CSX Bank – Review, Test and Complete Overview (December 2025) + Receive 25 CHF

| Offering | 9.1 |

|---|---|

| Security | 10 |

| Opening an account | 6.5 |

| Bank card | 8.5 |

| Features | 8.3 |

| Interest rates | 0 |

| Transfer speed | 8.2 |

| TWINT | 10 |

| Fees | 8 |

| Abroad | 5.5 |

| Cash deposit | 9.5 |

| Customer service | 6.5 |

Review of CSX: The Most Comprehensive Swiss Neo-Bank. We have evaluated the CSX application in daily life. Advantages… drawbacks… coverage of banking services… fees… features… things to know and shortcomings… This complete review scrutinizes all criteria. Use the promo code JD8615 when opening your account to receive 25 CHF in your account.

Description

Summary of the CSX bank offer

CSX is Credit Suisse’s neo-banking app launched in 2020. It leverages Credit Suisse’s national footprint, recently acquired by UBS, to attract younger customers looking for a basic banking account.

CSX White – the account and the card 💳

0 CHF/month

CSX Black – the premium offer

For young people, there’s CSX Young (Basic) for ages 12 to 25, with a free Black card.

Is CSX a bank? Is CSX bank safe?

CSX is an online account offering developed by Credit Suisse.

- Services provided by Banque Crédit Suisse Group AG in Zurich, authorized by FINMA.

- Swiss deposit protection insurance up to CHF 100,000 in the event of bankruptcy.

- The data is stored in Switzerland.

Promo Code

Free account ✔︎

Open a CSX account – Receive 25 CHF

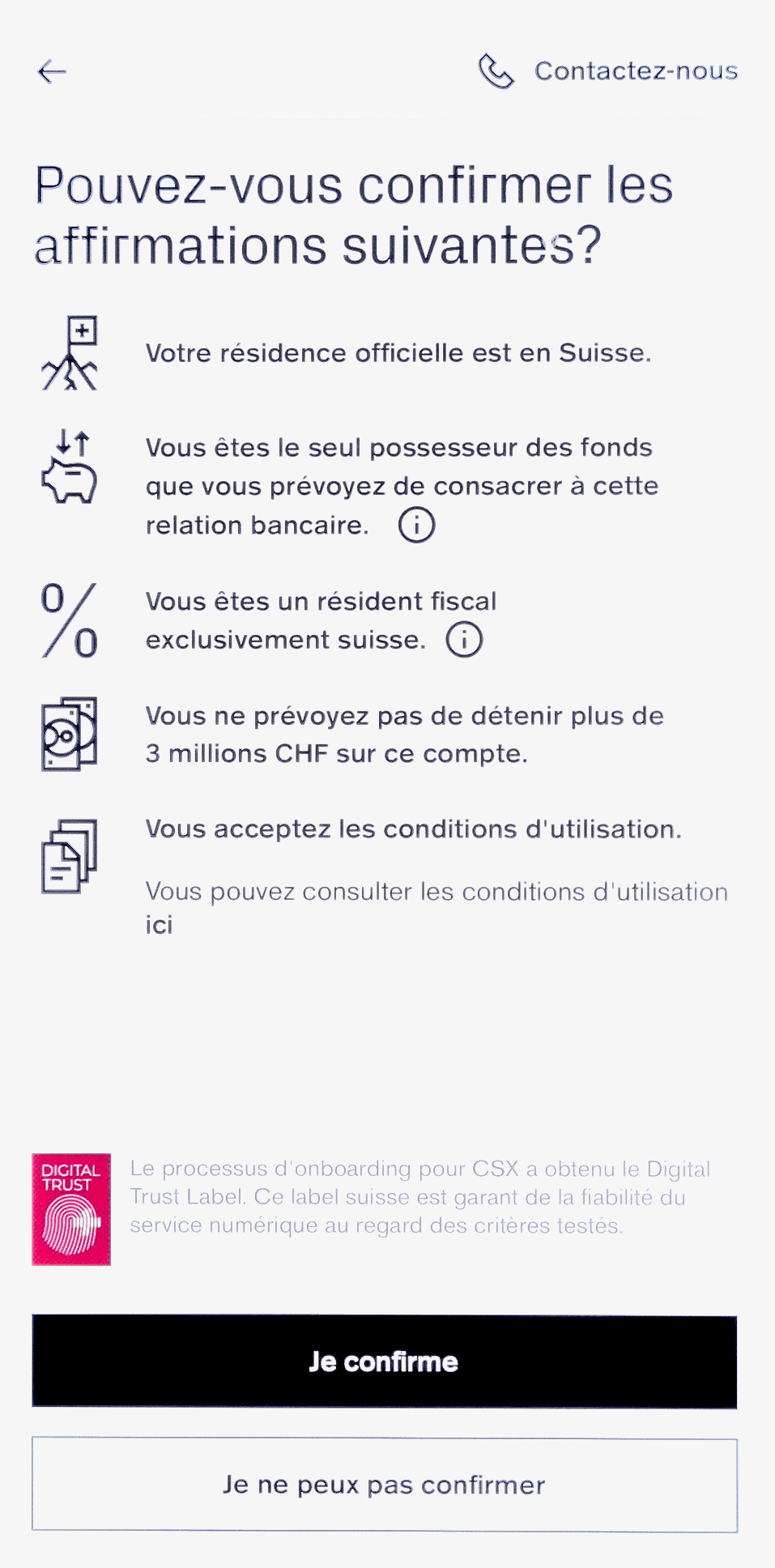

CSX is available in French, German and Italian. The 3 conditions for opening an account are :

- Be at least 12 years old (YUH 18 years, Neon 16 years, CSX 12 years)

- Reside in Switzerland (residence permit for foreigners, but not accessible to cross-border workers and non-residents)

- Have an iOS or Android smartphone

Step-by-step guide to opening a CSX account

Download the YUH app

on the App Store / Google Play Store

Create a new account

Select CSX “Starting from 0 CHF”

Confirm your country of residence

Indicate whether or not you are a US citizen.

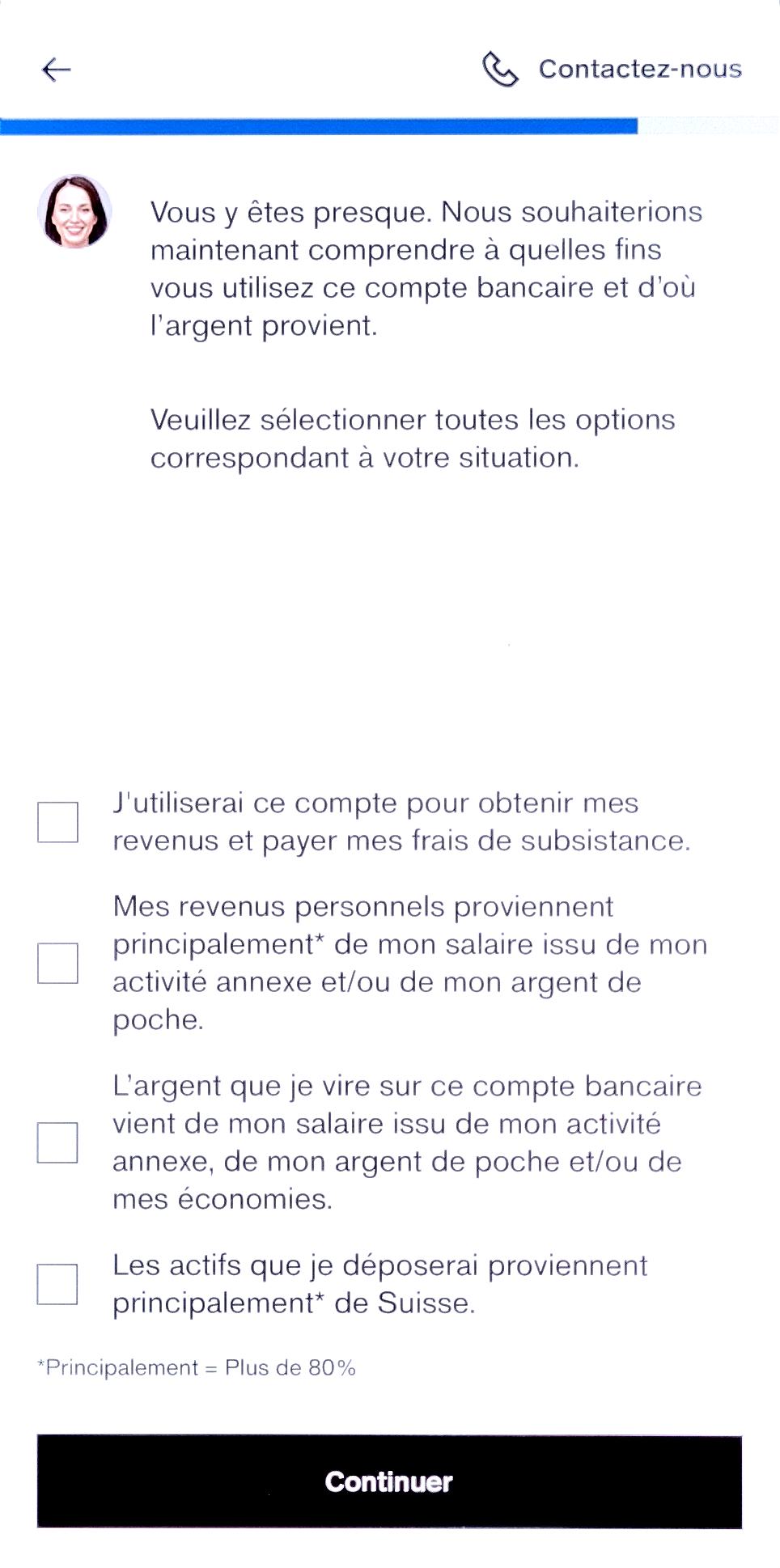

CSX requires several additional pieces of information: continue.

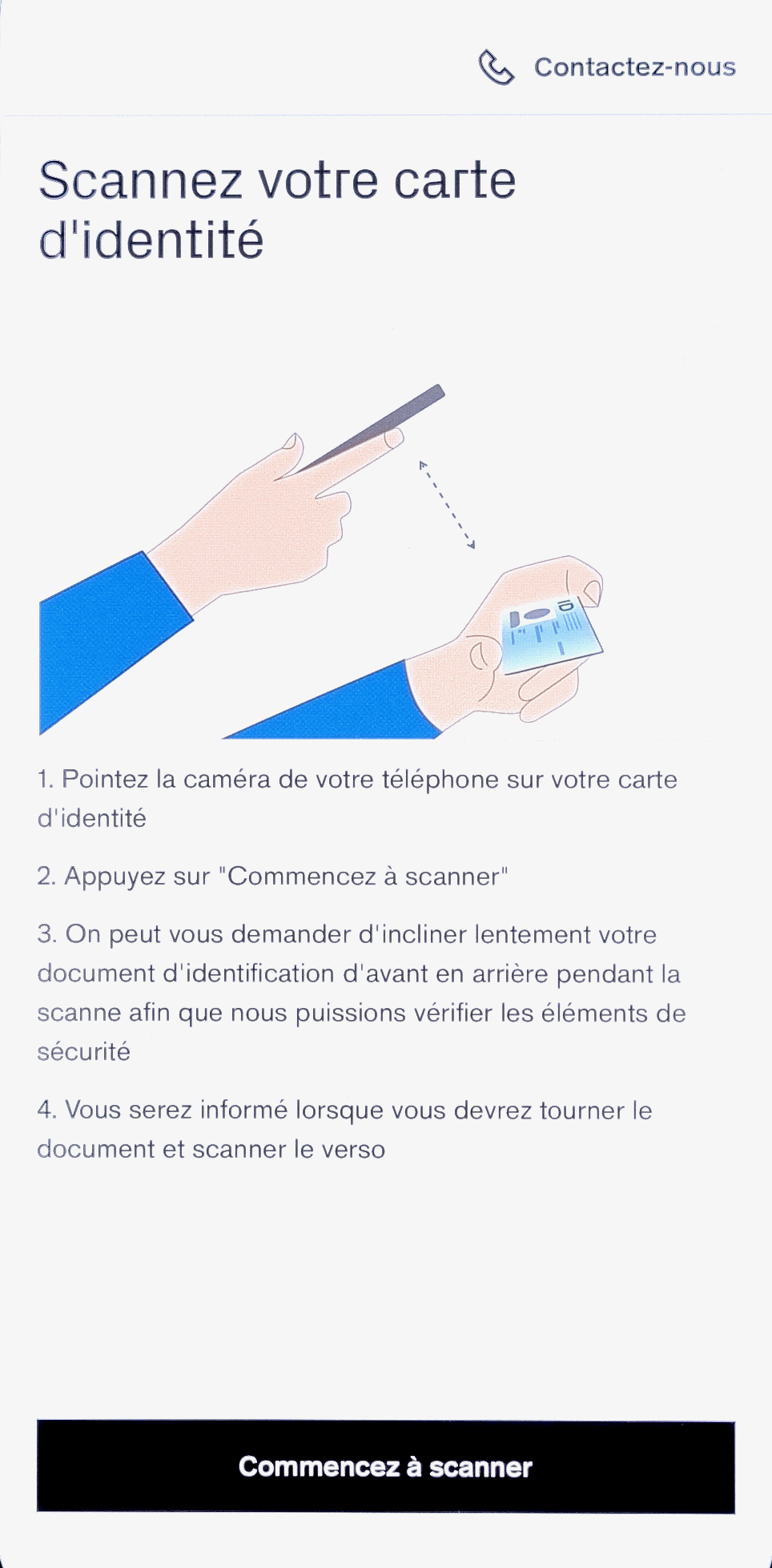

Verify your identity

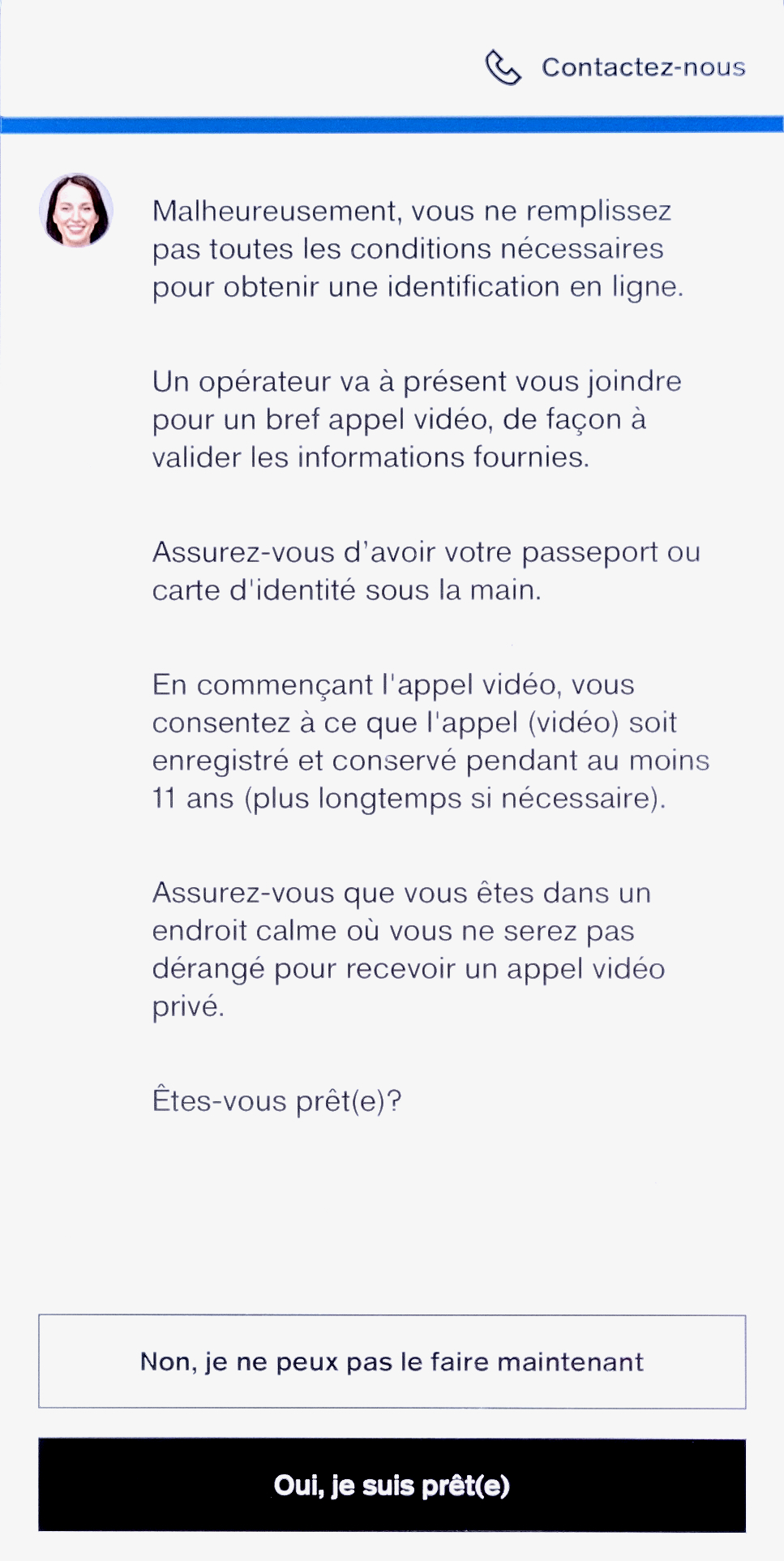

Is your document not recognized? No worries. The CSX app guides you through another identity verification process with a video call application. Everything is very easy:

This adds a good 5 minutes to the registration process.

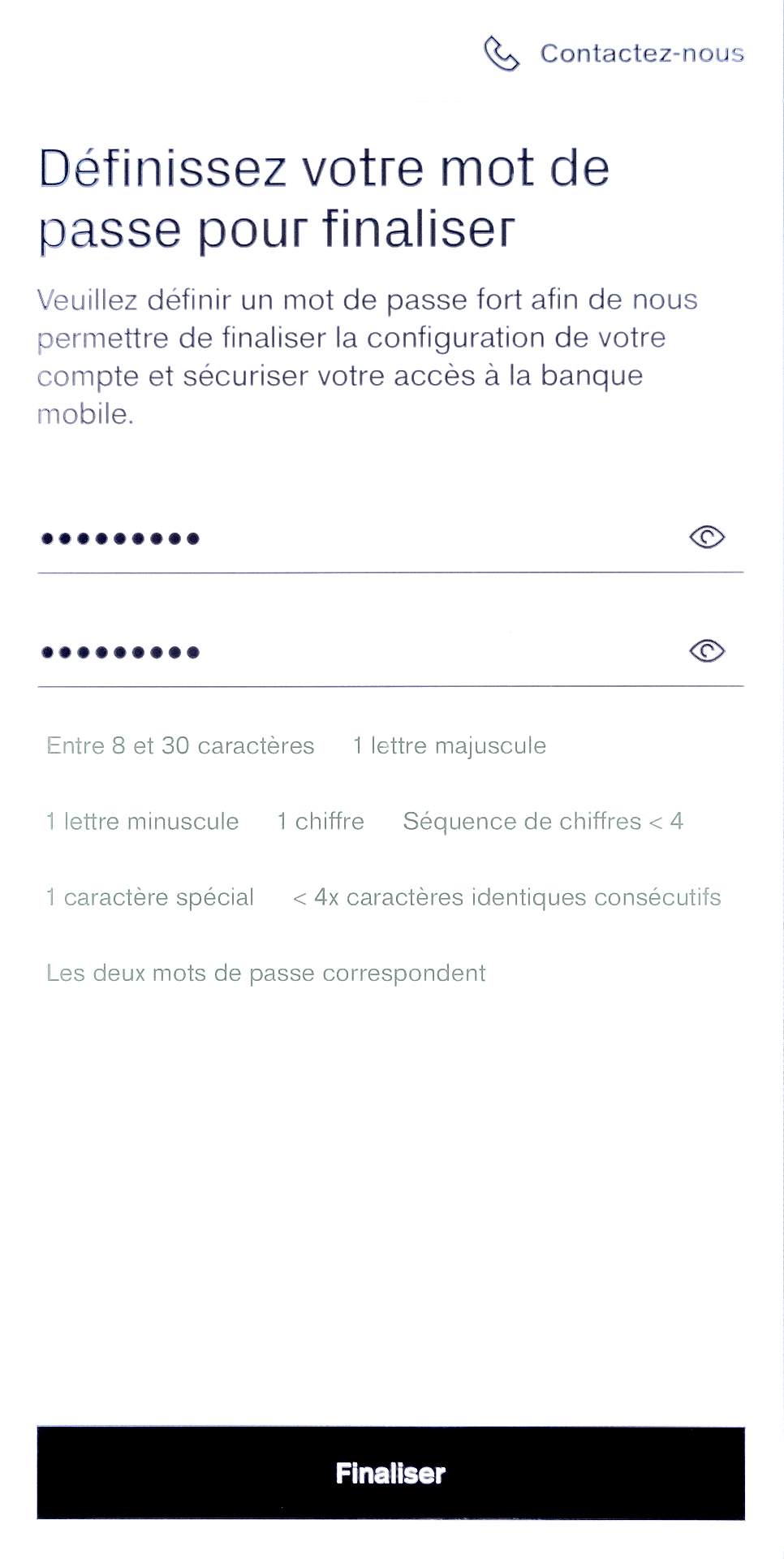

Choose a password

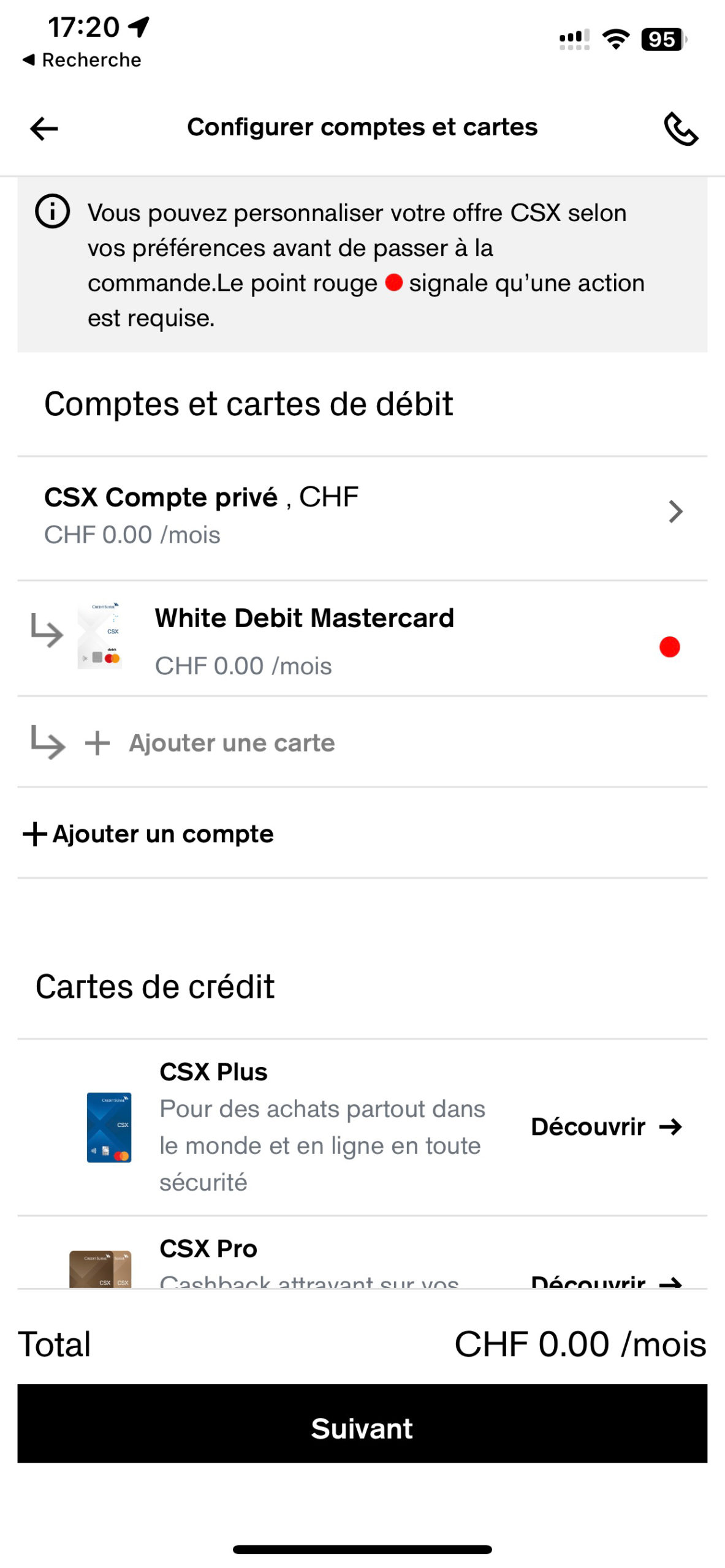

Select your CSX offer

CSX White is the completely free option. Choose and configure:

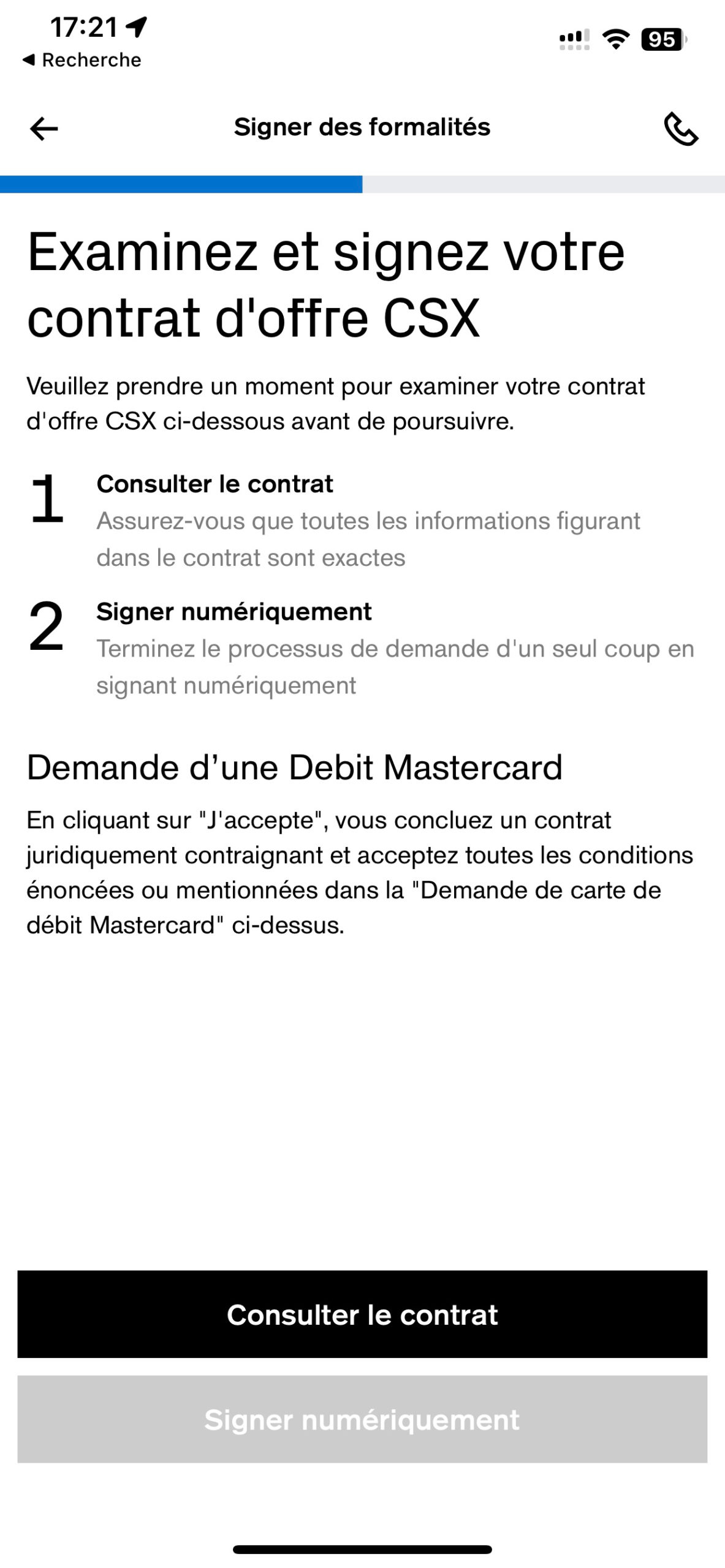

Validate your contract

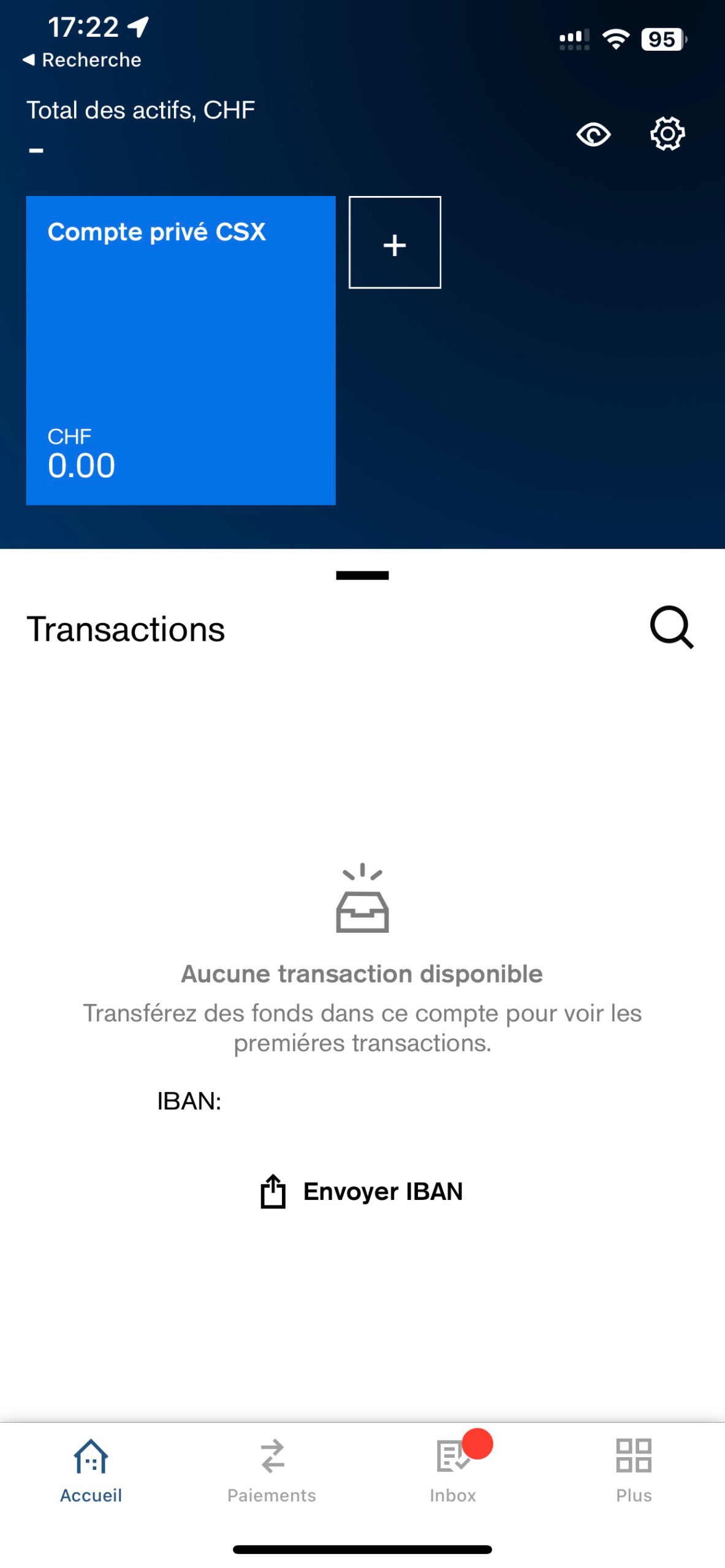

Now your CSX application is available. You will receive your card within a few days. Last step: receive your money using our code.

Receive your money with the promo code 👇

Enter our code JD4990 to receive your money directly into your account.

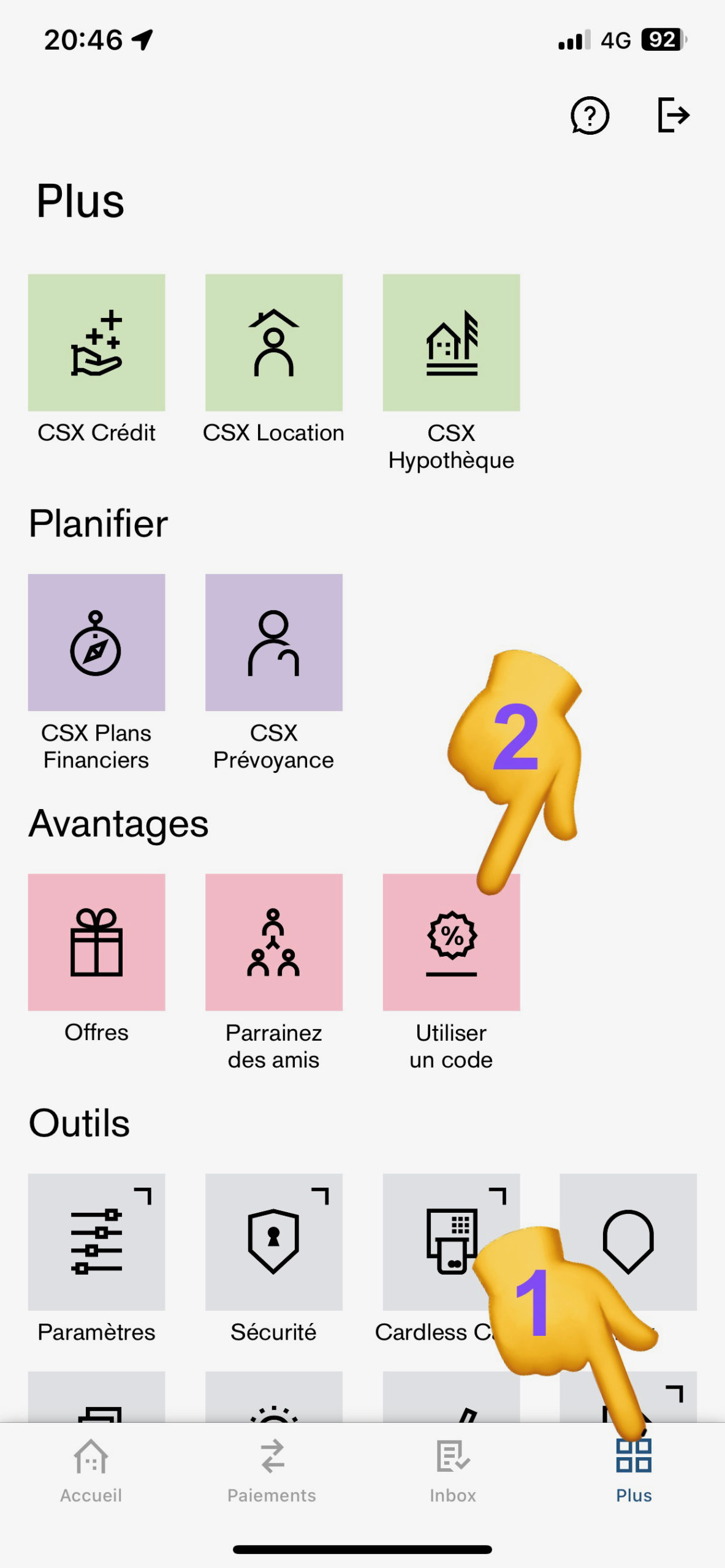

Go to the CSX app, tab “More” then “Benefits” and “Use a code”:

Your account will be credited within a few days.

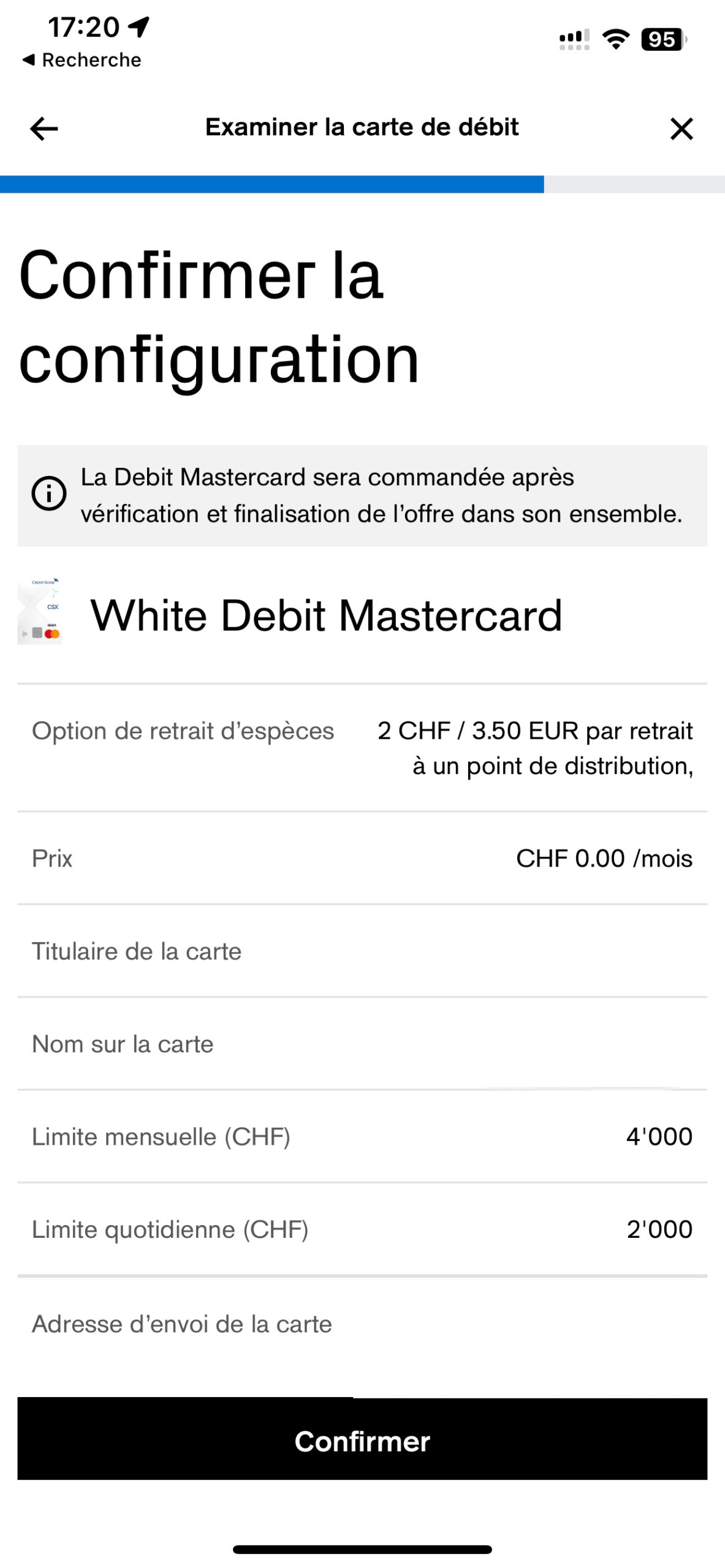

Voir plus +The CSX bank card

La carte bancaire CSX White (gratuite) :

💳 Mastercard CSX White at a glance :

- Code-free contactless payment up to CHF 80/purchase. Beyond that, the code is required.

- Works with Apple Pay / Google Pay / Samsung Pay / SwatchPAY! / Garmin Pay / Fitbit Pay

- Payments are immediately visible in the application.

You can temporarily block your card from the app, and deactivate or activate contactless, but you have to go to the ATM to change the PIN code.

Cash withdrawal limit: default is 2,000/day and max. 4,000/month, modifiable via the application (up to 15K).

Can I rent a car?

CSX Application: Features

CSX allows you to do everything in Switzerland:

- Monitoring account movements

- eBill and standing orders

- Scanning Swiss invoices

- QR invoice payment

- Turn a QR invoice into a standing order?

- Mastercard limit management

- Changes to service packages

- IBAN personalization (CHF 2.-)

- Contact details management

The features it lacks :

✘ A dark mode, which is so popular nowadays.

✘ Generation of virtual cards like at Revolut or N26.

✘ Creating sub-accounts in other currencies (not for free).

✘ “Income/Expense” statistics and the ability to distinguish withdrawals from payments in transactions.

✘ Buying and selling cryptocurrencies. It’s a shame because there is demand. Do CSX’s banking roots prevent it from taking the plunge into offering cryptocurrency acquisition? Without a doubt.

Promo Code

Free account ✔︎

Interest rates offered by the CSX account

CSX offers up to 3 free savings accounts with paying offers only (interest rate of 1.5% up to CHF 250,000, 0.50% up to CHF 500,000 and 0.30%).

Speed of transfers with CSX – sending money

● An IBAN transfer from Switzerland to Switzerland made before noon arrives the same day. If it’s done in the afternoon, it arrives the next day.

● A transfer abroad takes from a few minutes to a maximum of 24 hours.

CSX Twint – pay with TWINT everywhere in Switzerland

TWINT, Switzerland’s No. 1 payment app, allows you to :

- Pay in stores

- Transfer money between friends

- Share a bill within a group (restaurant, outings, etc.)

- Pay parking meters

- Pay online and in train stations

To use TWINT at CSX, you need to download the Credit Suisse TWINT app for iOS or Android.

Promo Code

Free account ✔︎

CSX Bank fees: card, exchange, transfers, cash withdrawals, etc.

● Free bank account

● Free CH IBAN

● Customizable IBAN CHF 2

● Free Mastercard Debit

● Replacement card CHF 20.

● 💳 Card payments without transaction fees.

● Exchange fees (Credit Suisse exchange rate, less advantageous).

Money transfers in Switzerland 🇨🇭 ➔ 🇨🇭

● IBAN transfers in CHF and EUR are free of charge.

If it’s in another currency, there’s a conversion at the “Credit Suisse rate” of the day, less advantageous than Neon, Revolut or Yuh.

International transfers 🇨🇭 ➔ 🌍

All SEPA transfers in EUR are free within the European Union

➔ You have to be careful to feel good in SEPA when making a transfer so that the system recognizes it.

Transfers in other currencies cost CHF 5 on top of the “exchange rate of the day”.

Outside SEPA: the most advantageous to avoid additional fees is to choose “at our expense”. It’s a flat rate to avoid surprises from intermediary bank charges. If we opt for shared fees, we don’t know in the end how much we will pay.

Cash withdrawals in Switzerland 🇨🇭

At Credit Suisse ATMs

● CSX White (0.00 CHF/month) :

2 CHF/withdrawal at all Swiss ATMs including Credit Suisse (EUR 3.50)

● CSX Black (3.95 CHF/month) :

Free CHF and EUR at Credit Suisse and UBS ATMs (otherwise CHF 2/withdrawal).

(EUR 3.50 = if withdrawn at other ATMs)

● CSX Black (CHF 7.00/month) :

Withdrawals in EUR are free of charge at all ATMs in Switzerland.

➔ This is the best offer with unlimited withdrawals on the market.

Cash withdrawals abroad 🌍

ATMs (classic cash dispensers)

CHF 4.75/withdrawal + 0.25% of amount

Should you choose CSX White or CSX Black?

On the one hand, CSX Black for withdrawals anywhere in Switzerland already costs CHF 7/month.

On the other hand, with CSX White, all withdrawals have to be paid for.

It’s all or nothing. Is it worth it?

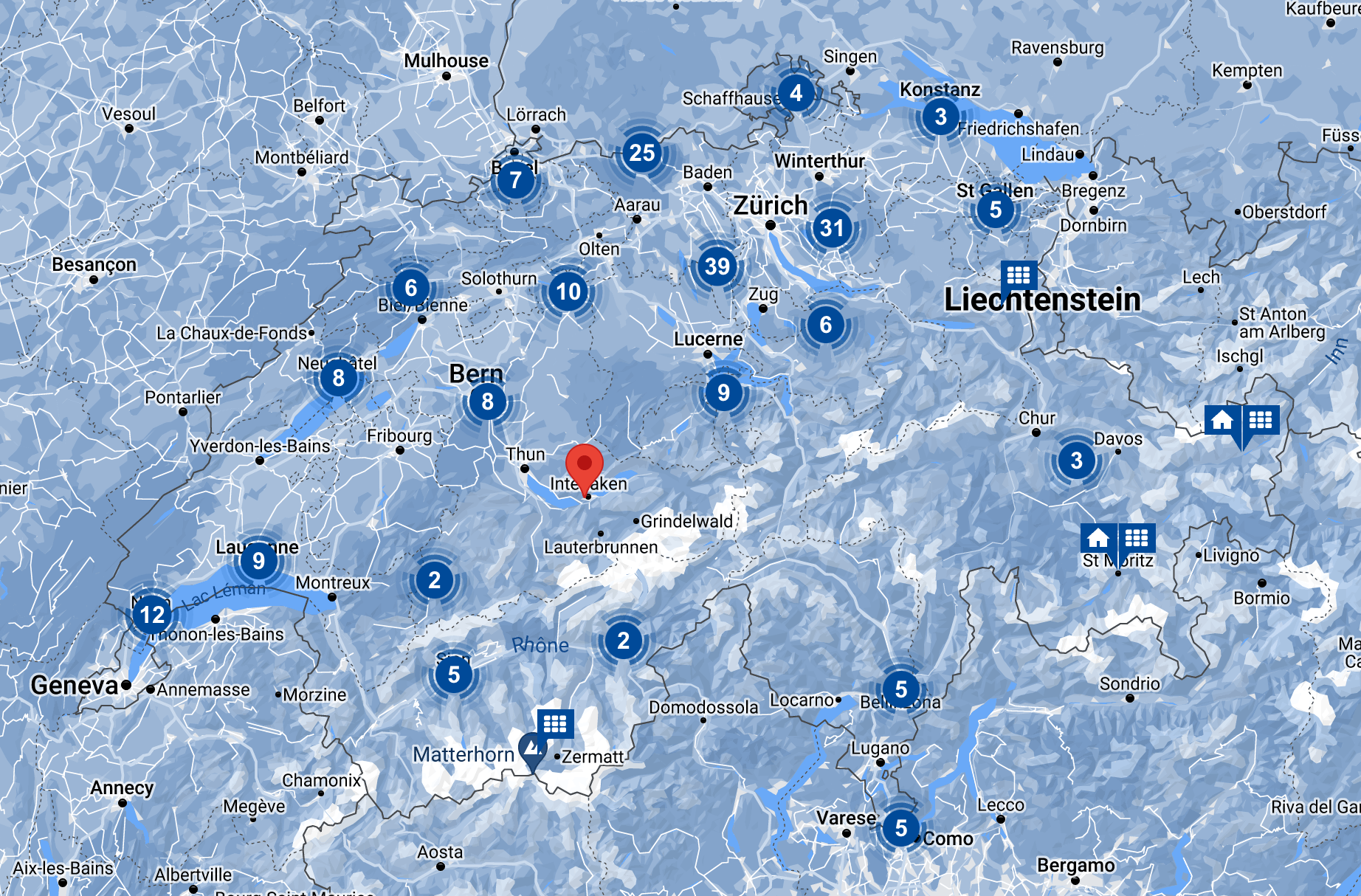

🦦 The good news: since the takeover of Crédit Suisse by UBS, users of CSX Black at CHF 3.95 can now withdraw cash from Crédit Suisse and UBS ATMs!

Given the territorial coverage 🇨🇭 coverage, it’s reasonable to assume that you won’t need to pay CSX Black at CHF 7/month.

✔︎ The sum total of all vending machines should more than cover your needs:

Promo Code

Free account ✔︎

CSX while traveling and abroad

CSX is not the bank to travel with:

● Withdrawals are expensive.

● The Credit Suisse exchange rate is higher than elsewhere (at Neon or Yuh for example).

● The application does not offer sub-accounts to organize budgets like at Zak or Neon.

Depositing cash into the CSX account

Cash deposits are possible free of charge at Credit Suisse ATMs.

CSX customer service

● Accessibility: by telephone 🤳 Monday to Friday, 8:00 am to 6:00 pm. Response time is fast.

✘ Support is not reachable from the app. : no form, nothing.

● Reported experience: satisfactory, but the legacy of traditional banking is striking at every level.

Even in the age of neo-banking, advisors systematically refer to their “Factsheet.pdf” to explain the plethora of CSX services. Offering a lot of services is all very well, but referring to a .PDF in a fundamentally mobile bank is missing the point.

Despite our precise and clearly delineated questions, at every interaction the advisors took unsolicited detours to “tell” us about paid offers. Quite a change from the relaxed atmosphere of Neon or Yuh.

✔︎ In spite of this, we’ve always had precise answers to all our questions, even the ones we never asked.

CSX bank cashback

CSX offers cashback only with its credit card offers, not with the debit cards that go with CSX White and CSX Black.

Good reasons to open an account with CSX Bank

CSX offers all the advantages of an established bank. Why benefits? Because users can take advantage of Credit Suisse banking services at any time. They can add different types of accounts, credit cards and more. No other neo-bank is able to offer the same range of banking services.

The accessibility of physical branches is an asset that is hard to compete with.

The CSX online account is one of the most serious options in Switzerland for choosing your first bank. Firstly, the app provides all the basic essentials: a CH IBAN and Swiss QR bill payment and eBill. Secondly, it is able to provide “à la carte” services to keep pace with users’ changing needs.

✔︎ Receive CHF 25 with our code JD8615 when you open your account. 👍

✔︎ As it’s entirely free, you can open an additional account with another app. to enjoy the benefits of each and compare banks in practice 👍.

Quick comparison between CSX, Neon, and Zak ⚡️

CSX vs. Neon vs. Zak

Promo Code

Free account ✔︎

Additional information

Specification: CSX Bank – Review, Test and Complete Overview (December 2025) + Receive 25 CHF

| Online banking | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ||||||||||||||||

| Bank card | ||||||||||||||||

| ||||||||||||||||

| For who? | ||||||||||||||||

| ||||||||||||||||

| Mobile payments | ||||||||||||||||

| ||||||||||||||||

There are no reviews yet.