N26 Switzerland – Review, Test, and Comprehensive Overview (December 2025) + get 20 EUR

| Offering | 9 |

|---|---|

| Security | 8.5 |

| Opening an account | 10 |

| Bank card | 8.2 |

| Features | 9.2 |

| Interest rates | 3 |

| Transfer speed | 9 |

| TWINT | 0 |

| Fees | 6.9 |

| Abroad | 8.5 |

| Cash deposit | 0 |

| Customer service | 8.5 |

Fill up on features. We explored N26 in real-life conditions. Strengths… weaknesses… banking offers… prices… features… pros and cons… This detailed guide will help you compare quickly. Use the referral code julienbd1769 when you open your account to get 20 EUR. Happy reading!

Description

[Update – July 23, 2025: Introducing the N26 eSIM offer]

Summary of the N26 Switzerland offer

A pure player in neo-banking: N26 has been creating the market since 2013. It now has over 8 million users and is also available in Switzerland.

N26 Standard – account and card 💳

free

N26 Smart – the premium offer

CHF 4.90/month

- The physical Mastercard

- Piggy bank” sub-accounts called Spaces

- Shared spaces

- Features for easy savings

Both plans allow you to open a joint account with IBAN, ideal for managing shared expenses (rent, bills, etc.). You can set up recurring payments and link it to an N26 card to pay with shared funds.

Security: is N26 Safe?

- Services are provided by N26 Bank AG based in Berlin. It is not a Swiss bank and is therefore not licensed by FINMA. However, it holds a European banking license.

- German deposit protection insurance up to EUR 100,000 in the event of bankruptcy.

- The crypto part is provided by Bitpanda Asset Management GmbH

- Enhanced security with two-factor authentication (2FA) and real-time notifications

Promo Code

Free account ✔︎

Open a N26 Switzerland account EUR 20 free

N26 is available in English, German, French, Italian, Spanish.

Requirements to open an account:

– Be at least 18 years old (YUH 18 years, Neon 16 years, ZAK 15 years, CSX 12 years).

– Reside in Switzerland, or in one of the countries covered by N26.

– Have a smartphone.

– Your Tax Identification Number (TIN) for the crypto part.

– No proof of income or initial deposit required.

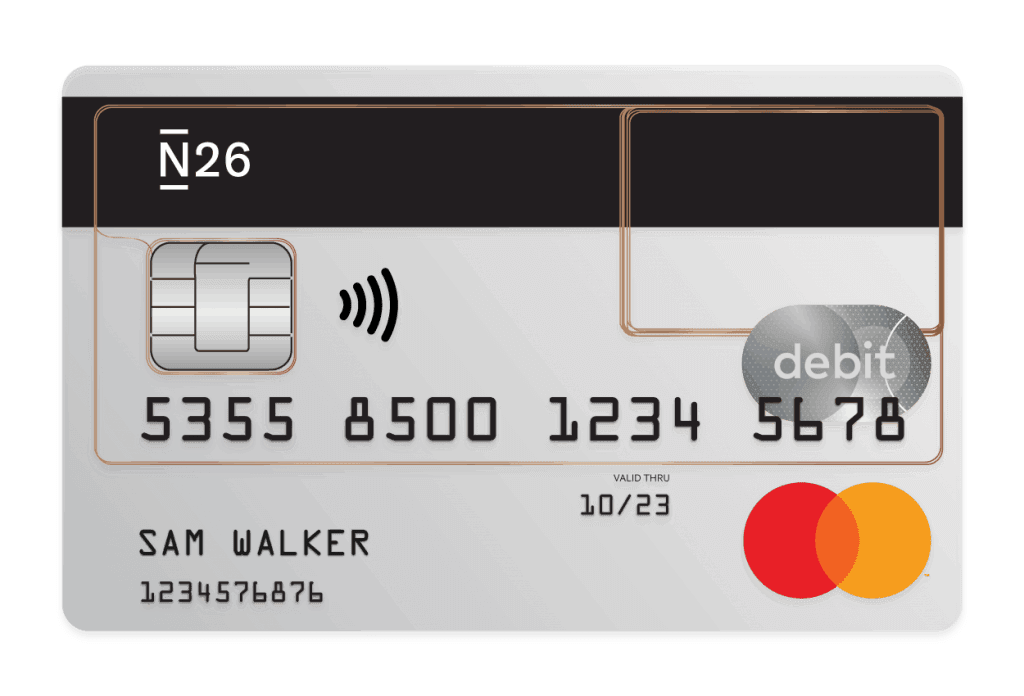

N26 Switzerland bank card

The transparent bank card from N26 Standard :

The 5-colour N26 Smart card:

💳 The N26 Debit Mastercard at a glance :

- Contactless payment is code-free up to EUR 150. Beyond that, a PIN code is required.

- Monthly withdrawal limit: EUR 20,000

- Daily withdrawal limit: 2,500 EUR

- Replacing the card costs 10 EUR

Virtual card generation

As with Revolut, N26 offers the possibility of creating virtual bank cards.

To create a new virtual map, go to the Maps tab in the “Get an additional map” application, then “Virtual”.

Can I rent a car?

N26 application: features

In Standard the app. N26 is basic

- Monitoring account movements

- Transfers

- Standing orders

- View expenses by category

- Push notifications

- Instant MoneyBeam payments (between N26 users)

- Personal data management

- Chat support

- Dark mode

Card management

- Temporarily block the card from the application

- Suspend card

- Change map limits

- Change PIN code

- Activate/deactivate contactless payments, ATM withdrawals, foreign payments

Smart (premium)

- Creation of “Spaces” sub-accounts

- Locking spaces

- Shared areas for N26 users

- Associate Mastercard with a space (can be modified)

- Recurring transfers between current account and Espaces

- Round up to the next euro to save without realizing it (“gas pedal” up to 5X)

Buying and selling Crypto (200)

- Algorand, Avalanche, Bitcoin, Cardano, Chainlink, Cosmos, Ethereum, Polkadot, Polygon, Solana, Stellar, Tezos …

The features it lacks

- no eBill

- no invoice scanning

- no TWINT

- No CHF account or multi-currency card

Promo Code

Free account ✔︎

Interest rates offered by the N26 account

0%: Standard and Smart accounts offer no interest, even when funds are held in “Spaces”.

Transfer speed with N26 – send money

● Instant money transfers with MoneyBeam (between N26 users)

● A SEPA transfer / IBAN is instant within the SEPA zone even on weekends.

● A transfer in a currency other than EUR passes through the Wise payment infrastructure. Payments are made almost instantly (as in the case of an N26 transfer in EUR to another Swiss account in CHF) and in less than a day anywhere in the world.

● One exception: a transfer in EUR to a EUR account in a Swiss bank takes one to two working days.

N26 Twint – pay with TWINT anywhere in Switzerland

N26 does not support TWINT payments. The only fast payment option is the MoneyBeam system (only between N26 users). It’s unfortunate because TWINT remains by far the #1 payment app in Switzerland that allows you to:

– Pay in stores.

– Transfer money between friends.

– Split a bill within a group (restaurant, outings, etc.).

– Pay for parking meters.

– Pay online and at train stations.

Promo Code

Free account ✔︎

N26 Bank charges: card, foreign exchange, transfers, cash withdrawals, etc.

● Free bank account

● Free German IBAN (DE)

● Free virtual card Mastercard Debit

● Optional physical card for 10 EUR

● 💳 Card payments without transaction fees.

● Exchange fees without Mastercard reference rate mark-up.

MoneyBeam: instant money transfer

MoneyBeam is a service developed by N26 that allows free and instant transfers from one N26 account to another N26 account.

Transfers to Switzerland 🇪🇺 ➔ 🇨🇭

Free SEPA transfers are an advantage if you frequently make transactions in EUR. Since N26 only offers accounts in EUR, payments in CHF are not possible, a point to consider for your operations in Switzerland.

International transfers 🇪🇺 ➔ 🌍

WISE (TransferWise) operates these transfers for currencies other than EUR.

This solution is generally faster, less expensive, and more transparent. Everything is directly integrated into the app:

- Advantageous fees between 0.5 and 1.5% in more than 18 currencies

- Transfers that can be completed in minutes on the other side of the world

Everything is transparent. The application gives an overview of the exchange rate and fees charged before validating a transfer.

Unlike NEON, N26 does not add a 0.40% convenience fee for integrating WISE into the app.

SEPA transfers: you can use this system free of charge for Smart accounts, and for a fee of 0.99 EUR for Standard accounts.

No WISE account? No problem at all. The procedure is integrated:

- Initiate a transfer in a foreign currency (other than EUR), then enter your N26 account e-mail address and click on “forgot password”.

- You receive a WISE e-mail to set a password.

- Return to the N26 application and use this password. That’s it.

Cash withdrawals in Switzerland 🇨🇭

- Standard: in EUR free 3x/month then 2 EUR/withdrawal

- Smart: in EUR free 5x/month then 2 EUR/withdrawal

- In CHF and other currencies at an exchange rate of 1.7%.

Cash withdrawals in Europe and worldwide 🇨🇭🌍

- In EUR within the euro zone free of charge 3x/month then 2 EUR/withdrawal

- In CHF and other currencies at an exchange rate of 1.7%.

Crypto-currencies

- 1.5% fee for Bitcoin (BTC)

- 2.5% fee for most altcoins

- N26 Metal allows for reducing these fees, but is not available in Switzerland

Lower crypto fees: the N26 Metal offer does lower crypto fees, but it’s not available in Switzerland. YUH Banque is a good alternative with a simple and effective crypto buy-sell offer for 1% commission.

N26 on the move and abroad

When it comes to travel, N26 really does its users a favor. To recap.

For travel, N26 Standard offers :

- A EUR account

- Free transactions

- Free Mastercard exchange rate.

With N26 Smart you can :

- Create a space dedicated to travel.

- Set aside a regular amount to build up your budget.

- Round up to the nearest euro when making purchases Save money in the Dedicated Area.

- Link Mastercard Debit to the chosen Espace.

- Lock other Spaces so you don’t exceed your budget during your trip.

N26 eSIM: A Practical Solution for Travelers

N26 integrates an eSIM service into its app: you can buy data plans for 100+ countries, without changing SIM cards or going through an operator.

Useful when landing without network coverage or to avoid roaming charges. The N26 eSIM does not provide a local number, but allows you to stay connected temporarily, directly from the app.

Convenient for short stays, but not always the most economical solution depending on the country.

Promo Code

Free account ✔︎

Cash deposit on N26 account

N26 users cannot deposit cash into their account. The only options available to fund the account are :

- standard bank transfers

- deposits via Apple Pay or Google Pay

- credit card payment

- transfers between N26 users

N26 customer service

● Accessibility: by chat integrated into the 🤳 application every day from 07:00 to 23:00. Response time is extremely fast.

The chatbot is simply useless.

It must be said that the N26 documentation (and research) is very well done. Unfortunately for Swiss customers, it is only available in English. Please ensure that you remain within the ‘Europe’ documentation. The French version is not valid for Switzerland.

Cashback N26 Standard

N26’s cashback offer earns 0.1% on every card payment.

Good reasons to open an account with N26 Switzerland

The N26 account does not cover the needs of life in Switzerland for 3 reasons:

- This is a EUR-only account.

- There is a charge for using it in Switzerland.

- It does not scan Swiss invoices.

On the other hand, N26 is a perfect support account for business in Europe with :

- Free withdrawals in EUR (even in Switzerland)

- The DE IBAN for receiving payments

- Quick online account opening

- Reduced fees on EUR payments

Promo Code

Free account ✔︎

N26 VS. Revolut – Quick Comparison ⚡️

N26 is easy to use for managing a budget in EUR. Personal IBAN, well-designed app, free card: everything works well as long as you stay in the Eurozone. But as soon as you want to pay in other currencies, withdraw cash outside Europe, or track a multi-currency balance, you quickly reach the limits.

Revolut is more flexible for juggling multiple currencies, paying everywhere, sending money internationally, or tracking a balance in USD, JPY, or GBP without surprises. However, neither allows normal operation in Switzerland: no CH IBAN, no native TWINT, no compatibility with local bills.

To be preferred if…

- you live or work in the Eurozone and want a clear app in EUR: N26

- you travel often or manage multiple currencies in your daily life: Revolut (read Revolut review and test)

To avoid if…

- You live in Switzerland or need a CH IBAN to receive or pay locally

- You use TWINT, eBill, or direct debits in CHF

- You’re looking for an app compatible with everyday Swiss payments

Promo Code

Free account ✔︎

N26 VS. Wise – Quick Comparison ⚡️

N26 is suitable for those who receive income in EUR or mainly pay within the SEPA zone. The personal IBAN makes it easy to get paid in euros and the card works well for everyday payments. But it’s not possible to manage multiple currencies or track a balance other than EUR.

Wise is more useful when juggling multiple currencies. You can maintain different balances, convert at the real rate, and use the card in almost all situations. But there are no direct transfers in CHF, no personal IBAN in EUR, and no classic banking functions like eBill or LSV.

Neither covers Swiss banking uses. You can’t receive a salary in CHF or use TWINT.

To be preferred if…

- you are paid in EUR or stay within stable SEPA usage: N26

- you often pay abroad or want to convert multiple currencies without hidden fees: Wise (read Wise review and test)

To avoid if…

- you live in Switzerland or need to manage a budget in CHF

- you want a single app to do everything without having to juggle between multiple tools

- you use TWINT or eBill in your daily life

Promo Code

Free account ✔︎

Online Account: Quick Comparison Between Neon, Yuh and N26 ⚡️

Yuh vs. Neon vs. N26

Additional information

Specification: N26 Switzerland – Review, Test, and Comprehensive Overview (December 2025) + get 20 EUR

| Online banking | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ||||||||||||||||

| Bank card | ||||||||||||||||

| ||||||||||||||||

| For who? | ||||||||||||||||

| ||||||||||||||||

| Mobile payments | ||||||||||||||||

| ||||||||||||||||

Reviews (1)

1 review for N26 Switzerland – Review, Test, and Comprehensive Overview (December 2025) + get 20 EUR

Show reviews in all languages (2)

Teo –

Very practicle