Investment and trading platforms in Switzerland in 2026

Switzerland’s investment ecosystem is evolving

Beyond the numbers, investment is becoming more democratic in Switzerland. New platforms are appearing in the form of online banks and smartphoneapplications. What are they worth? Can they replace the traditional approach? What is the feedback?

How can I compare investment/trader apps?

Before exploring the intricacies of each platform, heyneo.ch takes a look at the fundamentals. We test all the essential points for investing, buying and selling securities with peace of mind, such as :

- bank security guarantees

- clarifications on investment products

- interactions with customer service

After verifying and satisfying these criteria, we test the functionality of each application over time. Whether it’s trading stocks, bonds, ETFs, cryptocurrencies, trackers, or thematic investment funds, we explore a substantial portion of each type of investment product available.

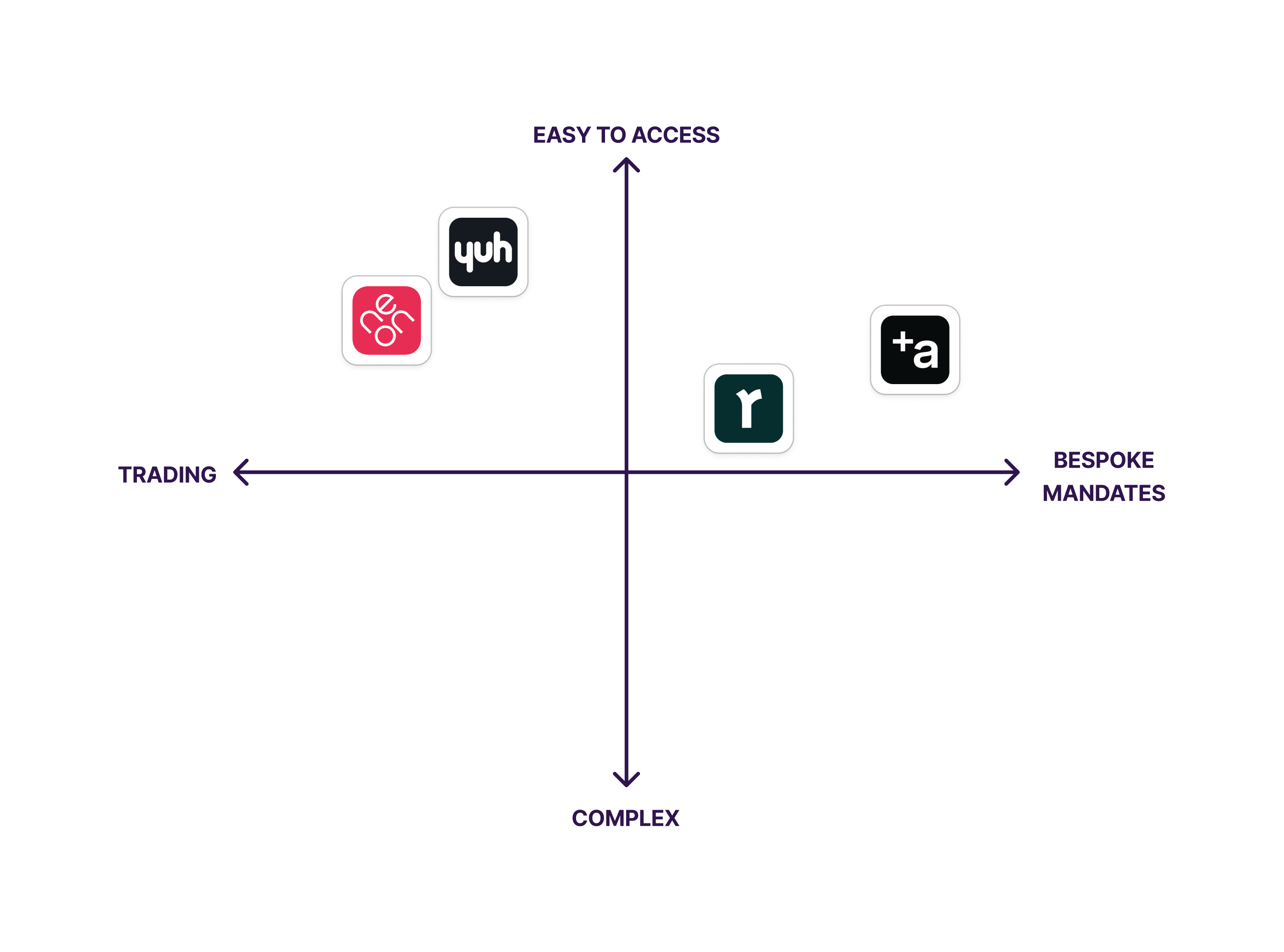

Assessing the differences between investment/trading platforms

To compare pragmatically, you need to choose the evaluation criteria that are most practical for you as a user. At heyneo.ch, we use apps to measure the details that make a difference in everyday life, such as :

- easy-to-understand financial products

- affordability

- clear performance indicators

- ease of use

- UX user experience and ergonomics

- investment education

- diversity of investment themes

- integrating environmental impact

Putting neo-banks in context

Your voice counts to reflect the opinions of users and investors

The ranking of trading and investment apps/platforms of neobanks reflects the specificities of the Swiss market. Your experiences and opinions shape our evaluations and help heyneo.ch answer the questions of other investors and users of neo-banks in Switzerland.

To help you make an informed decision

See the ranking of investment platforms in Switzerland in 2026.