NEON Bank – Review, Test, and Comprehensive Review (December 2025)

| Offering | 7.8 |

|---|---|

| Security | 10 |

| Opening an account | 8.9 |

| Bank card | 8.6 |

| Features | 8.5 |

| Interest rates | 8.5 |

| Transfer speed | 9 |

| TWINT | 6 |

| Fees | 8.5 |

| Abroad | 9 |

| Cash deposit | 3 |

| Customer service | 8.8 |

Review of Neon: we have tested the pioneering neo-bank in Switzerland under real conditions. Strengths… weaknesses… services offered… costs… features… things to know and drawbacks… Our detailed analysis helps you compare effectively. Use the promo code VSWH3C when opening your account.

Description

Neon Swiss bank offer summary

NEON Bank is the first independent Swiss neo-bank. Its app focuses on simplicity of operation with a clean design. It relies on the Hypothekarbank Lenzburg to provide its financial services.

Neon offers 4 mobile bank account packages, tailored to different needs:

Neon Free 💳 – Free

Neon Free is perfectly suitable for basic local use, but its limitations quickly become apparent when traveling or withdrawing money.

Neon plus ➕ (2 CHF/Month)

Includes the benefits of Neon Free, plus:

- 2 free withdrawals in Switzerland per month

- No foreign exchange fees abroad

- Phone customer service

Neon Global 🌍 (8 CHF/Month)

Includes the benefits of Neon Plus, plus:

- Insurance package included (shopping, travel, cyber, etc.)

- Cashback on Wise transfers

- Reduced fees for payments or withdrawals abroad

Neon Metal 💎 (15 CHF/Month)

Includes the benefits of Neon Global, plus:

- Metal Mastercard

- Phone insurance against damage and theft

- Free withdrawals worldwide

Neon Green and Neon Duo

You can customize your account with 2 additional extensions compatible with all plans:

🌱 Neon Green (3 CHF/Month)

- Wooden card (Mastercard Debit)

- Extended warranty for electronic devices

- Integrated carbon offsetting

- Free card delivery

- 1 tree planted for every CHF 500 spent

👥 Neon Duo (3 CHF/Month per Person)

- Shared account with 2 co-holders

- 2 cards, 1 common IBAN

- Consolidated view of transactions

- Budget tools and shared expense tracking

Neon Invest

Also discover all of Neon’s investment solutions (ETFs, stocks, etc.) in our dedicated review.

Security: is NEON Safe?

– Banking services are provided by Hypothekarbank Lenzburg, licensed by FINMA.

– The Swiss deposit protection insurance covers funds up to “CHF 100” 000.- in case of bankruptcy.

– Data is stored in Switzerland.

– Two-factor authentication (2FA) is enabled by default.

Promo Code

Free account ✔︎

Open a NEON Free, plus, Global, Metal Account

Neon bank is available in French, German, English and Italian.

The conditions for opening an account:

– Be at least 15 years old (YUH 14 years, ZAK 15 years).

– Reside in Switzerland (not accessible to cross-border workers and non-residents).

– Have an iOS, Android or Huawei smartphone.

– No proof of income or minimum balance required.

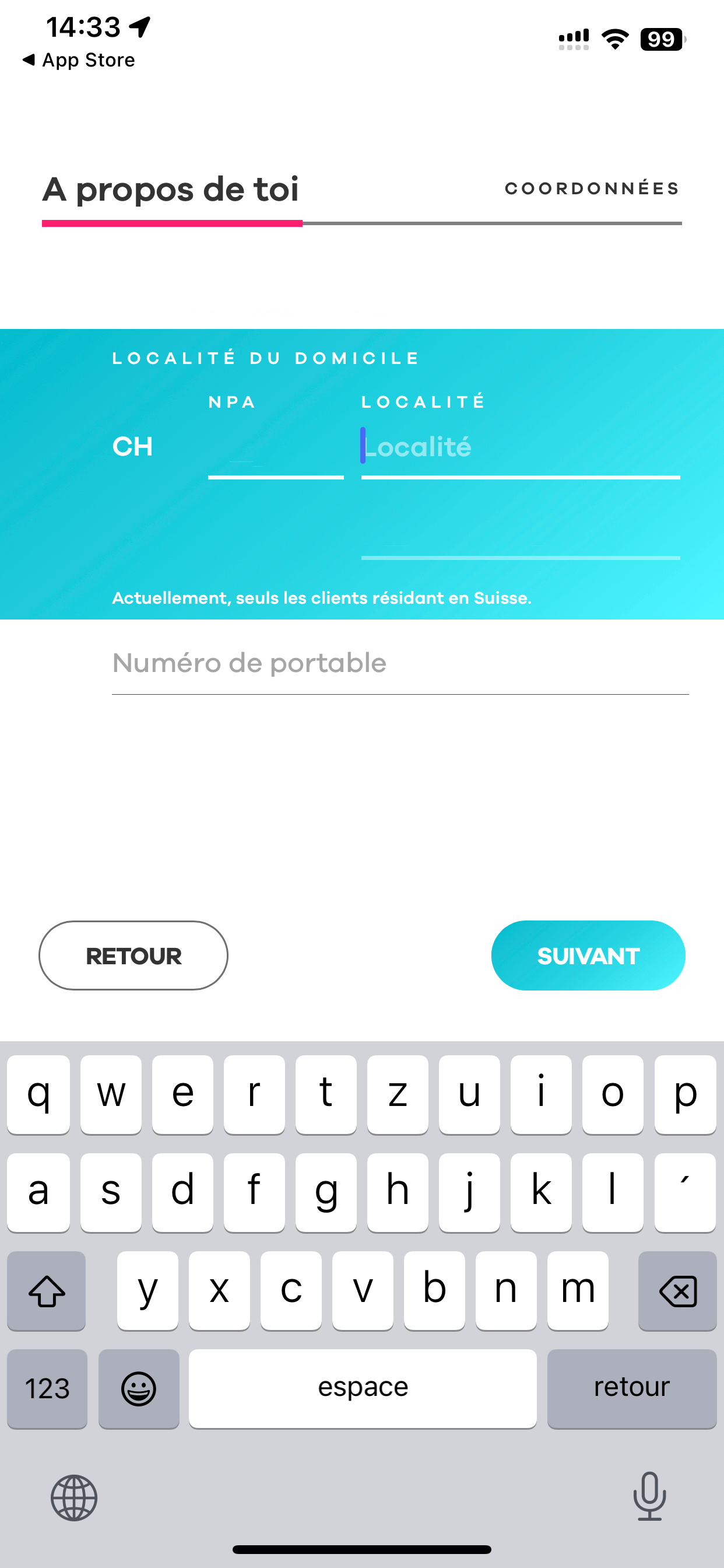

Step-by-step guide to opening a NEON account

Download the NEON app

on the App Store / Google Play Store / Huawei App Gallery

Create a new account

3 steps are required:

About you – Enter your personal information

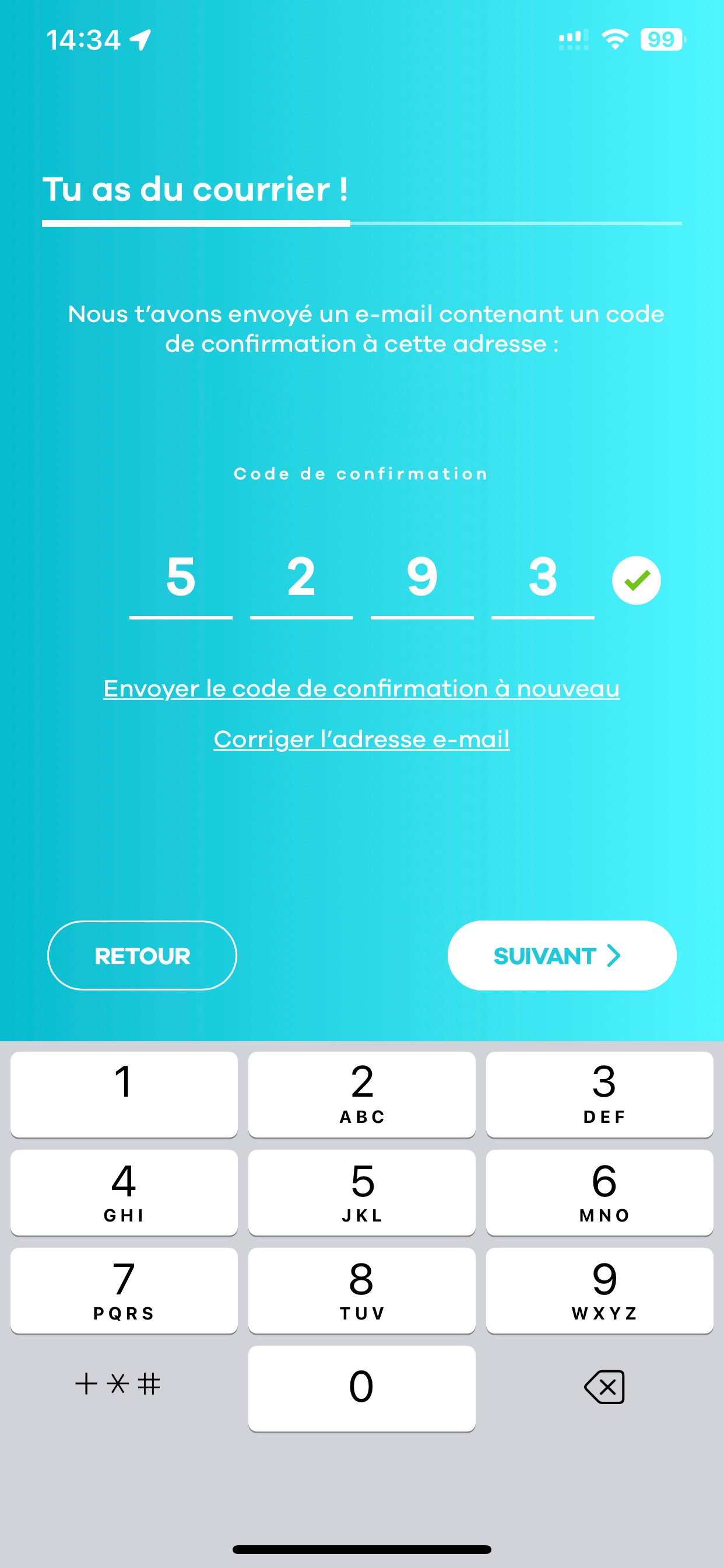

Verify your email address

Enter the code sent by email.

Enter your promo code: VSWH3C

Select the desired account type

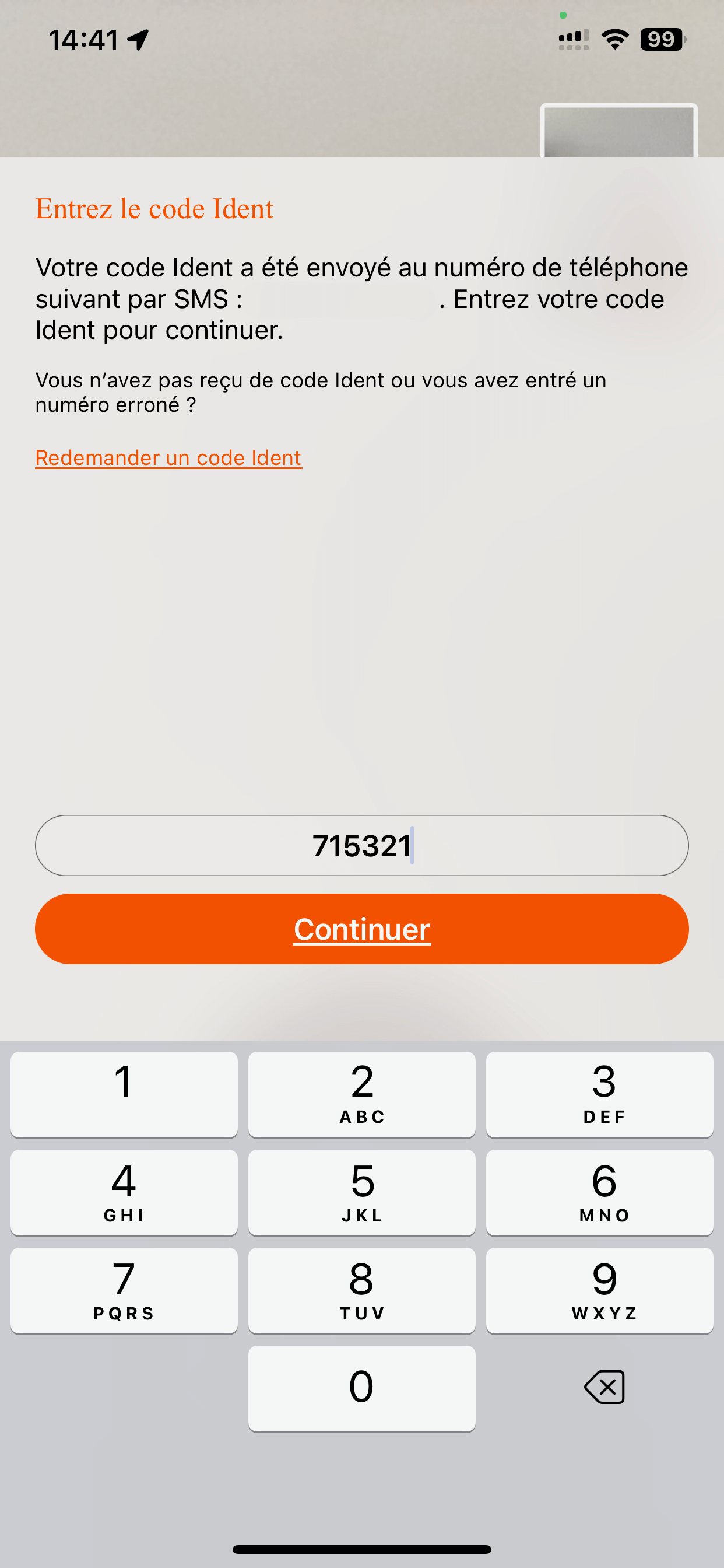

Verify your identity

You can choose your ID card or passport:

Set your own login code

All that’s left is to verify your email address and make an initial deposit of at least CHF 10. You’re all set in less than 15 minutes!

You will need to wait for your first transfer to arrive to access all the app’s features.

A few days later you will receive your Mastercard debit card by mail. The PIN code is sent separately.

The NEON bank card

💳 Mastercard Prepaid NEON Free in brief :

- Contactless payment without code up to CHF 80/purchase, max CHF 250/day. Cannot be modified. Beyond that, the code is required.

- Works with Apple Pay / Google Pay / Samsung Pay / SwatchPAY! / Garmin Pay

- Push notifications for card payments

- Daily payment limit: 5,000 CHF online and in-store

- Monthly payment limit: 10,000 CHF

● To activate contactless, you need to finalize a first payment with the card code.

● Even if it takes a few days for the card to be delivered, you can use it via your smartphone oruse the payment information available in the app to make online purchases.

You can temporarily block your card from the app, but you have to go to the ATM to change the PIN code.

The default cash withdrawal limit is CHF 2,000/day or 10,000/month. The card is only funded from the main account (money from Spaces is excluded).

Can I rent a car?

Promo Code

Free account ✔︎

NEON Bank App: Features

The Neon Bank app is adapted to all situations in Switzerland:

- Track account movements

- Push notification of movements

- View expenses by category

- eBill 🇨🇭

- Standing orders

- Scan payment slips (QR invoices) 🇨🇭

- Create “Spaces” sub-accounts

- Instant payment with “Pay a friend” (from Neon user to Neon user)

- Change contact details (2FA required)

- Temporarily block the card

- neon invest allows you to invest in stocks (Swiss and international) and ETFs directly through the app

- Open a joint account directly from the app

- Open a savings plan

- Budget tools and detailed expense tracking

The features it lacks :

✘ A dark mode, yet so popular nowadays.

✘ Create sub-accounts in other currencies (as offered by YUH).

✘ Change card limits in the app.

✘ Buying and selling cryptocurrencies. Too bad because we count on the fintech DNA to bridge the gap between the cryptic world of crypto and the people 😉 Neon should find a way to offer at least Bitcoin (BTC) / Ethereum (ETH).

Interest Rates Offered by the NEON Bank Account

Neon offers no interest rate.

Fast transfers with NEON – send money

- Instant transfers with “pay a friend” (from Neon user to Neon user).

- An IBAN transfer within Switzerland made before noon arrives on the same day. If it’s done in the afternoon, it arrives the next day.

- A transfer abroad takes from a few minutes to a maximum of 24 hours.

NEON Twint – pay with TWINT anywhere in Switzerland

Yes. TWINT, the #1 payment app in Switzerland allows you to:

– Pay in stores

– Transfer money between friends

– Split a bill within a group (restaurant, outings, etc.)

– Pay for parking meters

– Pay online and in train stations

To use TWINT with Neon Bank, you need to use the TWINT Prepaid application for iOS or Android. In this case, you cannot directly debit the bank account, but only pay with prepaid amounts.

👉 Read the guide to set up TWINT applications with NEON.

Promo Code

Free account ✔︎

NEON Banque fees: card, foreign exchange, transfers, cash withdrawals, etc.

- Free bank account

- IBAN CH free of charge

- Prepaid Mastercard 20 CHF for Neon Free and Plus, free for Neon Global and Metal

- Replacement card 20 CHF (120 CHF for the metal card)

- 👛 Virtual sub-accounts “Spaces” free

- 💳 Card payments without transaction fees

- Exchange fees without markup on the Mastercard exchange rate, except for Neon Free (0.35%)

neon invest

- Swiss stocks and ETFs: 0.5% of the purchase or sale price per transaction

- International stocks: 1.0%

- From July 1, 2024: Minimum fee of 1 CHF per transaction, except:

- Above 200 CHF for Swiss stocks or ETFs

- Above 100 CHF for international stocks and investment plans

Discover all Neon Invest’s investment solutions (ETFs, stocks, etc.) in our dedicated review.

Money transfers in Switzerland 🇨🇭 ➔ 🇨🇭

IBAN transfers in CHF are free. In EUR, there are no transaction fees, but a 1.5% markup on the Mastercard exchange rate.

In comparison, banks often charge a hidden fee of 2-3% in the interbank exchange rate, in addition to transaction costs.

International transfers 🇨🇭 ➔ 🌍

SEPA transfers are not available, but Neon allows you to save fees and time with international transfers:

➔ A very advantageous exchange rate at the average market rate.

➔ Transfers that can end up on the other side of the world in a matter of minutes.

How does it work?

- It’s the WISE service that operates these transfers. It’s generally faster, less expensive, and more transparent than IBAN and SEPA transfers.

- The fees are clearly indicated. They range between 0.8 and 1.7%. This includes a 0.40% convenience fee applied by Neon for integrating the service into the app. Therefore, it’s not necessary to have a WISE account.

To save more, you can use our link to open a WISE account which will allow you to eliminate the 0.4% convenience fees.

Cash withdrawals in Switzerland 🇨🇭

At ATMs (cash dispensers) :

- Neon Free: 2 CHF per withdrawal

- Neon Plus: free 2x/month then 2 CHF per withdrawal

- Neon Global: free 3x/month then 2 CHF per withdrawal

- Neon Metal: free 5x/month then 2 CHF per withdrawal

☝️ Withdrawal limit: 1,000 CHF

➔ In parallel, Neon enables free cash withdrawals in stores, kiosks and restaurants with Sonect, whose updated partner locations are shown below.

➔ You can also withdraw cash from Lidl cashiers (CHF max 300.-/withdrawal) conditional on a minimum purchase of CHF 10.

Cash withdrawals abroad 🌍

ATMs (classic cash dispensers)

- Neon Free: 1.5% of the withdrawn amount, no exchange rate markup

- Neon Plus: 1% of the withdrawn amount, no exchange rate markup

- Neon Global: 0.5% of the withdrawn amount, no exchange rate markup

- Neon Metal: free withdrawals

There is a daily cash withdrawal limit of 1K CHF or 1K EUR.

Neon Metal vs. Neon Free – which to choose?

Neon Metal is essentially free withdrawals everywhere for CHF 15/month. Once you’ve done the math: at what usage level is it worth taking out Neon Metal?

3 examples:

- In Switzerland, you need to use the 2 free withdrawals from Neon Free + make 8 additional withdrawals.

- Abroad, you need to withdraw more than 1000 CHF.

- A combination of 500 CHF withdrawal abroad + 6 withdrawals in Switzerland.

You can easily place yourself in front of these 3 examples to find out if Neon Metal is right for you. ✔︎

Don’t forget:

- Replacement Neon metal card charged at 120 CHF (compared to 20 CHF for other offers)

- Free delivery of the metal card included

Promo Code

Free account ✔︎

NEON Bank for Travel and Abroad

With NEON bank, there are no transaction fees or exchange fees.

The exchange rate is Mastercard’s, which is about 0.5% above the actual interbank rate. In comparison, it’s more advantageous than Zak, for example, which also uses a VISA reference rate but with a 2% markup.

📍 We always recommend paying in local currency.

- International transfers via WISE available in more than 40 currencies

- Application adapted for mobile payments abroad (Apple Pay / Google Pay, etc.)

Cash deposit on NEON account

Here’s how to deposit cash into your Neon bank account. Purchase a TWINT top-up at a Post Office, Coop, or Interdiscount with the amount you wish to deposit into your account:

With TWINT Prepaid, you need to select the “Unload credit” function then indicate an amount and the account IBAN.

The money is deposited into the account 2 to 3 working days later.

NEON bank customer service

Accessibility: by phone 🤳 Monday to Friday from 8am to 5pm. Response time is quick. By email and form in the app, the response window is two days ⏳, but urgent matters are dealt with quickly.

Unlike N26 and Revolut, it is not possible to speak to a support person directly via chat from the app or website.

Reported experience generally excellent. On the basis of all our interactions in French, the agents are fully up to the level of their promises. There’s a real culture of user feedback within the support department, so that information can be passed on to the development team. Even on Fridays, at the end of the day, even if the call goes overtime, the search for solutions and the efficiency are there.

Cashback NEON banque

Relatively inconsequential. NEON bank’s limited offer allows you to benefit from discounts with partner businesses such as: NordVPN, MoneyPark, EF, etc.

No standardized and developed cashback system like some neobanks such as Zak, Radicant and Revolut.

Good reasons to open an account with Neon Banque

Neon is currently one of the best neo-banks in Switzerland. The app provides a CH IBAN and Swiss QR bill payment and eBill. It is particularly interesting for customers resident in Switzerland who often travel or regularly spend across the border. It’s the best Swiss card for paying abroad, as there are no exchange rate surcharges or foreign fees.

✔︎ As the card costs 0 CHF with our code VSWH3C, you can open an additional account for free with another app. to take advantage of each one and compare services in practice 👍.

Neon vs. Zak – Quick Comparison ⚡️

Neon vs Zak

Zak natively integrates TWINT, supports eBill, LSV, and covers common payments in Switzerland seamlessly. However, it doesn’t allow managing multiple currencies, severely limits withdrawals outside Switzerland, and offers no access to investment.

Neon bank is more minimalist in terms of classic banking services, but better suited for foreign payments and small investments from the app.

To be preferred if…

- You want a simple app, with integrated TWINT, for 100% local use in CHF: Zak (read Zak review and test)

- You sometimes pay in foreign currencies, travel, or want to invest easily: Neon

To avoid if…

- You’re looking for a multi-currency tool (Zak is limited to CHF)

- You often use TWINT (not compatible with Neon)

- You need an all-in-one tool for bills, payments, transfers and local management (Zak is more complete in this aspect)

Neon vs. Yuh – Quick Comparison ⚡️

Yuh vs Neon

Neon bank offers a better experience for everyday Swiss payments: CH IBAN, QR-bills, eBill, LSV, and free CHF withdrawals. However, the lack of native TWINT and the inability to hold multiple currencies limit its use when traveling or receiving funds in EUR.

Yuh covers traditional Swiss banking services less comprehensively, but it has an advantage in multi-currency payments, EUR withdrawals, and access to investment.

Also read

For a detailed comparison, criterion by criterion: check our complete analysis of Neon vs Yuh.

To be preferred if…

- You live in Switzerland, with regular payments in CHF and bills to manage easily: Neon

- You pay in EUR, travel or wish to invest occasionally: Yuh (read Yuh review and test)

To avoid if…

- You use TWINT daily

- You’re looking for a multi-currency account or an EUR IBAN

- You want to manage your payments, expenses and investments in several currencies

Neon vs. Alpian – Quick Comparison ⚡️

Neon vs Alpian

Alpian allows holding multiple currencies in a single account (CHF, EUR, USD, GBP), making international transfers without fees, and accessing an investment platform assisted by a human advisor. However, the card costs 60 CHF, withdrawals in Switzerland are charged 2 CHF, TWINT is only available as prepaid, and the app remains focused on wealth management logic.

Neon bank is more direct, without fixed fees, smoother for everyday payments in Switzerland, but without multi-currency features or personalized financial management.

To be preferred if…

- You want an account without fixed fees, compatible with Swiss payments and suitable for daily use in CHF: Neon

- You’re looking for personalized support to invest capital, with integrated wealth management: Alpian (read Alpian review and test)

To avoid if…

- You use TWINT or pay regularly by LSV

- You want a free card or CHF withdrawals without surcharge

- You don’t have an active investment project (Alpian then loses its main interest)

Neon vs. Radicant – Quick Comparison ⚡️

Neon vs Radicant

Radicant focuses on an ecological positioning, with a modern interface and access to investments aligned with sustainable goals. But it still lacks common banking functions: no TWINT, no eBill, no LSV, and only one CHF account. Withdrawals in Switzerland are limited, and the card is still in a transitional phase.

Neon bank remains more comprehensive for managing payments, bills, and daily withdrawals, even if the investment offer is more basic and without ESG filters.

To be preferred if…

- You’re looking for a stable solution for CHF payments, Swiss bills and free withdrawals: Neon

- You want to invest according to sustainability criteria and give meaning to your portfolio: Radicant (read review and test of Radicant)

To avoid if…

- You need TWINT or a complete billing system (QR, eBill, LSV)

- You want a ready-to-use card, well integrated for physical withdrawals and payments

- You don’t plan to invest in the short term (Radicant then loses its main interest)

Quick comparison between Neon, Yuh and Revolut ⚡️

Yuh vs. Neon vs. Revolut

(See reviews on the complete review of Yuh and the complete review of Revolut Switzerland.)

|  |  |  |  | |

| Free bank account | ✔︎ | ✔︎ | ✔︎ | ||

| Individual CH IBAN | ✔︎ | ✔︎ | ✘ | ||

| Free bank card | ✔︎ | ✘ | ✘ | ||

| Withdrawal in Switzerland | ✔︎ | ✔︎ | ✔︎ | ||

| International transfers | ✔︎ | ✔︎ | ✔︎ | ||

| Traveling abroad | ✘ | ✔︎ | ✔︎ | ||

| TWINT | ✔︎ | ✔︎ | ✘ |

Promo Code

Free account ✔︎

What do you think of Neon?

- Does the Neon app make your daily life easier?

- What feature would you like to customize or improve?

- Is Neon suitable for your needs abroad?

Share your feedback with all Neo’s friends 😈

Additional information

Specification: NEON Bank – Review, Test, and Comprehensive Review (December 2025)

| Online banking | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ||||||||||||||||

| Bank card | ||||||||||||||||

| ||||||||||||||||

| For who? | ||||||||||||||||

| ||||||||||||||||

| Mobile payments | ||||||||||||||||

| ||||||||||||||||

Reviews (2)

2 reviews for NEON Bank – Review, Test, and Comprehensive Review (December 2025)

Show only reviews in English (0)

Ivan –

Moi je préfère Yuh. C’est plus complet que Neon (en fonction des besoins bine sûre).

P. Talon –

Cet avis sur Neon est complet même si je n’aime pas Neon. J’ai changé pour Alpian + Revolut