Opening a Swiss bank account for non-residents or as a foreigner is necessary for many people in 2025:

→ receiving a salary in CHF when working from abroad,

→ protecting part of your savings in Swiss francs,

→ or simply accessing a secure and stable banking solution.

But here’s the thing: the majority of Swiss banks tend to limit access to non-residents, by requiring a minimum deposit or charging high account management fees:

The conditions are unclear.

The fees are sometimes prohibitive.

Opening an account takes time.

📝 The purpose of this article:

- Understanding what blocks the opening of an account in Switzerland when living abroad

- Presenting the 5 solutions available in 2025

- Comparing their real advantages and limitations

- Helping to choose according to one’s profile and needs

- And most importantly: explaining how to easily open an account in Switzerland

(🚨 Spoiler: only one Swiss bank really checks all the boxes today.)

Summary: the 3 Main Options for Opening a Non-Resident Account in Switzerland

| Account Type | Personal CH IBAN | Low fees | Easy to Open | Recommended? |

| Swiss Neo-bank (e.g., Yuh) | ✔︎ | ✔︎ | ✔︎ | ✔︎ |

| Traditional bank (UBS, PostFinance…) | ✔︎ | ✘ | ✘ | ✘ |

| Multi-currency account (Wise, Revolut) | ✘ | ✔︎ | ✔︎ | As a complement |

What You Need to Understand Before Looking for a Bank in Switzerland

Who is Considered a Non-Resident?

Anyone whose tax domicile is located outside of Switzerland. Whether it’s a cross-border worker, an expatriate, or a retiree living in the EU, it’s the declared place of residence that determines whether a Swiss bank applies its “non-resident” conditions or not.

There are Two Major Obstacles in 90% of Cases

- No Swiss IBAN in one’s name → this point alone is enough to cause rejection of a transfer from a Swiss employer.

- Remote opening impossible → the majority of banks require an in-person appointment, sometimes with a substantial initial deposit.

Why So Many Conditions with Swiss Banks?

It’s not just a commercial issue. Swiss banks are subject to strict rules on:

- Anti-money laundering (compliance)

- Automatic exchange of tax information (CRS)

- Administrative risks related to remote accounts

Result: for a bank, a non-resident client often costs more to manage and involves more paperwork. This explains the fees:

Actual Bank Fees for Non-Residents

| Bank | Monthly Fees | Conditions |

| UBS | CHF 30.– | High deposit, Form A |

| PostFinance | CHF 25.– | Min. balance CHF 25,000.– |

| Bank Migros | CHF 30.– | Variable conditions |

| BCGE, BCV, ZKB, TKB, … | From CHF 30.– | Access via OSA |

These fees are significantly higher than those applied to Swiss residents. And some banks also charge:

- Inactivity fees after 12 months without movement (depending on the bank),

- A significant initial deposit at opening (CHF 10,000 to 50,000 depending on the institution).

This is why the solutions that prevail today for the majority of non-residents are without fixed fees or complex conditions.

Banks to Avoid if You Don’t Live in Switzerland

Some neo-banks or “digital” offerings are attractive, but it’s impossible to open an account if you don’t reside in Switzerland. This is the case for Zak, Neon, Radicant, Alpian for example.

What About Multi-Currency Accounts?

Multi-currency services facilitate conversions from CHF to EUR, but:

- they do not provide a personal Swiss IBAN

- they do not allow receiving a Swiss salary under good conditions

Opening a Non-Resident Account in Switzerland with a Traditional Bank

UBS, BCGE or Banque Migros: these institutions theoretically accept non-residents. But in practice, the conditions are often restrictive.

You can obtain a Swiss IBAN in your name, but you need to:

- make a physical appointment at a branch,

- provide numerous tax and bank documents,

- deposit between CHF 10,000 and 50,000 depending on the institution,

- pay monthly fees of up to CHF 30.

This solution can work only if you have significant capital or a very specific use (assets, real estate in Switzerland, etc.).

Documents Required by Traditional Banks to Open a Non-Resident Account in Switzerland

To open an account in a Swiss bank as a non-resident, here are the documents that are most often requested:

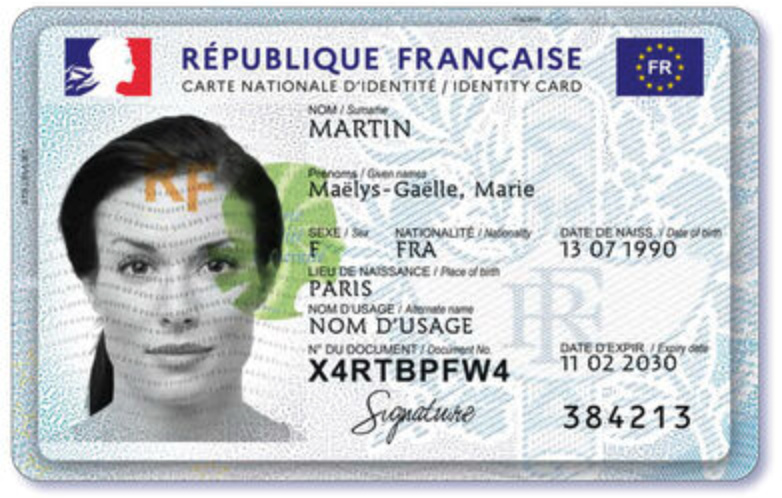

- Valid ID

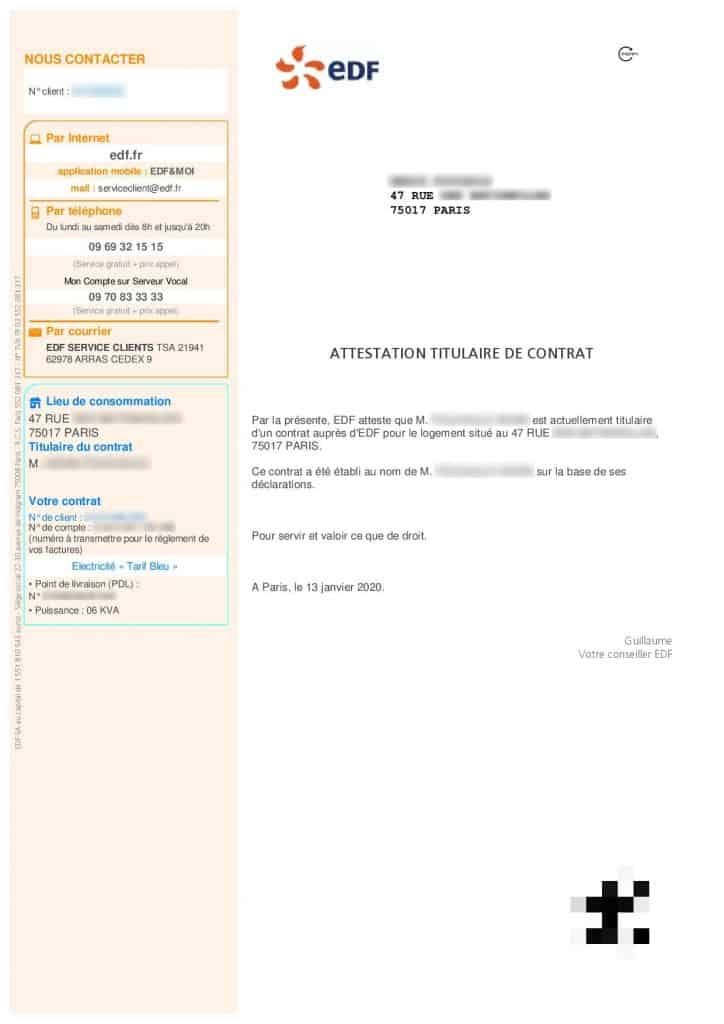

- Proof of address: recent bill (electricity, internet…), lease agreement or certificate of residence < 3 months.

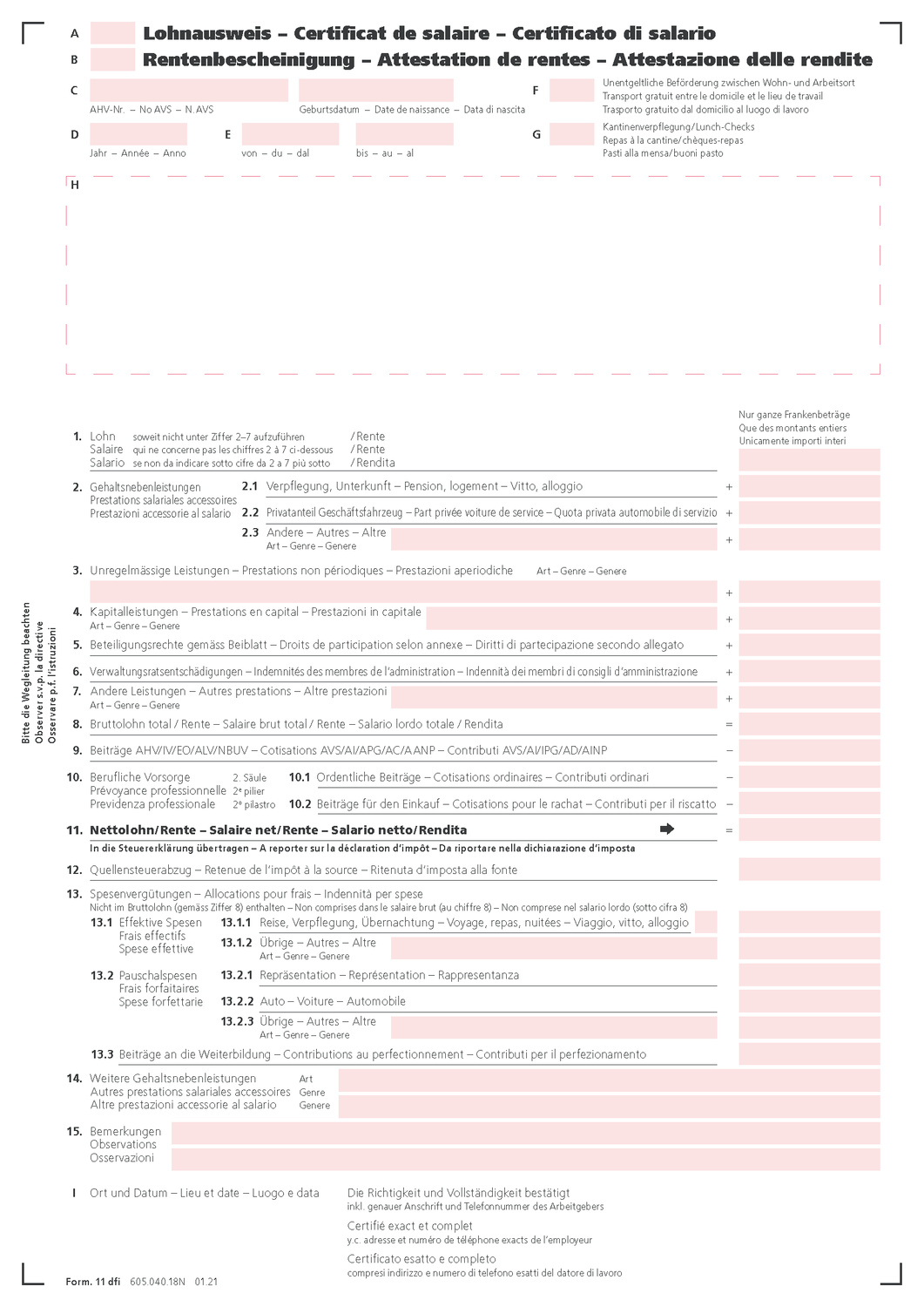

- Proof of income: Swiss employment contract, pay slip or proof of professional activity.

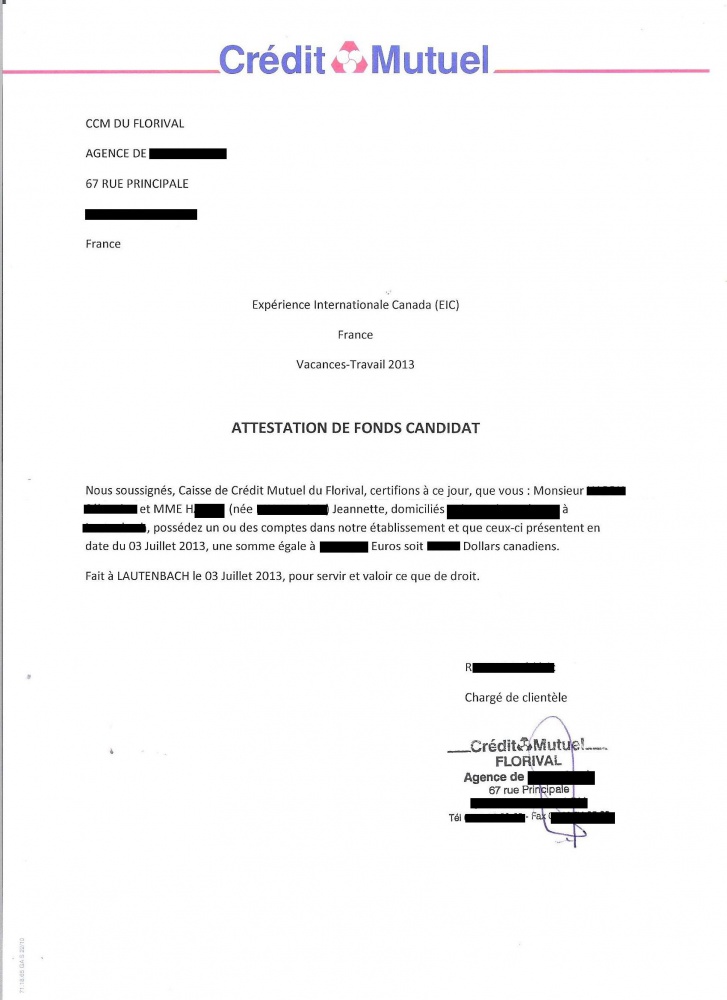

- Proof of source of funds: often covered by income documents, but a bank statement may also be requested.

- Tax Form A: required by some banks for regulatory reasons.

- Sometimes: bank reference letter or recent bank statements.

All these documents allow banks to verify your identity, your connection to Switzerland and your financial situation while complying with “compliance” regulations.

Allows you to have a 100% Swiss account, perfectly accepted everywhere, with a personal CH IBAN and a full range of banking services.

The opening process is long, expensive and reserved for those who can justify a strong economic connection with Switzerland.

Opening a foreign multi-currency account with CH IBAN (Wise, Revolut, N26…)

Platforms like N26, Wise and Revolut are ultra-accessible: you can open an account in minutes, without conditions, with excellent exchange rates.

But beware: Wise does not provide a personal Swiss IBAN, only foreign IBANs (Belgian or British). Revolut, on the other hand, now offers a Swiss IBAN (starting with CH) through a partnership with PostFinance. This IBAN is useful for receiving local payments in CHF, but it remains shared: transfers must include a specific reference to be correctly credited, with a risk of errors. Some Swiss employers may refuse to transfer a salary to a non-personal IBAN, which is essential.

However, these services are perfect as a complement to a Swiss account: for transferring, converting and reusing funds at the best rate.

Very easy to open, without fixed fees, ideal for converting or spending CHF once received.

Do not allow receiving a Swiss salary under good conditions, as there is no personal CH IBAN.

Opening an account in Switzerland with a neo-bank open to non-residents

Among all the solutions analyzed, Swiss neo-banks are the only ones that allow a truly simple remote opening.

Two online banks accept non-residents with a personal CH IBAN: Yuh and Yapeal. But one is clearly more suitable than the other.

Yuh – the most comprehensive banking solution, accessible to non-residents

The neo-bank Yuh (read full review) is one of the few Swiss banking solutions open to non-residents that combines accessibility, reliability, and modern features:

- Personal CH IBAN

- 100% online opening (mobile)

- No minimum deposit required

- No monthly fees

- Free debit card

- Access to investments (ETFs, stocks, cryptocurrencies) from CHF 25.–

Who can open an account with Yuh?

Requirements:

- Be at least 18 years old.

- Reside in Switzerland or in one of these countries: Germany 🇩🇪, Austria 🇦🇹, France 🇫🇷, Italy 🇮🇹, Liechtenstein 🇱🇮.

- Have a smartphone compatible with the Yuh app.

No additional requirements:

- No proof of income

- No minimum deposit

- No Swiss address

Yuh allows you to open a Swiss account remotely, without fees or restrictive conditions, with a personal CH IBAN and access to investment.

No dedicated advisor. The offer remains designed for simple personal use, even if it tends to expand month by month.

Promo Code

Free account ✔︎

Yapeal – an alternative open to non-residents that remains limited

Yapeal (read full review) is a 100% digital Swiss neo-bank, with a CH IBAN and remote opening. It accepts certain non-residents, but offers fewer features than Yuh, especially as it now focuses on developing its institutional clientele and businesses, rather than private customers. In brief:

- Personal CH IBAN

- Mobile app with basic functions

- Payment-oriented offer, without investment

Who can open an account with Yapeal?

Requirements:

- Be at least 18 years old

- Reside in the EU or Switzerland

- To have a smartphone

Points to note:

- App not always stable

Yapeal allows you to obtain a personal Swiss IBAN with 100% online opening, without required deposit or branch appointment.

Unstable app, very limited banking features.

Promo Code

Free account ✔︎

Opening a non-resident account with a Swiss IBAN at a border bank (French, German, Austrian, Italian)

When living near Switzerland, one might be tempted to open an account with a bank in their bordering country. This is an option that can be considered, especially if one wishes to:

- keep their finances grouped in their country of residence,

- avoid opening an additional account in Switzerland,

- or benefit from familiar banking services (local advisor, known interface, etc.).

Banks such as BNP Paribas, Crédit Mutuel or Sparkasse offer standard accounts with a local IBAN (FR, DE, IT), some with services for cross-border workers.

However, these solutions can generate additional fees: commissions on incoming transfers in CHF, uncompetitive exchange rates, or fixed monthly fees if the account is rarely used.

But these accounts quickly reach their limits when it comes to receiving a salary or using Swiss services:

- You don’t get a Swiss IBAN, which can be a problem for an employer.

- International transfers can incur fees or delays, even with SEPA.

- No access to Swiss banking services such as TWINT or eBill.

In some cases, this type of solution may be sufficient, especially when the bank offers a dedicated service for cross-border workers.

This is the case with Crédit Mutuel, which allows you to receive a salary in CHF directly into an account in France, without a Swiss IBAN, but with adapted services (CHF account, guaranteed exchange rate, CHF deposit/withdrawal in branch).

However, other banks like BNP Paribas or Sparkasse do not offer a concrete equivalent.

In these cases, these accounts mainly serve as a complement, to convert or repatriate funds once the salary is received elsewhere.

Stable solution if you live on the border, with direct access to a local banking network and a familiar environment.

Rigid and costly solution for managing finances related to Switzerland: cumulative fees, limited services, and little flexibility in daily operations.

The Combo: Local Bank Account + Swiss Exchange Service

Last possible option: combining a classic bank account (in France, Germany or Italy) with a Swiss-based exchange service, such as b-sharpe or the Migros exchange service.

The idea is to have your Swiss salary transferred to an IBAN provided by the exchange service (usually a CH IBAN), which converts the CHF at the best rate, then transfers it to the main account in the euro zone.

What is it for?

- To reduce conversion fees (often much more competitive than a traditional bank)

- To receive a Swiss salary even without a Swiss bank account

- To optimize CHF → EUR transfers if you don’t want to open an account in Switzerland

But this solution is not without limitations…

- The Swiss IBAN provided is not in your name: it belongs to the exchange service, even if the transfer is identified in your name.

- Some employers refuse this type of IBAN, as it doesn’t always meet their compliance criteria.

- No access to Swiss banking services (no card, no payment, no investment)

So it’s a workaround solution, useful as a supplement if the employer accepts it. But it doesn’t replace a real Swiss bank account.

Allows you to receive a Swiss salary and convert CHF at the best rate, without opening an account in Switzerland.

No card, no banking interface, no personal IBAN: depends entirely on the employer’s acceptance of the service.

How to choose the right Swiss account option according to your profile?

Which solution to choose to open an account in Switzerland among the 5 possible options?

Here are the concrete scenarios to consider:

If you work in Switzerland while living abroad (cross-border worker, teleworking, EU resident)

In this case, the employer usually requires a Swiss IBAN in your name.

- Not possible with Wise, Revolut or a simple French account.

- Some exchange services may work, but it’s risky (non-personal IBAN).

✔︎ The simplest and most functional option: Yuh.

Once the salary is received, it’s possible to transfer CHF to Wise or Revolut to convert at the best rate, then fund a main account in EUR.

There is an optimized system for cross-border workers described in this article. It allows you to benefit from highly favorable conditions to repatriate your Swiss salary and have effective payment methods on both sides of the border.

Promo Code

Free account ✔︎

If you are an expatriate, retiree, or investor based abroad

You don’t work in Switzerland, but you want to keep or manage funds in CHF from abroad:

- CHF savings or current account

- Stock market or crypto investments

- Swiss inheritance or pension

✔︎ In this case too, Yuh emerges as the simplest solution: remote opening, personal CH IBAN, access to ETFs/cryptos without restriction.

Other solutions (traditional or cross-border banks) are only useful if you have significant assets or need a dedicated advisor.

How to Open a Swiss Bank Account for Non-Residents from Abroad?

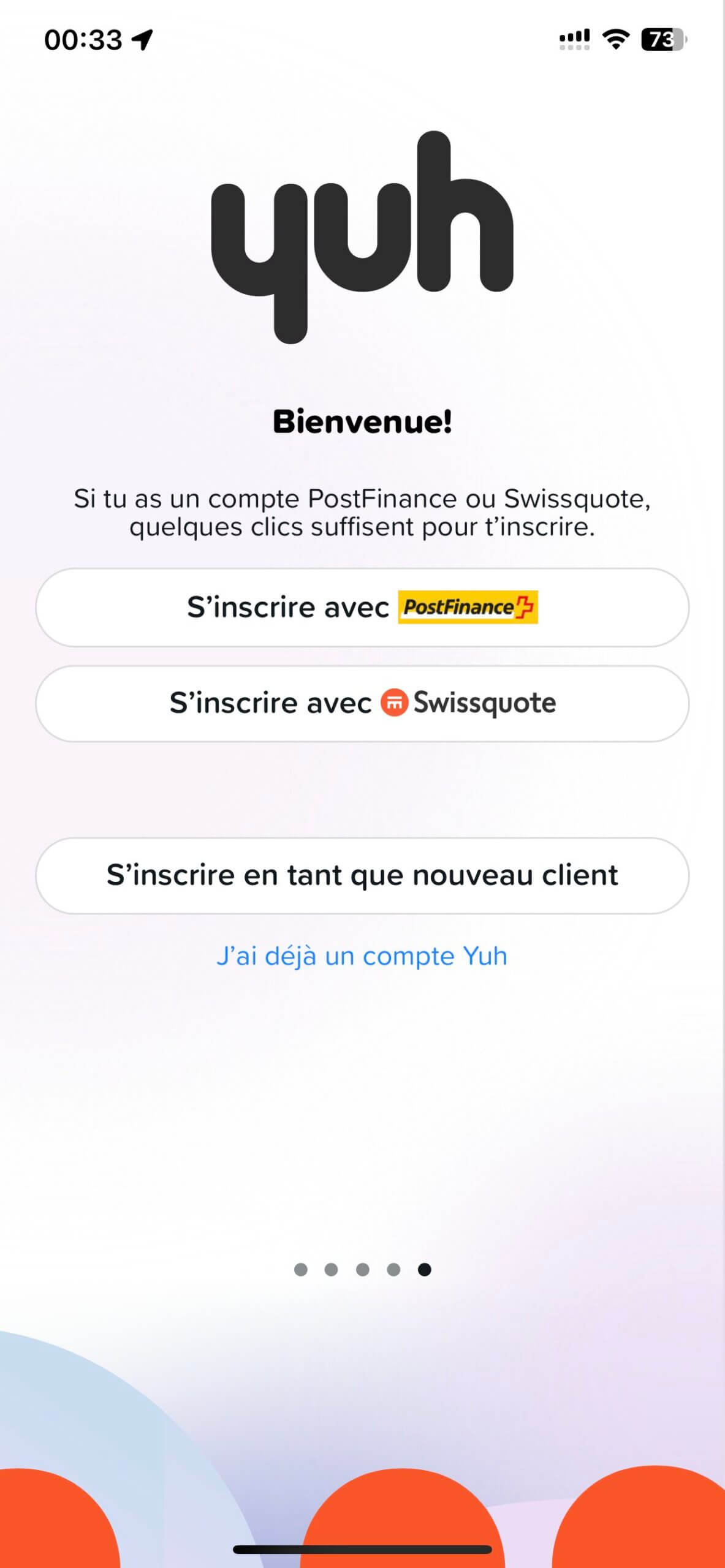

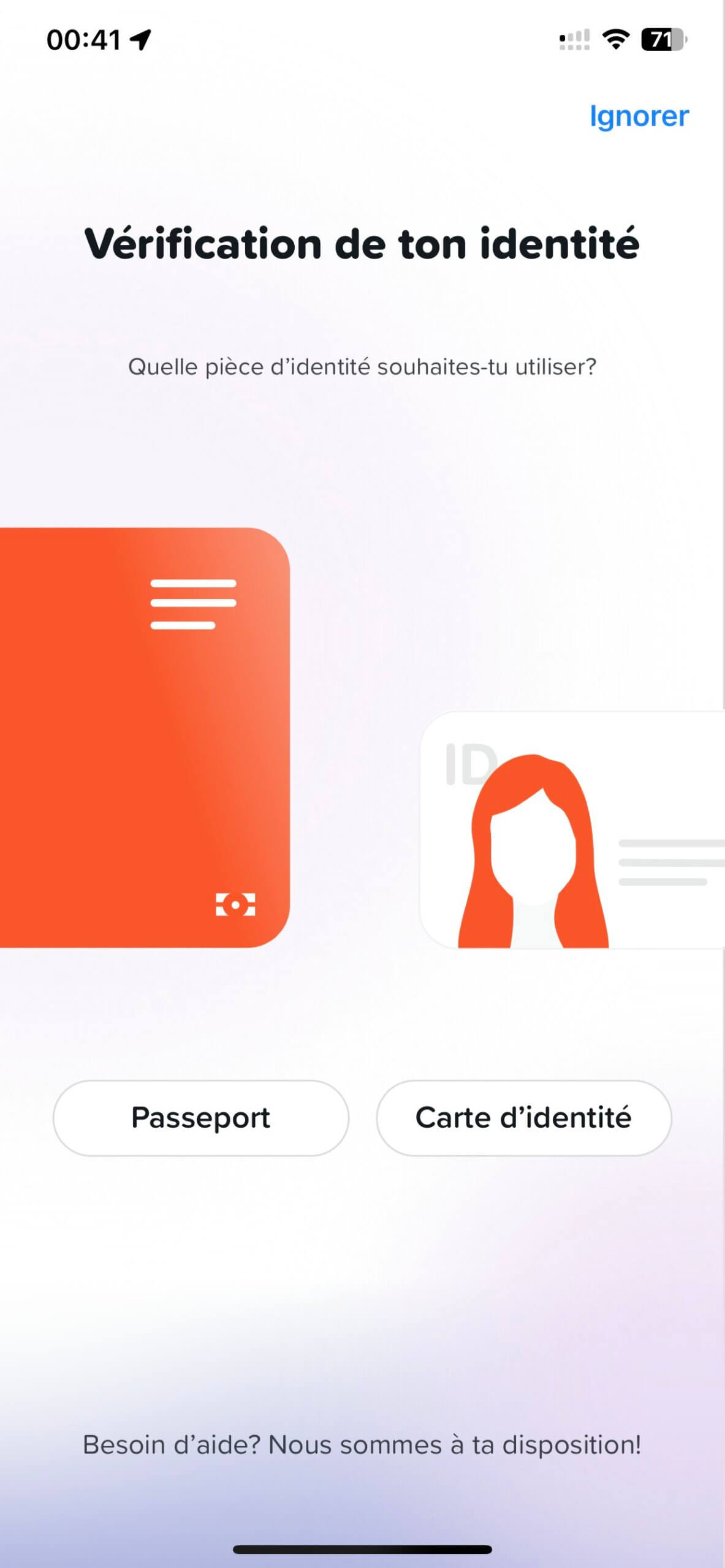

Open an account with Yuh (100% mobile procedure)

Yuh allows you to open an account in a few minutes from your smartphone without a complex procedure.

Opening steps:

- Download the Yuh app (App Store or Google Play)

- Prepare your documents: ID + proof of address less than 3 months old

- Identity verification via scan and video selfie directly in the app

- Account activation → immediate receipt of IBAN, then the card within a few days

Eligibility conditions (non-residents accepted if):

- Minimum age: 18 years

- Reside in one of these countries: 🇩🇪🇫🇷🇮🇹🇱🇮🇦🇹

- Smartphone compatible with the app

✔︎ No proof of income required

✔︎ No minimum deposit required

✔︎ No Swiss address required

Promo Code

Free account ✔︎

Opening a Non-Resident Account in a Traditional Swiss Bank

Opening is possible, but remains a constraining process. Unlike neo-banks, no traditional bank offers a 100% online process for non-residents.

In practice, you need to:

- Contact the branch in advance to check if opening is possible.

- Send a complete file for pre-validation (tax documents, identity, income…).

- Then physically go to the branch (in Switzerland or at a foreign branch) to finalize the opening.

Opening delays: 5 days to 3 weeks depending on the bank.

Initial deposit: CHF 10,000 to 50,000 depending on your profile and the bank.

This process is suitable for high net worth profiles or specific projects (real estate purchase, wealth management…).

The documents required by Swiss banks for non-residents are listed above in the article.

Yuh vs traditional Swiss bank (online account opening)

| Criterion | Yuh | Traditional bank |

| Personal CH IBAN | ✔︎ | ✔︎ |

| 100% mobile process | ✔︎ | ✘ |

| Required deposit at opening | ✘ | ✔︎ (10k–50k CHF) |

| Branch appointment | ✘ | ✔︎ |

| Opening delays | 10–15 min | Several days/weeks |

For the majority of non-residents, Yuh remains the only practical and realistic solution in 2025.

Comparison of solutions for opening a non-resident account in Switzerland

Here’s a summary of the 5 banking options with the criteria that really matter for a non-resident:

| Options | Personal CH IBAN | Low fees | Remote opening | Compatible with CH salary | Recommended? |

| Traditional banks | ✔︎ | ✘ | ✘ | ✔︎ | Too constraining |

| Wise / Revolut / N26 | ✘ | ✔︎ | ✔︎ | ✘ Often refused | As a complement |

| Yuh | ✔︎ | ✔︎ | ✔︎ | ✔︎ | Ideal solution |

| Yapeal | ✔︎ | ✔︎ | ✔︎ | ✔︎ | Plan B |

| Bank + currency exchange service | ⚠️ Non-nominative | ✔︎ | ✔︎ | ⚠️ Not always accepted | Workaround |

Are there Swiss banks abroad?

Some Swiss banks like UBS do have subsidiaries abroad (France, Germany, Luxembourg, etc.).

But these entities do not allow opening a real Swiss account with a CH IBAN from abroad. They mainly serve to:

- manage investment portfolios,

- introduce high-value clients to the parent company,

- or offer private management services.

Therefore, it is not a daily banking solution for a non-resident.

Conclusion: What is the best solution for opening a non-resident account?

In 2025, opening a bank account in Switzerland without residing there remains possible, but truly interesting options are limited.

Most Swiss banks discourage opening accounts for non-residents, due to fiscal, regulatory, and therefore financial constraints. Even border banks or multi-currency accounts don’t solve all needs, especially when it comes to receiving a Swiss salary.

Among existing solutions, Yuh is currently the only solution that allows:

- to have a personal CH IBAN,

- a quick 100% mobile opening,

- free and complete usage,

- and unrestricted access to investment.

Other options (traditional banks, Wise, currency exchange services, border banks) can be complementary, but none replace Yuh for daily use.

The right choice will always depend on one’s needs:

- receiving a salary,

- investing from abroad,

- or simply minimizing fees.

But in 90% of cases, Yuh is sufficient to do everything.

Promo Code

Free account ✔︎

Which solution do you prefer as a non-resident?

- Do you already use a non-Swiss neobank?

- Have you already tried the combination of local bank + currency exchange service?

- Do you have a preference between N26, Wise, and Revolut for complementary services?

- Will you beat my record of signing up for Yuh in less than 11 minutes?

Share your feedback with all Neo’s friends 😈