Zak Bank – Complete Review and Test (February 2026) + get 25 CHF

| Offering | 8 |

|---|---|

| Security | 10 |

| Opening an account | 7 |

| Bank card | 7.8 |

| Features | 8.5 |

| Interest rates | 9 |

| Transfer speed | 8.5 |

| TWINT | 10 |

| Fees | 7.8 |

| Abroad | 5 |

| Cash deposit | 8 |

| Customer service | 8.9 |

Review of Zak: the local neobank. We have evaluated ZAK in real-life situations in Switzerland. Strengths… weaknesses… banking services… fees… features… pros and cons… This detailed review saves you valuable time for comparison. Use the promo code KNSGS6 when opening your account to receive 25 CHF.

Free!

Description

[Update – Feb. 3, 2026: Zak VS Radicant comparison removed, following Radicant’s closure.]

[Update – Nov. 10, 2025: Introducing the Zak 3a offer.]

Zak banque offer summary

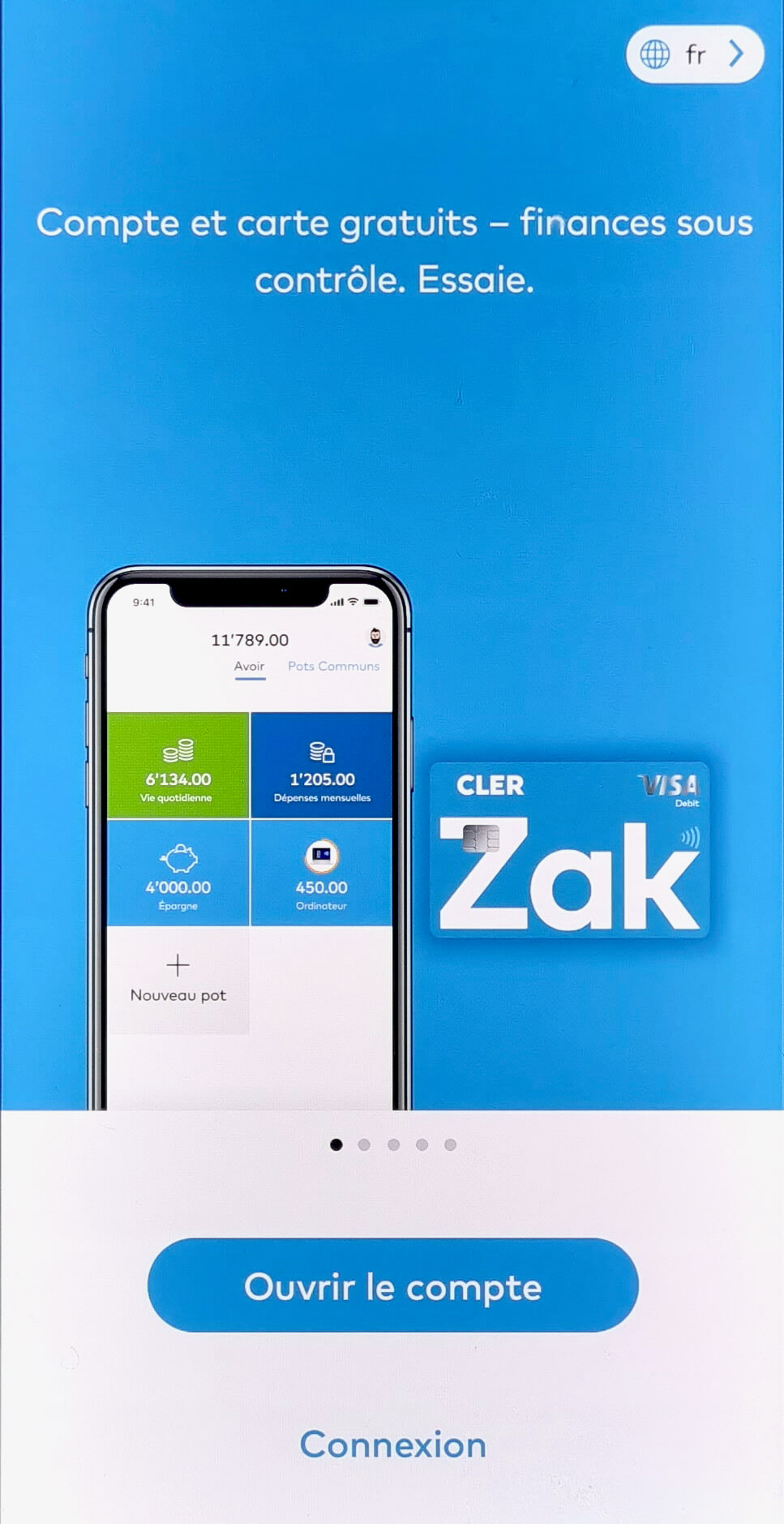

ZAK is the first purely mobile bank to appear in Switzerland (2018). It offers features for planning your budget (alone or with others) in real time. Zak is based on Banque Cler for financial services.

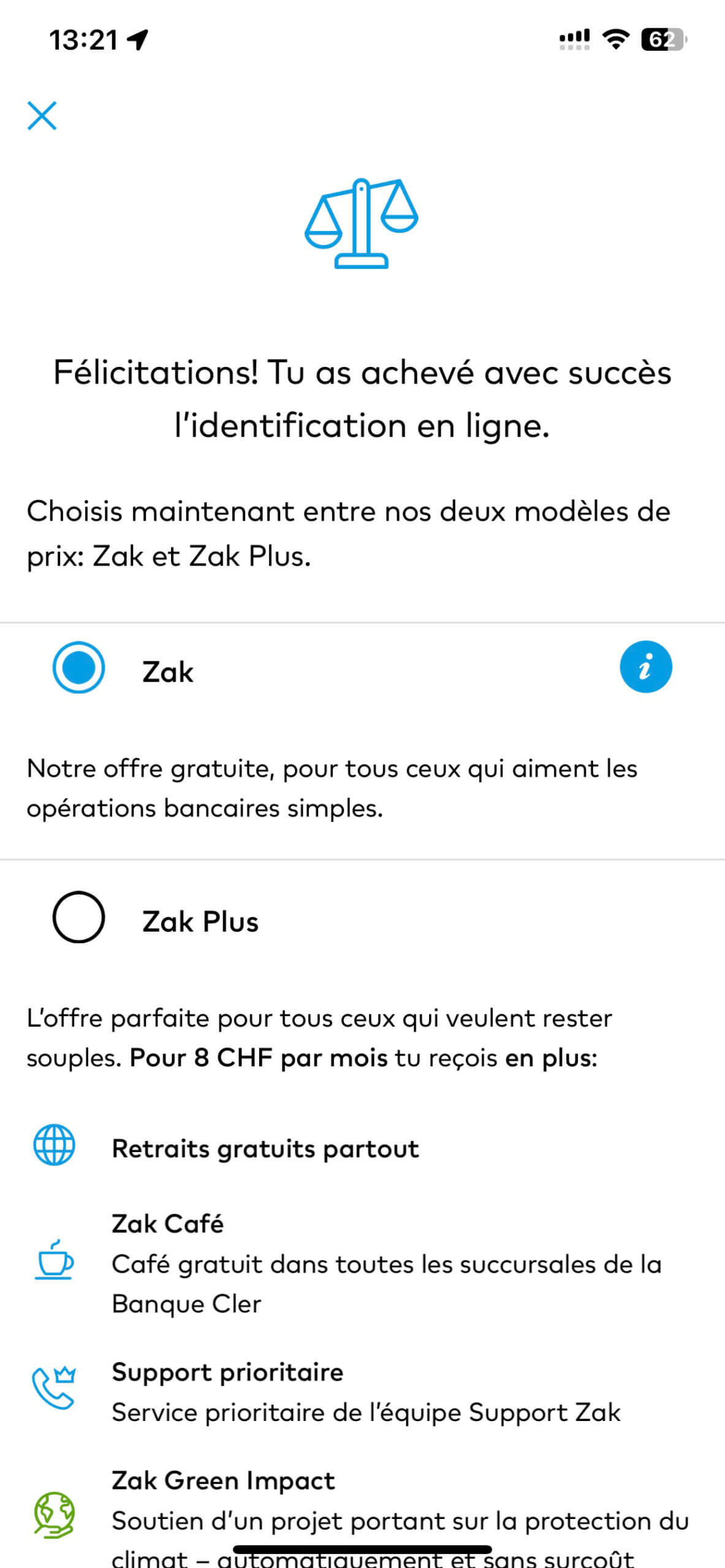

Zak Free – the account and the card 💳

0 CHF/month

Zak Plus – the premium offer

CHF 8/month

- Free cash withdrawals worldwide

- Priority support

- Carbon offsetting

- Elimination of Foreign Payment Fees

- Free Coffee at Bank Cler Branches (Yes, Really ☕️)

Security: is Zak Safe?

Banking services are provided by Bank Clerc SA in Basel, approved by FINMA.

The Swiss deposit protection insurance covers up to CHF 100,000 in case of bankruptcy.

Zak bank user data is stored in Switzerland.

Two-factor authentication (2FA) is used for account access.

Promo Code

Free account ✔︎

Open a Zak account – Receive CHF 25

Zak is available in French, German, and Italian.

– Be at least 15 years old (YUH 14 years, Neon 16 years)

– Reside in Switzerland (residence permit for foreigners, but not accessible to cross-border commuters and non-residents)

– Have an iOS or Android smartphone

– No proof of income or minimum balance required.

Step-by-step guide to opening a YUH account

Download the ZAK app

on the App Store / Google Play Store

Create a new account

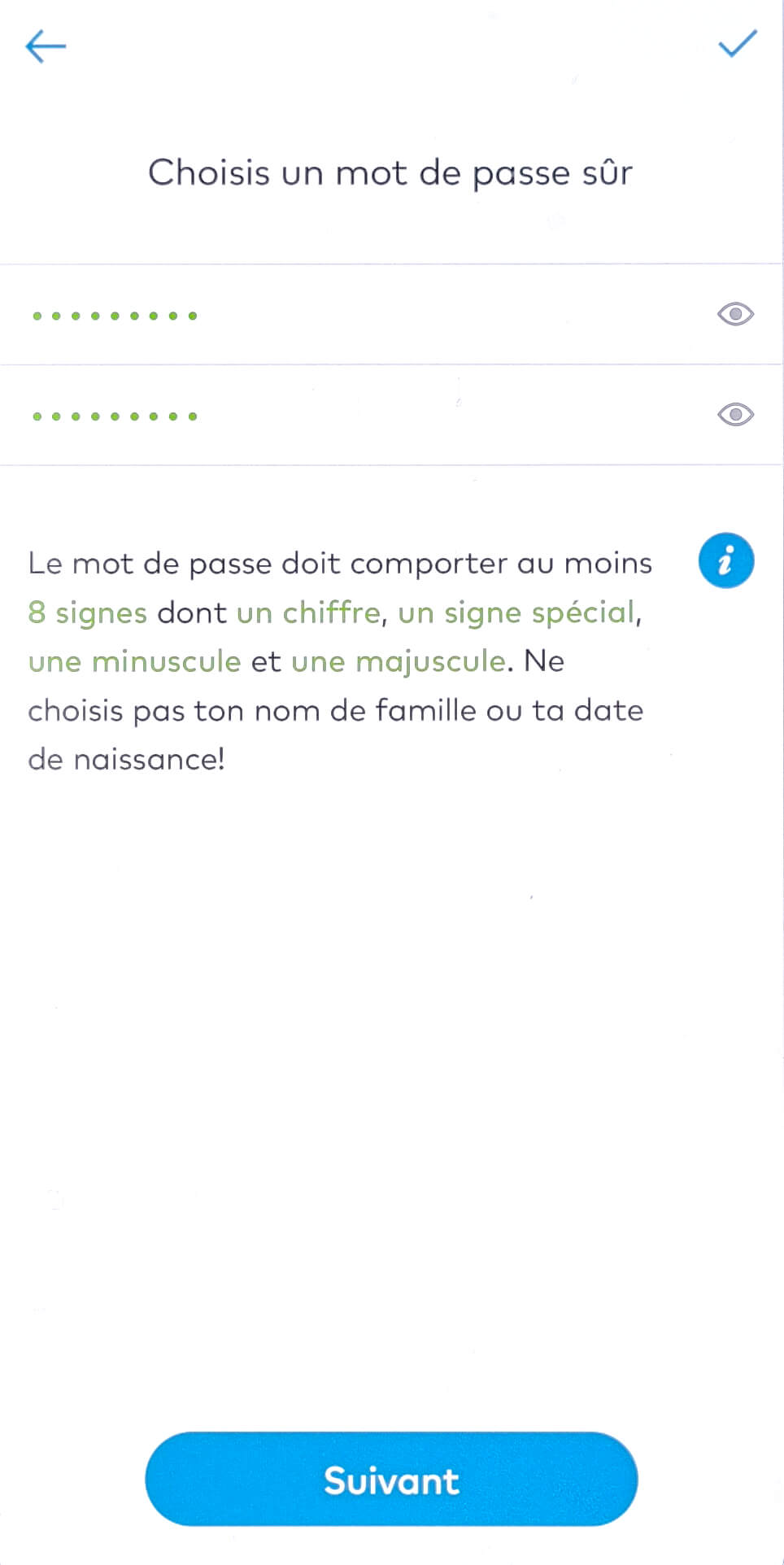

Create a password

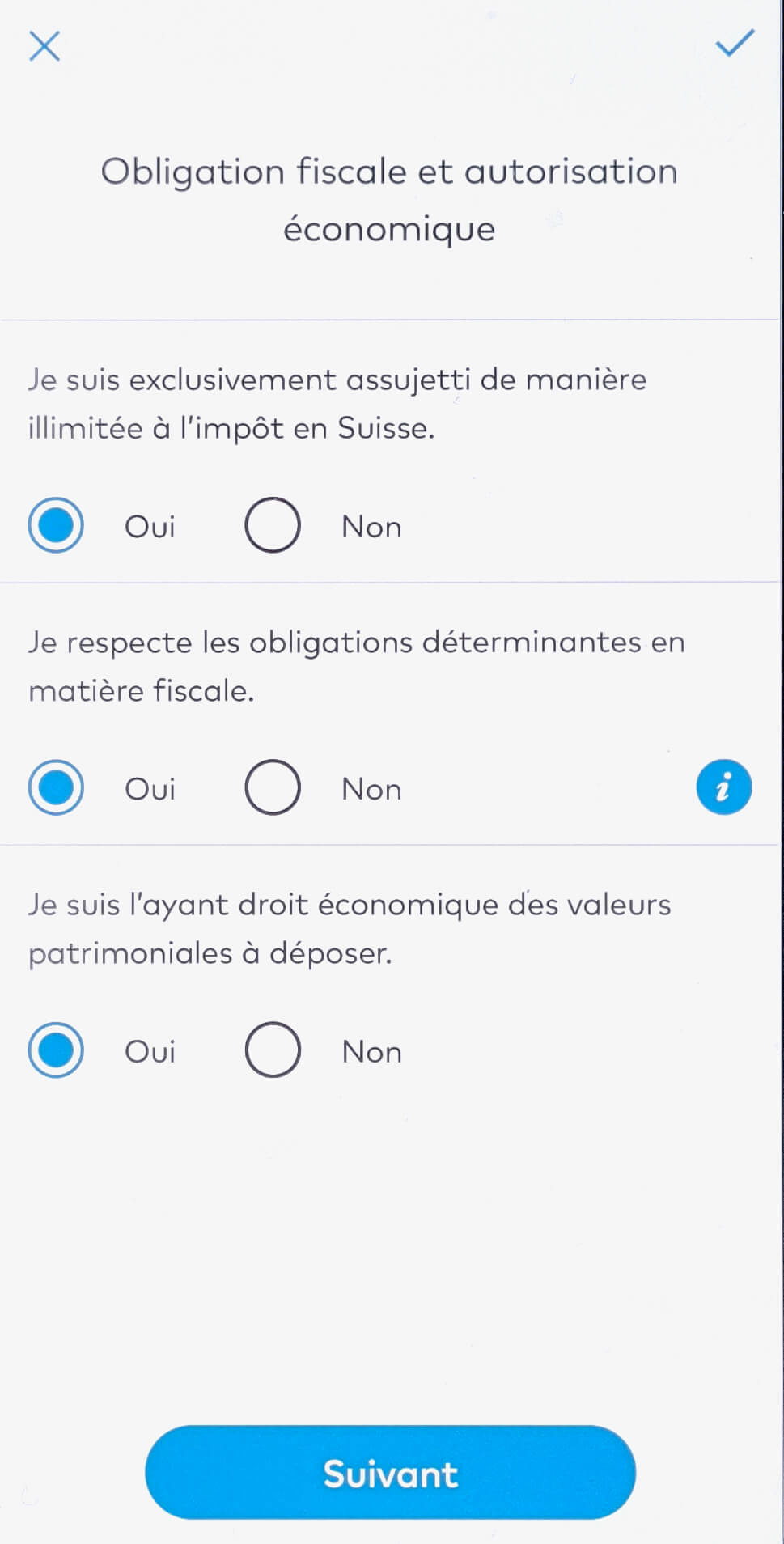

Confirm your country of residence

and provide some additional information:

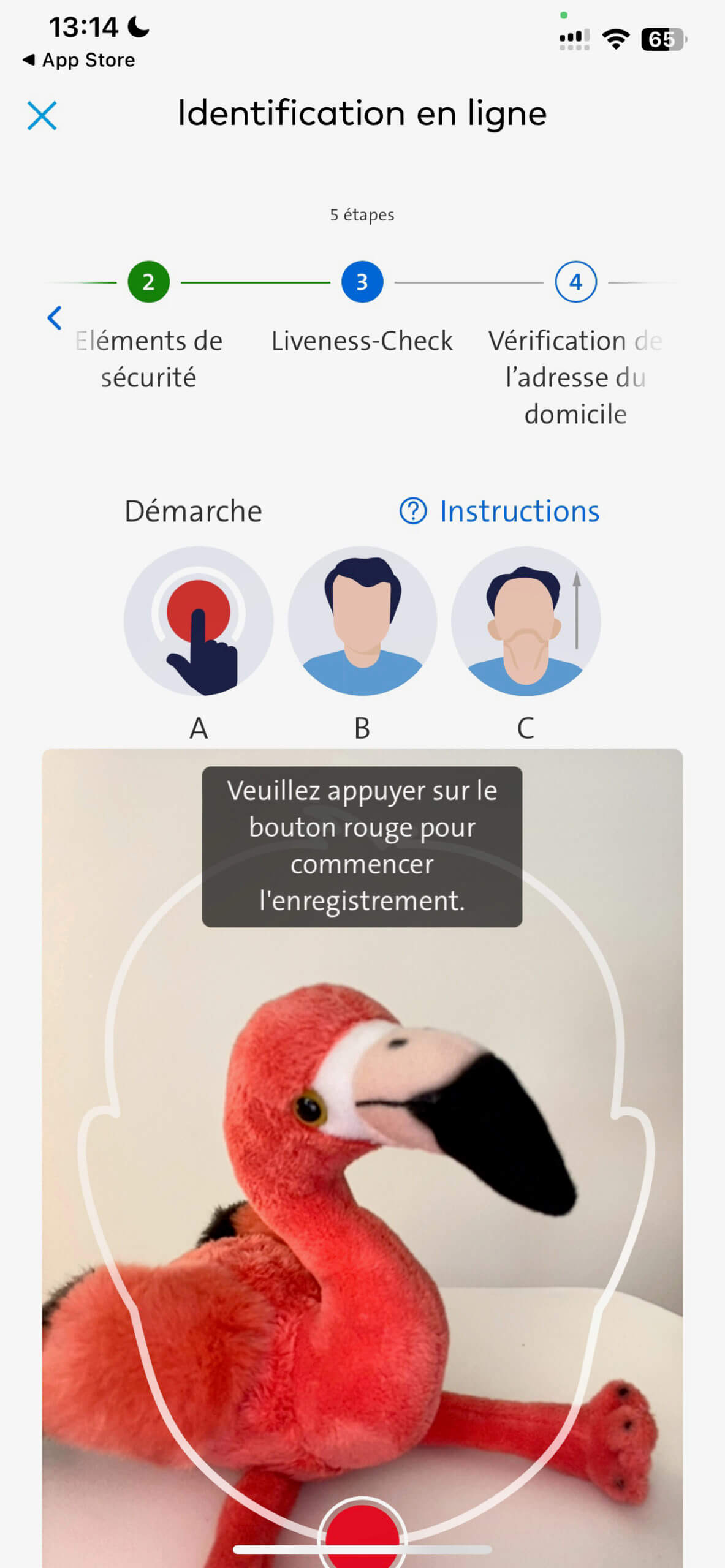

Verify your identity

The process is entirely managed by Swisscom. First, the ID scan:

Then the video identification:

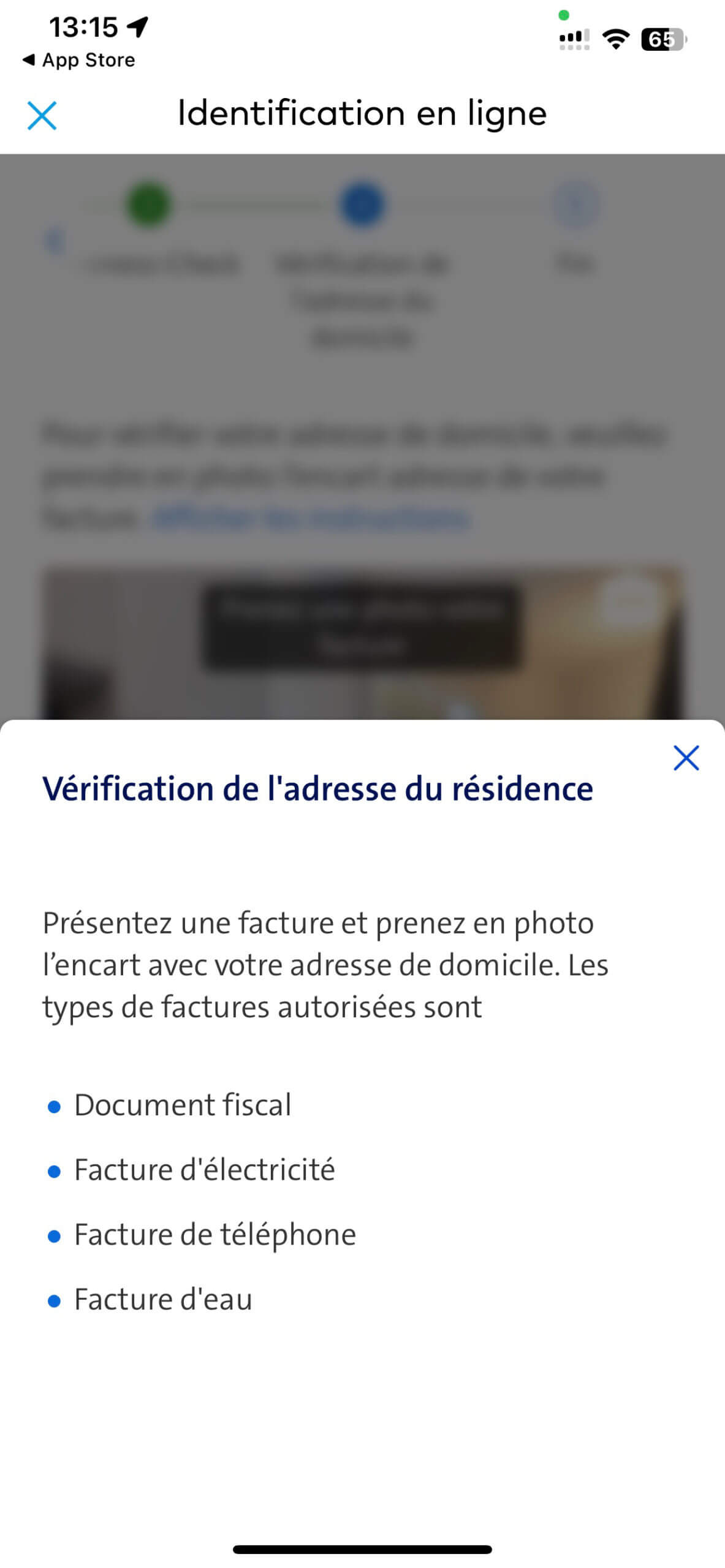

Verify your residential address

Zak requires proof of residence. Fortunately, the choice is quite broad:

Choose the Zak or Zak Plus offer

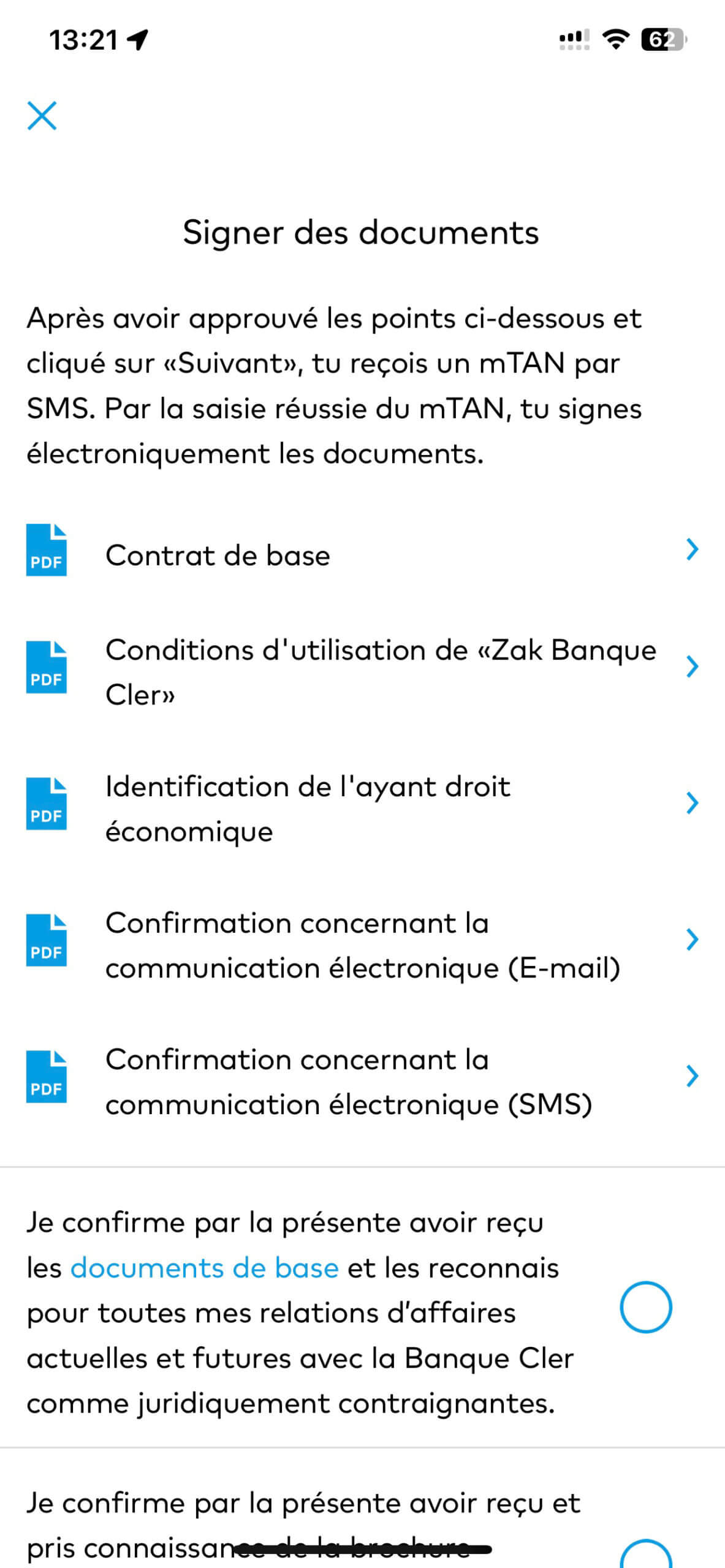

Sign your contract digitally

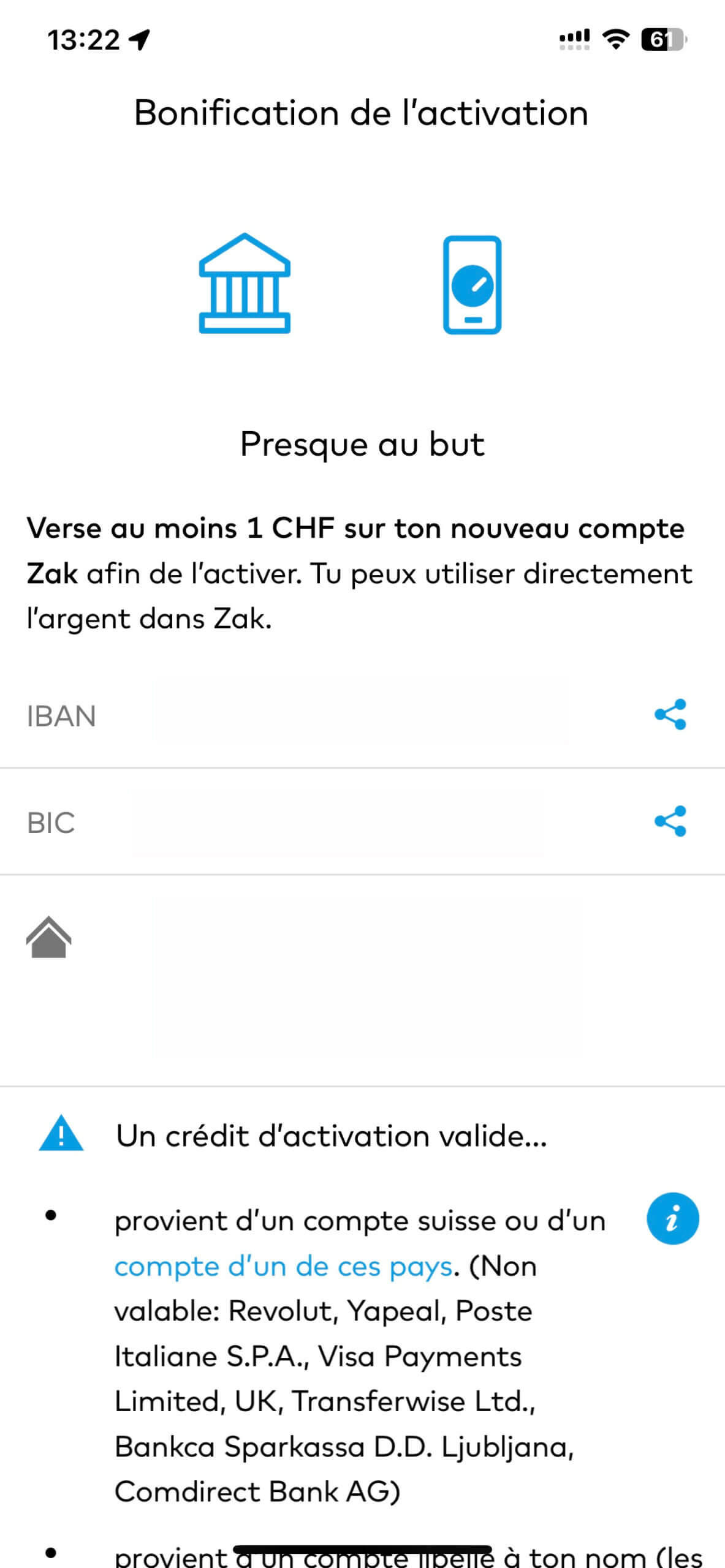

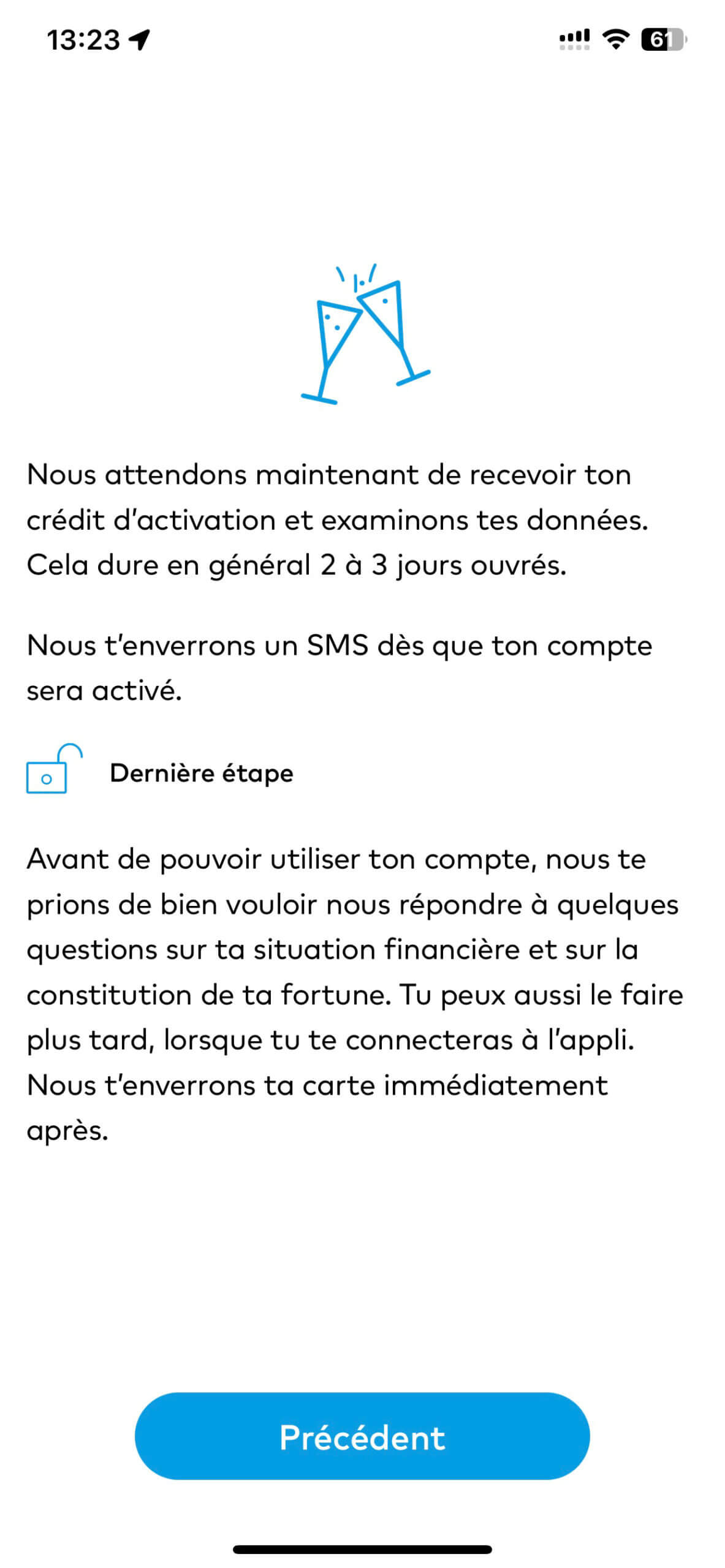

Make an initial deposit to activate your account

To activate your account, you need to make an initial deposit. The account is activated within 2-3 days:

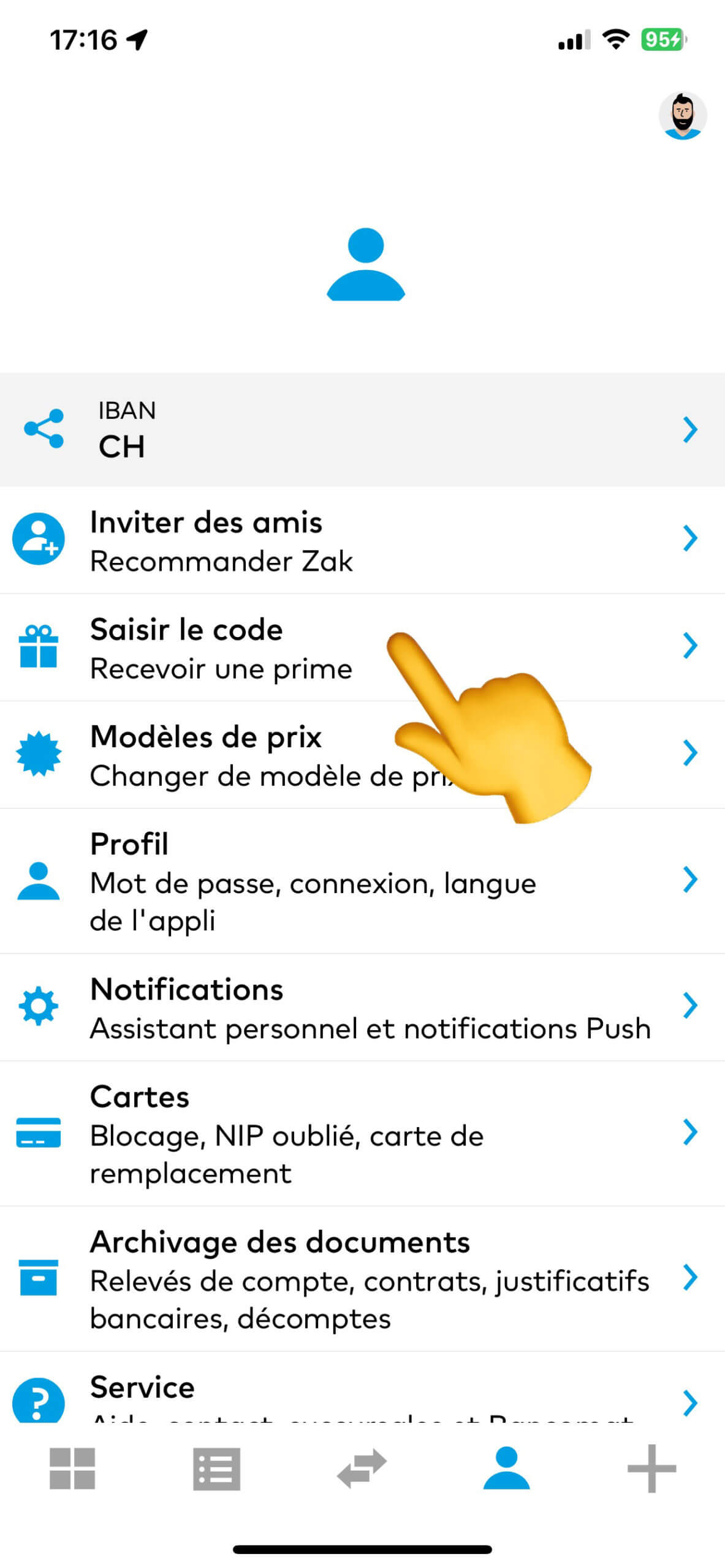

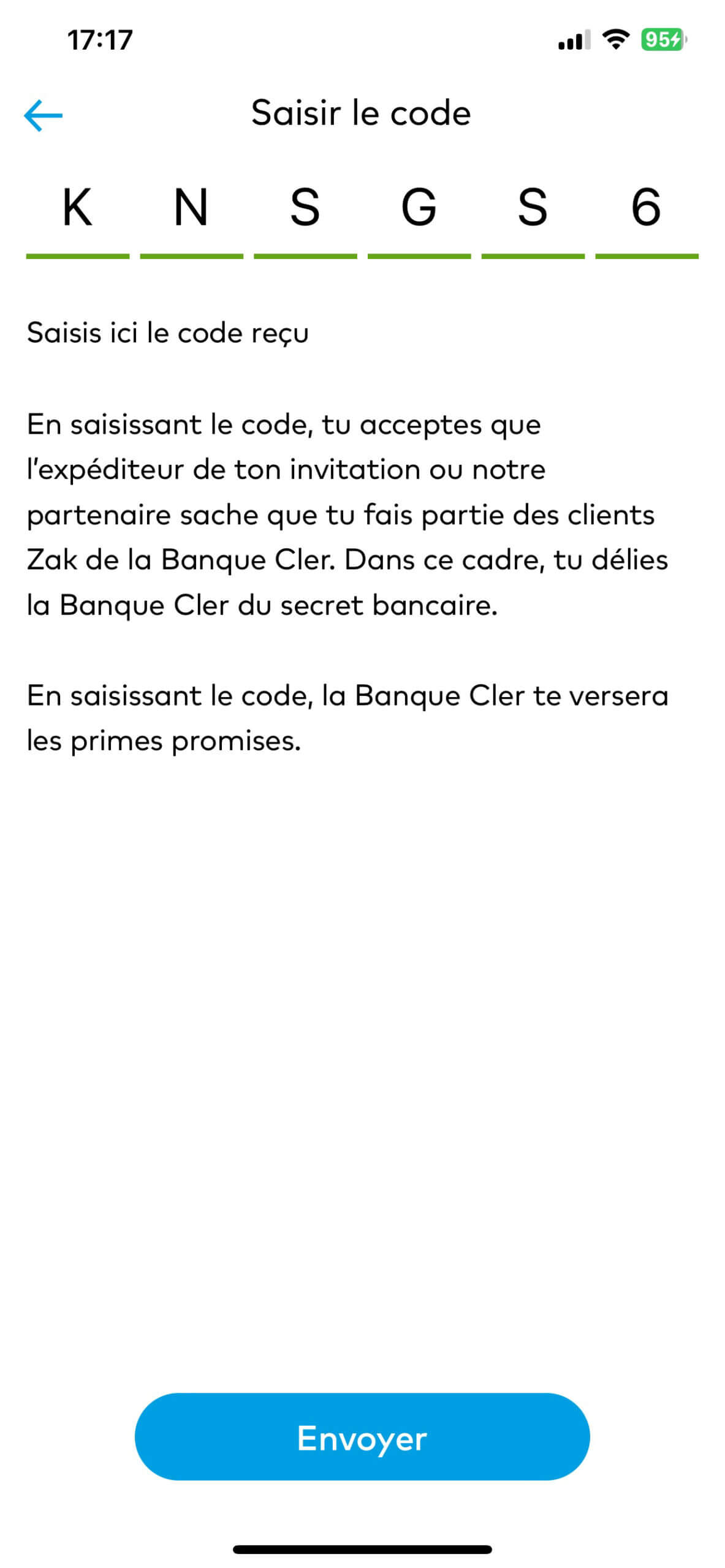

Enter your code 👇

Receive 25 CHF: go to “settings” then “Enter code” and enter the code KNSGS6.

You can do this 24 hours after the account activation confirmation SMS and you have up to 30 days maximum.

You will receive your money practically overnight.

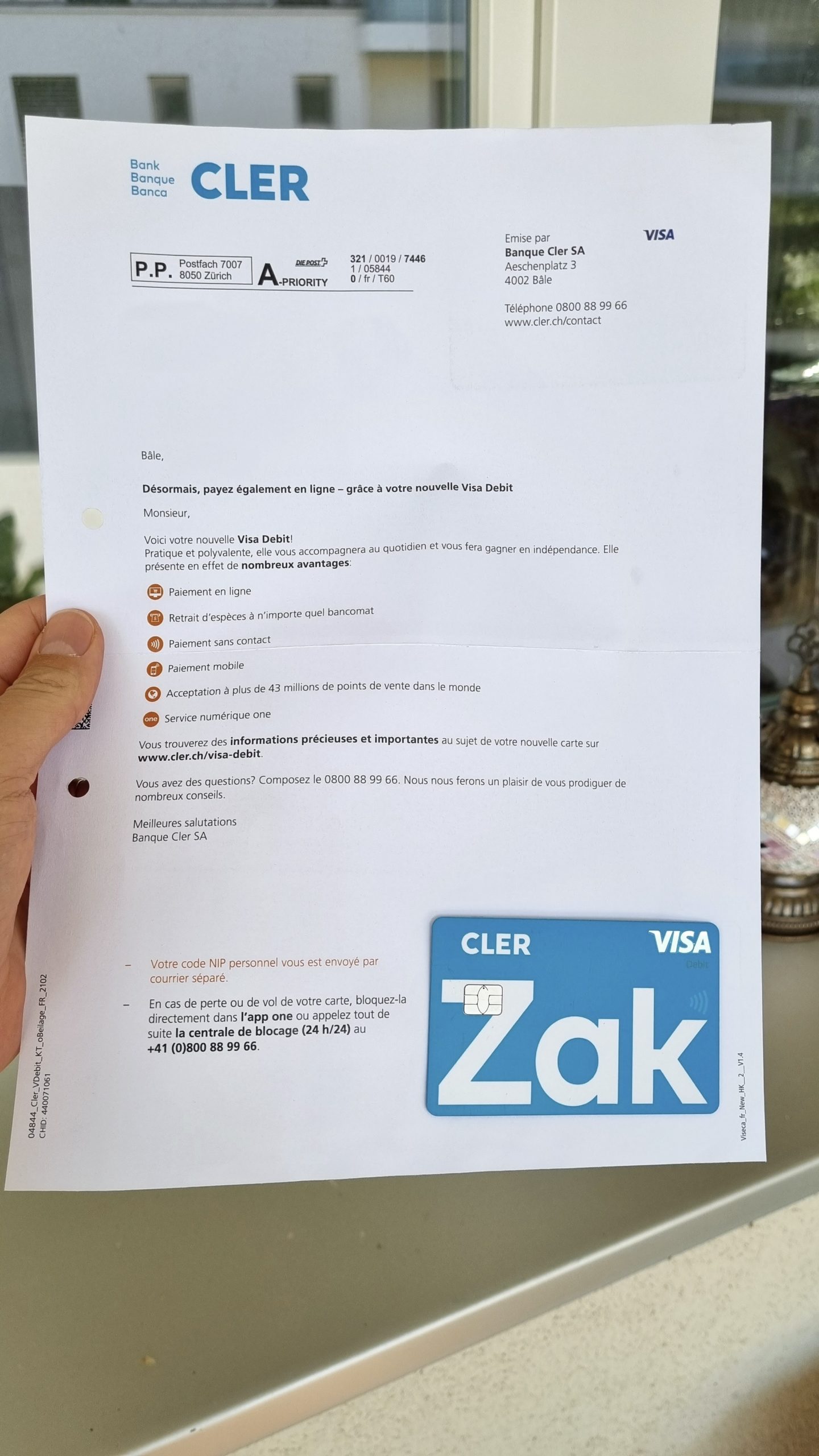

Voir plus +The Zak bank card

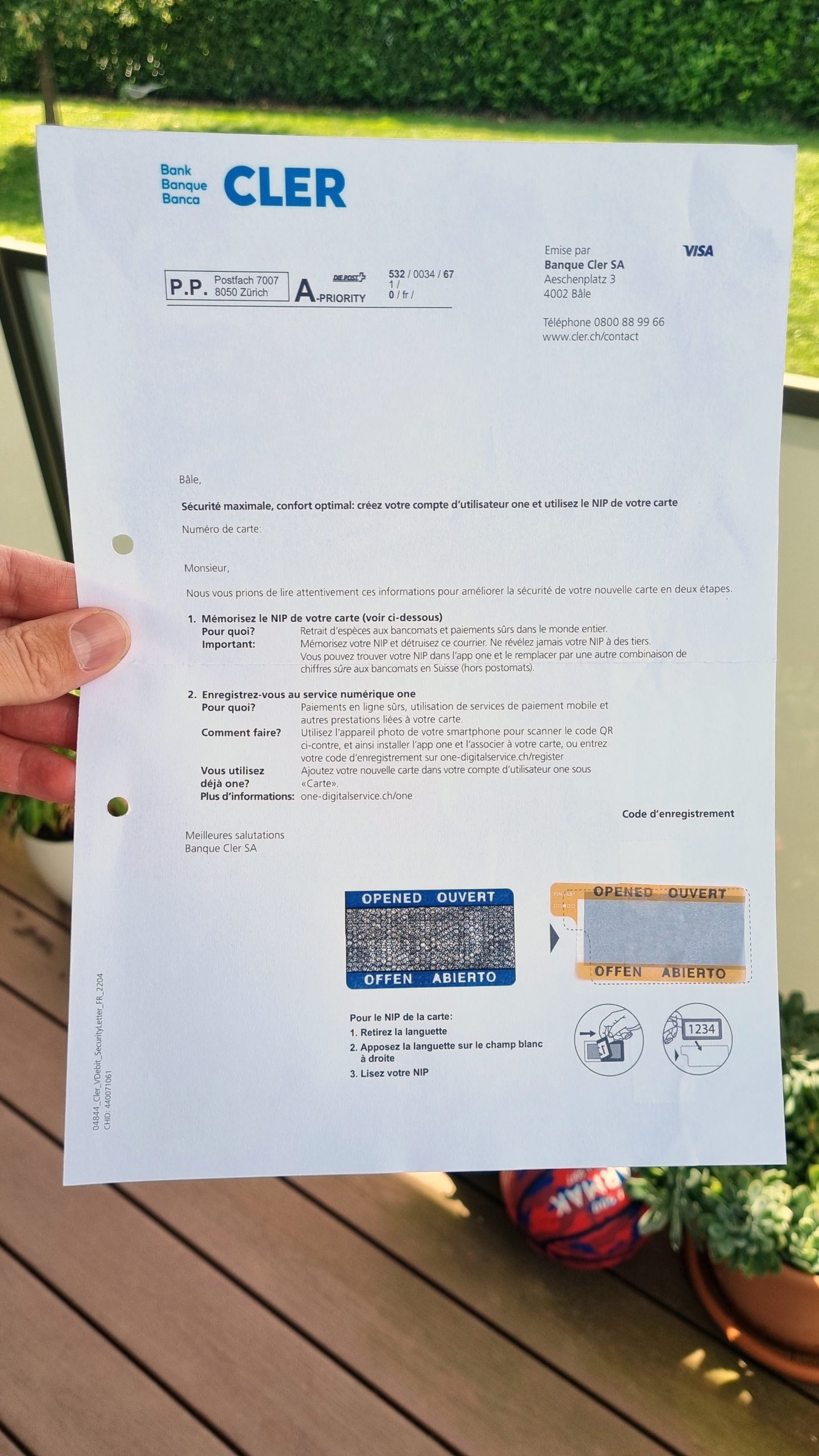

You receive your card first. The PIN code is not immediately available in the app.

The PIN is sent separately.

💳 the Zak Visa Debit card at a glance :

- Code-free contactless payment up to CHF 80/purchase. Beyond that, the code is required.

- It works with Apple Pay / Google Pay / Samsung Pay.

- Push notifications for card payments.

● To activate contactless, you need to finalize a first payment with the card code.

● Even if it takes a few days for the card to be delivered, you can use it via your smartphone oruse the payment information available in the app to make online purchases.

You can temporarily block your card from the app, but you have to go to the ATM to change the PIN code.

The default cash withdrawal limit is CHF 2,000/day or 3,000/month, but this can be changed by calling support. Payments are debited from the main account (Spaces money is excluded).

Card Blocking Is Charged at 50 CHF, Even in Case of Loss

Can I rent a car?

Promo Code

Free account ✔︎

Zak application: features

The Zak Application Is Rich and Adapted to All Situations in Switzerland

- Account Movement Tracking

- Push notification of movements

- eBill 🇨🇭

- Standing orders

- Twint

- Scan payment slips (QR invoices) 🇨🇭

- Turning a QR invoice into a standing order

- Sharing bank details via QR

- PushTAN function replaces mTAN (sms)

The app. allows you to manage group budgets:

- Pots: dividing your budget between different pots

- Pots communs: manage group expenses, find out who owes you money and pay off your debt in a click

- Instant payment “Zak Illico” to instantly send or request money from other users among your contacts.

And to manage the card?

You have to go through another application, Viseca One on iOS and Android for :

- Request New PIN Code

- Temporarily Block the Card

- Activate / Deactivate Contactless, etc.

- View card expenses

Features it lacks:

✘ The ability to change daily or monthly card limits directly in the app

✘ The ability to make investments (stocks, ETFs, etc.).

Interest rates offered by the Zak account

Zak offers a rate of 0.3% up to 100,000 CHF and 0.8% on “Prévoyance dans Zak” (pillar 3a) regardless of the amount.

Zak also offers a 3a pension solution directly accessible from the app. It allows investment in one or more sustainable funds, with a customizable risk profile. Management is entrusted to Swisscanto (Banque Cler), with management fees of around 1.25% per year. Contributions can be made on an ad-hoc or automatic basis, and the evolution of one’s 3rd pillar can be tracked in real-time.

Discover the full review here: Zak 3a – complete test & analysis

Transfer speed with Zak – send money

● Instant transfers with “Zak Illico” (Zak user to Zak user).

● An IBAN transfer from Switzerland to Switzerland or within the SEPA zone made before 1 pm will arrive on the same day. If it is placed after 1 pm, it will arrive the following day.

● A transfer to a foreign country (outside SEPA) takes 2 days.

Zak Twint – pay with TWINT anywhere in Switzerland

For quick payments between its users, ZAK offers the Illico feature, but if TWINT is the #1 payment app in Switzerland, it’s not without reason. TWINT allows you to :

Yes. Zak has developed its own TWINT application, the #1 payment app in Switzerland.

It allows you to:

– Pay in stores

– Transfer money between friends

– Split a bill within a group (restaurant, outings, etc.)

– Pay for parking meters

– Pay online and in train stations

To use TWINT with Zak, you need to use the TWINT application from Bank Clerc directly connected to your Zak account.

Promo Code

Free account ✔︎

Zak Banque fees: card, foreign exchange, transfers, cash withdrawals, etc.

● Free Bank Account

● Free CH IBAN

● Free Visa Debit Card issued by Viseca

● Card Blocking: 50 CHF

● Replacement Card: 20 CHF.

● 💳 Card payments without transaction fees.

● Foreign exchange fee of 2% on top of the Visa reference rate.

● Free “Pots” virtual sub-accounts

Money transfers in Switzerland 🇨🇭 ➔ 🇨🇭

● IBAN transfers in CHF and EUR are free.

● Transfers outside the SEPA zone are not available currently

International transfers 🇨🇭 ➔ 🌍

Transfers in Euros and CHF within the SEPA zone are free of charge (without exchange rate surcharge).

Please note: payments outside the SEPA zone and in currencies other than CHF and EUR are not currently available.

Cash withdrawals in Switzerland 🇨🇭

● Unlimited cash withdrawals at Banque Cler ATMs.

● At the same time, Zak allows you to withdraw cash free of charge (CHF min 20.-/max 300.-) from cashiers at Coop and Coop City Food supermarkets in Switzerland (subject to a minimum purchase of CHF 10).

The monthly withdrawal limit is 10,000 CHF/month. per withdrawal, this makes a free withdrawal threshold of 2K/month.

At other ATMs in Switzerland:

- Withdrawals in CHF: CHF 2

- EUR withdrawals: 5 CHF at Visa reference rate + 2% markup

- Zak Plus: in CHF withdrawals are free, but in EUR there is a 2% surcharge on the Visa reference rate.

Cash withdrawals abroad 🌍

- 5 CHF + 2% Surcharge

- Zak Plus: Free

Zak vs. Zak Plus – which one to choose?

We’ve done the math. To make ZAK Plus profitable, you need :

➔ Make 4 CHF withdrawals/month outside Banque Cler ATMs in Switzerland.

or

➔ Make a single withdrawal of EUR 150/month outside Banque Cler ATMs (in Switzerland or abroad).

For people who need to withdraw cash abroad, including outside Europe, Zak Plus may seem more attractive.

➔ Keep in mind that with a 2% surcharge, Zak is much less advantageous abroad than other neo-banks.

For users who stay in Switzerland, Zak Plus in Switzerland is not particularly justified. We think that with unlimited withdrawals at Banque Clerc ATMs and the option of withdrawals in the Coop network, it’s sufficient.

If you’re looking for unlimited withdrawals anywhere in Switzerland, we’ve got something better.

Promo Code

Free account ✔︎

Zak on the road and abroad

With ZAK there are no fees for foreign payments (like with Neon or YUH Bank), but there is a 2% surcharge on the Visa reference rate, which easily amounts to 2.5%.

Unfortunately, it’s not possible to associate your card with a jar. For example, a “travel” pot in preparation for a vacation. This is a well-thought-out option found at N26.

In short, ZAK is out of the running compared with its competitors YUH Banque and especially NEON Banque, whose exchange fees are minimal or non-existent.

Cash deposit on Zak account

Zak allows you to deposit cash directly into your account free of charge via Banque Cler ATMs.

Zak customer service

● Accessibility: by telephone 🤳 Monday to Friday, 8am to 6pm. Response time is fast.

No chat. A simple form (the same as on the website) is used to contact the support team, who can also be reached by e-mail at [email protected]. Clearly, if you need quick answers on weekends, you’ll have to make do with online help. Even if the service is good, it’s not really what neo-banking customers expect.

● Reported experience: Zak has an eye for detail and the waiting time is virtually nil. Based on all our interactions in French, the agents are good listeners and don’t hesitate to go for specific answers.

Cashback Zak banque

The cashback offer is interesting. Simply open the “Zak Store” (+ sign at the bottom right of the screen) then click on “Cashback” to be redirected to the shopmate page (shopemate.cash) to take advantage of offers from 250 partner merchants (MediaMarkt, Booking, Ochsner Sport, etc.).

Refunds Are Credited Directly to the Zak Account

Good reasons to open an account with Zak Banque

Zak is a locally-oriented bank, and that’s a good thing. It covers all everyday needs and lets you organize your money in pots. Sound familiar? Try searching for videos of cash stuffing challenges and you might change your mind.

Free + physical branches (Cler Bank) available to users = a huge confidence-building advantage. True to its positioning, Zak is “only” available in the national languages (German, French and Italian). Not in English.

Zak’s strength also lies in cash management. When it comes to withdrawing or depositing, Zak makes it all very easy.

✔︎ You can open a free account and receive CHF 25 with the code KNSGS6 with another app. to enjoy the benefits of each and compare banks in practice 👍.

Promo Code

Free account ✔︎

Zak vs. Yuh – Quick Comparison ⚡️

Yuh vs Zak

Zak adapts perfectly to local use in Switzerland: CH IBAN, integrated TWINT, QR-bill management, eBill and LSV are directly accessible from the app. However, it remains limited to CHF, applies fees on foreign currency withdrawals, and does not offer any integrated investment tools.

Yuh is more flexible for juggling multiple currencies: CHF, EUR, USD managed in the same account with automatic payments without conversion, but it remains more limited on local payment automations (no LSV, separate TWINT).

To be preferred if…

- CHF is mainly used, with a need for direct access to TWINT, eBill and Swiss banking standards: Zak

- You travel regularly, receive or spend in EUR/USD, or want to invest easily without leaving the app: Yuh (read Yuh review and test)

To avoid if…

- You need an active multi-currency account (Zak only manages CHF)

- You want to group local payments and investments in the same interface (unavailable with Zak)

- You often use foreign currencies in daily life

Promo Code

Free account ✔︎

Zak vs. Neon – Quick Comparison ⚡️

Neon vs Zak

Zak covers everyday banking operations in Switzerland very well: native TWINT, QR-bill payments, eBill management, and the ability to set up LSV. However, everything remains limited to CHF: there are no foreign currency accounts, withdrawals outside Switzerland are subject to fees, and there is no option to invest directly from the app.

Neon offers an account with no fixed fees, competitive card payments in foreign currencies, and easy access to investments, but remains less integrated with Swiss automatic payments.

To be preferred if…

- You want a smooth app, fully aligned with Swiss standards (TWINT, eBill, LSV): Zak

- You regularly pay in EUR, travel or wish to invest occasionally from your account: Neon (read Neon review and test)

To avoid if…

- You need a multi-currency account to manage both CHF and other currencies

- You use TWINT daily (Neon doesn’t have native integration)

- You’re looking for a solution that combines payments, savings and investment without multiplying services

What do you think of Zak?

- Has the Zak app made your daily life easier?

- What feature would you like to customize or improve?

- Is Zak Plus a better choice for you?

Share your feedback with all Neo’s friends 😈

Additional information

Specification: Zak Bank – Complete Review and Test (February 2026) + get 25 CHF

| Online banking | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ||||||||||||||||

| Bank card | ||||||||||||||||

| ||||||||||||||||

| For who? | ||||||||||||||||

| ||||||||||||||||

| Mobile payments | ||||||||||||||||

| ||||||||||||||||

Reviews (1)

1 review for Zak Bank – Complete Review and Test (February 2026) + get 25 CHF

Show only reviews in English (0)

Stephyyy –

Ce qui est bien c’est les agences partout où il y a une grande ville, pas comme les autres où c’est tout en ligne…