Investing with Alpian – Review and Full Analysis (December 2025), get 75 + 125 CHF

| Investment security | 10 |

|---|---|

| Fees | 9.1 |

| Investment income | 8.8 |

| Crypto-currencies | 4.3 |

| Trading features | 7.2 |

| Training | 8.6 |

| Customer support | 9.8 |

| Opening an account | 9.4 |

The best online bank for investing? Alpian, the 100% digital Swiss private neo-bank, stands out with a unique approach. Analysis of advantages, mandates, limits, and fees: we decipher everything to save you time. 💰 Use the promo code HEYALP when opening your account to receive 75 CHF for deposits of 500 CHF and 125 CHF for any mandate of at least 10,000 CHF. Let’s get started!

Description

[Update – 2025-11-10: Introduction of new fees applied to mandates Managed by Alpian.]

[Update – 2025-09-23: Introduction of Alpian’s recurring investment feature.]

Why Consider Alpian for Investing in 2025

Switzerland’s first ‘digital private bank’ is intriguing, but what is Alpian truly like in 2025? Is it effective for all investors? Let’s examine that.

📝 The purpose of this review:

- To detail what Alpian offers and what sets it apart from other banks.

- To compare Alpian to other solutions available in Switzerland.

- To evaluate the fees, performance, and investor profiles it suits best.

Alpian: A Hybrid Bank Between Private Bank, Robo-Advisor, and Broker

Managing your investments alone requires discipline: you need to monitor markets, make the right decisions at the right time, and avoid emotional biases. It’s doable, but requires time, solid knowledge, and a clear strategy.

When we talk about “wealth management”, we first think of Lombard Odier, Pictet, or UBS Wealth, which “cater to wealthy clients with entry thresholds often exceeding 500,000 CHF.

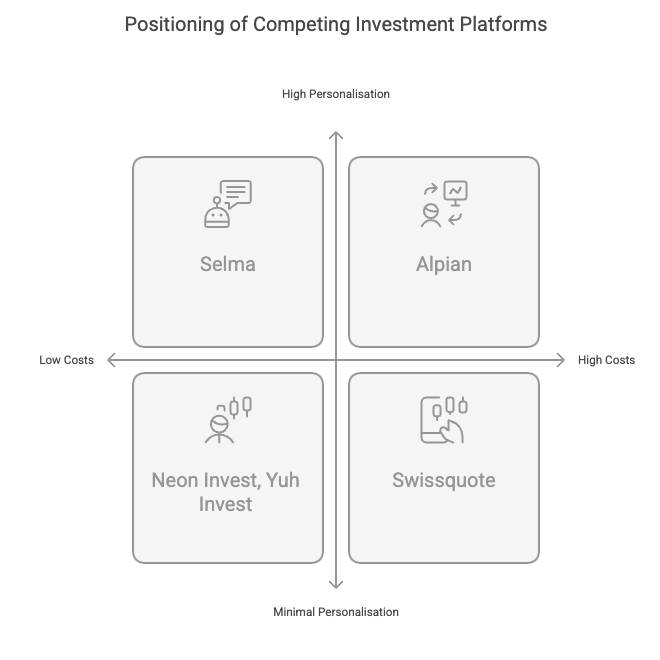

On the” other hand, robo-advisors like Selma make “investing accessible from a few hundred francs, but without real human support.

There are brokers like Swissquote and neo-banks like Yuh or Neon, which offer direct access to markets or directly to investment products, but require complete autonomy in” managing investments.

Alpian is between all these models: more structured than an online broker, more personalized than a robo-advisor and less expensive than a traditional private bank.

Alpian resembles a private bank, but with a much more accessible approach: one can open a mandate from 2,000 CHF (compared to several hundred thousand in a traditional bank). It distinguishes itself from robo-advisors like Selma through genuine support, but maintains an algorithmic approach to optimize allocations. And unlike brokers, one does not directly choose their stocks: everything is managed via optimized portfolios.

| Criteria | Private Bank | Alpian | Neon Invest | Yuh Invest | Selma | Swissquote |

| Approach | Traditional Private Bank | Digital Private Bank | Stock ETF Trading | Stock ETF Trading | Robo-advisor | Full Broker |

| Delegated Management | ✔︎ Managed by an Advisor | ✔︎ Managed by Alpian | ✘ | ✘ | ✔︎ Automated, without adjustment possibility | ✔︎ Free Management |

| Personalized advice | ✔︎ Human | ✔︎ Human | ✘ | ✘ | ✔︎ Automated | ✘ |

| Wide Range of Assets? | ✔︎ (stocks, bonds, etc.) | ✘ (ETFs only) | ✔︎ | ✔︎ | ✘ (Non-customizable ETF Portfolio) | ✔︎ |

| Management fees | 1.32% (average) / year | between 0.50% and 0.75% per year, depending on the chosen plan, all fees included | 0.5% / order | 0.5% / order | 0.47% / year | 1-1,5 % |

Alpian differentiates its offerings with two service levels. The Standard plan offers a fixed rate of 0.75% per year, applicable to all available investment strategies.

On the other hand, the Signature option is designed for clients with a more substantial asset base: one must either invest a minimum of CHF 150,000, or invest CHF 1,000 monthly to benefit from it. In this case, fees gradually decrease based on the amount managed:

- Up to CHF 300,000: 0.69%

- Between CHF 300,000 and CHF 500,000: 0.60%

- Above CHF 500,000: 0.50%

In all cases, no additional fees are applied: neither transaction commissions nor custody fees; everything is included in the annual percentage.

An investor primarily looking to minimize fees might prefer Neon Invest or Yuh, while an investor wanting to delegate investment management at an affordable price might turn to Alpian. But it also depends on expectations regarding personalization and support.

Who is behind Alpian?

Alpian was founded in 2019, but it’s not an isolated player: it’s part of the Intesa Sanpaolo group, one of the largest European banks.

Management models: how does Alpian invest your money?

It’s a key decision when choosing to invest: do you want to be completely autonomous, or do you prefer a manager to handle your investments?

There are three levels of support:

- A turnkey portfolio with predefined investment strategies.

- Support with recommendations, while retaining control over decisions.

- Full discretionary management, where you completely delegate investment decisions.

Alpian investment mandates

| Mandate | Description | Minimum investment | Client autonomy | Level of personalization |

| Managed by Alpian Essentials | Turnkey portfolio with predefined risk profiles | 2,000 CHF | ✘ | Standard |

| Guided by Alpian | The investor makes decisions with Alpian recommendations | 10,000 CHF | ✔︎ | Moderate |

| Managed by Alpian | Tailored management by Alpian experts | 30,000 CHF | ✘ | Very high |

Unlike robo-advisors that apply a fully automated model, Alpian integrates a human dimension at the heart of the process, within the application: you can discuss with a manager and adjust your strategy when you wish.

Alpian Promo Code

Free account ✔︎

Investment products available at Alpian

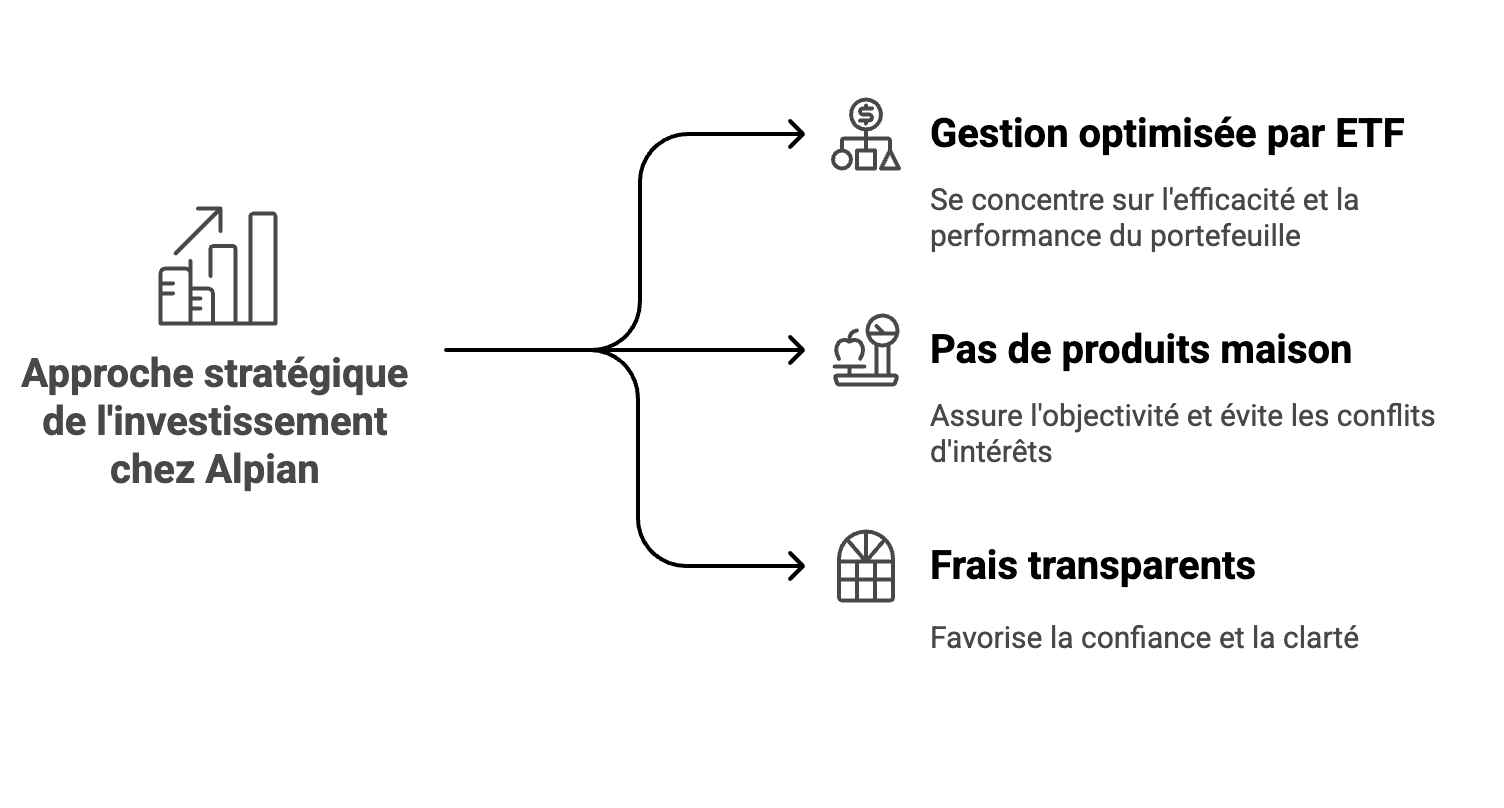

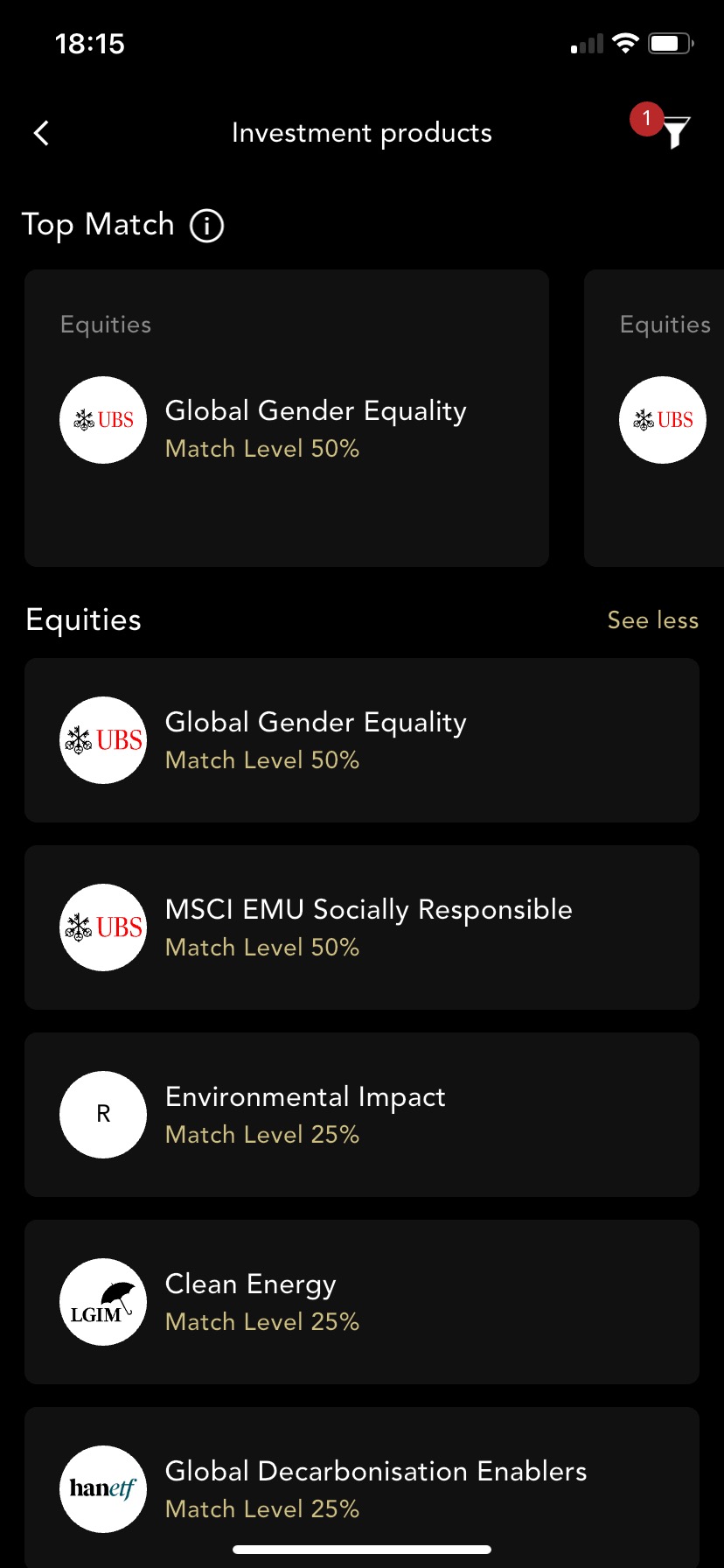

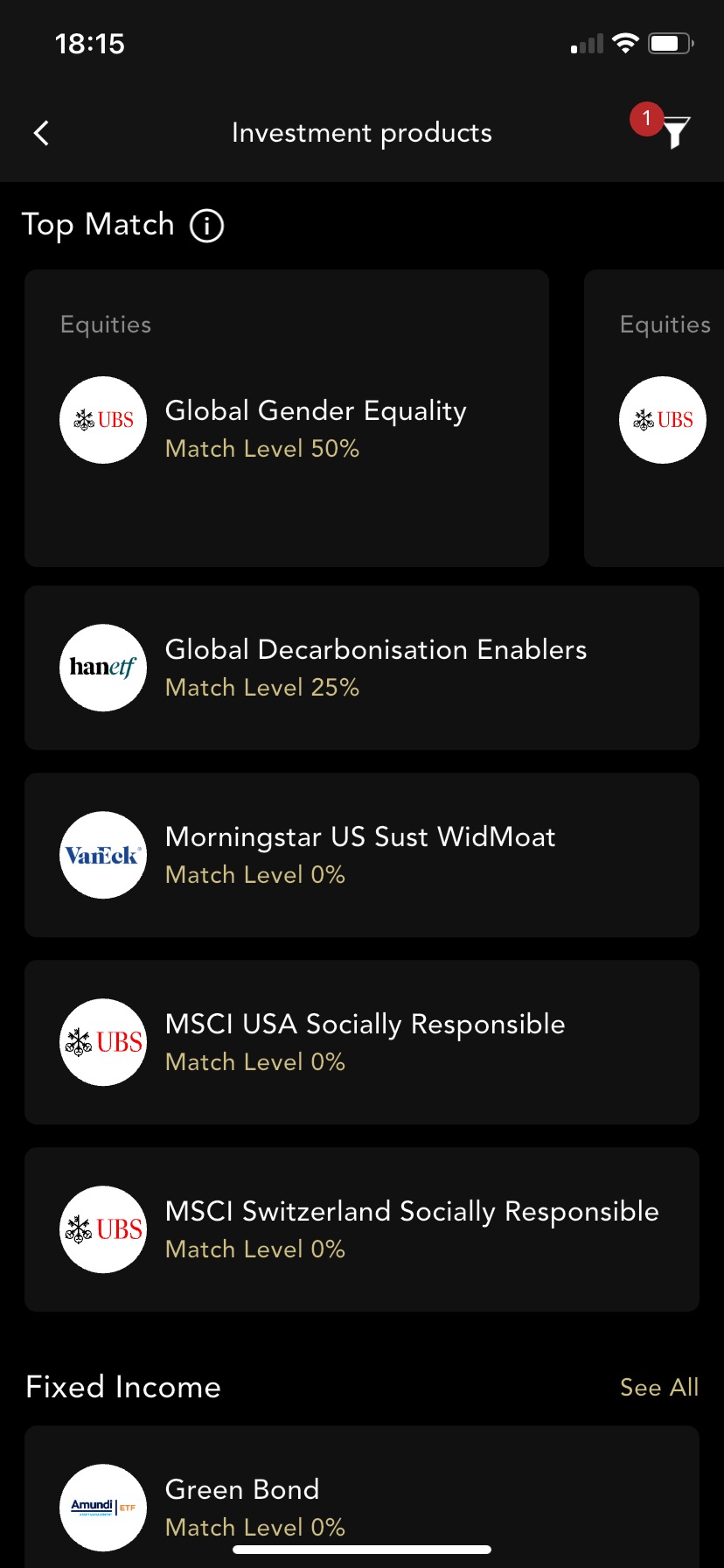

With Alpian, you don’t manually choose each stock like with Swissquote: everything is based on a predefined allocation, optimized according to your profile. You invest via a selection of 45 ETFs managed automatically.

💡 An ETF (Exchange-Traded Fund) is a fund listed on the stock exchange that groups several securities, such as stocks or bonds, into a single product. The idea is to diversify investments while keeping fees low. Some ETFs track global stock market indices, others allow exposure to specific themes like clean energy, tech, or even crypto assets via listed products.

It’s impossible to directly buy individual stocks. The ETFs do include companies like Tesla or Nestlé, but you can neither select specific securities nor freely adjust their distribution. For a more flexible approach, Swissquote or Yuh allow more customization.

Cryptocurrencies: a controlled exposure, without direct management

Investing in cryptocurrencies with Alpian is only possible through specialized ETFs, such as the 21Shares Bitcoin Core ETP. No direct purchases, no wallets, no private key management: everything is integrated into the standard investment framework.

It’s a model that reduces risks, but also limits freedom of action. Unlike Yuh, where you can directly buy Bitcoin or Ethereum, here it’s not possible to enter and exit the market at will.

No direct stocks, commodities, or private equity

At Alpian, you can’t invest directly in individual stocks, commodities, or private equity. Everything is framed within a standardized strategy and adjustable only within certain limits.

If you’re looking for more flexibility in managing your portfolio, Swissquote and Yuh allow you to buy and sell securities freely. With Alpian, you follow an allocation defined from the start, without the possibility of modifying it individually.

Investment mandates at Alpian: three levels of support

How involved do you want to be in managing your portfolio? Some want to delegate everything, others prefer to have control while being supported, and others seek a fully automated solution. Alpian offers three types of support, each with a different degree of flexibility:

With Managed by Alpian Essentials, everything is automated and the investor follows a fixed strategy, without the possibility of adjustment (except for weekly rebalancing).

Managed by Alpian offers management more adapted to the risk profile, but without manual intervention.

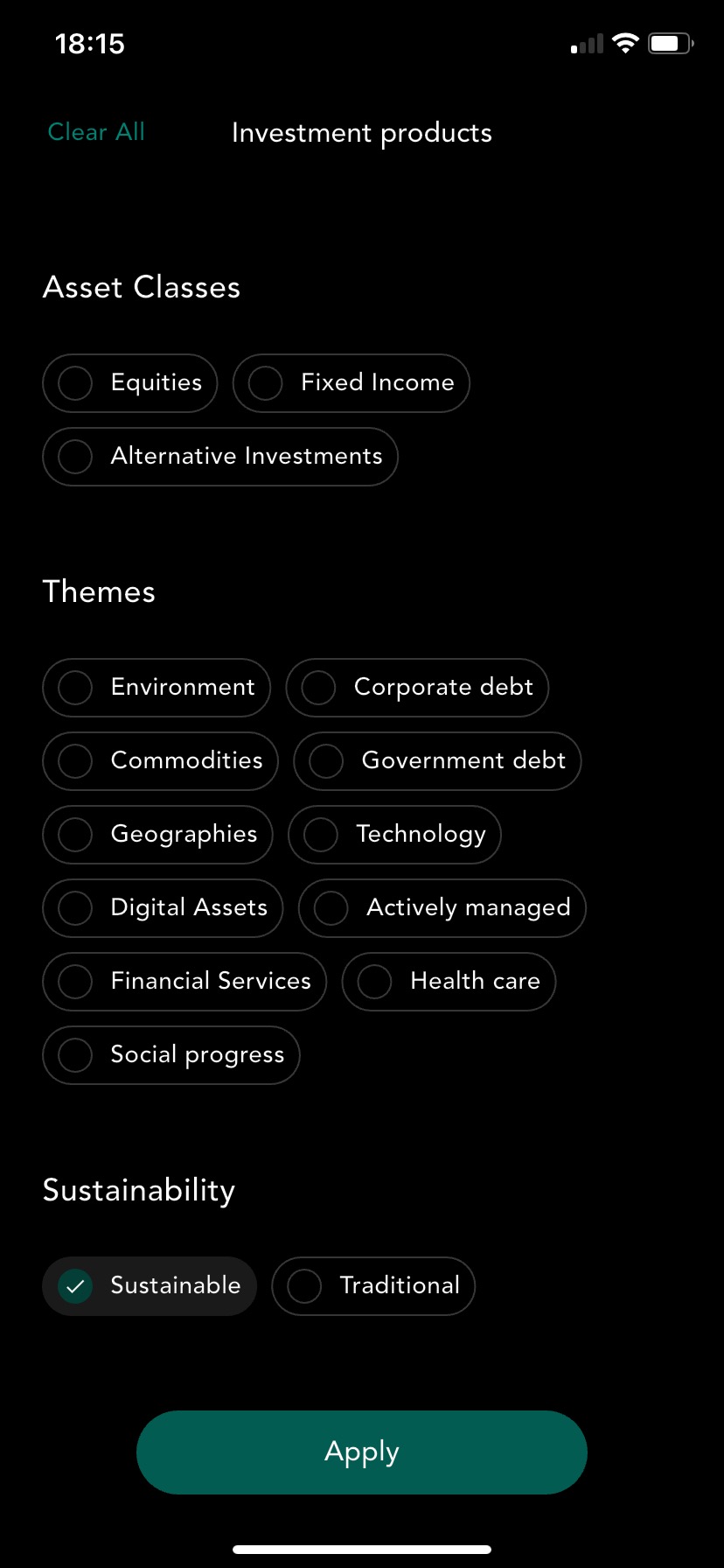

Only the Guided by Alpian mandate allows for a certain degree of control, with a margin of ±10% on asset allocation and the possibility of choosing ETFs from a pre-established selection. An approach that provides a framework for personalization, while allowing more freedom than a robo-advisor such as Selma, but less than a broker such as Swissquote, where every choice is left to the investor.

Image: heyneo.ch

What changes is the degree of customization and autonomy left to the investor (which we explain in the next point).

Managed by Alpian Essentials: Passive Management (from 2,000 CHF)

This is Alpian’s entry point for investors who want to test the waters🌡️. When you’re starting out or looking for a turnkey investment solution, it’s reassuring to have an already structured portfolio without worrying about asset allocation. This is the principle of Managed by Alpian Essentials.

In this mandate, everything is predefined: you choose a risk profile from five options and Alpian manages the portfolio allocation accordingly. The investment is based exclusively on carefully selected and diversified ETFs. You can also opt for a particular investment theme such as Sustainable, Global, Swiss, or Global Crypto.

You let the financial experts handle it while having full visibility on what’s happening in the portfolio. But this level of simplicity also has its limitations:

What you gain

- Ease.

- An accessible entry from 2,000 CHF (far from the 500,000 CHF minimum required by a private bank).

- Management without the need for intervention.

- Fixed fees (between 0.50% and 0.75% per year), which remain the same for all mandates.

What you lose

- No customization beyond the defined risk profiles.

- The portfolio follows the performance of ETFs but does not make strategic decisions as an active manager might.

Guided by Alpian: the Compromise between Autonomy and Advice (from 10,000 CHF)

Everyone is different. You may want to manage your investments without being completely left to your own devices (especially when you don’t necessarily have the time to constantly monitor the markets). This is where Guided by Alpian becomes interesting. You retain control over your decisions, but with recommendations to refine your strategy.

What you gain

- A good compromise between autonomy and guidance.

- Access to about fifty ETFs, compared to only pre-made portfolios in Essentials.

- Regular recommendations to optimize the portfolio.

What you lose

- Orders are not executed in real-time, but scheduled.

- You can’t completely deviate from defined strategies (maximum 10% difference).

Alpian compared to Neon and Yuh?

This touches on Alpian’s hybrid nature: more guidance than with a simple trading account, but less freedom than with a broker. In comparison, Neon Invest and Yuh allow you to buy stocks freely, but without any follow-up or advice. Guided by Alpian positions itself right between the two with a structured framework, but a certain degree of flexibility.

| Criteria | Alpian Guided | Neon | Yuh |

| Minimum investment | 10,000 CHF | 1 CHF | 25 CHF |

| Management | Assisted | Free | Free |

| Choice of assets | Pre-selected ETFs | Free stocks and ETFs | Free stocks and ETFs |

| Personalized advice | ✔︎ | ✘ | ✘ |

And Guided by Alpian Compared to a Robo-Advisor like Selma?

Comparing with Selma, we see that the idea is quite similar: passive management through ETFs, an equivalent entry threshold, and an algorithmic approach:

| Criteria | Alpian Essentials | Selma |

| Minimum investment | 2,000 CHF | 2,000 CHF |

| Personalization | Low (predefined profiles) | Automatic, but adjustable |

| Active management? | ✘ | ✘ |

| Human interaction? | ✔︎ | ✘ |

| Pricing | between 0.50% and 0.75% per year | 0.47% / year |

But unlike Selma, you have access to a human advisor at Alpian, which can be a real plus if you want to discuss your strategy.

Alpian Promo Code

Free account ✔︎

Managed by Alpian: Tailored Wealth Management (from 30,000 CHF)

Managed by Alpian is the closest experience to private banking, but without the exorbitant entry fee. Everything is handled by the investment team, which adjusts the portfolio based on market conditions and your preferences.

This mandate is intended for investors who want to fully delegate the management of their assets, while having true personalization.

What you gain

- 100% customized management where everything is optimized.

- Portfolios adjusted according to market trends.

- Possibility to define exclusions (e.g., avoiding certain industries, excluding cryptocurrencies).

What you lose

- The minimum investment of 30,000 CHF is higher.

- No flexibility to choose specific ETFs yourself.

Alpian compared to Swiss private banks?

Compared to a private bank such as Pictet or UBS Wealth Management, the main difference is the fees. Whereas private banks charge an average of 1.32% according to the 2024 survey by moneyland.ch and require substantial sums, Alpian offers a much more accessible alternative.

| Criteria | Managed by Alpian | Private Bank (Pictet, UBS Wealth) |

| Minimum investment | 30,000 CHF | 500,000 CHF and + |

| Active management? | ✔︎ | ✔︎ |

| Management fees | between 0.50% and 0.75% per year | 1.32% / year (average) |

Alpian Promo Code

Free account ✔︎

The list of ETFs available at Alpian in December 2025

The ETFs available depend in part on the selected mandate: with Managed by Alpian (managed portfolio), the allocation is entirely defined by Alpian and adjusted on an ongoing basis. With “Guided by Alpian” active management, you have a choice and room for adjustment based on the advice provided.

Complete Table of ETFs Available at Alpian

| List of ETFs at Alpian | ETF Type | ETF | Symbol + TER |

| Corporate Bonds | |||

| USD Corporate Bond | US corporate bonds | iShares $ Corp Bond UCITS ETF | LQDE – |

| Euro Corporate Bond | European corporate bonds | iShares Core € Corp Bond ETF CHF H Acc | IECH 0.25% |

| Global Corporate Bond | Global corporate bonds | iShares Global Corp Bond UCITS ETF | CORP 0.20% |

| CHF Corporate Bond | Corporate bonds in Swiss francs | UBS ETF (LU) Bloomberg Barclays CHF Corp 1-5 UCITS ETF (CHF) A-dis | CHCORP 0.15% |

| ESG Euro Corporate Bond | ESG European corporate bonds | UBS ETF (LU) Bloomberg MSCI Euro Area Liquid Corporates Sustainable UCITS ETF (EUR) A-dis | SUOE 0.17% |

| ESG Swiss Bond Index Corporate | ESG Swiss corporate bonds | UBS ETF (CH) SBI® ESG Corporate UCITS ETF (CHF) A-dis | ESCB 0.15% |

| Government Bonds | |||

| Global Government Bond | Global government bonds | iShares Global Govt Bond UCITS ETF | IGLO – |

| Swiss Domestic Government Bond 0-3yr | Short-term Swiss government bonds | iShares Swiss Dom Govt Bd 0-3 ETF (CH) | CSBGC3 0.15% |

| Swiss Domestic Government Bond 3-7yr | Medium-term Swiss government bonds | iShares Core CHF Bond ETF | CSBGC7 0.15% |

| Emerging Markets | |||

| MSCI Emerging Markets | Emerging market stocks | iShares MSCI EM UCITS ETF USD (Dist) | IEEM 0.18% |

| JP Morgan USD Emerging Market Bond | Emerging market bonds in USD | iShares J.P. Morgan USD EM Bond UCITS ETF | IEMB 0.50% |

| ESG Emerging Markets Corporate Bond | ESG emerging market corporate bonds | iShares J.P. Morgan ESG $ EM Corp Bond UCITS ETF | EMBE 0.38% |

| Global Stocks | |||

| MSCI World | Developed global stocks | iShares Core MSCI World UCITS ETF USD (Acc) | SWDA – |

| MSCI World CHF-H | Global Equities Hedged in Swiss Francs | iShares MSCI World CHF Hedged UCITS ETF | IWCH 0.55% |

| FTSE All-World | Global Equities All Countries | Vanguard FTSE All-World UCITS ETF | VWRD 0.24% |

| Regional Equities | |||

| MSCI USA | US Large Cap Equities | iShares Core S 500 UCITS ETF | CSPX 0.07% |

| MSCI Europe | European Large Cap Equities | iShares Core MSCI Europe UCITS ETF EUR (Acc) | IMEU 0.12% |

| MSCI Japan | Japanese Equities | iShares Core MSCI Japan IMI UCITS ETF | IJPN – |

| MSCI India CHF-H | Indian Equities Hedged in Swiss Francs | iShares MSCI India CHF Hedged UCITS ETF | INIC 0.65% |

| MSCI Switzerland 20/35 | Swiss Equities with Concentration Limit | iShares Core SPI® ETF (CH) | CHSPI – |

| Specific Sectors | |||

| MSCI World Financials | Global Financial Sector | iShares MSCI World Financials Sector UCITS ETF | WFIN 0.30% |

| MSCI World Health Care | Global Health Care Sector | iShares MSCI World Health Care Sector UCITS ETF | WHEA 0.25% |

| MSCI World Information Tech | Global Technology Sector | iShares MSCI World Information Technology Sector UCITS ETF | WTEC 0.25% |

| MSCI World Energy | Global Energy Sector | iShares MSCI World Energy Sector UCITS ETF | NRGE 0.25% |

| Sustainable Themes | |||

| Global Gender Equality | Companies Promoting Gender Equality | Lyxor Global Gender Equality (DR) UCITS ETF | GEND 0.50% |

| Environmental Impact | Global Clean Energy Companies | iShares Global Clean Energy UCITS ETF | INRG 0.65% |

| Clean Energy | Global Clean Energy Companies | iShares Global Clean Energy UCITS ETF | INRG 0.65% |

| Global Decarbonisation Enablers | Companies Facilitating Decarbonisation | Lyxor Net Zero 2050 S Eurozone Climate PAB (DR) UCITS ETF | CLMA 0.65% |

| Green Bond | Green Bonds for Environmental Projects | Lyxor Green Bond (DR) UCITS ETF | CLIM 0.30% |

| Cryptocurrencies and Commodities | |||

| Bitcoin Core ETP | Bitcoin Exposure | 21Shares Bitcoin Core ETP | BTCA 1.49% |

| Crypto Basket ETP | Diversified Cryptocurrency Basket | 21Shares Crypto Basket Index ETP | HODL 2.50% |

| Solana Staking ETP | Solana Staking Exposure | 21Shares Solana Staking ETP | SLNC 2.50% |

| Bloomberg Commodity | Diversified Commodity Exposure | iShares Diversified Commodity Swap UCITS ETF | CMOD 0.34% |

| Physical Gold | Physical Gold | iShares Physical Gold ETC | SGLD 0.22% |

| ESG Strategies | |||

| MSCI USA Socially Responsible | US Socially Responsible Equities | UBS ETF (LU) MSCI USA Socially Responsible UCITS ETF (USD) A-dis | SUAS 0.22% |

| MSCI Switzerland Socially Responsible | Swiss Socially Responsible Equities | UBS ETF (CH) MSCI Switzerland IMI Socially Responsible UCITS ETF (CHF) A-dis | CHSRI 0.28% |

| MSCI EMU Socially Responsible | Eurozone Socially Responsible Equities | UBS ETF (LU) MSCI EMU Socially Responsible UCITS ETF (EUR) A-dis | UIMM 0.22% |

| Others | |||

| Artificial Intelligence | Artificial Intelligence Companies | L Artificial Intelligence UCITS ETF | AIAI 0.35% |

| Morningstar US Sust WidMoat | Sustainable US Stocks with Competitive Advantage | VanEck Morningstar US Sustainable Wide Moat UCITS ETF | MOAT 0.49% |

| Development Bank Bonds | Development Bank Bonds | iShares Development Bank Bonds UCITS ETF | DDBB 0.15% |

| Sustainable Development Bank Bonds CHF-H | Sustainable Development Bank Bonds in CHF | UBS ETF (LU) Sustainable Development Bank Bonds UCITS ETF (hedged to CHF) A-dis | SDBCH – |

| Global High Yield Corporate Bond | Global High Yield Bonds | iShares Global High Yield Corp Bond UCITS ETF | GHYU 0.25% |

| Global Inflation-Linked Bond | Global Inflation-Linked Bonds | iShares Global Inflation Linked Govt Bond UCITS ETF | IGIL – |

| US Liquid Corporates CHF-H | US Corporate Bonds Hedged in CHF | UBS ETF (LU) Bloomberg US Liquid Corporates 1-5 Year UCITS ETF (hedged to CHF) A-dis | USICH 0.16% |

| ESG J.P. Morgan Global Government Liquid Bond | ESG Global Government Bonds | iShares J.P. Morgan ESG $ EM Bond UCITS ETF | GBGG 0.18% |

| FTSE Developed Asia Pacific ex Japan | Developed Asia Pacific ex Japan Stocks | Vanguard FTSE Developed Asia Pacific ex Japan UCITS ETF | VDPX 0.15% |

This view represents the latest update made by heyneo.ch. The available ETFs are constantly updated in the Alpian application where you will find the latest developments.

Alpian’s ETF Selection by Theme

Management Fees and Investment Costs at Alpian (in Detail)

Fees inevitably reduce the performance of an investment: it’s better to understand them in detail before choosing your mandate.

Between 0.50% and 0.75%, All-Inclusive?

Alpian applies a single management fee of between 0.50% and 0.75% per year on the total value of investments.

What is included in these fees:

✔︎ Portfolio management (more or less active depending on the chosen mandate).

✔︎ Access to financial advisors.

✔︎ Annual tax report.

✔︎ Execution of transactions without additional fees.

The rate is fixed, regardless of the amount invested, unlike private banks which often apply degressive fees. For comparison, Selma charges 0.47% per year and True Wealth between 0.25% and 0.50% depending on the amounts invested.

There Are Other Costs to Consider

Even if the fees cover the overall portfolio management, other costs are added and must be taken into account.

Swiss Stamp Duties

Like all platforms in Switzerland, Alpian applies stamp duty on transactions:

0.075% for Swiss securities and 0.15% for foreign securities.

Exchange Fees

These are the exchange fees when investing in a currency other than Swiss francs.

Pricing applied at Alpian:

- 0.2% on weekdays.

- 0.5% on weekends.

During the week, these rates remain competitive:

– Yuh applies an integrated spread, between 0.5% and 1.5%, without fixed fees.

– Swissquote can go up to 1.5% depending on the currency.

– Neon uses the interbank rate but adds fees per order.

The majority of Alpian portfolios are structured in CHF, which reduces the need for frequent conversions. Additional positive point: at Alpian, the bank account is multi-currency, which allows you to keep the currencies of your choice in anticipation of future investments.

📌 There are no transaction fees at Alpian.

ETF Fees

Alpian portfolios are built exclusively with ETFs that include internal fees called TER (Total Expense Ratio). On average, the selected ETFs are around 0.25%. If we add the delegated management charged between 0.50% and 0.75%, we arrive at a total cost of approximately 0.75% to 1% per year for the investor.

📌 This level of fees remains reasonable for a fully managed solution, even if higher than a robo-advisor or a self-directed broker.

Alpian’s Fees Compared to Other Investment Platforms in Switzerland

Alpian positions itself against other solutions such as Neon Invest, Yuh and Selma which offer models with different fees.

Comparison of management and transaction fees:

| Platform | Management fees | Transaction fees |

| Alpian | between 0.50% and 0.75% per year (active management, advice included) | Included in annual fees (excluding stamp duty and exchange fees + TER 0.25%) |

| Neon Invest | No management fees | Swiss stocks ETFs: 0.5% per transaction |

| Yuh | No management fees | 0.5% per transaction |

| Selma | 0.47% / year | ETF TER (approximately 0.25%) |

| Swissquote | None – variable | Variable transaction fees |

Analysis:

- Neon and Yuh are the least expensive, but require completely autonomous management.

- Selma remains slightly cheaper than Alpian, but offers no human support.

Is Alpian competitive on fees?

Advantages:

✔︎ Clear and predictable fee structure.

✔︎ Cheaper than a traditional private bank.

✔︎ No per-transaction fees, unlike brokers.

Limitations:

✘ More expensive than Neon and Yuh for self-directed investors.

✘ The total cost (between 0.50% and 0.75% + TER 0.25%) reaches 1%, slightly above Selma.

Alpian Promo Code

Free account ✔︎

How much Does Alpian Really Cost?

Should We Always Aim for the Lowest Fees?

Alpian charges between 0.50% and 0.75% per annum for portfolio management, depending on the package chosen (more information on the packages offered by Alpian can be found in the ‘fees’ section of the Alpian review). Approximately 0.25% in fees related to the selected ETFs must be added. This total cost, around 1% per annum, may seem high compared to platforms such as Neon Invest or Yuh, which do not charge any management fees.

But this comparison is misleading, as we forget the nature of the service.

What the Fees Cover at Alpian

At Alpian, you’re not just paying for access to financial markets. You’re paying for complete management of the portfolio:

- Semi-active management driven by Alpian’s algorithm, enriched by market views from experts.

- Automatic weekly rebalancing to maintain the target allocation.

- Personalized advice in the “Guided” and “Managed” mandates.

- A tailor-made allocation, based on the behavioral profile, not just a simple standard model.

The Objective: Better Performance… Or Avoiding Mistakes

Alpian doesn’t just follow an index. Each week, the allocation is adjusted according to market movements, the client’s risk tolerance, and expert convictions. The goal is not simply to replicate the market, but to intelligently adapt it to each investor.

Conversely, low-cost platforms apply a passive strategy or leave the client alone with their decisions. If all goes well, it works. But a bad decision, poor timing, or insufficient diversification can quickly erase the savings made on fees.

What to Remember

Fees at Alpian are higher, but they cover a managed service, often absent from low-cost competitors. They should be considered against the potential performance gain.

The choice depends on the profile:

– If you want to manage everything yourself, you’ll prefer Yuh, Neon, or Guided by Alpian.

– If you’re looking for a stable, personalized, and assisted approach, Alpian is the most suitable.

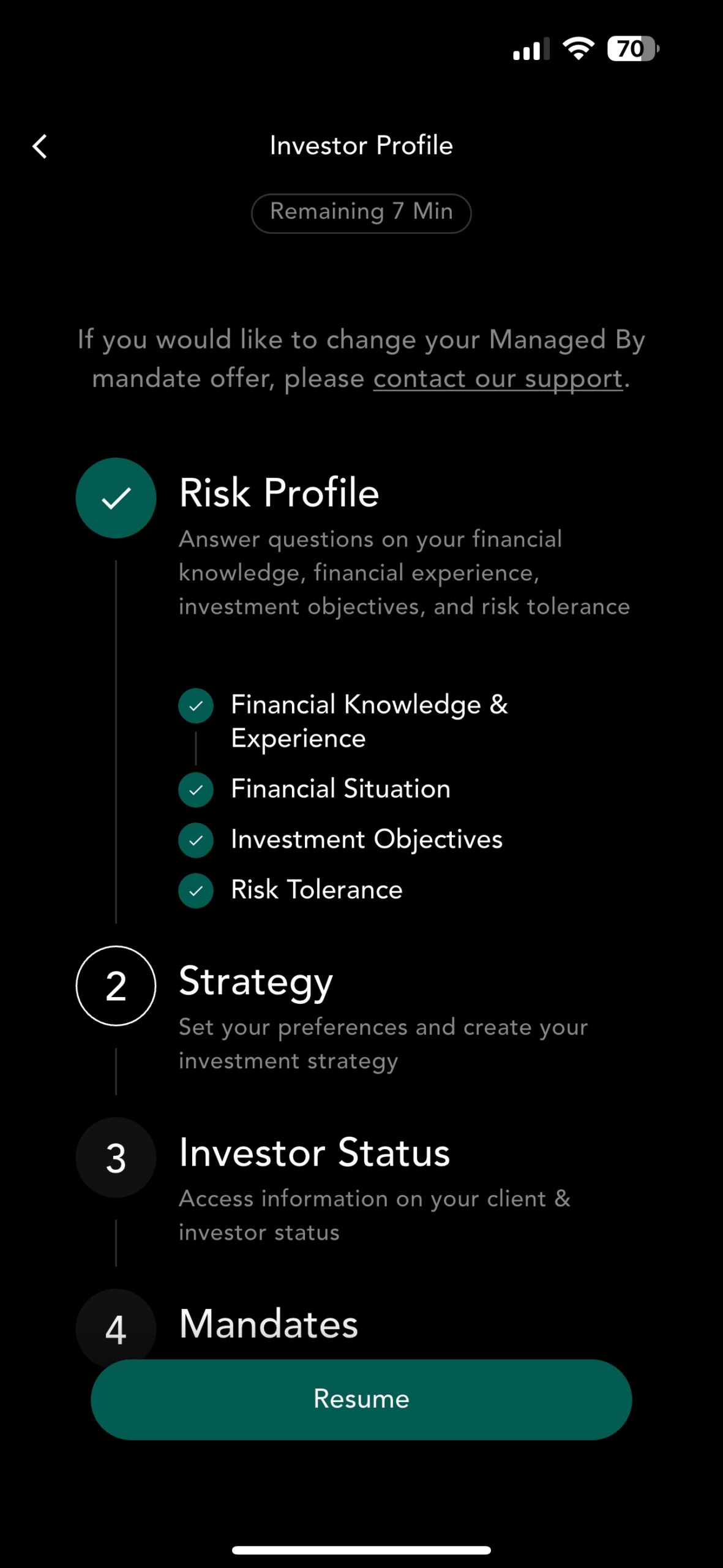

Definition of investment strategy

Define risk profile – step 1/4

Financial experience : Alpian assesses understanding of financial markets and different investment products.

Financial situation: This step allows Alpian to assess its investment capacity and propose suitable solutions.

Investment objectives : Definition of short, medium and long-term financial objectives.

Risk tolerance : the customer’s ability to withstand market fluctuations and potential losses.

Create an investment strategy – step 2/4

The investment strategy is created by going through several modules.

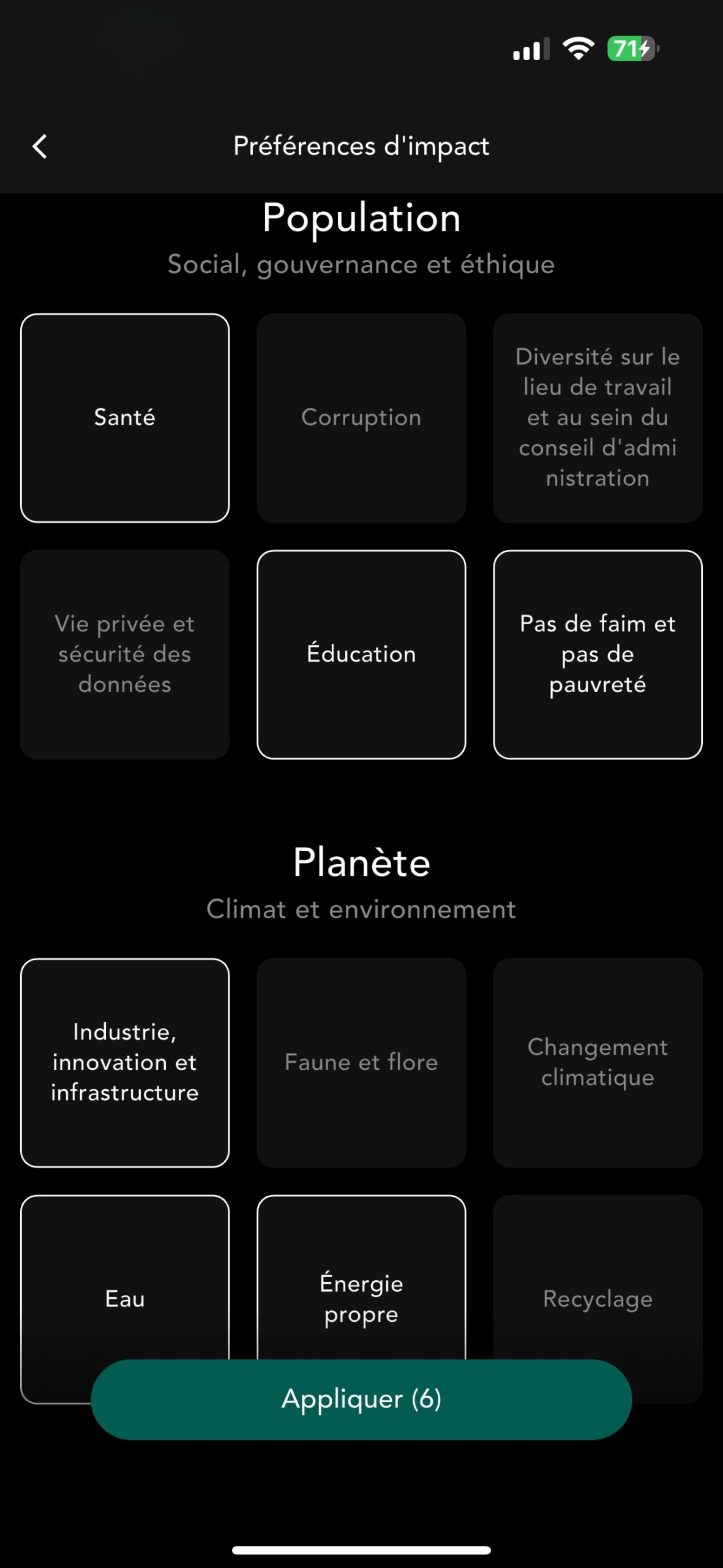

Restrictions: allows aligning investments with personal convictions by choosing to include or exclude certain sectors or types of investments.

Impact Preference: Allows personalizing the investment portfolio based on values or preferences regarding environmental and social impact.

Strategic Allocation: Proposes a personalized asset allocation, optimized by experts according to your objectives and risk tolerance, for a diversified portfolio adapted to your profile.

Consult the performance history of the portfolio allocation (exposure) – step 3/4

Validate the mandate – 4/4

The final step is to validate (sign) the mandate directly on the phone.

Performance and portfolio management at Alpian

Wealth management in retail banks uses a single model: they group investors into 3 or 4 predefined categories with standardized allocations that vary little from one client to another:

– conservative

– balanced

– dynamic

Two people classified as “balanced” have an identical portfolio without taking into account their actual tolerance for market fluctuations.

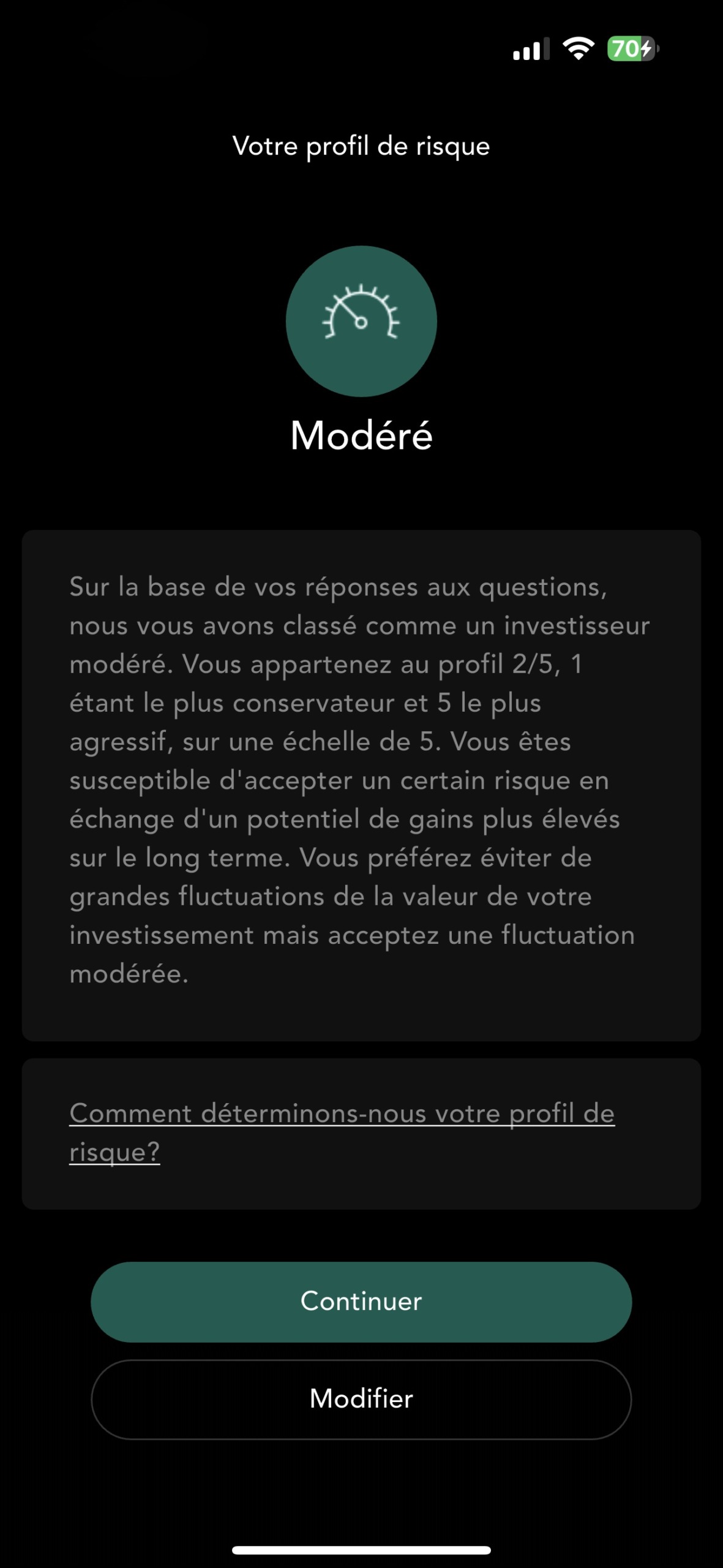

With Managed by Alpian, the allocation is not standardized. It is individually adjusted with an infinity of possible variations based on the real risk tolerance, calculated via a proprietary model inspired by behavioral finance.

With Essentials, the approach is simpler: you choose a profile from five risk levels, and the allocation remains fixed within this framework. It’s a more accessible model, but also less refined, which doesn’t take into account the psychological nuances specific to each investor.

Two investors with the same profile may receive different allocations based on their individual risk perception, which is rarely taken into account in a traditional bank.

Concrete example:

- In a traditional bank: two investors considered “balanced” will each receive 50% in equity funds and 50% in bond funds, with a standardized allocation.

- At Alpian: one might have 60% in ETFs exposed to stocks and 40% in bond ETFs, while the other might stay closer to 40% in stock ETFs and 60% in bond ETFs, depending on their risk tolerance and reaction to market fluctuations.

I’m glad to be so useful to banks 😊

Neo – Unsolicited advice (as usual).

The client’s utility function

Alpian’s approach uses the “customer utility function”, a model derived from behavioral finance that adjusts allocation based on the customer’s actual ability to bear risk. Two theoretically similar profiles can therefore result in different allocations, which is not the case in a traditional bank where a uniform framework is applied.

What this changes in practice

✔︎ More refined risk management: each portfolio is adjusted to best match expectations and actual tolerance for fluctuations.

✔︎ Better emotional stability: less risk of abandoning a strategy after a downturn, as the allocation better reflects the investor’s ability to handle market variations.

✔︎ A unique positioning: more personalized than a robo-advisor, more structured than a completely free approach like Swissquote, and more agile than a classic private bank.

Comparison of risk assessment models

| Criterion | Alpian | Retail bank (wealth management) | Robo-advisor |

| Risk profile | Individually adjusted according to actual tolerance | Fixed category (conservative, balanced, dynamic) | Automatic, based on a few questions |

| Adaptability | Portfolio modulated according to risk perception | Identical for all in the same category | Standardized, without fine adjustment |

| Reassessment | Regular adjustments | Little or no adaptation | Automatic but impersonal rebalancing |

| Example | Two “balanced” → different allocations | Two “balanced” → same portfolio | Fixed allocation according to a predefined model |

Alpian’s portfolio management methodology

How is the allocation defined?

It all starts with the detailed questionnaire that targets the risk level, financial objectives, and investment preferences. Based on this, Alpian builds an optimized portfolio taking into account several parameters:

✔︎ Intelligent diversification: a selection of ETFs to cover different sectors and geographical areas.

✔︎ Risk-return optimization: asset selection is based on their volatility and growth potential.

✔︎ Advanced personalization with the possibility to exclude certain investment themes or favor a sustainable portfolio, for example.

Image: heyneo.ch, steps in building an investment portfolio at Alpian.

Recurring Investments

To simplify wealth building, Alpian also offers a recurring investment feature. Automatic contributions (e.g., monthly) can be set up for one’s portfolio, which helps to average out market entry points while investing regularly and disciplinedly. This is a practical solution for building capital over the long term, without the need to worry about market timing.

Continuous optimization and the role of market views

The work doesn’t stop at setting up the portfolio. Unlike a purely passive approach, Alpian regularly adjusts its investment strategies based on economic and financial conditions. Financial markets are constantly evolving. Some asset classes are more attractive at a given time, while others become riskier or less profitable. The market views produced by Alpian allow for adapting asset allocations according to these changes.

During periods of high inflation, long-term bonds may become less attractive, while more targeted investments in high-growth stocks or commodities may be preferable.

How does Alpian apply these market views?

Alpian continuously analyzes several macroeconomic and financial indicators. Based on this, the team can overweight or underweight certain asset classes to optimize profitability:

Overweighting = if an asset class seems particularly promising, Alpian can increase its weight in the portfolio.

Underweighting = conversely, if a sector becomes too risky or unattractive, it can be reduced in the allocation.

Image: heyneo.ch, market views are used to dynamically rebalance portfolios.

What this changes in practice:

Alpian adjusts its positions according to market conditions while remaining within a structured management. Conversely, Selma applies a totally passive management with automatic rebalancing, without taking into account economic cycles.

Alpian Promo Code

Free account ✔︎

Comparison with a robo-advisor like Selma

These are two opposing philosophies: active management vs. total automation

| Criterion | Alpian | Selma |

| Type of management | Depending on mandate: delegated with dynamic model + advisors | 100% automated |

| Personalization | Highly advanced (choice of sectors, sustainability, etc.) | Standardized |

| Adjustments | Market views applied to optimize returns | Simple automatic rebalancing |

| Support | Human advisors accessible | None, everything is managed by algorithm |

| Fees | between 0.50% and 0.75% + ETF costs (approx. 1% total) | 0.47% + ETF costs (approx. 0.72% total) |

Alpian vs Selma, which option for which profile?

Alpian is a better option for:

✔︎ Investors seeking a more personalized and dynamic approach.

✔︎ Those who want to benefit from human guidance and financial advice.

✔︎ People who want to have an influence on the investment strategy (choice of sectors, sustainability, etc.).

Selma is more suitable for:

✔︎ Those who want a fully automated solution with lower fees.

✔︎ Long-term investors looking for simple and passive management.

✔︎ Those who want to minimize their involvement and fully delegate management.

The difference between the two:

Alpian stands out with a semi-active approach, which incorporates an advanced personalization model and strategic adjustments to optimize portfolios based on market conditions. On the other hand, Selma remains a simpler and more economical alternative, ideal for those seeking 100% passive management.

Security and regulation: what are Alpian’s real guarantees?

Alpian is a Swiss digital private bank. Unlike fintech companies that operate without banking status, it has its own banking license issued by FINMA.

Swiss banking license and FINMA supervision

- Alpian is subject to the same regulatory requirements as traditional banks in terms of solvency, risk management, and transparency.

- The institution must comply with strict capital and liquidity ratios, ensuring its financial strength.

Unlike trading platforms or robo-advisors operating with more flexible statuses, Alpian is a full-fledged bank.

Deposit protection guarantee

Cash deposits with Alpian are covered up to 100,000 CHF thanks to the Swiss deposit protection mechanism.

Note:

- This protection applies only to deposits in CHF.

- Investments (ETFs, bonds, stocks) are not covered by this guarantee, as they are registered in the client’s name and belong to the clients.

Where are investment assets stored?

- Unlike banks that store securities with SIX (the Swiss central securities depository), Alpian uses Interactive Brokers, a trusted custody platform based outside of Switzerland.

- In case of any issues with Alpian, the securities remain the property of the client and can be transferred to another institution.

Alpian compared to the competition in Switzerland

Compared to Alpian, platforms like Neon Invest, Yuh Invest, Swissquote and Selma offer various investment solutions, with models ranging from self-management to automated robo-advisors. So, how does Alpian compare?

| Criteria | Alpian | Neon Invest | Yuh Invest | Swissquote | Selma |

| Management fees | between 0.50% and 0.75% | 0.5% / order | 0.5% / order | 1-1,5 % | 0,47 % |

| Minimum investment | 2,000 CHF | 1 CHF | 25 CHF | 1,000 CHF | 2,000 CHF |

| Personalized management | ✔︎ | ✘ | ✘ | ✘ | ✔︎ |

| Wide range of assets | ✘ (ETFs only) | ✔︎ | ✔︎ | ✔︎ | ✘ |

| Investment deposits | Interactive Brokers (outside Switzerland) | Switzerland | Switzerland | Switzerland | Interactive Brokers (outside Switzerland) |

What we can conclude:

- Alpian and Selma are the only solutions offering automated management. However, Alpian adds human support, unlike Selma, which is 100% automated.

- Neon Invest, Yuh Invest, and Swissquote allow investing in a wider range of assets, while Alpian is limited to ETFs.

- Alpian and Selma store invested assets via Interactive Brokers, outside of Switzerland, while Neon, Yuh, and Swissquote keep securities in Switzerland.

What Type of Investor is Alpian for?

Each platform caters to specific needs.

Alpian is suitable for:

✔︎ Investors seeking human support and semi-active management.

✔︎ Those who want to delegate management while maintaining some strategic flexibility.

✔︎ People who prefer a structured framework rather than choosing their investments themselves.

Alpian is not ideal for:

✘ Those who want to actively invest in stocks, bonds, or cryptocurrencies.

✘ Investors concerned with minimizing fees at all costs.

✘ Those who want their invested assets to be kept in Switzerland.

Alpian Promo Code

Free account ✔︎

Quick comparison with competitors in Switzerland:

- Neon Invest and Yuh Invest → Ideal for self-directed investors who want to choose their assets and manage their own purchases and sales at reduced costs.

- Swissquote → Comprehensive solution for experienced traders, with a wide range of assets and advanced tools, but at higher costs.

- Selma → Suitable for those who want passive management with a robo-advisor, without human intervention and with lower fees than Alpian.

Image: heyneo.ch, degree of personalization of investment platforms competing with Alpian

Conclusion: Is Alpian right for you?

Investing is not just about returns or fees. It’s also about method and trust in the tool you use. With Alpian, you delegate part of the work while maintaining influence over the investment strategy.

This positioning between self-management and expert guidance makes sense for those who want personalized follow-up without having to manage each transaction themselves. But it all depends on how you perceive your investment.

When is Alpian the right choice?

If you prefer structured management with human support, Alpian offers an alternative to impersonal robo-advisors, Alpian ticks many boxes. You’ll find structured and adaptable management, human support, and strategies adjusted according to the market.

From 10,000 CHF, Alpian allows access to more flexibility in portfolio management, with automated diversification.

What you need to know or consider if you’re hesitating:

Alpian is not necessarily designed for everyone. You can’t buy individual stocks, invest in cryptocurrencies, or directly invest in other asset classes. Everything is based on ETF portfolios selected by the algorithm and adjusted by Alpian’s finance specialists.

The annual fees cover the entire service, but remain higher than those of a robo-advisor like Selma (0.47%), or a broker like Neon Invest and Yuh, where costs are solely related to executed orders. Solutions like True Wealth offer more flexible automated management, but without the human guidance that Alpian offers.

Finally, there’s the question of storing invested assets. Unlike Swissquote or Neon Invest, Alpian keeps securities with Interactive Brokers (outside Switzerland). Is this a real problem? Not at all, but it’s a difference to consider if you absolutely want your securities to remain deposited locally.

The decision is yours:

Alpian stands out if you want to delegate intelligently or be guided (Guided by Alpian). In management mandates, the investment is piloted by experts, but you retain a degree of control through adjusting your allocation or risk level. It’s a good balance between human guidance and autonomy, without going through a classic private bank.

Conversely, if you prefer to manage your orders yourself, freely choose your securities, and minimize fees as much as possible, solutions like Neon, Yuh, or Swissquote will be more suitable.

Alpian Promo Code

Free account ✔︎

Also read

- Complete Review and Opinion on Managed by Alpian Essentials

- Review of Guided by Alpian

- Complete Review and Opinion on Managed by Alpian

- Review and Test of Yuh Investment Trading

- Review and test of Neon Investment Trading

- Review and Test of Selma, the Investment Platform

What do you think of Alpian for your investments?

- Has the Alpian app. made your investments easier?

- What feature would you like to customize or improve?

- How did you use the consulting services offered by Alpian?

- Have you ever tested your Alpian advisor’s knowledge with trick questions?

Share your feedback with all Neo’s friends 😈

Additional information

Specification: Investing with Alpian – Review and Full Analysis (December 2025), get 75 + 125 CHF

| Security | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ||||||||||||||

| Investment | ||||||||||||||

| ||||||||||||||

| For who? | ||||||||||||||

| ||||||||||||||

| Accessibility | ||||||||||||||

| ||||||||||||||

There are no reviews yet.