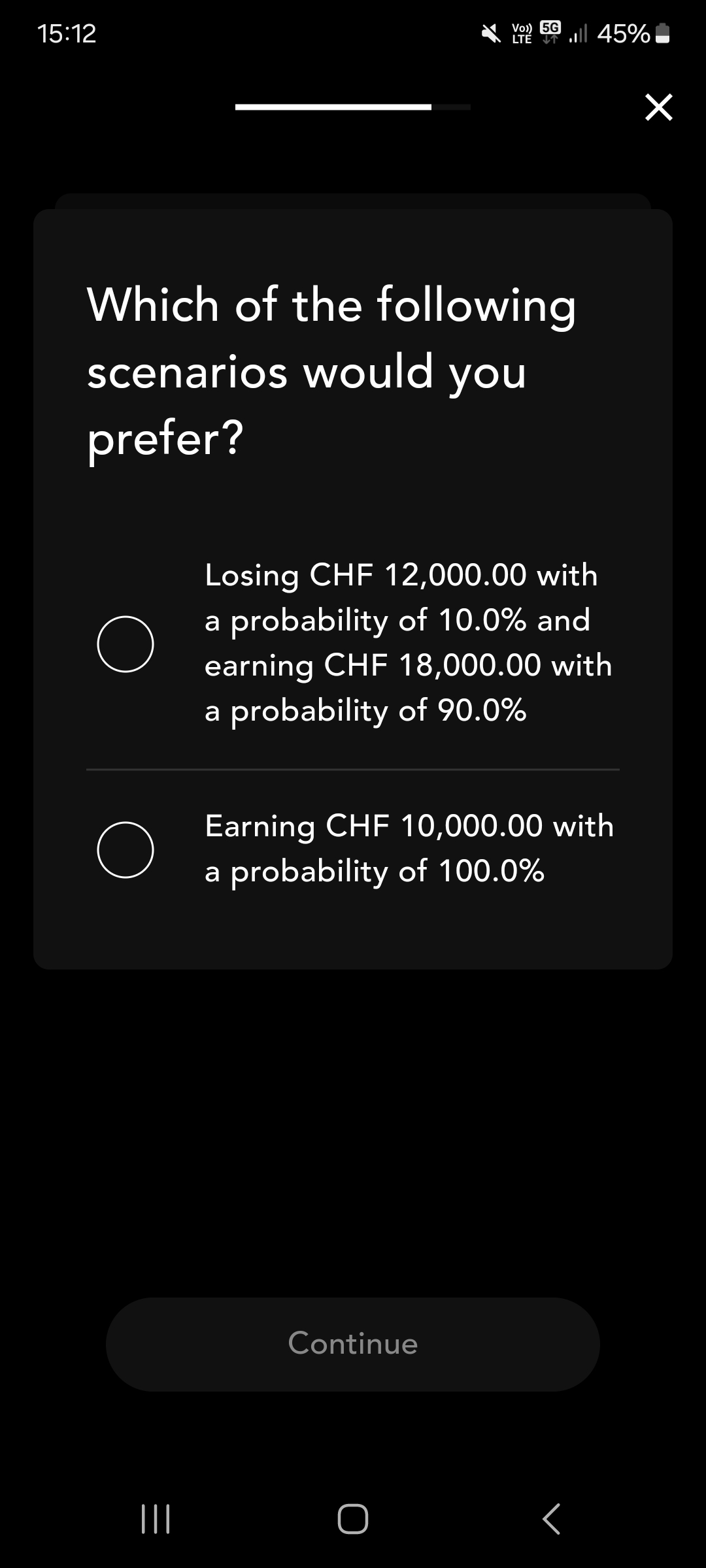

Then came the key step before investing: the questionnaire that will determine the appropriate risk level.

I expected a simple series of standard questions about my risk tolerance (the kind of test where you quickly tick boxes), but the approach is actually more in-depth.

They don’t just ask if I’m comfortable with market fluctuations. The questions explore my emotional reactions to potential losses, my investment horizon, and my view on long-term risk-taking. There’s also an analysis of my financial situation (income, savings, etc.)

It’s based on principles of behavioral finance (explained in the Alpian Investment review), with the goal of protecting me from my own psychological biases (for example, the natural tendency to panic during market downturns).

Once completed, a risk profile is automatically assigned to me from the following five categories:

1️⃣ Prudent

2️⃣ Balanced

3️⃣ Balanced-aggressive

4️⃣ Dynamic

5️⃣ Aggressive

The idea: to assign me a portfolio that truly matches my ability to withstand market fluctuations and prevent me from taking more risks than what I can actually tolerate.

My Portfolio: No Customization, but a Clear Framework

Once my investor profile is determined, the Alpian app offers different investment plans.

Essential invests exclusively in ETFs, with an allocation between asset classes (stocks, bonds, crypto) defined according to the risk level.

A cautious profile will have a larger share of bonds, while an aggressive profile will be almost 100% exposed to stocks.

What I immediately notice is the complete lack of customization. It’s impossible for me to choose the ETFs myself or adjust my allocation.

At this stage, even though I understand the principle, I don’t yet know if this will be an advantage (simplicity) or a frustration (lack of control).

My Alpian Essentials Portfolio: How My Allocation Was Decided

The Moment of Truth

Was I going to end up with a portfolio that was too cautious or, on the contrary, too risky?

My risk profile has been defined as “balanced” and I discover the different investment options proposed to compose my portfolio:

It’s at this moment that I discover the four predefined investment plans are not all accessible to me:

- Swiss, with local exposure, with up to 60% of assets in CHF.

- Global, with diversification across multiple regions and asset classes.

- Sustainable, with ETFs focused on companies with strong ESG practices.

To my “great dismay”, the Global + Crypto plan (incorporating up to 10% digital assets, but reserved for the riskiest profiles) is not accessible to me due to my “balanced” risk profile.

I therefore “settled” for the global plan, which appealed to me more due to the international diversification I was looking for.

An Ultra-Structured Approach, Practically Without Room for Maneuver

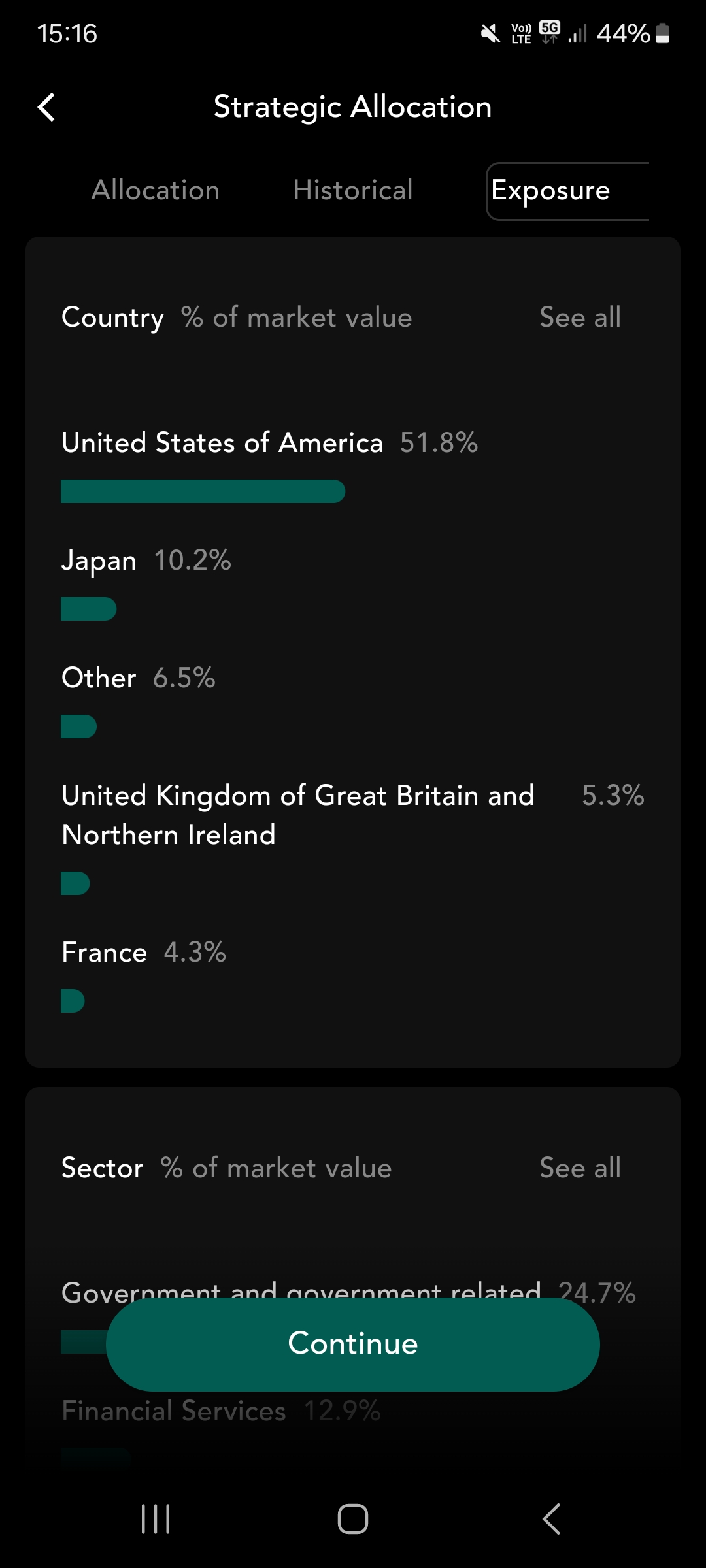

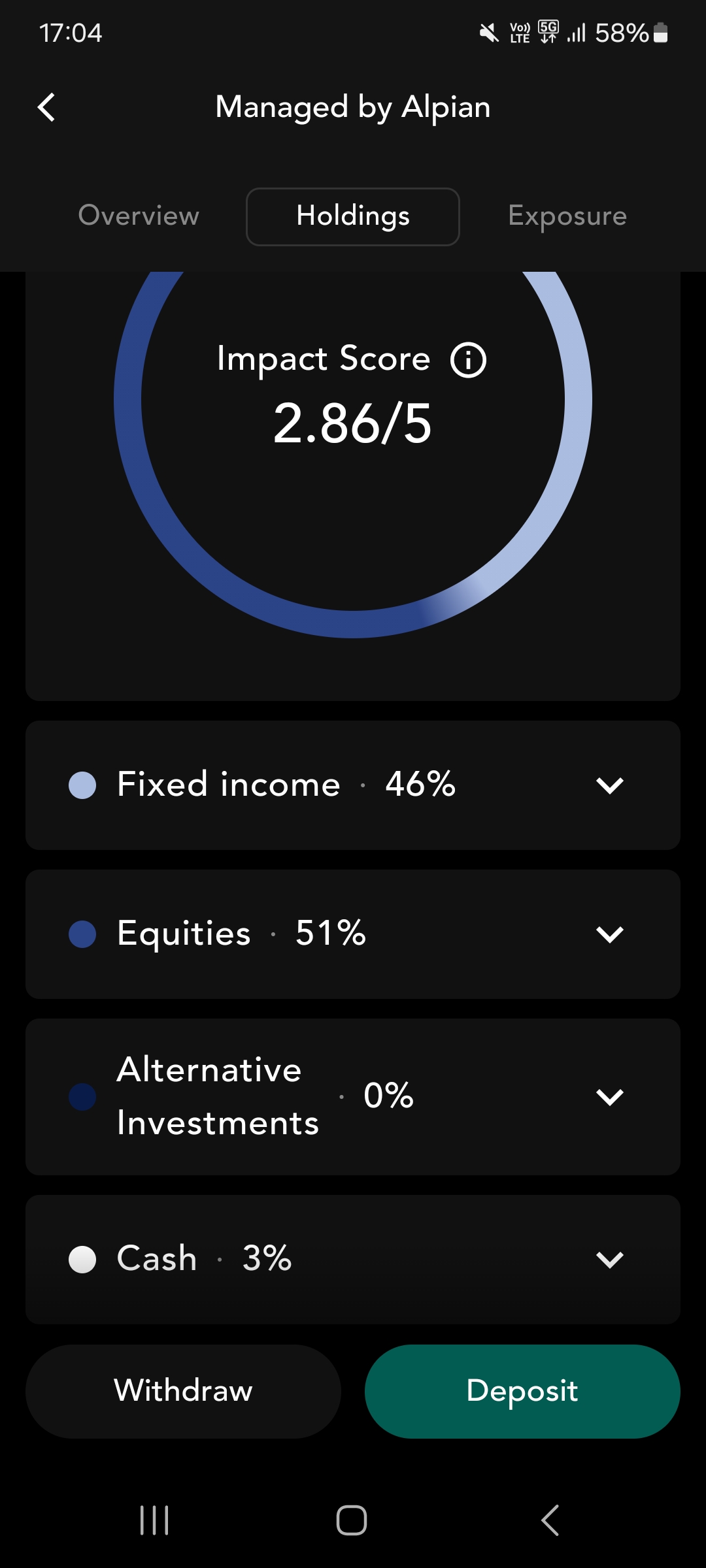

The application directly displays the portfolio assigned to me, without the ability to modify anything. I discover the distribution of asset classes.

The allocation depends entirely on my risk profile:

A mix of stocks and bonds

Unlike a cautious profile, I don’t have a majority of bonds, but they remain present to stabilize market fluctuations.

Marked international exposure

Within the Global plan, my ETFs are diversified across several regions, with a strong presence in developed markets.

A Sustainable approach is possible

If I preferred ESG criteria, I could choose a portfolio aligned with these values, without changing the overall allocations.

Unlike the riskier profiles, I don’t have access to the 10% digital assets of the Global + Crypto plan.

The balance is there: I’m not confined to an ultra-defensive model, but I’m also not taking overly risky bets. But I’m already wondering if this balance is truly optimal in the long term or if I would have preferred a bit more flexibility in the exact allocation.

If you have a different risk profile than mine:

I have prepared two examples of possible allocations for you…

If your profile is defined as “cautious”, your portfolio would be mostly composed of bonds, an approach aimed at limiting volatility. The number of stocks would be reduced to the bare minimum, prioritizing security at the expense of higher potential returns.

If you’re considered a “dynamic” or “aggressive” investor, the allocation would be quite different. Your portfolio would be composed mostly of stocks with the main objective of maximizing long-term performance. You would have access to the Global + Crypto plan, which includes a limited but existing exposure to digital assets, up to 10% of your portfolio.

Why these ETFs and not others?

Here are the ETF selection criteria for Alpian Essentials:

- The ETFs must have solid prospects over several years (growth potential).

- They must show consistent and competitive returns (historical performance).

- They must offer a balance between market volatility and stability (risk management).

- They must minimize management costs while maintaining attractive performance (fee reduction).

- The ETFs must be easily tradable and offer full transparency on their composition (liquidity and transparency).

What I mainly notice is that Alpian is not looking to take risky bets or offer exotic ETFs 🏝️ (obligatory). Everything is oriented towards stable long-term growth. There’s very little flexibility in this regard.

You can find the updated list of all ETFs available at Alpian here.

The first days of using Alpian Essentials: the daily experience

After setting up my portfolio, here’s how using Alpian Essentials goes week by week…

The Alpian Essentials interface is well-designed, classy, and streamlined

In Essentials, I find the minimalist interface that I appreciate in the Alpian app. The essentials are accessible at a glance:

- the current portfolio value

- performance evolution

- asset allocation.

Alpian has chosen to limit complex indicators, which can be an advantage if you’re looking for a simple approach, but may also seem a bit basic for someone used to more detailed tools.

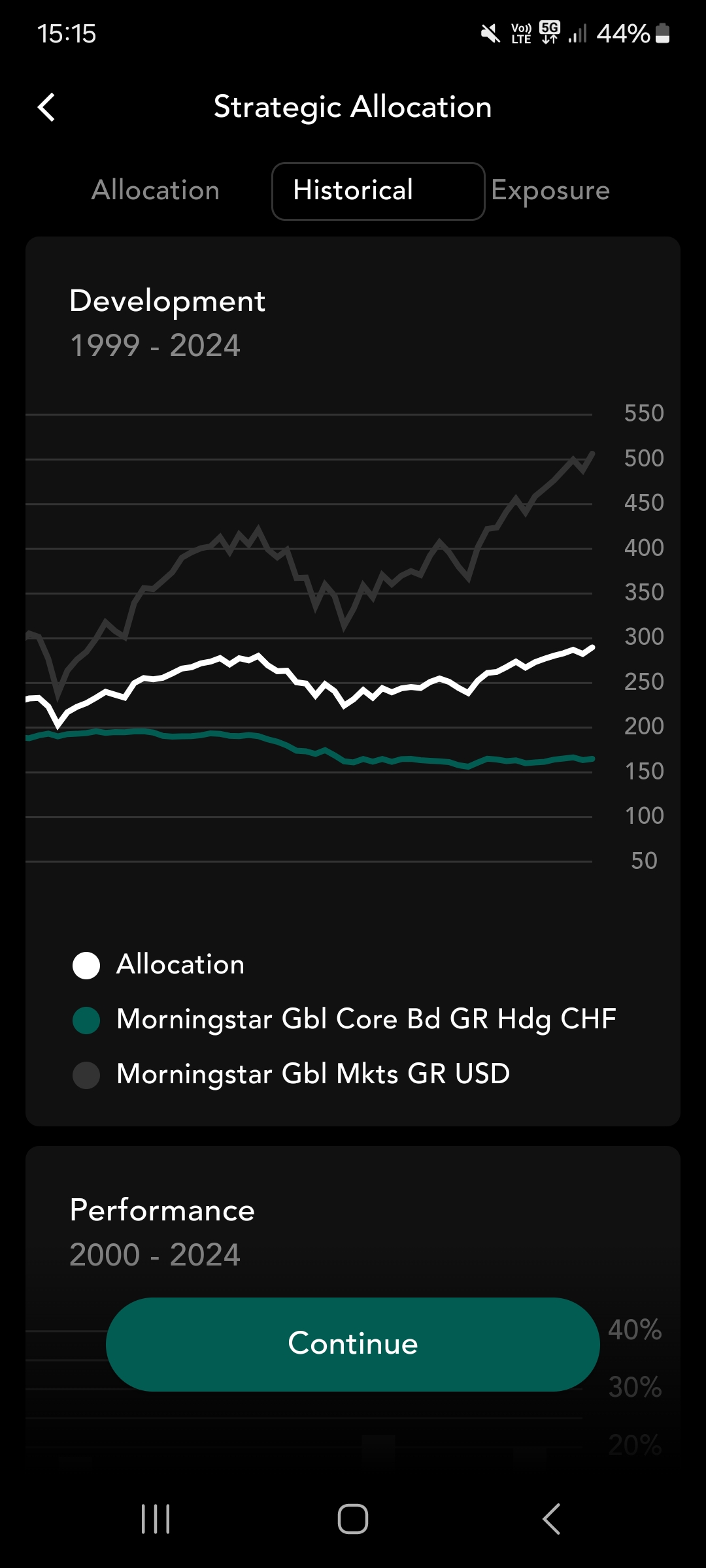

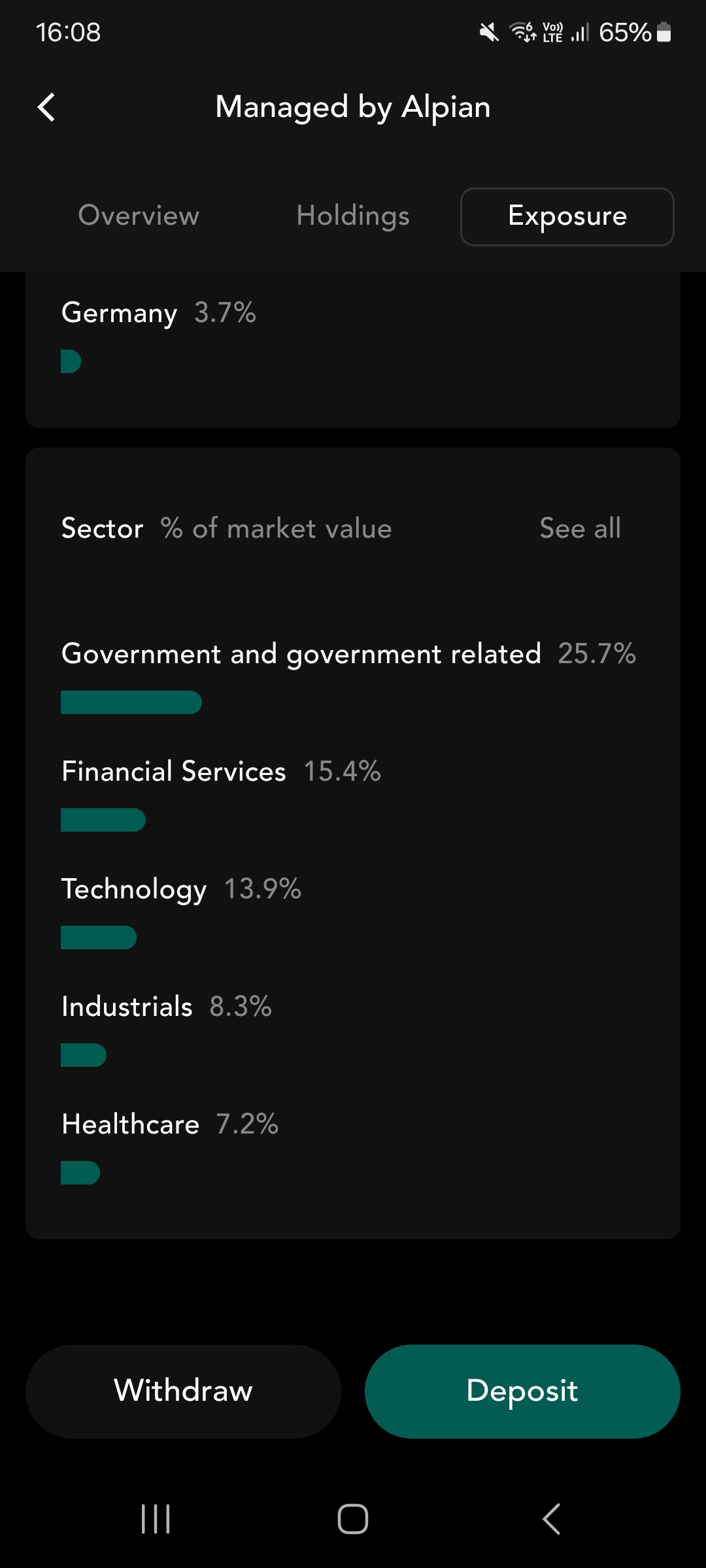

The Exposure tab allows you to easily see in which sectors and geographical areas your money is invested.

The Impact Score provides an indication of the sustainability level of my portfolio based on ESG criteria. It is a useful tool if you want to incorporate a responsible dimension into your investments, even if it remains a very general and even imprecise indicator.

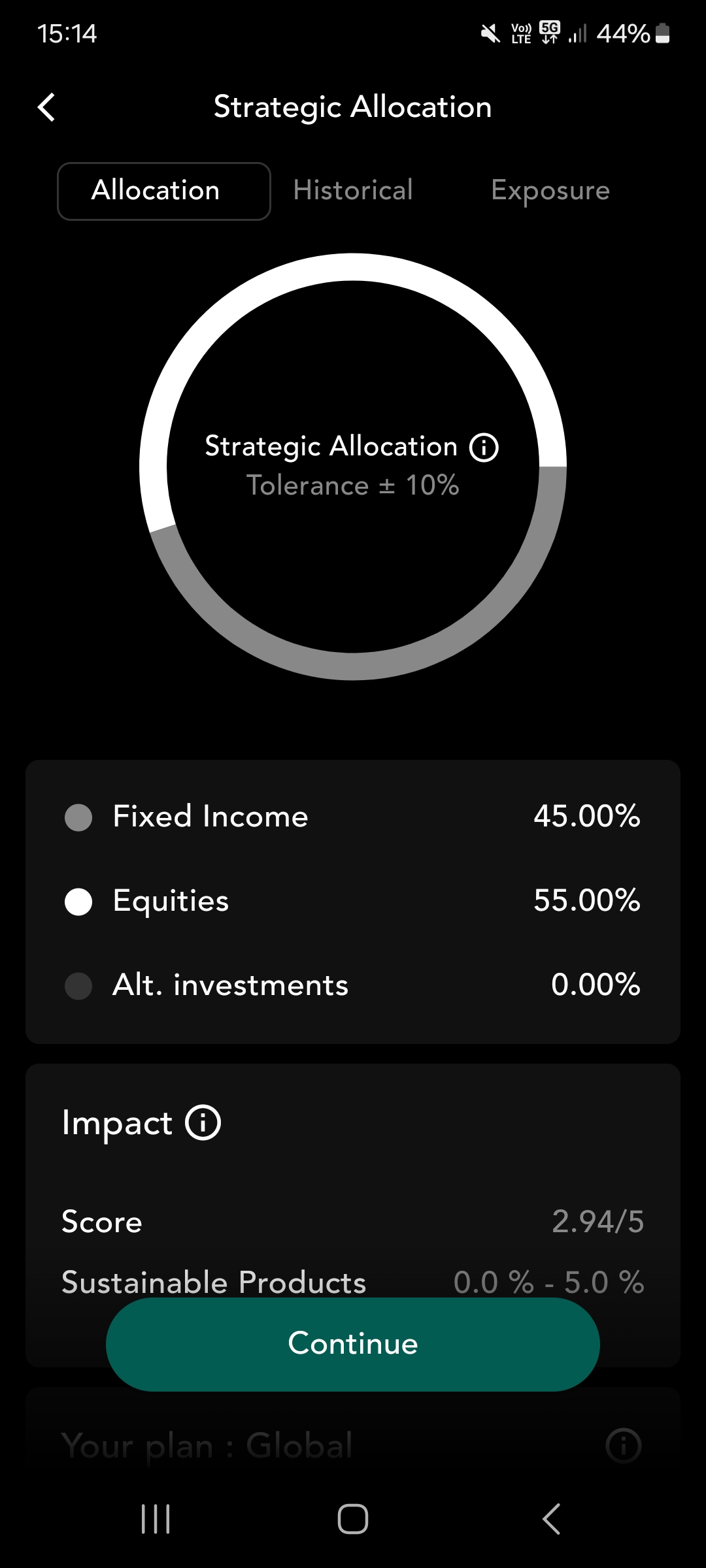

Performance tracking requires a bit of patience

In the first few days, I wanted to check my portfolio’s evolution regularly. But I quickly understood that on Alpian Essentials, the updates are not in real-time.

Portfolio performance is only recalculated once a week. This choice follows the logic of passive management, where the idea is to avoid reacting to short-term fluctuations. The portfolio is automatically rebalanced each week to remain aligned with the investment strategy defined at the outset.

At first, this functionality left me a bit unsatisfied 🍰, as I wanted to follow market variations hour by hour. But after a few weeks, I got used to this rhythm which corresponds to a longer-term vision and avoids falling into the trap of unnecessary micro-monitoring.

Access to advisors is interesting and non-intrusive

One of the points highlighted by Alpian Essentials is access to wealth management advisors, a service that doesn’t exist with most competitors.

I wanted to test this service by asking a question about ETFs. The advisor responded quickly with a clear and detailed explanation, without trying to offer me a product or another service. However, the advisors didn’t take any initiative. If I hadn’t made the effort to contact them, I wouldn’t have had any spontaneous exchange with them. You can feel that their role is primarily to inform, not to push financial or banking products.

For someone expecting proactive support, this may give an impression of distance. On the other hand, if you know what you want and are ready to ask your questions, the service is efficient.

My overall feeling a few weeks later

After several weeks of use, the experience is smooth and pleasant. Tools like the Exposure tab and the Impact Score are good tools for understanding your portfolio well.

As I mentioned, tracking performance only weekly can be surprising at first, especially if you’re used to monitoring your investments in real-time. But it’s a choice consistent with Alpian’s philosophy: avoiding short-termism and favoring a steady management approach.

Testing the Limits of Essentials: What Can Be Problematic

Alpian Essentials is designed for simple and automatic management. But after several weeks of use, I noticed certain limitations in the analysis tools that can be frustrating

How Did I Become an Expert?

Neo – Unsolicited advice (as usual).

Compulsively refreshing the performance indicator as if my fortune depended on it: that’s the key.

Limited Analysis Tools

The application allows for simple portfolio tracking, but there are no detailed charts or technical analysis tools, which is a constraint for those who like to dig a bit deeper into their investment performance.

After several months of use, have these limitations proved to be so problematic as to question my choice, or do they remain acceptable in the context of passive investment? No.

Am I Continuing with Alpian Essentials?

After several months of use, Alpian Essentials delivers on its promise: hassle-free management with a solid, pleasant application.

What I like is the ease of use. The application is well-designed, pleasant to use, and the information is clear. No unnecessary complexity, everything is accessible in a few clicks.

The fact that everything is managed automatically is also an asset. My portfolio is adjusted every week, I don’t have to do anything. No need to monitor the market or make decisions: it’s a truly passive approach.

Access to advisors is a positive point. You can ask questions without additional fees and get clear answers. It’s not essential on a daily basis, but it’s reassuring to know that someone is there if needed.

Finally, the minimum investment of CHF 2,000 is affordable compared to other investment platforms in Switzerland. The fees between 0.50% and 0.75% are announced upfront, so there are no surprises.

Why Consider Changing?

Over time, I might also feel certain limitations.

The most obvious is the lack of personalization. It’s impossible to choose your own ETFs or adjust the allocation. You follow the framework set by Alpian, period. At first, this didn’t bother me, but I’m starting to feel the desire to have more control.

Performance tracking, limited to a weekly update, is also a bit frustrating. It’s not problematic in itself, but you feel disconnected from your portfolio.

Verdict: Am I Continuing with Alpian Essentials?

Yes, because the passive approach meets my expectations and in this sense, the Essentials mandate does the job very well. But if one day I need more control, I’ll look for another solution.

What Alternatives if I Want More Flexibility?

- Guided by Alpian allows you to choose your ETFs and receive more comprehensive guidance.

- Selma is an even more automated robo-advisor without human intervention.

- Neon Invest and Yuh Invest allow free management with direct purchase of ETFs and stocks.

If one day I feel the need, I could keep Alpian Essentials for passive investment and use other options to test more personalized strategies.

For now, I will wait to see how it evolves.

Is Alpian Essentials the right choice for you?

I can now clearly identify the strengths and limitations of Alpian Essentials. Some aspects make it a good solution for certain investor profiles, while others might be frustrated by its highly structured operation. So here’s how we can view Alpian Essentials:

Alpian Essentials is ideal for…

✔ beginners: the application is clear, smooth, and easy to use. Everything is designed to simplify investing, without the need for advanced knowledge.

✔ passive investors: if you’re looking for hands-off management, Essentials does exactly that. The portfolio is rebalanced weekly, without the need to act yourself – a well-executed “invest and forget” approach.

✔ those who want human support: unlike a typical robo-advisor, Alpian allows you to interact with an advisor if needed. No upselling or hard selling, just neutral and accessible support.

✔ Investors with modest to intermediate capital: a starting investment of CHF 2,000 is more affordable than most private wealth management services. The fees between 0.50% and 0.75% remain competitive compared to traditional banks.

✔ those who prefer digital solutions: everything is managed from the application, without paperwork or unnecessary banking interactions. It’s a truly modern and accessible wealth management service.

Alpian Essentials will be less suitable for…

✘ active investors: it’s impossible to buy individual stocks, modify portfolio allocation, or make investment decisions. If you like to adjust your investments yourself, you’ll be frustrated.

✘ those who want more dynamic management: the portfolio follows a passive approach, without tactical adjustments based on market news. No optimization according to opportunities, which can be a drawback for those seeking more flexibility.

✘ investors requiring advanced tools: no technical tools, no data export. Tracking is simplified, which may suit some, but limits more detailed analysis.

Also read

- Review of Guided by Alpian

- Complete Review and Opinion on Managed by Alpian

- Review and test of investing with Alpian

- The Swiss Guide to Private Banking in 2025

- Review and Test of Yuh Investment Trading

- Review and test of Neon Investment Trading

- Review and Test of Selma, the Investment Platform

What do you think of Alpian Essentials for your investments?

- Has the Alpian app facilitated your access to investing?

- What feature would you like to add or improve?

- Is Alpian your first investment portfolio?

Share your feedback with all Neo’s friends 😈