[Update – November 10, 2025: Introduction of new fees applied to Guided by Alpian mandates.]

Guided by Alpian: a New Solution for Investors

There are several ways to invest with Alpian: manage everything yourself, delegate completely, or find a happy medium. Guided by Alpian is positioned precisely in this middle ground. We follow a strategy proposed by experts, while retaining a certain amount of freedom to adjust our portfolio. This is an option that can make sense if you want to avoid common mistakes without giving up control over your investments.

This model might interest you if:

- You are already an Alpian client, but want more flexibility than what Managed by Alpian offers.

- You are hesitating between several hybrid solutions like Guided by Alpian, Findependent, or Investart, where you remain in control of your investment decisions while being advised.

Guided Autonomy, Designed to Avoid Mistakes

Guided by Alpian offers a hybrid approach: you follow an investment strategy with personalized recommendations, but you retain the ability to adjust your portfolio within a certain margin. This allows you to progress without starting from scratch, while maintaining some control over your decisions.

For example, if you think the technology market is too volatile in the short term, you can slightly reduce your exposure to this sector. But you can’t exit it completely, nor invest specifically in a thematic ETF not included in Alpian’s selection. The adjustment margins are intentionally limited to ±10% to avoid significant deviations.

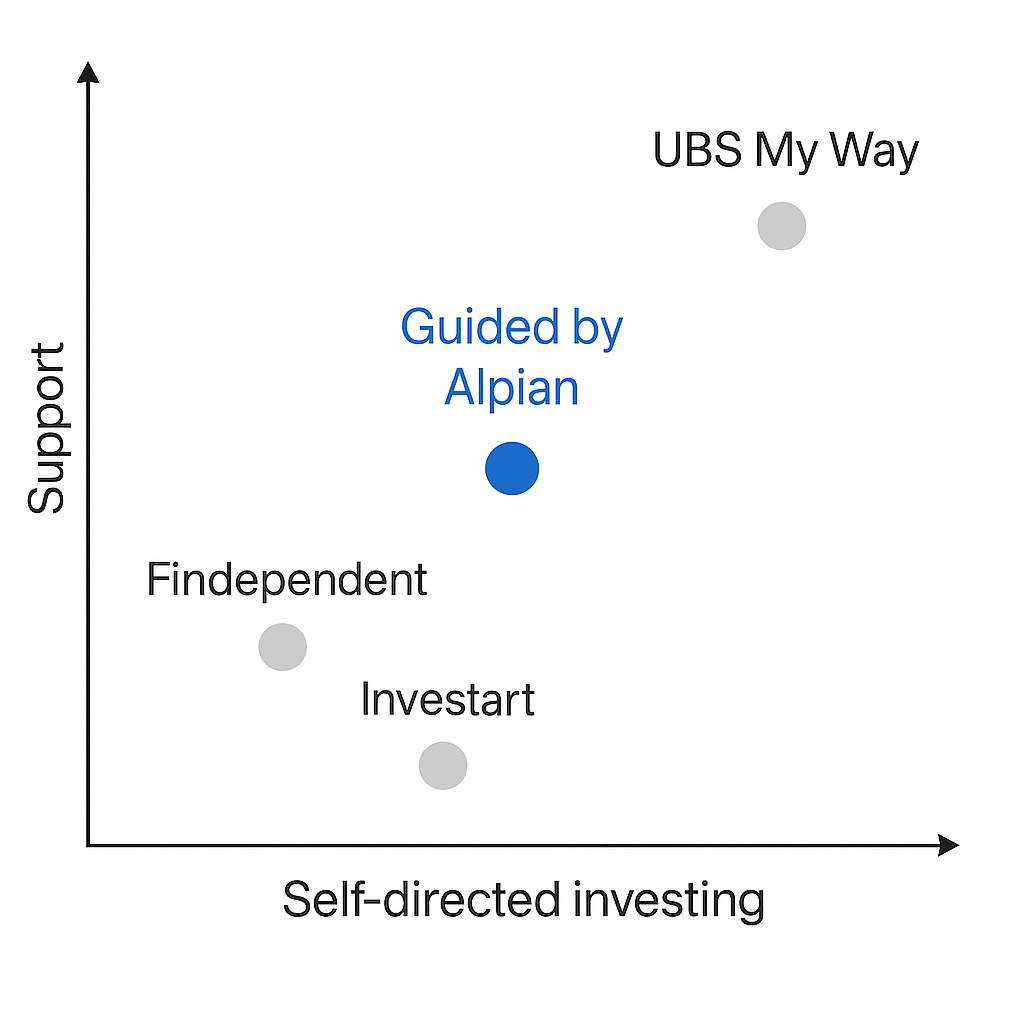

Here’s how this approach compares to other offers in the Swiss market:

| Criterion | Advisory (private banks) | Guided by Alpian | Managed by Alpian | Findependent | Investart |

| Management Autonomy | Partial (recommendations + client validation) | Partial (limited adjustments) | None | Total | Medium |

| Support | Dedicated advisor + recommendations | Recommendations + advisor contact | Expert management | None | Basic support |

| Fees | 1.0 – 1.2%/year (excluding product/transaction fees) | between 0.50% and 0.75%, depending on the chosen plan, all fees included | between 0.50% and 0.75%, depending on the chosen plan, all fees included | 0.29–0.40%/year | ~0.30%/year |

| Product Selection | Wide (funds, ETFs, structured products) | Defined universe of pre-selected ETFs | Pre-selected universe by Alpian | Free within an ETF framework | Predefined ETF framework |

| Strategic Framework | Personalized recommendations + regular follow-up | Recommendations + limited adjustments | 100% expert management | No guidance | Basic support, without framework |

This approach is suitable if you want to invest relatively autonomously within a secure framework. You select your portfolio from a range of pre-selected ETFs, receive recommendations tailored to your profile, and can adjust your allocation up to ±10% from the proposed strategy.

But this model isn’t for everyone: if you want total management freedom, Guided by Alpian will seem too rigid. And if you don’t want to manage anything yourself, you might as well opt directly for delegated management like with Managed by Alpian (or Essentials). Guided by Alpian is suitable for those who want to progress in their management without starting from scratch, while maintaining a real capacity for adjustment.

How Does Guided by Alpian Differ from other Platforms?

The positioning of Guided by Alpian is atypical in the Swiss market 🇨🇭. To better understand what it really brings, we need to compare it to the two main families of existing solutions: independent hybrid platforms on one side and digitalized private management offers on the other.

1. Hybrid Solutions with Support (Findependent, Investart)

If you’re looking for something similar to Guided by Alpian, the alternatives in Switzerland are not numerous. Findependent and Investart are the closest, with a semi-autonomous approach: you have a structured investment base, but you can adjust certain parameters.

How Far Does the Freedom Go?

At Findependent, you can freely modify the allocation, but without a real structuring framework. At Investart, adjustments are possible, but very limited and without personalized guidance.

Advice

There is customer support, but nothing comparable to the guidance at Alpian. No active strategy proposed, no proactive recommendation, let alone a dedicated advisor.

Fees

Alpian offers fixed fees between 0.50% and 0.75% (more information on the plans offered by Alpian in the “fees” chapter of our Alpian review), covering management, access to advisors, performance reports, and the year-end tax report.

Findependent is between 0.29% and 0.40%, Investart around 0.30%, thus slightly lower than Guided by Alpian, but for a less premium service.

What investment products are available?

Mainly ETFs, with a wider selection at Findependent. Guided by Alpian sticks to a more limited range, but consistent with its guided management approach.

2. Digital Private Wealth Management Solutions (UBS MyWay, Pictet Smart Advice, etc.)

Some major banks also offer online guided management services, such as UBS MyWay, for example.

What you’ll find:

Tailored guidance, a proposed strategy, sometimes a few customization options. And an advisor at your disposal.

What you lose with this type of solution:

Flexibility. These solutions are almost always 100% managed: you have no leverage to adjust your portfolio yourself and very little visibility on the detailed composition. Moreover, fees are often much higher (often >1%) and the investment universe may include in-house products, which are less transparent.

Guided by Alpian occupies a rare position:

- more structured than Findependent or Investart,

- more flexible and transparent than private wealth management solutions,

- with personalized guidance that remains accessible.

It’s a coherent alternative if you’re looking for real strategic support without completely losing control and if you’re willing to pay the (contained) fees to benefit from this framework.

User Experience: What Really Matters for an Independent Investor

- Does Guided by Alpian provide all the tools to manage your investments?

- How far does decision-making freedom go?

- Does interaction with an advisor bring real added value?

Profile Configuration: a more Detailed Assessment than Average

From the start, it’s not just a simple questionnaire. The profile assessment incorporates several dimensions: loss tolerance, reactions to volatility, thematic preferences (such as dividends or ESG criteria), as well as investment horizon.

This assessment allows for the assignment of a profile (Conservative, Balanced, Dynamic) with a corresponding strategy. This profile can be modified later, but not directly from the app: you need to go through an advisor. So it’s not completely locked, but it’s not instantaneous either.

Recommendations: Useful, but Never Imposed

The application detects deviations from the target strategy (often around ±5 to 10%) and proposes adjustments. For example, you might receive a recommendation like: adjust exposure to emerging markets or slightly reduce the bond portion if it exceeds the threshold set for your profile.

These suggestions are well-argued: they are based on market context, risk profile, and basic strategy. Then, you choose what to do with them. You can directly apply the recommendation, adjust it according to your preferences, or simply ignore it.

You always remain the decision-maker, but without being alone: the app provides concrete insight, and recommendations are designed to guide without imposing.

The Role of Advisors: Real Support, without Taking Control

At Alpian (see Alpian’s full review and test), you can chat with a certified adviser via chat, telephone or video call. It’s really helpful. You can ask for advice, clarify a recommendation, or discuss a change in strategy.

This is where Guided by Alpian distinguishes itself from robo-advisors like Selma or True Wealth: you can ask your questions to a professional, adapt a recommendation to your personal situation, while keeping control over decisions.

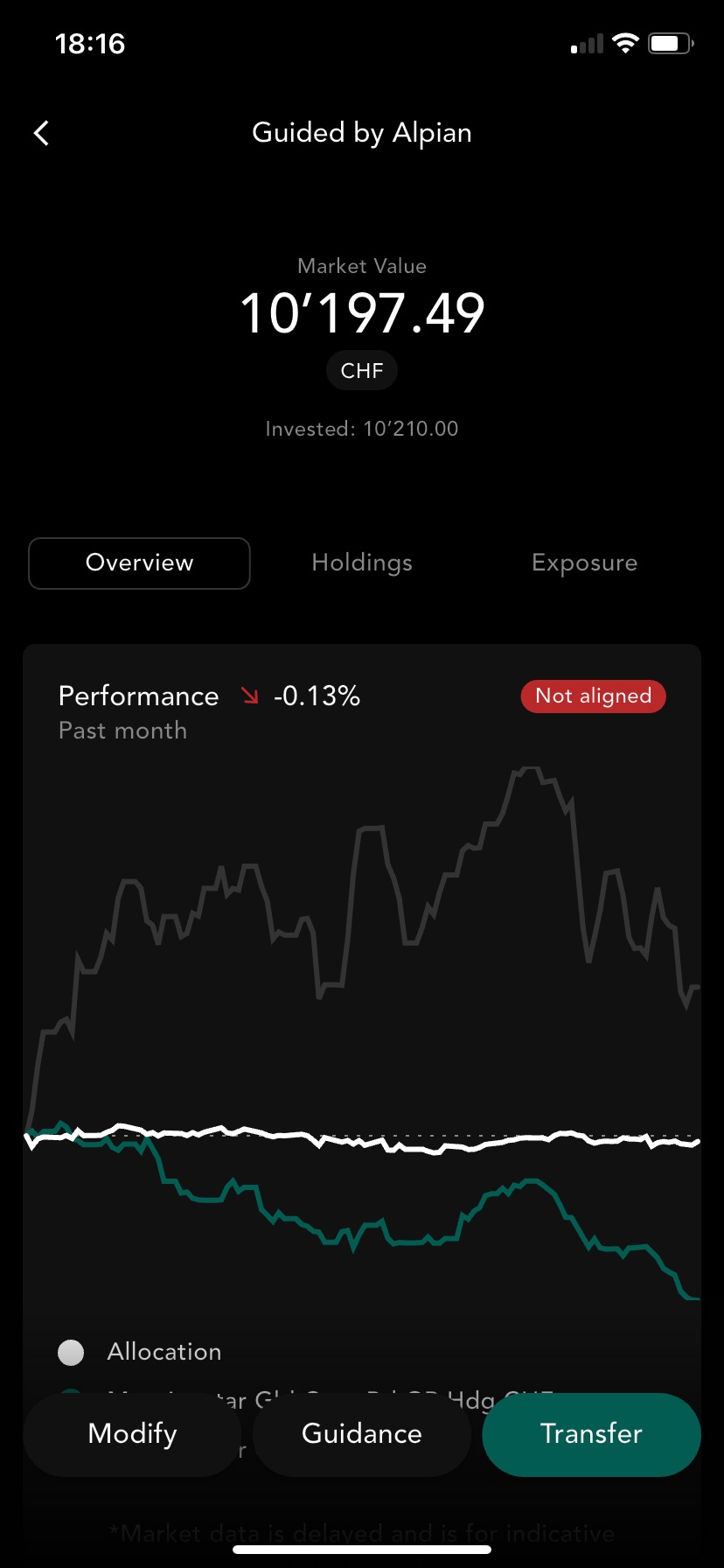

The Performance Tracking is Clear

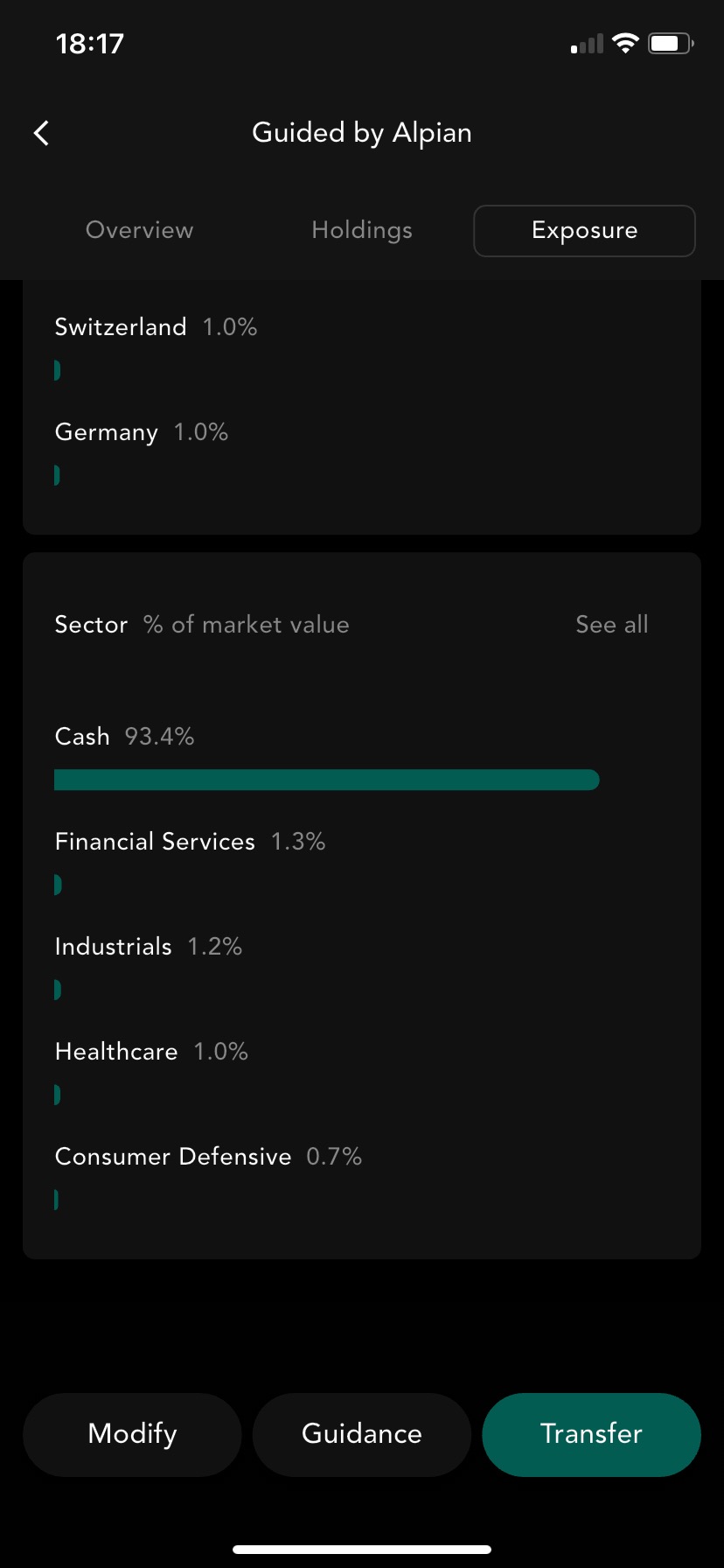

The application offers a clear dashboard: net return, sector and geographic exposures, volatility indicators, alerts in case of strategic deviation.

However, unlike some automated platforms, no automatic rebalancing is performed. If the allocation deviates too far from the target, an alert is displayed, but it’s up to you to validate the adjustment or not. The tool provides guidance but never decides for you.

Verdict: a Structured Solution for those who Want to Remain Active

Guided by Alpian allows you to invest methodically, without feeling trapped in a rigid system. You retain control over your decisions while benefiting from personalized guidance and well-designed tools to avoid common mistakes.

Alpian Promo Code

Free account ✔︎

Performance with Guided by Alpian: how Can You Optimize your Portfolio?

Guided by Alpian offers a structured selection of ETFs, with some room for “adjustment. It’s not free management, but not a rigid model either. So what can you do?”

The Available Assets

There are no cryptocurrencies, no individual stocks, no private equity. You invest only through a selection of “ETFs constructed by Alpian.”

✔︎ The advantage: Automatic diversification, fewer emotional biases, and quality screening assured by the bank.

✘ The disadvantage: No freedom to integrate strong personal convictions or go beyond the proposed framework.

What Strategy and Investment Profile?

Guided by Alpian offers 3 typical profiles, each with a target allocation and clear logic:

| Style | Typical allocation | Approach | Investor profile |

| Conservative | 30% stocks, 50% bonds, 20% cash | Aims for stability, limits volatility | Conservative or close to a goal |

| Balanced | 60% stocks, 30% bonds, 10% cash | Growth/security compromise | Alpian’s core target |

| Dynamic | 85% stocks, 10% bonds, 5% cash | More exposed, seeking returns | Risk-tolerant, long-term horizon |

You can adjust up to ±10% in each asset class. But the investment universe remains strictly defined:

- ETFs are pre-selected by Alpian, with no option to choose your own funds;

- No exposure to specific thematic strategies (like clean tech or AI);

- No advanced ESG filtering: we stick to standard large indices.

So you can’t build an ultra-personalized strategy. But you operate within a solid, already structured framework, with minimal flexibility to adapt your exposure.

Are there Dynamic Adjustments?

No. Unlike some robo-advisors (like True Wealth or Selma), Guided by Alpian doesn’t offer automatic rebalancing.

Cost and Profitability: is Guided by Alpian Worth it?

With annual fees of 0.50% to 0.75%, Guided by Alpian positions itself between low-cost robo-advisors and traditional private banking. The question is therefore not just “is it expensive?”, but: what do you get in return? (And is it more profitable in the long term?)

Fees in Direct Comparison

| Solution | Management fees | Personalization | Human advice | Minimum investment |

| Guided by Alpian | 0.50 – 0.75% | High | Yes | CHF 10,000 |

| Findependent | 0.29% – 0.40% | Moderate | No | 500 CHF |

| Investart | ~0.30% | Limited | No | CHF 2,000 |

| UBS MyWay | >1% | Very high | Yes | 100,000 CHF |

What we observe:

- Guided is more expensive than Findependent or Investart,

- but much less exclusive than UBS MyWay,

- and the only one offering a structured framework with human support, without a 6-figure entry ticket.

The Impact of Fees on Performance

Over 10 years, fees weigh heavily. Here’s a simulation with equal returns (7% gross/year):

| Initial investment | Guided by Alpian (0.50% – 0.75%) | Findependent (0.29–0.40%) | Investart (0.30%) |

| 50,000 CHF | 95,463 CHF | ~98,500 CHF | ~98,470 CHF |

| 100,000 CHF | 190,926 CHF | ~197,000 CHF | ~196,940 CHF |

| 200,000 CHF | 381,852 CHF | ~394,000 CHF | ~393,880 CHF |

📌 Important:

With equal fees, low-cost solutions offer a slightly better net performance, but only if you manage everything yourself. This does not take into account the results that can be obtained with Guided by Alpian, where guidance can actually improve decisions… and therefore performance.

What the Fees Cover

- A multi-currency account with a Swiss bank approved by FINMA.

- Access to Alpian advisors to challenge or validate your decisions,

- Strategic portfolio monitoring: recommendations, deviation alerts, decision support.

Are We Really Optimizing Performance?

The benefit of Guided by Alpian is to:

- limit behavioral errors (emotional reactions, selling at the wrong time),

- stay aligned with your long-term strategy, even in volatile markets,

- benefit from professional monitoring without falling into passivity.

The Advantages and Disadvantages of Guided by Alpian

Guided by Alpian positions itself as a compromise between autonomy and guidance. This hybrid model offers some flexibility in management, while providing strategic and human support that is rare in this segment.

The Strengths

✔︎ Accessible human support (without commercial pressure)

With Alpian (using Guided by Alpian), you have access to real wealth management advisors. This human contact allows you to ask questions, challenge a recommendation, or clarify a strategy. It’s a service that’s almost non-existent in solutions like Findependent or Investart.

✔︎ Freedom

Guided by Alpian allows you to reject a recommendation, or adjust the allocation within a range of ±10%. It’s not total freedom, but it’s much more flexible than fully delegated management like with Managed by Alpian or UBS MyWay.

✔︎ A truly pleasant app

Alpian’s application centralizes banking and investment in a clear interface, with detailed portfolio tracking and indicators like the Impact Score to measure investment sustainability. Everything is transparent, without overloading your mind.

✔︎ Cheaper than traditional private banking

With fees ranging from 0.50% to 0.75% per year (all-inclusive), Guided by Alpian remains well below the average of 1.38%, or even up to 2% charged in private banking, while maintaining quality guidance.

The Weaknesses

✘ The entry threshold is higher than alternatives

The 10,000 CHF minimum can be a barrier if you’re just starting out or want to test a solution before committing. Findependent starts at 500 CHF, Investart at 2,000 CHF.

✘ A limited investment universe of selected ETFs

It’s impossible to invest in individual stocks, cryptocurrencies, or private equity. The universe is restricted to about forty ETFs pre-selected by Alpian, with programmed execution (no instant buying like with a broker).

✘ Fees are higher than with semi-autonomous solutions

Guided by Alpian charges between 0.50% and 0.75%, compared to 0.29–0.40% for Findependent and approximately 0.30% for Investart. Even if support is included, the difference can impact long-term performance, but it can be largely offset by the potential gain in performance.

✘ Less flexible than a broker like Swissquote or Yuh Invest

There’s no direct market access, no advanced customization, and no personalized multi-asset management as you can design on an open platform.

Alpian Promo Code

Free account ✔︎

Verdict: Guided by Alpian Will Certainly Appeal to a Certain Type of Investor

Guided by Alpian is not for complete beginners, nor for investors who want to control everything themselves. It’s a solution for those who want to progress in their management while benefiting from a structured framework, without excessive rigidity.

It’s Ideal if You’re Looking for a Middle Ground

✔︎ For investors who want to make decisions without being alone

You receive strategic recommendations, but you keep control over decisions. It’s useful when you want to avoid common mistakes, without switching to 100% autonomous management.

✔︎ For those who want support without the burden of a private bank

Guided by Alpian provides human guidance with certified advisors, without prohibitive fees or a minimum deposit of 100,000 CHF, unlike UBS MyWay for example.

(Read the 2025 Swiss private banking guide to compare private banking fees and rates)

✔︎ For Alpian clients who want to get out of “autopilot”

If you’re already using Managed by Alpian but want to be more involved, Guided by Alpian allows you to have more control while staying in a controlled environment.

To Avoid if You Have one of these Three Profiles

✘ For those who want to delegate 100%

If you don’t want to worry about allocation questions, you might as well go directly for an automated solution like Selma or True Wealth. Guided by Alpian requires a minimum level of involvement.

✘ For those who want total freedom

It’s impossible to invest in stocks, cryptocurrencies, or specific products. Everything is done within the universe of ETFs pre-selected by Alpian, with a limited margin for adjustment.

✘ For small investors or those who want to start slowly

The entry threshold is 10,000 CHF. If you want to test a simpler approach with a few hundred or thousand francs, Findependent or Investart will be more accessible.

Conclusion: a Compromise to Embrace

When I discovered Guided by Alpian, I was looking for what many want: a tool that helps to invest better without needing to spend hours on it. And on this point, the proposed balance works rather well.

In use, certain limitations appear. You can’t freely choose all ETFs, orders are not executed in real-time. If you want active management without constraints, you quickly feel restricted. But if you want to progress in your strategy while being supported, you’re clearly in the right format.

In the end, choosing Guided by Alpian is mainly about avoiding two extremes: 100% passive robotic management, or complete solo piloting. You move forward with a clear direction while remaining in control of your choices.

I hope this review has helped you better understand Guided by Alpian.

Alpian Promo Code

Free account ✔︎

Also read

- Complete Review and Opinion on Managed by Alpian Essentials

- Complete Review and Opinion on Managed by Alpian

- Review and test of investing with Alpian

- The Swiss Guide to Private Banking in 2025

- Review and Test of Yuh Investment Trading

- Review and test of Neon Investment Trading

- Review and Test of Selma, the Investment Platform

What do you think of Alpian for your investments?

- Has the Alpian app made it easier for you to access investing?

- What feature would you like to customize or improve?

- Is Alpian suitable for your cryptocurrency needs?

- Have you become more selective about your investments since using Alpian?

Share your feedback with all Neo’s friends 😈