[Update – November 10, 2025: Introduction of new fees for Managed by Alpian mandate.]

Managed by Alpian positions itself between private banks and robo-advisors, offering discretionary management by experts, human oversight, and more transparent pricing than private banks (as we will see). Here is my full review of Managed by Alpian.

Why Consider Managed by Alpian?

In brief, investment solutions in Switzerland generally follow two main approaches:

1️⃣ Private banks offer tailored management, but with high entry thresholds and often opaque fees:

✔ Discretionary management with personalized monitoring.

✘ High entry threshold (generally 500,000 CHF to 1 million CHF).

✘ Average management fees of 1.32% or more, sometimes with additional costs.

2️⃣ Robo-advisors make investing more accessible with reduced fees, but offer standardized allocations without personalized monitoring:

✔ Accessible from a few thousand francs.

✔ Reduced fees (often less than 0.7%).

✘ Standardized portfolios, with little or no human intervention.

✘ Personalization limited to risk profiles.

Managed by Alpian offers an intermediate alternative if you’re looking for a flexible approach, neither too exclusive nor too automated.

It’s a more Accessible Hybrid Investment Solution

With Managed by Alpian, management is discretionary, meaning it’s supervised by experts, but without the financial requirements of a private bank. Entry is set at CHF 30,000, with fixed fees between 0.50% and 0.75%, depending on the chosen formula (more information on Alpian’s formulas is available in the “fees” chapter of the Alpian review), covering management, transaction, and custody fees. Alpian offers an even more accessible discretionary mandate with Managed by Alpian Essentials (read our review of Managed By Alpian Essentials).

This approach allows you to tailor your portfolio to your investor profile while retaining fully delegated management. It is not a model where you choose your assets one by one, but it offers more customization than a robo-advisor.

What You’ll Discover in this Article

- How does Managed by Alpian work?

- How does the offer differ from other wealth management solutions?

- What fees apply and are they truly competitive?

- What are its strengths and limitations?

- What type of investor can benefit the most from it?

The purpose of this review is to enable you to compare, understand, and decide whether Managed by Alpian meets your personal expectations.

(Read my review and full test of Alpian, which explains all the specifics, strengths, and weaknesses of Switzerland’s first digital private bank).

Why Consider Managed by Alpian?

Managing your portfolio alone is a commitment. You need to monitor markets, adjust investments, avoid emotional errors, and maintain strict discipline. It’s not impossible, but it requires time, knowledge, and a real strategy. On the other hand, entrusting your money to a private bank involves high fees and often an inaccessible entry threshold.

When choosing a robo-advisor, you know what to expect: you have a portfolio allocated according to a predefined model, adjusted only based on standardized criteria. This works well if you want a clear framework, but it lacks reactivity to market opportunities or risks.

With discretionary management, you entrust your portfolio to professionals who adjust allocations based on market dynamics. The approach relies on a methodology defined in advance, but with much greater flexibility than a robo-advisor.

Accessing Private Management without a Fortune

Private banks apply the same principle of discretionary management as Alpian, but entry is much more selective. Most require a minimum of 250,000 CHF (some go up to 500,000 CHF or more).

One Can Invest without Having to Follow the Markets Daily

Making investment decisions yourself requires monitoring trends, anticipating risks, and adjusting accordingly. But not everyone can react at the right time, and there’s a risk of making decisions based on emotions.

With a discretionary mandate, you fully delegate portfolio management. This means giving up direct control over asset selection. Managed by Alpian makes decisions on our behalf, without possible intervention on the choice of assets or their weighting.

What Assets are Available with Managed by Alpian?

Managed by Alpian allows investing exclusively via ETFs selected by Alpian. About 45 ETFs cover different geographical areas, sector themes, and asset classes. These products are chosen for their long-term potential, stability, and contained fees.

Cryptos are included, via specialized ETFs without direct management or wallet.

The approach remains structured, designed to delegate management while maintaining diversified exposure.

Check the review on investing with Alpian to know all available products, particularly the list of ETFs.

Here’s how Managed by Alpian Works

Asset Allocation

When opening an account, you don’t receive a fixed portfolio that follows a pre-established model. Each allocation evolves based on our choices and the market, without the need for intervention.

Alpian’s Investment Management Module (IMM) adjusts the strategy by incorporating our preferences, values, and risk tolerance . The management team continuously monitors the markets and adjusts asset weightings to capture opportunities or limit risks. Everything is optimized without having to wonder when to buy or sell.

We retain control over the main orientations, but everything related to daily management is taken care of.

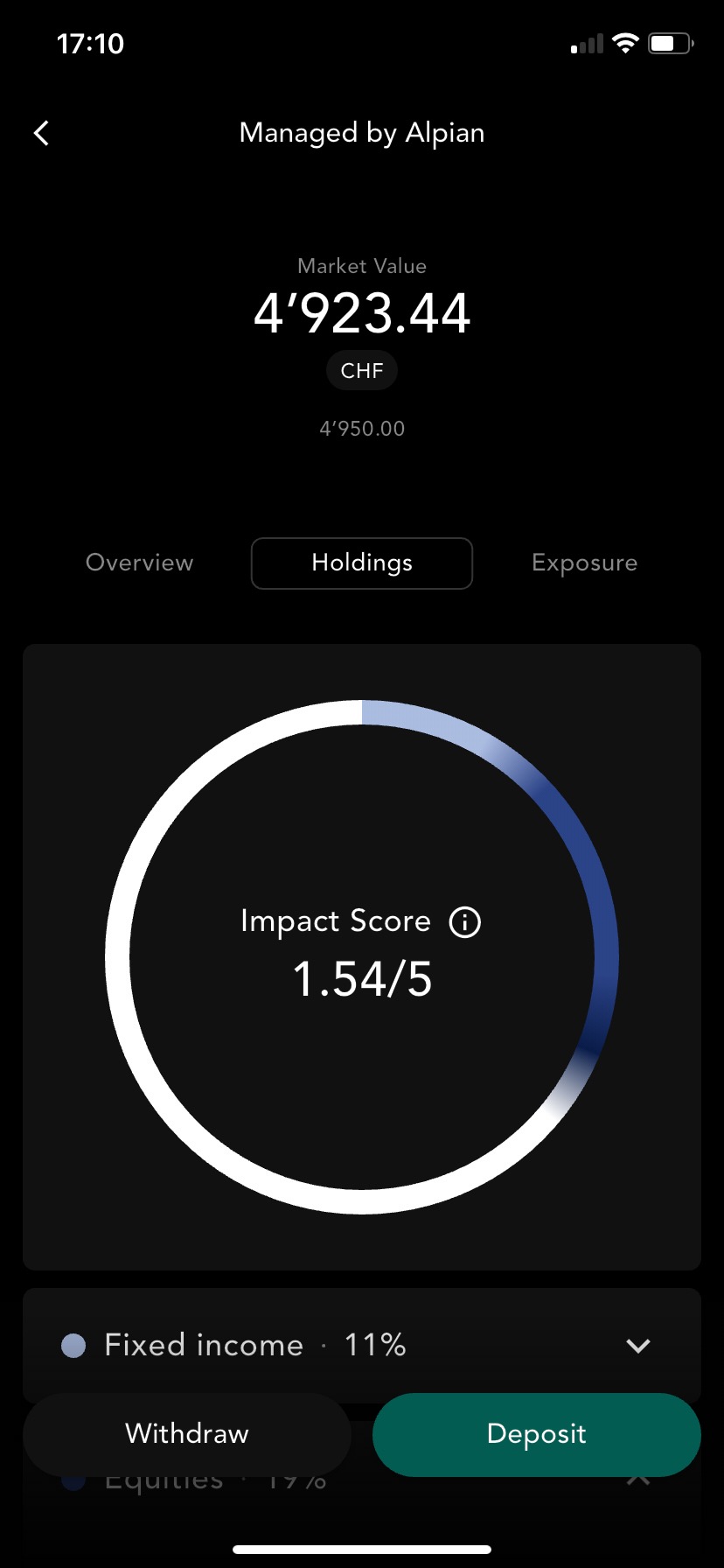

The Registration Goes beyond a Simple Risk Profile

Opening an account involves a detailed questionnaire, which doesn’t just classify us into a typical profile. The approach is more refined and takes into account:

- Our financial knowledge → The strategy adapts to our level of experience.

- Our investment preferences → We can exclude certain asset classes or favor others.

- ESG orientation and targeted geographical areas → The allocation is adjusted according to these criteria.

- Our reaction to gains and losses → Risk exposure is refined based on our behavior towards market fluctuations.

Each portfolio is built specifically for oneself, without a standardized model:

Continuous Adjustments rather than a Fixed Portfolio

Rebalancing doesn’t follow a rigid calendar. Management is based on three axes:

- Market evolution → Adaptation based on economic and financial trends.

- The initially defined framework → Our choices and risk level remain the foundation of decisions.

- A “ctive optimization” → Alpian’s management team applies strategic adjustments to seize opportunities.

The magnitude of these adjustments can reach ±10% of the portfolio, offering more flexibility than a purely automated model.

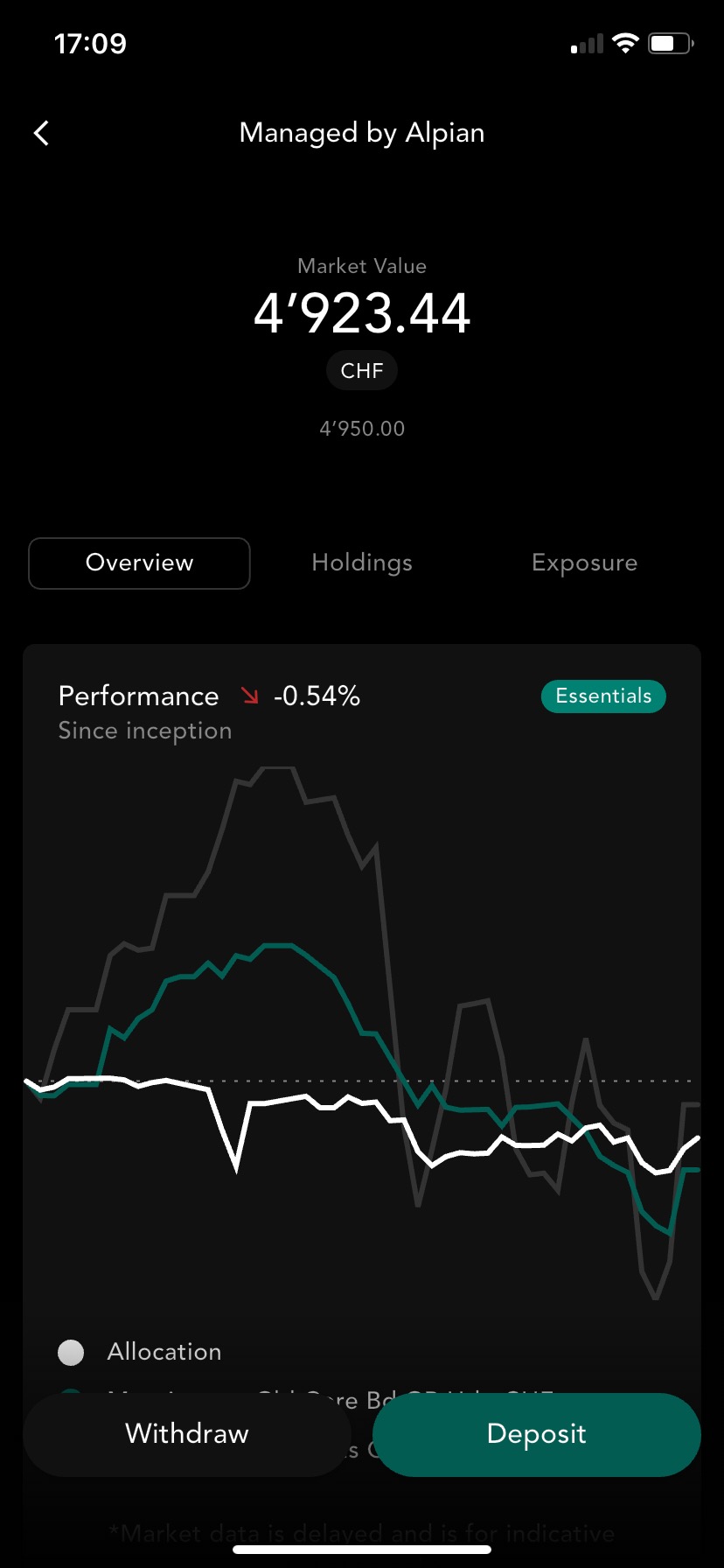

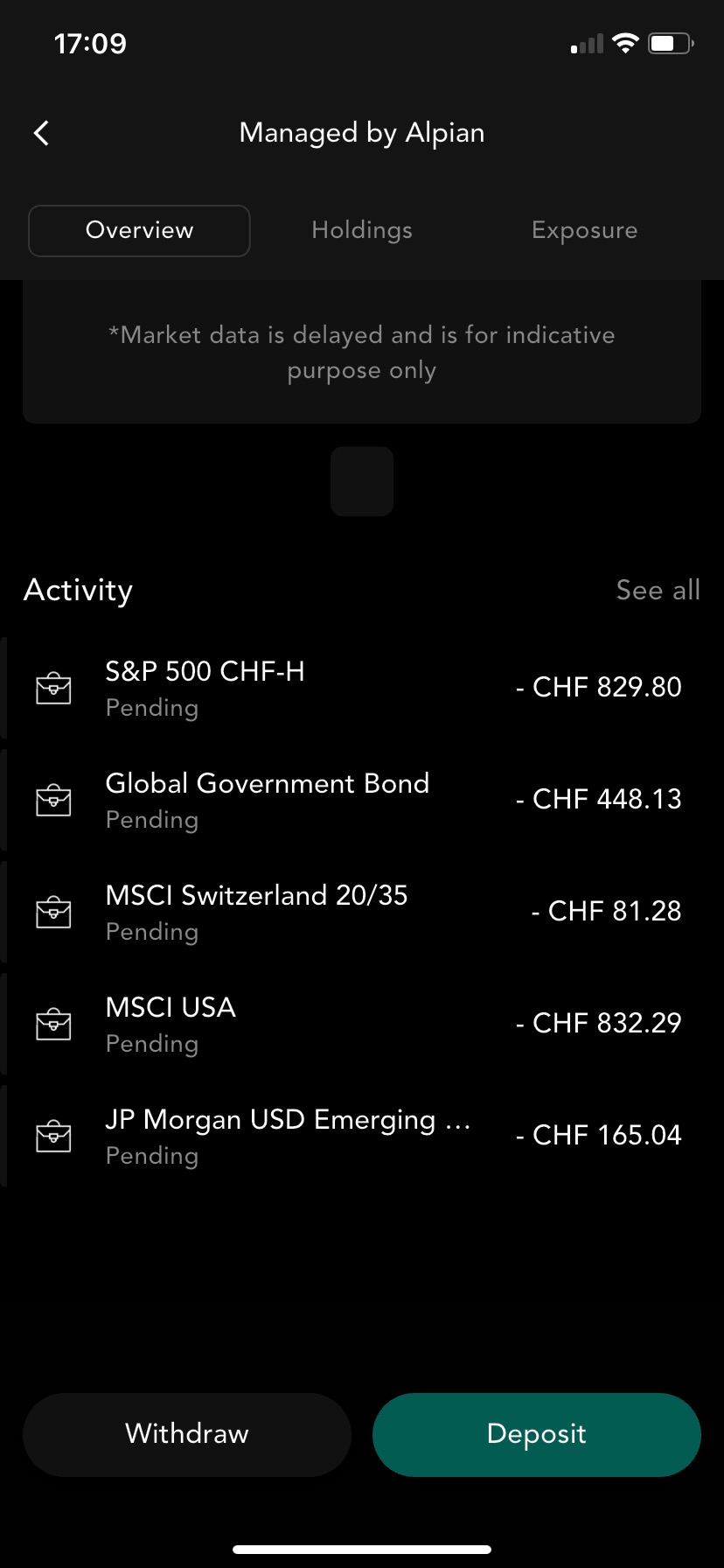

Everything is Managed on our Behalf, but We Maintain Full Visibility

- Performance can be viewed directly through the application.

- A monthly report details the adjustments made and the reasons for modifications.

- A management journal explains ongoing strategic choices.

We can exclude certain themes, but we don’t individually select assets.

Human Contact to Go beyond an Algorithm

Managed by Alpian doesn’t rely solely on automation. You can interact with a wealth management advisor via the application to discuss your strategy or ask specific questions.

The particularities:

- Advisors are not paid on commission, so there’s no incentive to push one product over another.

- They help clarify our investment objectives, according to our needs and personal developments.

- The management team actively adjusts allocations, without any intervention on our part.

One doesn’t benefit from the ultra-personalized service of a private bank, but access to expertise far exceeds what a robo-advisor offers.

What are the Fees and Conditions of Managed by Alpian?

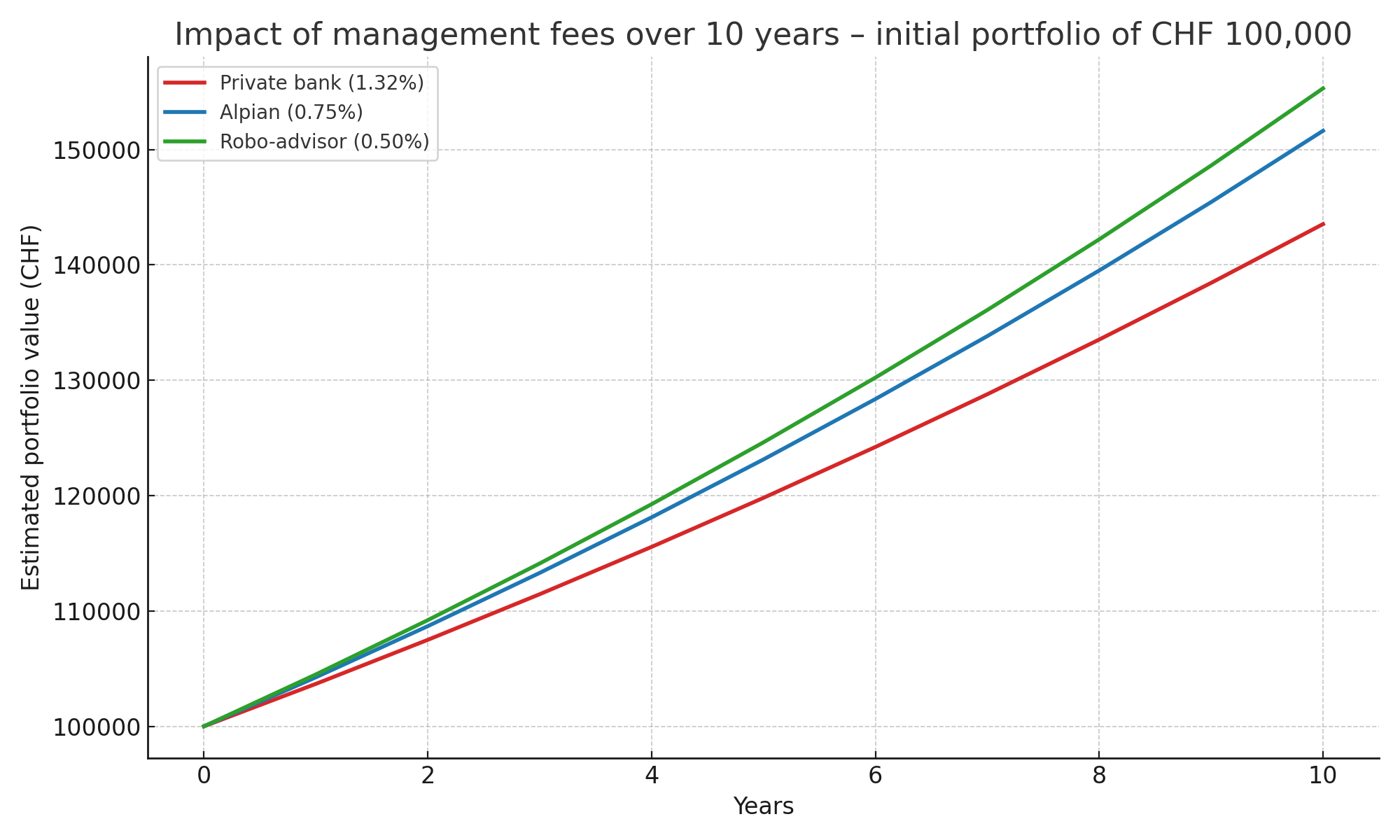

A Cost Well below a Private Bank, but Higher than a Robo-Advisor

With a private bank, fees for a management mandate vary between 1.32% and 3% per year. Managed by Alpian charges between 0.50% and 0.75% all-inclusive depending on the package chosen (more information on the packages offered by Alpian can be found in the “fees” section of the Alpian review), soit 30 % à 80 % which is 30% to 80% cheaper than with a traditional private bank. You save on fees, but there are a few differences. Private banks offer more flexibility on assets, including individual stocks or complex strategies. Managed by Alpian simplifies the approach with ETFs, while ensuring active management and human support.

But compared to robo-advisors such as Selma Finance (0.72%) or Investart (0.50%), Managed by Alpian is more expensive: around 30% more than Selma and twice as much as Investart. The difference is not just about price. A robo-advisor applies a standardized model based on a few initial questions. Managed by Alpian works differently: each portfolio is supervised by experts, adjusted according to the market, and tailored to our investment profile.

What is the Real Impact on Returns?

Percentages don’t tell the whole story. What matters is how much we actually pay.

For example, on a portfolio of 100,000 CHF:

- 1,000 CHF per year with Managed by Alpian.

- 1,500 to 3,000 CHF with a private bank.

- 720 CHF with Selma Finance.

- 500 CHF with Investart.

The savings are clear compared to a private bank: between 500 CHF and 2,000 CHF less per year. The additional cost compared to a robo-advisor is justified if you want more supervised management, with strategic adjustments made by a human team.

📌 But it’s important to look beyond management fees alone. You need to consider the overall performance offered by Managed by Alpian’s support services.

Anyone can invest with Apian, but a minimum of CHF 30’000 is required to open a Managed by Alpian mandate..

Access conditions:

– Only for Swiss residents.

– Only for individuals, no accounts for companies or legal entities.

What to Remember about Managed by Alpian Fees

Managed by Alpian breaks private bank prices without sacrificing human support. You pay 30% to 70% less than a classic mandate, while maintaining active management and expert monitoring. As claimed on the official page of Managed by Alpian, fees remain transparent and fixed, without unpleasant surprises.

Everything is clear from registration. No hidden fees or additional costs on transactions. We know what we’re paying for and why.

Managed by Alpian, a Good Compromise or Too many Limitations?

Managing a portfolio requires time and knowledge. Rather than having to monitor markets and adjust investments yourself, Managed by Alpian precisely addresses this need. Each allocation evolves according to a strategy designed to adapt to market conditions and the profile defined at the outset.

What changes is the support. We can ask questions, interact with an advisor, and follow portfolio developments. Everything is done without us having to intervene directly, but with real visibility on the decisions made. You also benefit from a free multi-currency account in a Swiss neobank approved by FINMA.

Monitor your Portfolio without Hassle

Rather than waiting for a complicated quarterly statement, everything is accessible in real-time from the application. Each month, a report explains the adjustments and evolution of the portfolio.

The idea is not just to see numbers evolving. The application provides direct access to implemented strategies, with explanations on recent adjustments. We maintain a clear vision of how our capital is managed.

Personalization, but with Limits

Each portfolio is built individually, with the possibility to exclude certain themes (such as cryptos or specific economic sectors).

However, the choice of assets remains restricted. It’s impossible to adjust allocations yourself or select specific securities. Those who want to maintain control over every decision will find more flexibility with alternatives like Guided by Alpian or Investart.

The Offering is more Standardized than that of Private Banks

Unlike private banks that offer a wide range of assets (stocks, private equity, hedge funds, structured products, real estate, etc…), Managed by Alpian focuses solely on ETFs, with possible exclusions on certain themes.

In a private bank, you often benefit from a dedicated advisor who monitors the portfolio individually. Managed by Alpian offers access to wealth advisors, but without this exclusive relationship.

Should We Reduce Fees or Prioritize Human Support?

The additional cost compared to robo-advisors finances active monitoring where experts actually adjust the allocation to limit exposure to market shocks and seize opportunities.

But if minimizing fees is the priority, a robo-advisor like Selma will be more suitable.

A Still Young Service, with Little Hindsight

Managed by Alpian has existed since 2022. The displayed performances are interesting (+18.09% since launch, with a volatility of 7.02%), but several more years are needed to judge its effectiveness over different market cycles.

Conclusion: is Managed by Alpian the Right Option?

Managed by Alpian occupies a niche between robo-advisors and private banks. The choice will depend on what you value most: personal attention and a dynamic approach, or lower fees and more direct control.

Are we willing to pay more than a robo-advisor?

Is discretionary management worth it if we don’t choose our own assets?

And most importantly, does Alpian’s offer deliver on its promises of personalization and human support?

After experiencing the service, here’s what concretely stands out:

✔︎ If you want a hassle-free managed portfolio, it works perfectly.

You don’t touch anything, everything is managed by professionals, and you follow the evolution with full transparency in the application. The monitoring is smooth, you always know what changes and why. But be careful, it’s not 100% tailored management: you can’t modify each allocation or choose your assets in detail.

✔︎ The fees are justified… if you value real human support.

We tested Selma and other robo-advisors, and the experience is different. With Alpian, you can interact with an advisor, ask questions, and understand what’s happening. It’s a real plus when you want a structured approach, but it comes at a price. If you’re only looking to minimize fees, Selma or Investart will be more competitive.

✔︎ The entry ticket is a barrier, but it places Managed by Alpian in a different segment.

30,000 CHF is not insignificant. It’s more than a classic robo-advisor, but well below private banks.

What I Retain from Managed by Alpian

If you’re looking for truly discretionary management, with a real team behind it and not just an algorithm, Managed by Alpian is a solid option. If you’re interested in the formula but want to start with 5,000 or 10,000 CHF, then I recommend looking at Managed by Alpian Essentials. It’s the right thing to do to test the approach before moving to a more advanced mandate. If, on the other hand, the goal is to save every percentage point in fees or maintain total control, it’s better to turn to a robo-advisor or a service that gives you control over asset selection.

Managed by Alpian is an excellent choice. It all depends on what you expect from your investment.

Alpian Promo Code

Free account ✔︎

Also read

- Complete Review and Opinion on Managed by Alpian Essentials

- Complete review of Guided by Alpian

- Review and test of investing with Alpian

- The Swiss Guide to Private Banking in 2026

- Review and Test of Yuh Investment Trading

- Review and test of Neon Investment Trading

- Review and Test of Selma, the Investment Platform

What do you think of Alpian for your investments?

- The app. Has Alpian facilitated your access to investment?

- What feature would you like to add or improve?

- Is Alpian your first investment portfolio?

Share your opinion with all Neo friends 😈