Neon – Investment & Trading: Complete Analysis and Review (December 2025)

| Investment security | 10 |

|---|---|

| Fees | 8.7 |

| Investment income | 8.5 |

| Crypto-currencies | 4.4 |

| Trading features | 8.3 |

| Training | 9 |

| Customer support | 8.3 |

| Opening an account | 8.5 |

Neon, the Swiss platform that simplifies stock and ETF investment and trading, makes financial markets accessible to everyone. Even without advanced trading features, it offers an intuitive solution for buying and selling securities. Use the promo code VSWH3C when opening your account.

Description

Neon as a Swiss online investment platform

Neon positions itself as a Swiss neo-bank aiming to simplify investment for its users. With an intuitive mobile application, it offers access to the financial markets via a selection of equities and ETFs. However, this approach may not satisfy investors looking for a wider range of instruments or advanced functionalities.

This review takes an in-depth look at Neon’s investment and trading platform:

- What are the unique features of Neon for trading and investing?

- How does the Neon application help you manage your transactions?

- How to choose investment products?

- What are the differences between Neon and Yuh’s trading features?

What security guarantees does Neon’s investment platform offer?

Neon is not a bank, but uses the Lenzburg Mortgage Bank to offer its services.

- Assets are held by Hypothekarbank Lenzburg, a Swiss banking institution regulated by FINMA.

- Deposits are guaranteed up to CHF 100,000.

- Neon ensures investment security by guaranteeing that customers’ assets remain separate from the bank’s assets, even in the event of bankruptcy. Assets (ETFs, stocks, etc.) are registered in the client’s name and therefore belong to the clients.

Neon app trading features

Portfolio performance indicator

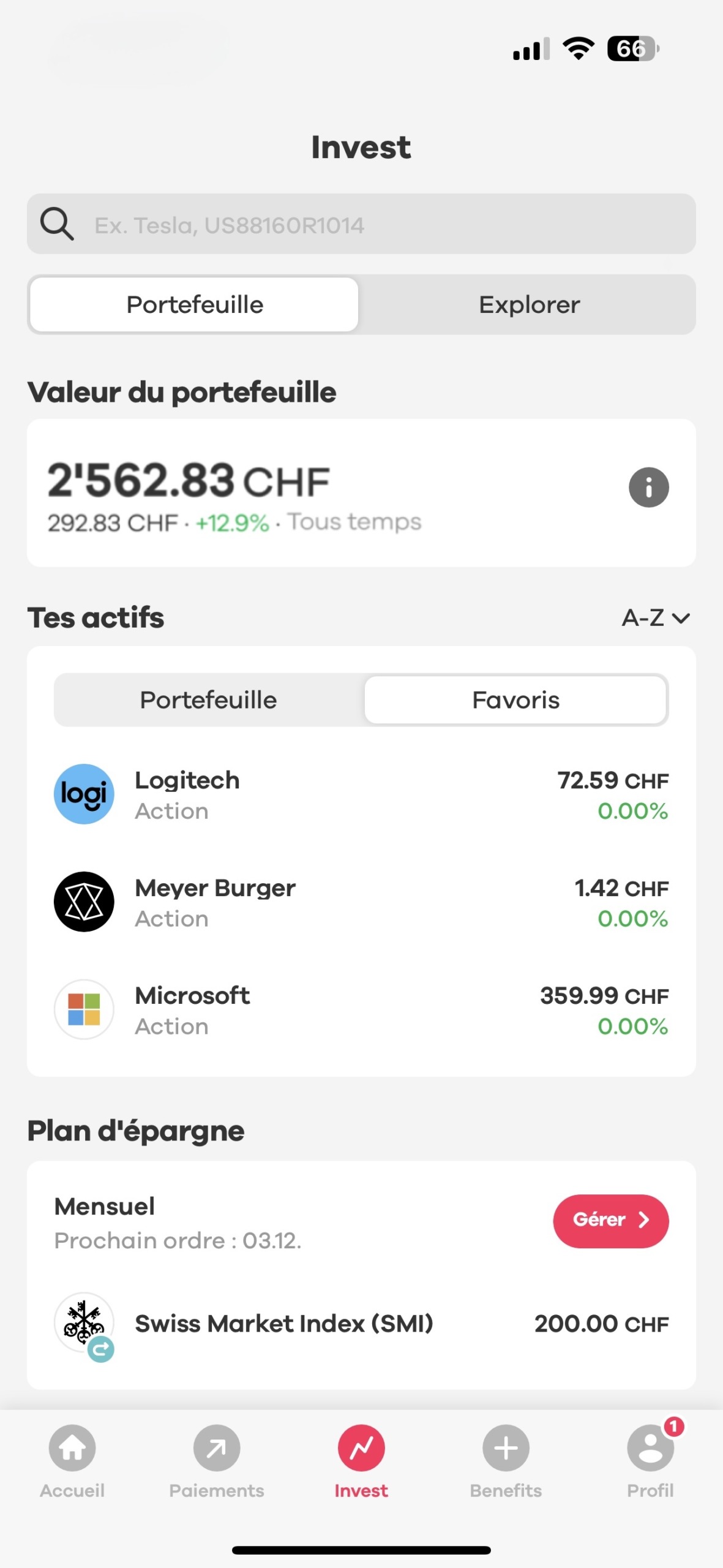

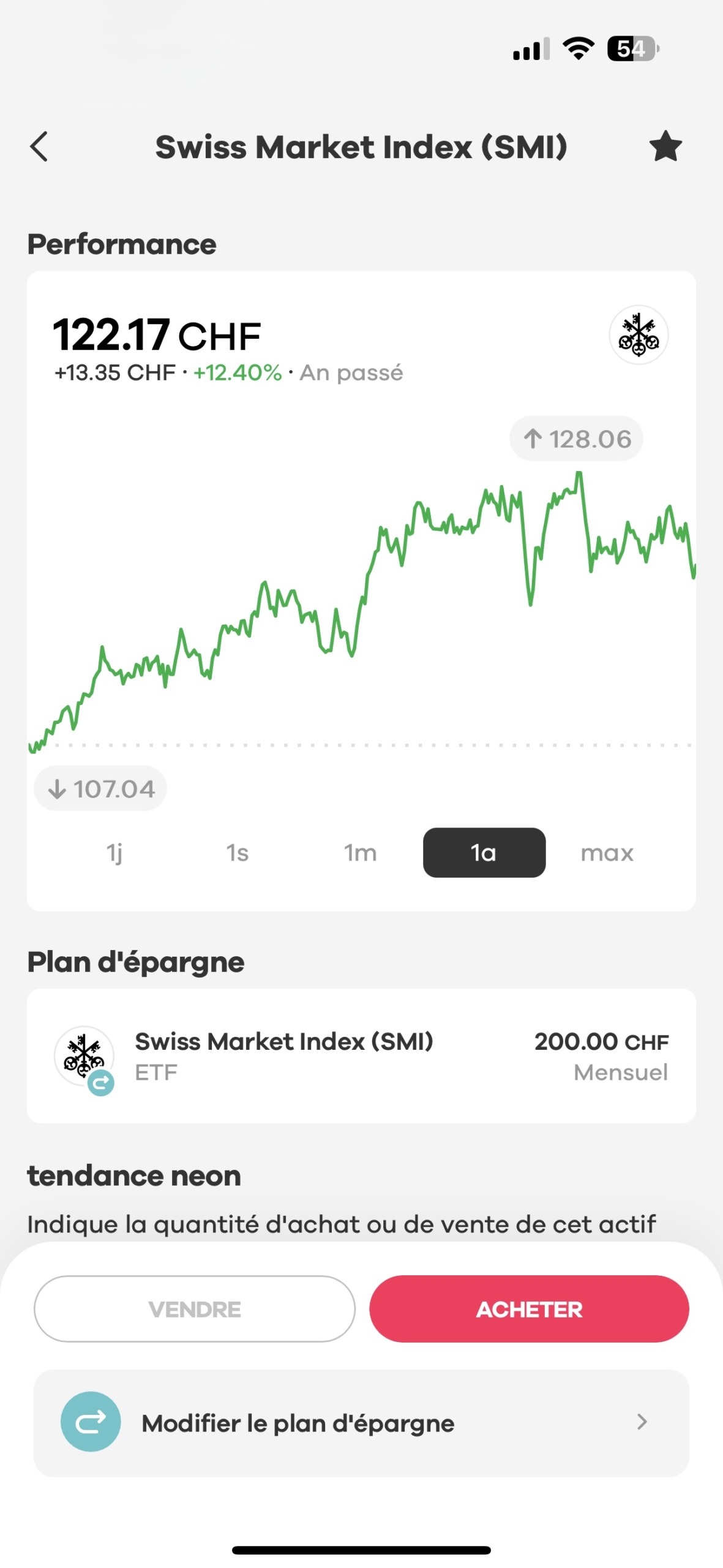

The app. allows general monitoring of the portfolio, current orders and savings plans:

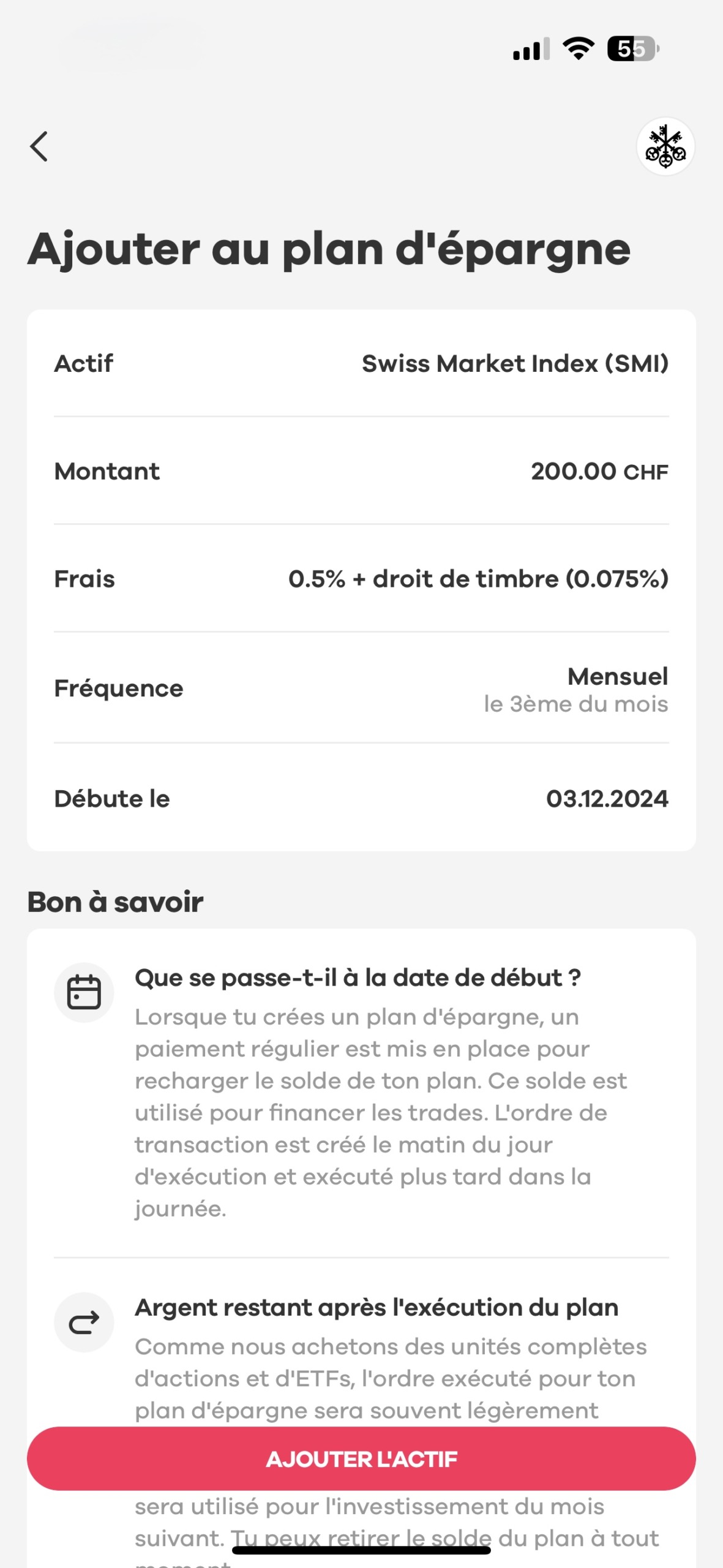

Creation of the investment savings plan

The Neon app allows you to create and compose a regular investment plan with one or more securities. When viewing an asset, you can easily add it and incorporate it into future recurring investments.

A drawback: Neon does not allow the purchase of fractional shares like Yuh does, for example. This means that the amount of recurring investment will always correspond to the value of a whole security. Depending on the context, a higher-priced security may have a lower investment frequency in the savings plan than a lower-priced security.

- Orders are executed immediately at the market price.

- Real-time order execution during market hours. Orders placed outside market hours (nights, weekends and public holidays) will be executed on the next business day.

- No limit orders, which limits control over buy/sell prices.

Stock market fees at Neon

Neon’s pricing structure is simple.

Our comparative review offers a table comparing Neon’s investment fees with those of other neo-bank investment platforms.

Here are the only rates you need to know to invest with Neon:

- Deposit fee: Free

- Transaction fees (minimum CHF 1 per transaction, excluding savings plan)

- 0.5% for Swiss equities and ETFs

- 1% for international equities

Additional costs :

- Federal stamp duty: 0.075% for transactions on Swiss stock exchanges, 0.15% for foreign stock exchanges.

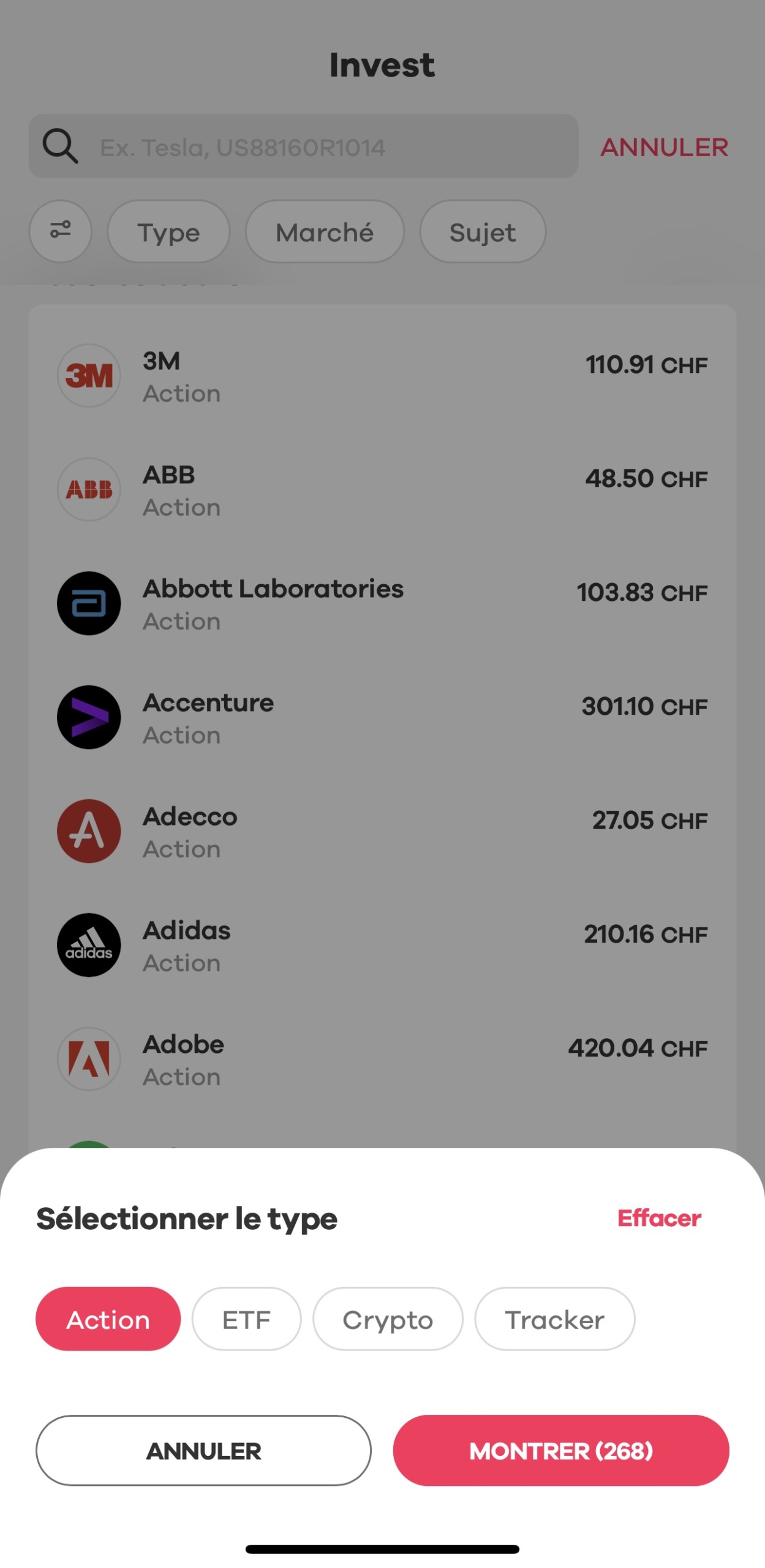

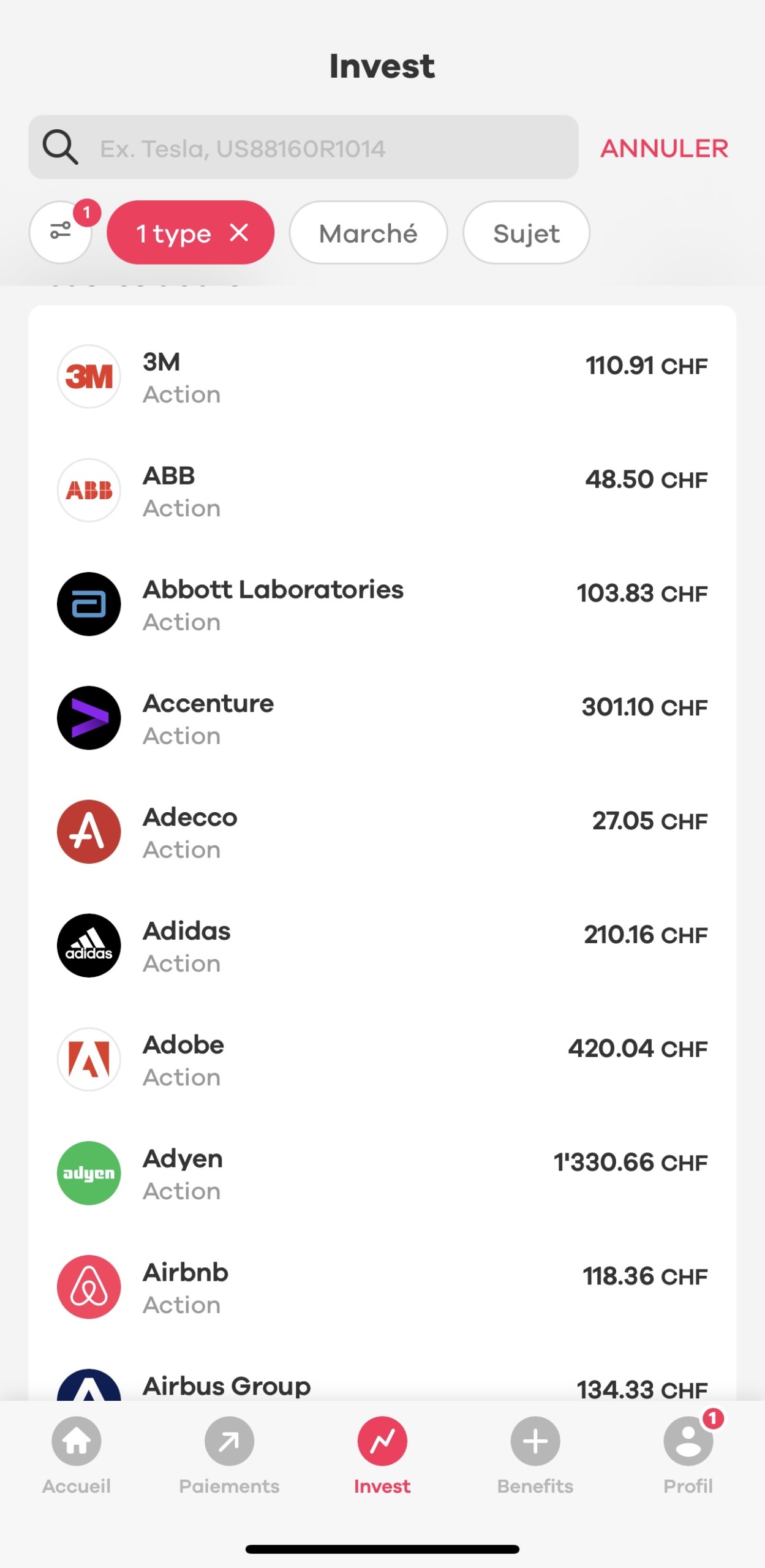

Investing in equities

Available investment income

More than 240 Swiss and international stocks:

Disadvantages :

- No fractional trading possibilities.

- Limited choice compared to specialized platforms.

Promo Code

Free account ✔︎

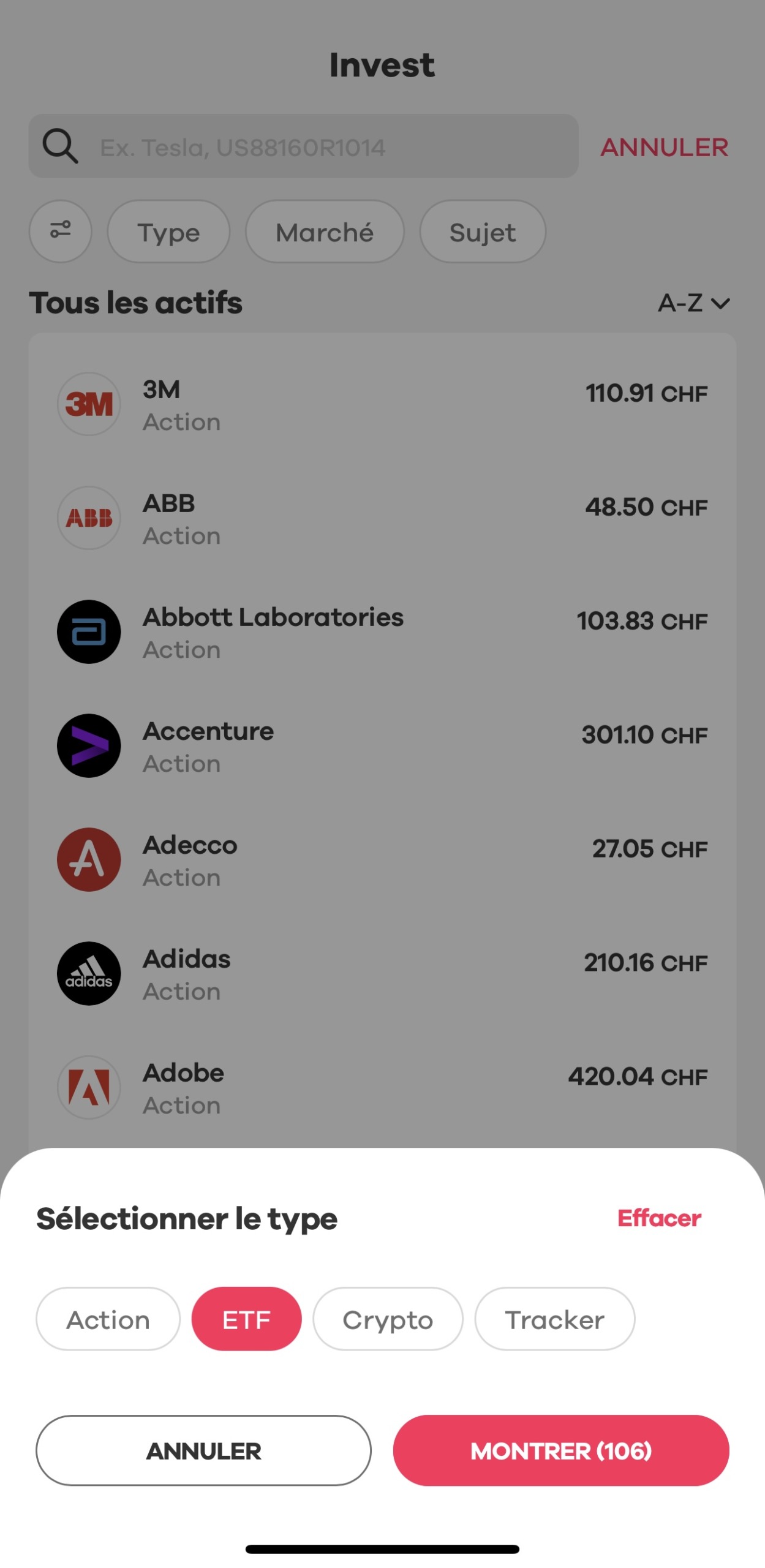

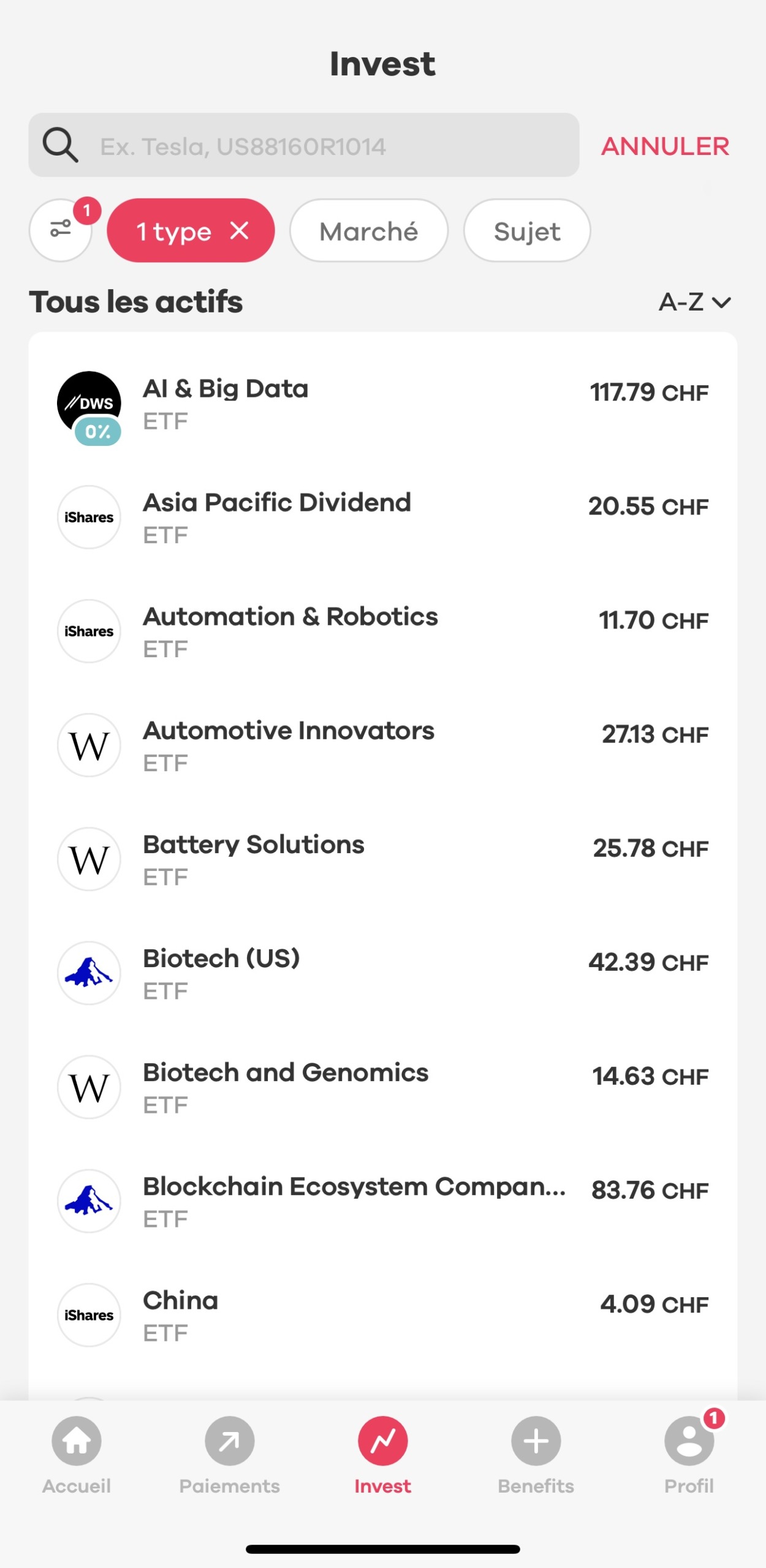

ETF and bond investments (ETFs)

ETFs allow you to invest in a basket of stocks and try to profit from long-term stock market growth.

- Over 70 ETFs available

- 0 trading fees for certain ETFs thanks to partnerships with Invesco, WisdomTree and Swisscanto (ZKB)

- Automated savings plan

The main drawback is the limited choice, especially when compared with specialized platforms.

Since April 2025, Neon invest now offers four new sustainable ETFs from Swisscanto 🍃 (Zürcher Kantonalbank): Swiss Stocks, Global Stocks, US Stocks and Eurozone Stocks. These ETFs apply strict selection criteria, based on ESG ratings and contribution to the UN’s sustainable development goals.

Until September 30, 2025, buying and selling these ETFs is free of trading fees. For Swiss Stocks and Global Stocks, this free trading also applies to the automatic investment plan. As Neon invest does not charge custody fees or currency conversion fees, only the federal stamp duty and the internal ETF fees (TER) remain the investor’s responsibility.

Investing in trends by investment theme

Unlike other banks such as Yuh, Neon does not offer themes but rather targeted exposures to specific trends like the Metaverse or Recycling through pre-designed products.

Promo Code

Free account ✔︎

Investing in Cryptocurrencies

Neon does not allow you to buy or sell crypto-currencies. The only possibility of gaining exposure to cryptos is through a limited number of financial products (trackers) that replicate market movements.

Training and support

Neon focuses on simplicity rather than financial education via the app. However, Neon does offer educational content on its social platforms, notably Youtube.

Excellent, efficient customer support, even on weekends.

Opening an account

The process of opening an account with Neon is quick and simple. We detail and illustrate each step HERE.

The best investment and trading platform among Swiss neo-banks

Neon offers an accessible and simplified investment solution, ideal for those new to trading or looking for passive management via automated savings plans. Its competitive fees and intuitive interface are major assets. However, the lack of advanced features and shareholder registration could deter experienced investors or those seeking a more active involvement in their investments.

Highlights :

- Competitive fees and no deposit fees.

- Simple, intuitive user interface.

- ETF savings plan with no additional fees for certain products.

Weaknesses :

- Limited functionality for experienced investors.

- No entry in the shareholders’ register.

- Narrower product range than specialized platforms.

In short, Neon is particularly suited to novice investors looking for a simple, efficient platform to manage their investments without excessive complexity. You can also see reviews on alternative investment solutions available in Switzerland such as:

What do you think of Neon for your investments?

- Does the app. Neon make your investments easier?

- What feature would you like to customize or improve?

- Will Neon be able to acquire crypto-currencies?

- Do you feel like becoming a trader now that you’ve installed Neon?

Share your feedback with all Neo’s friends 😈

Additional information

Specification: Neon – Investment & Trading: Complete Analysis and Review (December 2025)

| Security | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ||||||||||||||

| Investment | ||||||||||||||

| ||||||||||||||

| For who? | ||||||||||||||

| ||||||||||||||

| Accessibility | ||||||||||||||

| ||||||||||||||

There are no reviews yet.