Yapeal Transforms into a Fintech for Fintechs

The Swiss neobank Yapeal has initiated a strategic shift. Since March 2025, it has been operating as a banking infrastructure provider with a B2B offering centered on integrating banking services into third-party products/services in compliance with FINMA.

Unlike the B2C model which targets individuals, B2B addresses businesses that want to integrate banking services directly into their products or platforms.

Will Yapeal Abandon Individual Customers?

Officially, no.

Services for private clients remain available, and Yapeal claims they will continue to benefit from innovations arising from B2B. However, no new specific developments are planned for B2C. The priority lies elsewhere.

For now, nothing changes. But this kind of repositioning often paves the way for a gradual transition. It will be necessary to monitor the evolution in the coming months.

What Services Does Yapeal Now Offer to Businesses?

Yapeal offers a complete infrastructure, designed to be integrated directly into other companies’ services. It particularly targets startups, SMEs, fintechs, SaaS providers, and service companies.

This is what’s called embedded finance: integrating banking services (accounts, cards, payments…) directly into an application or platform that is not originally a bank.

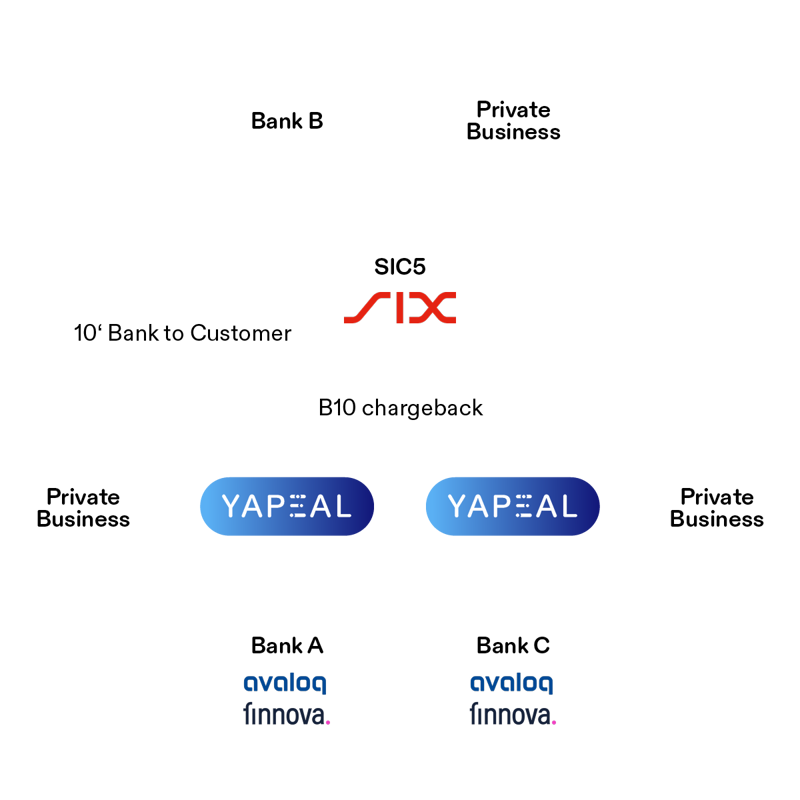

To make it work, Yapeal uses a banking-as-a-service (BaaS) approach: a modular infrastructure that companies can connect to their own tools via APIs.

Among the available modules:

- Transactional accounts with IBANs, including virtual IBANs, with deposits at the Swiss National Bank.

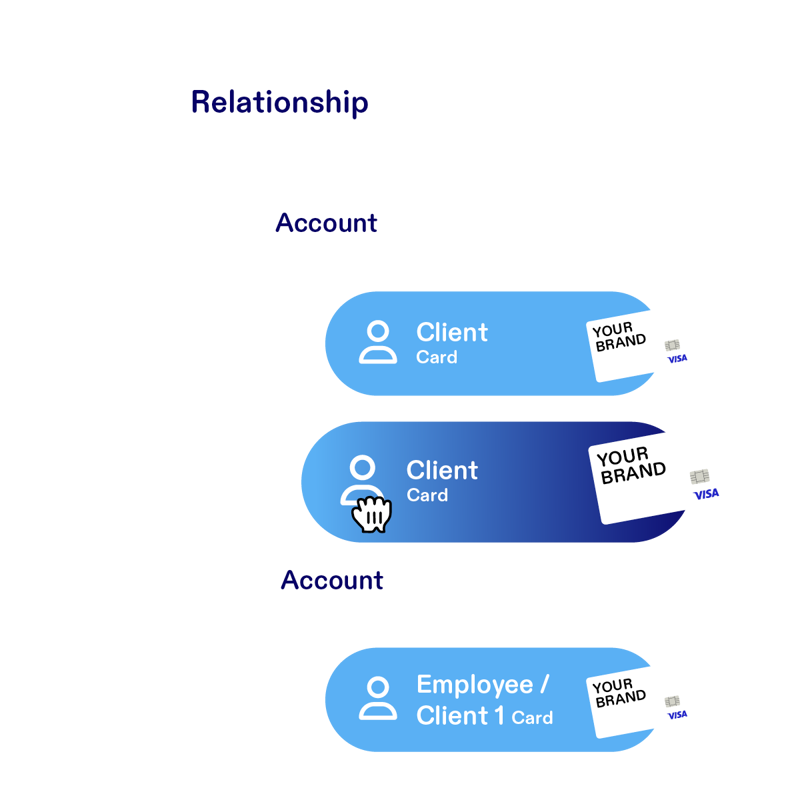

- Customizable cards, through a Cards-as-a-Service solution.

- Swiss and international payments, with integrated exchange options.

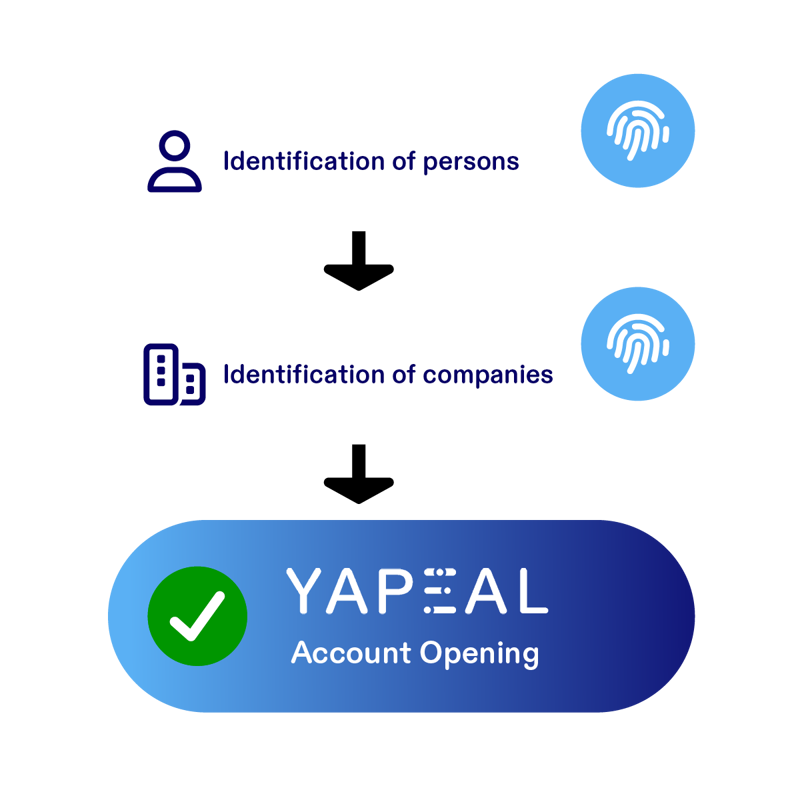

- Automated identification (KYC) for individuals and legal entities.

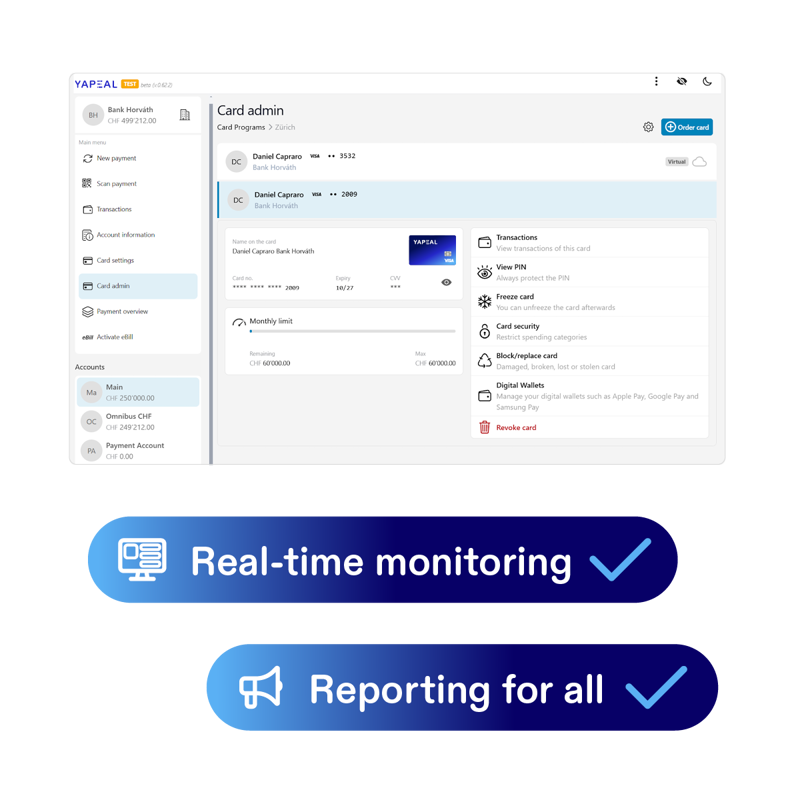

- Management tools, with real-time reporting, expense control, compliance management.

Identification (core module)

Payments (core module)

Cards (core module)

Payments (core module)

Source: Yapeal

The entire system is fully online. Each service can be activated separately as needed. This allows you to connect what you need and integrate it directly into your own product.

What Place for Yapeal Among B2B Players Already Present in Switzerland?

B2B banking in Switzerland is still in its early stages. A few players already occupy specific positions, each in a well-defined area.

In Zurich, Additiv offers a wealth management-oriented platform, mainly used by private banks. Relio, also in Zurich, caters to Swiss SMEs with a pro account offering, but without an open infrastructure for third parties at the moment.

In Geneva, Temenos remains a reference in core banking for large banks, with a very institutional approach. WeCan Group, on its side, focuses on compliance and blockchain technologies, building modular components for financial institutions.

What We Can Take Away

For individual customers: Nothing changes in the short term, but the priority given to B2B raises doubts about the longevity of the offer.

For businesses: Yapeal now offers a modular, usage-oriented infrastructure designed for the rapid integration of financial services.

This repositioning marks a clear strategic shift. It remains to be seen whether the offer will meet real demand from Swiss companies — and what will ultimately happen to private clients.

What do you think of Yapeal?

- Are you familiar with the Yapeal app?

- Do you think Yapeal’s new strategic direction is the right one?

- Do you like Yapeal’s new logo?

Share your feedback with all Neo’s friends 😈